ORDER

Smt. Beena Pillai, Judicial Member.- Present appeal filed by the revenue arises out of the order dated 17/04/2025 passes by Ld.CIT(A)-48 for assessment year 2018-19 on following grounds of appeal:-

“1. Whether on the facts and circumstances of the case and in law, the Ld.CIT(A) has justified in deleting the additional disallowance of Rs.54,28,892/- made by the Assessing Officer under Section 14A read with Rule &D of the Income Tax Rules, over and above the suo motu disallowance of Rs.9,00,00,000/-offered by the assessee, without appreciating that the disallowance under Section 14A is not restricted to the amount of exempt income, particularly in view of CBDT Circular No. 5/2014 and the amendment to Section 14A by the Finance Act, 2022, which is clarificatory and retrospective in nature.?

2. Whether on the facts and circumstances of the case and in law, the Ld. CIT(A) has justified in deleting the disallowance of interest expenditure made under section 36(1)(iii) of the Income Tax Act, 1961, without appreciating that the borrowed funds were not utilized wholly and exclusively for the purposes of business and the assessee having no main business activity during the year and the borrowed funds were invested in shares held as investments and in other non-business advances, which do not qualify as business purposes under section 36(1)(iii)?

3. Whether on the facts and circumstances of the case and in law, the Ld.CIT(A) has justified in concluding that the interest expense qualifies for deduction merely on the basis of a broad interpretation of the term “for the purpose of business,” without establishing a proximate nexus between the borrowed funds and income-generating business activity?”

2. Brief facts of the case are as under:

The assessee is a public limited company engaged into the business of wholesale trading along with acting as distributors and commission agents for all kinds and varieties of goods, mercantile, chattels, produce, care products, Fabric Care, Whiteners, Air Care, Hair care, household insecticides, surface cleaning, Cosmetics and Beauty products.

2.1. For the relevant assessment year, the assessee filed its return of income on 30/10/2018, declaring loss of Rs.17,66,63,335/-. The assesse incurred interest expenses amounting to Rs.27,58,48,630/-that was claimed as deduction under section 36(1)(iii) of the Act. Further, the assessee earned exempt income amounting to Rs.9,00,00,000/- comprising of dividend income received from Indian companies. and the assesse suo moto disallowed Rs.9,00,00,000/- under section 14A of the Act.

2.2. The case of the assesse was selected for scrutiny by issuing notice u/s 143(2) and 142(1). In response to the statutory notices, the representatives of the assesse appeared before the Ld.AO and filed replies dated 15/01/2021 and 15/02/2021. Subsequently, a show-cause notice dated 06.04.2021 was issued calling upon the assessee to show cause as to why the assessment should not be completed as per the draft assessment order. The assessee furnished its response vide reply dated 11.04.2021 raising its objections against the additions proposed to be made therein. The Ld.AO after considering the submissions passes the assessment order dated 01.09.2021 by disallowing the deduction claimed by the assessee under section 36(1)(iii) of the Act in respect of interest of Rs.18,05,18,055/- on borrowed funds. Also, a further disallowance of Rs.54,28,892/- was made u/s.14A of the Act over and above the suo-moto disallowance made by the assessee.

Aggrieved by the order of the Ld.AO, the assesse preferred appeal before the Ld.CIT(A).

3. The assesse agitated against the disallowances made by the Ld.AO u/s. 36(1)(iii) of Rs.18,05,18,055/- and Rs.1,21,93,533/- in respect of interest amount incurred on borrowed funds.

3.1. The assesse submitted that it had, raised fund of Rs.200,00,00,000/- and Rs.130,00,00,000/- from financial institutions, by issuing 8.55% redeemable nonconvertible debentures and by way of short-term borrowings and paid the interest thereon amounting to Rs.27,58,48,630/- and accordingly claimed deduction under section 36(1)(iii) of the Act.

