ORDER

Manish Agarwal, Accountant Member. – These two appeals are filed by the Revenue against the two separate orders, both are dated 22.04.2025 passed by the Learned Commissioner of Income Tax (Appeals)-3, Noida [‘Ld. CIT(A)’ for short] for following to different assessee.

| Sr. No. | Appeal No. | Name of Assessee | Asst. Year | Date of CIT(A)’s order | Date of AO’s order |

| 1. | 4119/Del/2025 | M/s Rudra Buildwell Homes Private Ltd. | 2022-23 | 22/04/2025 | 31/03/2024 |

| 2. | 4118/Del/2025 | M/s Rudra Buildwell Homes Private Ltd. | 2022-23 | 22/04/2025 | 31/03/2024 |

2. As the issues raised in both the appeals by the Revenue are identical and before us, both the parties have agreed to this fact and made common arguments in both the cases, therefore, both the appeals are decided by a common order.

3. First we take the Revenues’s appeal in ITA No.4119/Del/2025 in case of M/s Rudra Buildwell Homes Pvt. Ltd. for the Assessment Year 2022-23.

4. Brief facts of the case are that a search and seizure operation was carried on 04.01.2022 at the business premises of ACE & Rudra group and warrant of authorization was also issued in the name of assessee company. During the course of search, various documents/loose papers were found and seized. The assesse has filed its return of income on 07.11.2022 declaring a loss of Rs.23,69,041/-. Notice u/s 143(2) of the Act was issued followed by statutory notices along with questionnaire u/s 142(1) of the Act and the assessment was completed on 31.03.2024 u/s 143(3) of the Act wherein addition of Rs.71,34,21,000/- was made towards the amount of haircut or reduction in liability of the said amount.

5. Against the said order, assessee preferred the appeal before the Ld. CIT(A), who vide impugned order dated 22.04.2025 has deleted the additions so made by holding that there is no haircut or reduction in liability passed to the appellant company and, therefore, no addition could be made.

6. Aggrieved by the said order, the Revenue is in appeal before the Tribunal by taking following grounds of appeal:

| “1 | | . Whether on facts and circumstances of the case and in law, the Ld. CIT(A)-3, Noida has erred in deleting the addition Rs.71,34,21,000/ made by the Assessing Officer on account of ‘cessation of liability’ under section 41(1) of the Act, without appreciating the fact that the reduction in liability due to acquisition of loan by the Asset Reconstruction Company (ARC) at a discounted value constituted a deemed benefit liable to tax in the case of the assessee. |

| 2. | | Whether on facts and circumstances of the case and in law, the Ed. CELA) has erred in relying on judicial precedents which are distinguishable on facts and in holding that no cessation of liability occurred, despite the assessee having derived a tangible benefit by way of reduced loan obligation as a result of acquisition by the Asset Reconstruction Company. |

| 3. | | Whether on facts and circumstances of the case and in law, the Ld. CIT(A) has failed to appreciate that the assessee neither disclosed the waiver/reduction in its books of accounts nor provided any documentary evidence to rebut the Assessing Officer’s finding regarding the benefit arising from loan takeover, thereby failing to discharge the onus cast upon it. |

| 4. | | Whether on facts and circumstances of the case and in law, the Ld. CIT(A) has erred in deleting the addition solely on the basis of assumption that the reduction in loan value by the ARC did not result in benefit to the assessee, without appreciating that the commercial substance of the transaction indicated income in the hands of the assessee. |

| 5. | | Whether on facts and circumstances of the case and in law, the Ld. CIT(A)-3, Noida has erred in law by admitting the additional evidence filed under Rule-46A of the Income Tax Rules-1962, without referring the reasonable cause which prevented the assessee to produce the same during the assessment proceeding. |

| 6. | | That the above grounds are without prejudice to each other and appellant craves leave to add or amend any other more ground of appeal as stated above as and when needs for doing so may arise.” |

7. Since, all grounds of appeal are related to the deletion of addition made of Rs.71,34,21,000/-, therefore, they are taken together for consideration.

8. The Ld. CIT-DR vehemently supported the order of the AO and submits that assessee has not filed any details with respect to the reduction in the liability. He further submits that before the Ld. CIT(A), assessee filed additional evidences, though sufficient time was provided to the assessee by the AO for filing such details, therefore, the action of Ld. CIT(A) in admitting the additional evidences and deleting the additions made is not in accordance with law and he requested for the restoration of the addition made in this regard by the Assessing Officer.