3.2. It was submitted that the assessee invested Rs.262,72,50,000/-in the shares of Jyothy Laboratories Ltd. (Now known as Jyothy Labs Ltd) (“JLL”), Rs.9,51,46,462/- in the mutual funds of ‘Invesco India Medium Term Bond Funds’ and provided Loans and Advances of Rs.20,88,79,485/-.

3.3. The assesse submitted that it earned dividend income amounting to Rs. 9,00,00,000/- from Indian companies and voluntarily disallowed Rs.9,00,00,000/- under section 14A of the Act. It was submitted that for the year under consideration, the assessee earned other income of Rs.39,74,321/- as interest from interest bearing loans (at average rate of interest is 8.62%) and Rs.15,25,226/- as interest from fixed deposits (at average rate of interest 8.62%

3.4. The assessee submitted that its business objective was to become a distributor of JLL’s products also to venture into trading of fast moving consumer goods (“FMCG”) related products. The assesse submitted that during May 2011, JLL took over Jyothy Consumer Products Ltd. (earlier known as Henkel India Ltd, a well-established FMCG giant) – hereinafter known as JCPL (which was later merged into JLL with effect from 01.04.2012) to achieve expansion of business by appropriate consolidation of product portfolios, pooling and more efficient utilization of resources, attaining greater economies of scale and improvement in various operating parameters. After successful merger of JCPL & JLL, it was then felt that there was a need to infuse permanent capital to strengthen the financial structure. Since the assessee’s objective was to become a distributor of JLL’s products and also to venture into trading of FMCG related products, the assessee sought to capitalise upon this opportunity with a view to developing long-term relationship with JLL. JLL being a prominent player in the FMCG market and appellant’s business being thought to be dependent mainly upon the business relationship with JLL, it was essential to cater to JLL’s requirement with a view to leverage the same for assessee’s own business in the long run. Further, it also sought to acquire a financial equity ownership in JLL in the long run and to exploit the synergy between the two, JLL being one of the largest producer of FMCG goods and the appellant intending to establish a strong distribution network across the country, which would have immensely benefited the assessee in terms of guaranteed distribution business from JLL. With this intention, funds were borrowed by the assessee to make investment in the shares of JLL. Further, since JLL was also in need of capital for the purposes of growing its business, the assessee subscribed to the shares of JLL through preferential allotment and funded the same through borrowings from financial institutions on which interest has been paid and charged to the Profit and Loss account. A copy of resolution passed by the Preferential Allotment Committee of the Board of Directors of JLL for allotting the shares on preferential allotment basis in accordance with the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 and after requisite approvals from the SEBI/Stock exchanges and other regulatory authorities was submitted before the Ld.CIT(A).

3.5. The assesse thus submitted that it raised fund of Rs.200,00,00,000/- and Rs.130,00,00,000/- from financial institutions, by issuing 8.55% redeemable nonconvertible debentures and by way of short-term borrowings. It was submitted that the assessee invested Rs.262,72,50,000/- in the shares of Jyothy Laboratories Ltd. (Now known as Jyothy Labs Ltd) (“JLL”). It was submitted that the assessee paid the interest thereon amounting to Rs.27,58,48,630/- and claimed it as deduction under section 36(1)(iii) of the Act. Before the Ld.AO assesse had relied on the decision of Hon’ble Supreme Court in case of S.A. Builders Ltd. v. CIT (SC)/[2007] 288 ITR 1 (SC)and Hero Cycles (P) Ltd. v. CIT (SC)/[2015] 379 ITR 347 (SC).

3.6. The Ld.AO after considering the submissions disallowed Rs.27,58,48,630/- by alleging that the expenditure incurred by the assessee is not related to its business.

3.7. Ld.AO further noted that the assesse made suo moto disallowance under section 14A amounting to Rs.9,00,00,000/-against the exempt income. Whereas in the P& L account, assesse debited expenses in the nature of interest amounting to Rs. 27,58,48,630/-. The Ld.AO thus came to the conclusion that the investment in shares that yielded exempt income was made out of borrowed funds. The Ld.AO noted that the suo moto disallowance under section 14A amounting to Rs.9,00,00,000/- was not supported by any calculation as per Rule 8D. The Ld.AO thus computed the disallowance under Rule 8D at Rs.25,48,38,163/-. However, the disallowance was restricted at Rs.54,28,829/- by observing as under:

“7.1.5 In accordance with the provisions of Section 14A read with Rule 8D, the total disallowance comes to Rs. 25,48,38,163/-. The contention of the assessee is not acceptable that it has incurred Rs. 9,00,00,000/- to earn the dividend income which is not forming part of total income. Hence, the total amount of Rs. 25,48,38,163/- is disallowed as per provisions of Section 14A of the Income-tax Act read with Rule 8D of I.T. Rules, 1962.

However, interest on borrowed fund has already been disallowed u/s 36(1)(iii) of the I.T. Act, 1961 as not incurred for business purposes as discussed in preceding paras (5.1 to 5.1.8). Therefore, no separate addition is being made in respect of direct expenses of Rs. 22,75,66,464/- (computed above) in the nature of ‘interest on borrowed fund’. The assessee has also claimed expenditure of Rs. 54,28,892/- in the profit and loss account, other than the interest on borrowed fund. As per Rule 8D, the disallowance of indirect expenses comes to Rs. 2,72,71,699/- as above. Therefore, the disallowance in respect of indirect expenses restricted to the expenditure claimed in the profit and loss account other than the interest expenditure on borrowed fund. Accordingly, amount of Rs. 54,28,892/- is disallowed and added to the income of the assessee.”

The Ld.CIT(A), based on the above submission, allowed the claim of the assesse by observing as under:

6.19 In view of the above, it can be concluded that no disallowance is required be made under section 36(1)(iii) of the Act in respect of interest on funds borrowed for the purpose of making strategic investment. Further, as similarly noted in the aforesaid decision, if and when the equity shares of JLL are liquidated, there is expectancy of substantial gains to the appellant company. However, the assessing officer, referring the case of RPG Transmissions Ltd (supra) at page no. 8 of the impugned assessment order, recorded a vague finding that the aforesaid case of RPG Transmissions Ltd (supra) is not applicable in the instant case, in as much as in case of RPG Transmissions Ltd (supra) there is proximate nexus between the business of the assessee – company and that of the company in which investments were made in the form of shares which is not in case of the appellant.

6.20 In this regard it is submitted that, from the fact of RPG Transmissions Ltd (supra), it could not be established as to how there is proximate nexus between the business of the assessee -company and that of the company in which investments were made in the form of shares. The assessing officer has merely stated the same without discussing the facts of the case. In case of the appellant also, there is proximate nexus between the business of the appellant and JLL. As stated above, the appellant is also engaged into the business of all kinds and varieties of goods, mercantile, chattels, produce, care products, Fabric Care, Whiteners, Air Care, Hair care, household insecticides, surface cleaning etc whereas the JLL is one of the largest producers of FMCG goods.

6.21 In the present case, the assessing officer also has not been able to demonstrate that the borrowed funds have been used / diverted for non-business purposes. The appellant’s submission is that that the onus is on Revenue Authorities to prove nexus between borrowed funds and funds diverted for non-business purposes. Reliance is placed on the following decisions for the settled legal position of law that the burden is on the Revenue to prove that borrowed funds have been used / diverted for nonbusiness purposes free of interest to sustain disallowance out of interest paid:

| • | | CIT v. Hotel Savera: 239 ITR 795 (Mad) |

| • | | CIT v. Tin Box Co: 260 ITR 637 (Del) |

| • | | Dy. CIT v. Marudhar Hotels (P.) Ltd: 245 ITR 138 (Raj) |

6.22 I have considered this submission of the appellant. It has never been disputed that the investment was not made for the purpose of business, not even in the year in which such investment was made (that is, assessment year 2014-15). In fact, during the assessment proceedings for assessment year 201415, the case was selected for limited scrutiny and one of the reasons was in relation to interest expenditure which was examined in great detail by the NFAC /AO and after due verification, the deduction in respect of interest was allowed. Thereafter, similar stand has consistently been taken by the assessing officers and the appellant’s claim for deduction in respect of such interest expenditure has never been disputed. 6.23 Thus, the disallowance of Rs. 18,05,18,055/- made by the NFAC and adding the same to the total income of the appellant is perverse, arbitrary and bad in law and against the settled judicial precedents, therefore the said addition deserves to be deleted.” 6.24 In view of facts and circumstances of the case, the A.O. is directed to delete the addition of Rs. 18,05,18,055/- and Rs. 1,21,93,533/- made u/s. 36(1)(iii) being interest incurred on borrowing funds. Accordingly, the ground nos. 3 and 4 of appeal are allowed.

3.8. In respect of the disallowance under section 14A, the Ld.CIT(A), restricted the same to the suo moto disallowance made by the assesse under section 14A amounting to Rs.9,00,00,000/-.

Aggrieved by the order of the Ld.CIT(A), the revenue is in appeal before this Tribunal.

4. Ground No. 2-3

The Ld.DR placed reliance on the observation of the Ld.AO. He submitted that in respect of disallowance deleted under section 36(1) (ii) of the act, the assessee company is a second highest shareholder in JLL having 8.25% of shareholding in JLL. He submitted that that Shri M.P.Ramchandran, is a Director and shareholder of the assessee company holding 99% shares. It is submitted that he was the Chairman and Managing Director of Jyothy Laboratories Ltd., having shareholding of 38.60% in JLL. The Ld.DR submitted that, other three directors of the assesse being, Ms. M. R. Jyothy, Shri M. P. Divakaran, and Shri M. P. Siddhartha, having shareholding of 2.63%, 3.98% and 2.87% respectively. It is submitted that Ms. M. R. Jyothy is also the director of JLL He this submitted that the assesse was fully controlled by JLL through shareholder and CMD Shri M.P.Ramchandran.

4.1. The Ld.DR submitted that the assessee is an enterprise significantly influenced by Key managerial personnel of JLL. He submitted that the principal reason of raising a fund in the form NCDs and loans was to fund assessee’s existing investment in JLL. It is submitted that, the shares of JLL is not shown as stock in trade in the P&L A/c and Balance Sheet but shown as non current investment vide Note 9 of the Balance Sheet. The Ld.DR submitted that, the benefit of loan is enjoyed by JLL. The Ld.DR submitted that the Ld.CIT(A) completely ignored these facts.

4.2. The Ld.DR further submitted that, the assessee was neither having any business connection with JLL, nor is a subsidiary or holding company of JLL, which could justify that the investment made in JLL for the purpose of business. The Ld.DR emphasized that the assesse did not disclose any business activities since 2015. He thus submitted that the that proportionate interest pertaining to investment made in JLL was not for the purpose of business and accordingly computed the sum of Rs. 27,05,18,055/which are liable to be disallowed u/s 36(1)(vii).

4.3. On the contrary, the Ld.AR reiterated the submissions advanced before the Ld.CIT(A), reproduced herein above. She submitted that the appellant’s business objective was to become a distributor of JLL’s products also to venture into trading of fast moving consumer goods (“FMCG”) related products. She reiterated the submissions made before the Ld.CIT(A). These submissions by the assessee have been reproduced in para 6.1 of the order passed by the Ld.CIT(A). It is submitted that in May 2011, JLL took over Jyothy Consumer Products Ltd. (earlier known as Henkel India Ltd, a well-established FMCG giant) – hereinafter JCPL (which was later merged into JLL with effect from 01.04.2012) to achieve expansion of business by appropriate consolidation of product portfolios, pooling and more efficient utilization of resources, attaining greater economies of scale and improvement in various operating parameters.

5. The assesse had submitted that after successful merger of JCPL & JLL, there was a need to infuse permanent capital to strengthen the financial structure. It was submitted that the objective of the assesse was to become a distributor of JLL’s products and also to venture into trading of FMCG related products, the assessee sought to capitalize upon this opportunity with a view to developing a longterm relationship with JLL, being a prominent player in the FMCG market and assessee’s business being dependent mainly on the business relationship with JLL, it was essential to cater to JLL’s requirement with a view to leverage the same for assessee’s own business in the longer run.