9. On the other hand, the Ld. AR of the assessee vehemently supported the order of Ld. CIT(A) and submits that there was no reduction in the liability and no haircut was received by the assessee rather one M/s CFM Asset Reconstruction company had taken over the liability from the lender company and no benefit whatsoever was passed on to the assessee who is still liable to pay the loan taken alongwith interest. Therefore, he submits that Ld. CIT(A) after appreciating these facts has deleted the additions made. The Ld. AR also filed detailed submissions in this regard which is reproduced as under:

Facts of the Case

1. That the respondent is a company engaged in the business of real estate development and construction and is regularly assessed to tax under the provisions of the Income-tax Act, 1961. That for the A.Y. 2022-23, the assessee filed its return of income under section 139(1) of the Act on 07.11.2022, declaring a business loss of 23,69,041/-, on the basis of books of account maintained in the regular course of business and following the mercantile system of accounting.

2. That in order to finance its real estate projects, the respondent, in the ordinary course of business, availed financial assistance aggregating to 85.00 crores from ECL Finance Limited pursuant to a Facility Agreement dated 18.12.2017, and the said loan was disbursed in tranches as per the agreed contractual terms.

3. That the loan facility so availed was duly secured by creation of first charge and mortgage over various Immovable properties, including the project known as “Aqua Casa”, along with corporate guarantees and pledges, thereby creating an enforceable security interest in favor of the lender. That as per the terms of the Facility Agreement, the repayment obligation in respect of the principal amount was to commence only after the expiry of 24 months from the respective dates of disbursement. That the initial disbursement of loan amounting to 32.00 crores was made on 29.12.2017.

4. Further owing to adverse business conditions the loan account was classified as a NonPerforming Asset (NPA) on 31.03.2021 in the books of ECL Finance Limited, in accordance with applicable regulatory norms.

5. That under the Facility Agreement, ECL Finance Limited assigned all its rights, title, interests, benefits and receivables arising out of the loan facility to M/s CFM Asset Reconstruction Private Limited. That M/s CFM Asset Reconstruction Private Limited is a company incorporated under the Companies Act, 2013 and is duly registered with the Reserve Bank of India as an Asset Reconstruction Company under section 3 of the SARFAESI Act, 2002, and is legally empowered to acquire and recover financial assets.

6. That pursuant to the aforesaid assignment, M/s CFM Asset Reconstruction Private Limited stepped into the shoes of the original lender for all purposes and intents, and the respondent continued to remain legally and contractually liable for repayment of the entire outstanding loan, without any waiver, remission or concession.

7. That a search and seizure operation under section 132 of the Act was conducted by the Income-tax Department on 08.12.2021 in the case of M/s CFM Asset Reconstruction Private Limited. (Refer page no 2 of AO order)

8. That thereafter, a separate search and seizure operation under section 132 of the Act was conducted on 04.01.2022 at the premises of the ACE & Rudra Group. That it is an admitted and undisputed position that no Incriminating material was found or seized during the search conducted at the respondent’s premises which could indicate any remission, waiver, write-off or cessation of the loan liability or any benefit having accrued to the respondent.

9. That the notice issued u/s 143(2) is without jurisdiction as the same was issued without the approval of PCIT as per board instruction dated 11.05.2022 further amended dated 03.06.2022 and 26.09.2022

10. That the addition made in the assessment framed under section 143(3) of the Act is bad in law, inasmuch as the same is based entirely on material allegedly found during the course of search proceedings conducted in the case of M/s CFM Asset Reconstruction Private Limited. In such circumstances, the A.O could have assumed jurisdiction only by resorting to the provisions of section 147 of the Act, after following the due process prescribed therein, and not by making an addition in a regular assessment under section 143(3).

11. That the Ld. A. O. has placed reliance on a seized Excel sheet purportedly found during the course of search proceedings conducted in the case of M/s CFM Asset Reconstruction Private Limited and, on the basis thereof, alleged that the loan was acquired by CFM ARC for a consideration of 92.38 crores as against a total outstanding of 163.72 crores, thereby mechanically computing a so called notional “haircut” of 71.34 crores. On the strength of such presumption, the Ld. AO has further alleged that the said “haircut” was passed on to the respondent, completely ignoring the material fact that the alleged outstanding amount of 163.72 crores itself included an interest component aggregating to approximately 72 crores, which was never claimed, debited, or allowed as an expenditure in the hands of the respondent.

| Snapshot of data excel sheet seized |

| Original Lender | Trust name | Date of take over | Principal amount outstanding | Interest O/s | Total Outstanding | Purchase Price | Haircut |

| ECL Finance Limited | CFMA RC | 07.05.2021 | 9162.06 | 7210.59 | 16372.65 | 9238.44 | 7134.21 |

12. That the A.O. failed to appreciate that the seized excel sheet merely reflected the inter-se commercial arrangement between the original lender, ECL Finance Limited, and the Asset Reconstruction Company, and did not establish that any part of the alleged haircut was passed on to or benefited the respondent.