5.1. Further, with the intention to establish strong distribution network across the country, to benefit itself, in terms of guaranteed distribution business from JLL, the assessee sought to acquire a financial equity ownership in JLL in the longer run and to exploit the synergy between the two, JLL being one of the largest producer of FMCG goods. With this intention, funds were borrowed by the appellant to make investment in the shares of JLL. Further, since JLL was also in need of capital for the purposes of growing its business, the appellant subscribed to the shares of JLL through preferential allotment and funded the same through borrowings from financial institutions on which interest has been paid and charged to the Profit and Loss Account.

5.2. This Tribunal called upon the Ld.AR to furnish the agreement entered into between assesse and JLL. The Ld. AR was also directed to furnish the board resolution to support the borrowing towards subscription of 1,50,000 equity shares in JLL along with the financials of JLL for relevant period. The same were filed on 16/12/2025.

5.3. The Ld.AR relying on the details filed on 16/12/2025, submitted that assesse had entered into C & F Agreement with JLL with effect from 01/07/2012 for a period of three years for inventory management, account, stocking, storage clearing handling, safe custody and distribution of various types of products sold by JLL in the state of Kerala and Tamil Nadu. Copy of the said agreement is placed on record by the Ld.AR. She submitted that, the services were to be rendered by the assesse against certain commission as specified in Annexure to the C & F agreement filed before this Tribunal. She also referred to the financial statement of JLL for March ending 2014 wherein assesse has received commission from JLL for assessment years 2013-14 & 2014-15.

5.4. She submitted that assesse held extra ordinary general meeting to discuss and decide about the subscription of 1,50,000 equity shares of JLL was to cater its need towards business expansion. She submitted that the monies thus borrowed was for the purposes of business. She thus relied on the orders passed by the Ld.CIT(A) and submitted that the interest paid was on account of the loans taken for the purposes of business, and thus is an allowable expenditure in the hands of the assesse.

We have perused the submissions advanced by both sides in light of records placed before us.

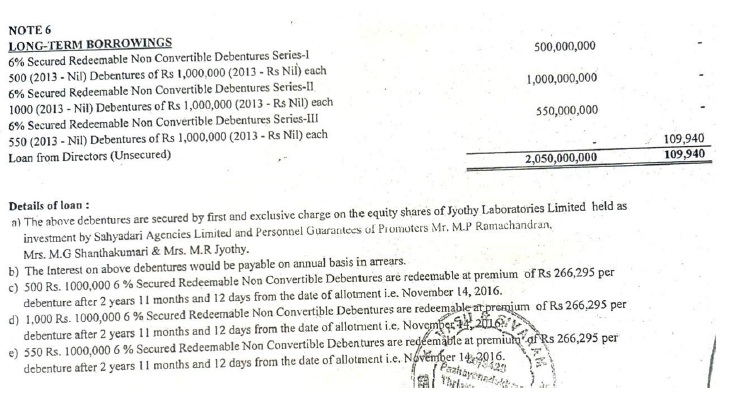

6. It is noted that the assessee borrowed funds during the financial year ending 2014. The particulars thereof, as reflected under Note 6 to the financial statements, are reproduced hereunder:

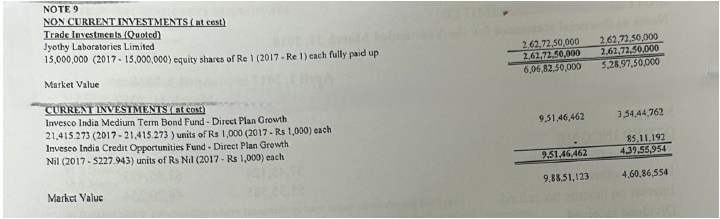

6.1. Against the aforesaid amount, the investments are reflected in Note 11 to the financial statements, wherein JLL issued 1,50,000 equity shares, which are duly recorded by the assessee under the head “Non-current Investments (Trade Investments)

6.2. From the aforesaid Note 6, it is evident that the borrowings were repayable after a period of 2 years, 11 months and 12 days. Accordingly, it is apparent that the assessee repaid the said borrowings during the year 2016.

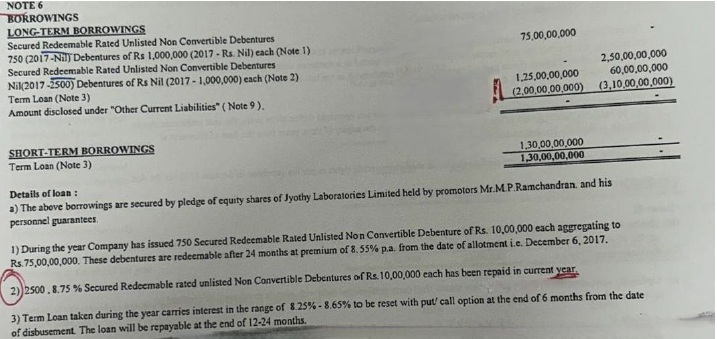

6.3. For the year under consideration, the financial statements of the assessee again reflect the existence of certain long-term and short-term borrowings. The relevant particulars, as extracted from the financial statements, are reproduced hereunder:

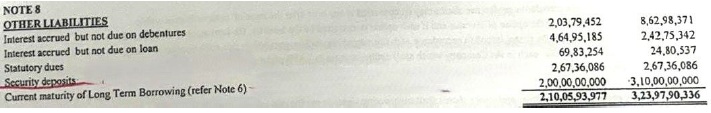

6.4. We also refer to Note 8 being the other liabilities recorded by the assesse which is as under:

6.5. Admittedly, it is evident that there were fresh borrowings during the year, against which no corresponding further investments are reflected in Note 9 to the financial statements, as reproduced hereunder:

6.6. The contention of the assessee is that it has been issuing fresh non-convertible debentures to discharge earlier borrowings, and that, therefore, there exists a direct and continuous nexus between the initial investment made in JLL during the financial year 2014 -15 and the borrowings raised in the subsequent years, including the year under consideration, out of which the earlier loans were repaid.

6.7. On a conjoint reading of financial statements for the financial year ending from 2014-15 to 2017-18, and having regard to the fact that the long-term borrowings during FY 2013-14 consisted of redeemable non-convertible debentures, it emerges that the initial borrowing undertaken by the assessee for investment in the shares of JLL was fully repaid in FY 2016 by availing fresh borrowings for an equivalent principal amount. The interest claimed by the assessee, therefore, pertains to the subsequent borrowings raised for the purpose of repaying the earlier loan.

6.8. In such circumstances, the critical issue that arises for consideration is whether the subsequent borrowing, taken merely to discharge the earlier loan, can be regarded as having been incurred for the purposes of the business, so as to qualify for deduction of interest thereon u/s 36(1)(iii). This aspect requires a careful examination of the purpose, utilisation, and nexus of the subsequent borrowings with the business activities of the assessee.

6.9. The Ld.CIT(A) failed to examine or verify these material and glaring facts emerging from the financial statements, resulting in the issue not being adjudicated on the correct factual foundation.

7. The allowability of interest under section 36(1)(iii) of the Act is contingent upon the assessee establishing that the capital was borrowed for the purposes of business and that a direct and proximate nexus exists between the borrowing and the business activity. While it is settled law that interest on borrowed capital used for purposes of business is allowable. Hon’ble Supreme Court in case of S.A. Builders Ltd. v. CIT (supra) has explained that, the expression “for the purposes of business” is wider than “for the purposes of earning profits” and that the test to be applied is one of commercial expediency, namely, whether the expenditure was incurred as a measure of commercial prudence from the point of view of a businessman.