13. That the addition of 71.34 crores made by the Ld. AO under section 41(1) of the Act is wholly untenable, as neither the principal nor the interest liability was ever claimed or allowed as a deduction in any assessment year, nor was there any waiver, remission, or cessation of liability by M/s CFM Asset Reconstruction Private Limited. In the absence of a prior allowance and any remission of liability, the essential preconditions for invoking section 41(1) are not fulfilled.

14. Aggrieved by the order of AO, the respondent filed an appeal CIT(A) raising certain grounds. That during the appellate proceedings. The ld. CIT(A), in exercise of the powers conferred under section 250(4) of the Act, directed an independent enquiry and issued a notice under section 133(6) to M/s CFM Asset Reconstruction Private Limited vide letter dated 21.10.2024 seeking clarification as to whether any haircut or waiver had been granted to the respondent. The same is reproduced hereunder: –

Date: 24.10.2024

To

The Director, CFM Asset Reconstruction Pvt. Ltd.

First Floor, Wakefield House, Ballard Estate-38. Mumbai Sub: Enquiry u/s 133(6) of the Income Tax Act, 1961 in the cases of M/s Rudra Buildwell Projects Pvt. Ltd. and M/s Rudra Buildwell Homes Pvt. Ltd. for Financint Year 2021-22-reg.

Kindly refer to the above subject.

It is learnt that you your company was assigned the assets of ECL Finance Ltd. (lender) daring the year under consideration with respect to the loans advanced by ICL Finance Led, to the entities mentioned in the subject above. Le. (borrowers):

(1) M/s Rudra Buildwell Projects Pvt. Ltd. and

(2) M/s Rudra Buildwell Homes Pvt. Ltd.

It is directed to clarify as to whether any “haircut” was passed on to ECL Finance Ltd. regarding the outstanding loans of the above-mentioned entities during the year under consideration and whether the said “haircut” was passed on to the above entities. In case any “haircut” with respect to the outstanding loans was given to ECL. Finance Ltd. and further passed on to the above-mentioned entities, then the amount of “haircut” may be intimated to this office.

3. It is further informed that the said information is being called u/s 133(6) of the Income Tax Act, 1961 and the same be sent to this office on or before 15.11.2024 via email mentioned at top of the letter. Non-compliance to the above letter shall attract penal provisions of the Income Tax Act, 1961.

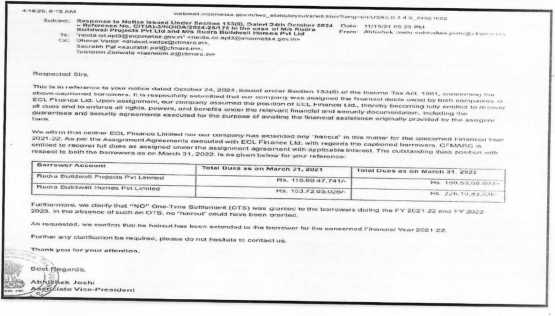

15. That in response to notice issued under section 133(6) of the Act (as reproduced at page 28 of the CIT(A)’s order), M/s CFM Asset Reconstruction Private Limited, vide its reply dated 15.12.2024, categorically clarified that upon assignment it had stepped into the shoes of ECL Finance Limited and was fully entitled to recover all dues in terms of the relevant financial and security documentation; that neither ECL Finance Limited nor CFM ARC had granted any “haircut” to the respondent for the financial years 2021-22 or 202223; that no One-Time Settlement (OTS) was ever extended and no waiver, remission, or cessation of liability had taken place; and that the respondent continued to remain fully liable to repay the principal as well as the interest strictly in accordance with the assignment agreements. The same is reproduced hereunder for your ready reference:

16. Rebuttal to department Ground No-5, that CIT(A) has erred in law by admitting the additional evidence under Rule 46-A

(a) That the information received from M/s CFM Asset Reconstruction Private Limited was duly furnished to the Ld. Assessing Officer on 16.11.2024, and despite four subsequent reminders issued to the Ld. AD vide e-mails dated 19.12.2024, 28.02.2025 01.04.2025, and 16.04.2025, no objection whatsoever was raised by the Ld. AO in respect of the enquiries conducted from CFM ARC and the material so shared (Refer page-34 of CIT(A) order). It is a settled position of law that enquiries made by the learned CIT(A) in exercise of appellate powers cannot be construed as “additional evidence”, a proposition which has been consistently upheld by various judicial authorities, as discussed hereinafter.

(b) Furthermore, the enquiry made u/s 250(4) cannot partake the character of additional evidence as per Rule-46A(4) Nothing contained in this rule shall affect the power of the (Joint Commissioner) (Appeals)] (or, as the case may be, the Commissioner (Appeals)] to direct the production of any document, or the examination of any witness, to enable him to dispose of the appeal, or for any other substantial cause including the enhancement of the assessment or penalty (whether on his own motion or on the request of the 19/Assessing Officer)) under clause (a) of sub-section (1) of section 251 or the imposition of penalty under section 271.)

(c) That the CIT(A) has also dealt this issue in detail that the evidence called from CFM ARC were called for under the power of enquiry u/s 250(4) and cannot be called as additional evidence. Please refer Pg-34 of CIT(A) order

(d) It is a settled position of law that the powers of the learned CIT(A) are co-terminus with the powers of the Assessing Officer. Accordingly, the learned CIT(A) was fully justified in making further enquiries by exercising powers under section 250(4) of the Income-tax Act, 1961. In the present case, the learned CIT(A) had called for specific information from CFMARC in order to adjudicate the issue in a just and proper manner. The information so received from CFMARC was duly forwarded to the Assessing Officer for his comments. Further, reminders were issued to the Assessing Officer on four separate occasions; however, no adverse comments or objections were received from the Assessing Officer. In such circumstances, the learned CIT(A) was fully justified in relying upon the information received from CFMARC while deciding the appeal. The action of the learned CIT(A) is strictly in accordance with law and principles of natural justice. Therefore, the ground raised by the Department challenging the enquiry conducted and reliance placed on CFMARC information is wholly misconceived and deserves to be rejected. The above legal position is supported by the following judicial precedents:” Commissioner of Income tax (International Taxation) v. Hotchand Techchand Punjabi (Delhi) [06-12-2023]

Section 698, read with section 147, of the Income-tax Act, 1961 – Undisclosed Investments (Recording of reasons) – Assessment year 2012-13-Assessing Officer had issued notice under section 148 having received information with regard to time deposits made by assessee, a US resident involved in retail business in USA, with Canara Bank and addition was made under section 698 based on unexplained investment in time deposits – Commissioner (Appeals) carried out an inquiry in matter by exercising his powers under section 250(4) and evidence was sought with regard to remittances made to NRE Account maintained with Canara Bank and having discovered that actual time deposits made in Assessment year 2012-13 were of lesser amount and difference in two amounts was wrongly quoted by Canara Bank, and as regards balance sum, since source of remittances was income earned by assessee in USA, he had deleted entire addition – Whether since Commissioner (Appeals) had exercised his powers under section 250(4) which was co-equal to that of Assessing Officer and it also took note of fact that notice was Issued to concerned branch of Canara Bank under section 133(6) and it was only after information was received from Canara Bank and material evidence furnished by assessee, that addition was deleted, no interference was called for particularly when these finding of facts were confirmed by Tribunal – Held, yes [Paras 17 to 19] [In favour of assessee

(e) (RAJ.) HIGH COURT OF RAJASTHANSilver and Art Palacev. Commissioner of Income-tax

(f) Commissioner of Income-tax, Central-l v. Manish Build Well (P.) Ltd. (Delhi)/[2011] 245 CTR 397 (Delhi) (15-11-2011]

(g)2021 (4) TM) 1033 DELHI HIGH COURT Other Citation: [2021] 435 ITR 85 (Del) International Tractors Ltd Versus Dy. Commissioner of Income Tax (LTU) &Anr.

(h) 2015 (4) TMI 940-BOMBAY HIGH COURT Rallis India Limited Versus Commissioner of Income Tax, (Appeals) -XXI, Mumbai and Others

(i) (BOM.) HIGH COURT OF BOMBAY Smt. Prabhavati S. Shah v. Commissioner of Income-tax.

J) Commissioner of Income-tax v. Kanpur Coal Syndicate [1964] 53 ITR 225 (SC) [30-04-1964)

17. That the learned CIT(A), by a detailed, reasoned and speaking order, rightly deleted the addition made by the Assessing Officer, and the present appeal filed by the Department, being based on conjectures, misinterpretation of facts and erroneous application of law, is devoid of merit and liable to be dismissed.