7.1. However, such allowability does not automatically extend to subsequent or replacement borrowings, unless it is demonstrated that the refinancing itself was undertaken on grounds of commercial expediency and that the substituted borrowing continued to serve a business purpose. The doctrine of commercial expediency, as judicially explained, requires an objective examination of whether a prudent businessman, acting for business considerations, would have incurred such expenditure. Mere continuity of borrowing or neutral substitution of liabilities, by itself, does not dispense with the requirement of establishing business nexus of the later borrowing.

8. Hon’ble Supreme Court in case of Hero Cycles (P) Ltd. (supra) categorically held that, onus lies on the assessee to demonstrate clear nexus between the borrowed funds and the business purpose, and that where such nexus is not established, or where borrowed funds are diverted for non-business purposes, the interest attributable thereto is not allowable. Hon’ble Court further clarified that the doctrine of commercial expediency cannot be invoked in the abstract and must be supported by material demonstrating business rationale.

8.1. In cases involving refinancing or repayment of earlier loans, the onus squarely lies on the assessee to prove, with cogent evidence, that the subsequent borrowing was not merely a financial rearrangement divorced from business needs, but was undertaken wholly and exclusively for the purposes of business. The assessee must therefore demonstrate the end-use of funds, the commercial rationale for refinancing, and the absence of diversion of borrowed funds towards non-business purposes or investments yielding exempt or non-business income. In the absence of such demonstration, the claim of interest cannot be allowed merely on the premise that the original borrowing may have been for business purposes.

8.2. Applying the above principles, it is incumbent upon the assessee to discharge the primary burden of proof by establishing, through contemporaneous evidence, that the subsequent borrowings raised for repayment of earlier liabilities were necessitated by business considerations, and were not a mere financial reshuffling, and that the interest-bearing funds were not diverted towards nonbusiness investments or activities. In the absence of such demonstration, the ratio laid down in S.A. Builders cannot be mechanically applied, and the benefit of section 36(1)(iii) cannot be extended merely on the plea of continuity of borrowing.

9. In view of the foregoing, and considering that these aspects have not been examined by the Ld.CIT(A), we deem it appropriate to restore the matter to the file of the Ld.AO for limited and focused verification. The Ld.AO shall examine:

(i) the purpose and commercial necessity of the subsequent borrowings raised to repay the earlier loan;

(ii) the actual utilisation and end-use of such subsequent borrowings, supported by contemporaneous financial records;

(iii) whether a direct nexus exists between the interest-bearing borrowings and the business activities of the assessee during the relevant period; and

(iv) whether the refinancing arrangement was undertaken as a matter of commercial expediency, as understood in law.

10.1. The Ld.AO shall afford proper opportunity of being heard to the assessee and shall adjudicate the issue in accordance with law by passing a speaking order. It is clarified that the burden of establishing eligibility of deduction under section 36(1)(iii) is cast on the assessee, and no presumption shall be drawn merely on the basis of the nature of the original borrowing.

Accordingly, Ground No.2-3 raised by the revenue stands allowed for statistical purposes.

10. Ground No.1

The Ld.DR submitted that the Ld.CIT(A) erred in law and on facts in deleting the disallowance made by the Ld.AO under section 14A of the Act. It was submitted that, the disallowance was warranted having regard to the nature of investments and the interest expenditure claimed by the assesse. He submitted that the Ld.CIT(A) failed to properly appreciate the applicability of section 14A read with Rule 8D in the facts of the case.

10.1. The Ld.AR relied on the order passed by the Ld.CIT(A).

We have perused the submissions advanced by both sides in light of records placed before us.

11. This issue is no longer res integra. In view of the settled legal position that the disallowance under section 14A of the Act read with rule 8D cannot exceed the exempt income earned by the assessee during the relevant previous year, as held inter alia by the Hon’ble Delhi High Court in Joint Investments (P) Ltd. v. CIT ITR 694 (Delhi), and considering that the assessee has already made a suo motu disallowance of Rs. 9,00,00,000/-, no further disallowance under section 14A is called for.

Accordingly Ground no.1 raised by the revenue stands dismissed.