18. Rebuttal to Ground No 1 to 4

18.1 It is respectfully submitted that Ground No. 1 raised by the Revenue is wholly misconceived, as it seeks to invoke Section 41(1) of the Income-tax Act, 1961 in complete disregard of the mandatory jurisdictional conditions embedded in the provision.

18.2 That Section 41(1) is a specific and conditional deeming provision, and it can be triggered only when all statutory prerequisites are cumulatively satisfied, namely:

(i) the existence of a trading liability;

(ii) allowance or deduction of such liability in an earlier assessment year, and (iii) subsequent remission or cessation of such liability resulting in a benefit to the respondent.

18.3 That the learned CIT(A) has correctly appreciated this settled legal position while deleting the addition. In the present case, the liability sought to be taxed is a loan liability, which is inherently capital in nature. The no deduction of the loan principal was ever claimed or allowed in any earlier assessment year. In the absence of an earlier allowance or deduction, the very foundation for invoking Section 41(1) fails at the threshold, as rightly noted by the learned CIT(A),

18.4 That after making enquiry u/s 133(6) it was noticed by the CIT(A) that no haircut or OTS have been offered to the respondent by CFM ARC and as such the CIT(A) rightly concluded that the provisions of Sec 41(1) are not applicable. Moreover, the CIT(A) also observed that it a normal practice in the business of Asset reconstruction companies that the distressed assets of various lenders are picked up at discounted price because they carry an inherent risk. The takeover of the loan at a reduced cost by CFM ARC from ECL Finance Ltd has by no means reduced the liability of the assessee as the new lender would be pressing the assessee for the recovery of the said loan at the original amount till the time One Time Settlement is offered. (Refer Page 36 and 37 of CIT(A) Order). In law, a liability can be said to have ceased only when there is an express waiver, settlement, or discharge, either by operation of law or by a clear agreement between the parties. Admittedly, no such waiver, OTS, or discharge exists in the present case. The borrower’s liability continues unabated, and therefore, the very premise of the AO’s addition collapses.

18.5 That the learned CIT(A) has further rightly observed that till Assessment Year 2022-23, judicial precedents have consistently held that even where there is a reduction in the principal component of a term loan, the same constitutes a capital receipt and cannot be brought to tax. The legislative change taxing waiver of principal under Section 28 has been made prospectively with effect from AY 202324, and therefore has no application to the year under consideration. (Refer Page 36 of CIT(A) Order)

18.6 That the department’s entire case rests on the assumption that the acquisition of the loan by M/s CFM Asset Reconstruction Pvt. Ltd. from ECL Finance Limited at a discounted value resulted in a “haircut” being passed on to the respondent. The learned CIT(A) has rightly rejected this assumption and has categorically observed that the assignment of a loan at a discount is a transaction entirely between the assignor bank and the ARC, and the borrower is neither a party to such transaction nor does the consideration paid by the ARC alter the borrower’s contractual liability.

18.7 That the learned CIT(A) has also correctly noted that the respondent has not written back any liability in its books of account, nor has any income been credited to the Profit & Loss Account. This accounting treatment is entirely consistent with the legal position that no real or notional benefit has accrued to the respondent. That the contention of the department that a “benefit” has arisen merely because the CFM ARC acquired the loan at a discount is thus wholly misconceived, as Section 41(1) cannot be invoked on assumptions, commercial perceptions, or lender-side accounting entries. The provision operates strictly within its statutory confines, which are conspicuously absent in the present case.

18.8 That the Department, in Ground No. 3, has alleged that the assessee failed to disclose the waiver of loan and did riot furnish any documentary evidence regarding the benefit arising from the alleged loan waiver. The said allegation is factually incorrect and contrary to the material available on record. It is an admitted and undisputed fact, as confirmed during the enquiry proceedings, that no loan was waived by CMC ARC. On the contrary, the loan was merely taken over by CMC ARC from ECL Finance, which fact is clearly recorded in the assessment order itself. Further, the assessee had duly filed detailed replies and supporting documents before the Assessing Officer during the course of assessment proceedings, clarifying that no waiver or remission of liability had taken place. in view of the above factual position, there was no occasion for the assessee to disclose any alleged benefit arising from loan waiver. Therefore, the ground raised by the Department is devoid of merit, based on incorrect appreciation of facts, and hence deserves to be rejected

18.9 That in Ground No. 4, the Department has contended that the learned CIT(A) erred in deleting the addition on the premise that the reduction in loan value by the CMC ARC did not result in any benefit to the assessee. The said ground is based on an incorrect appreciation of facts. As duly confirmed by CMC ARC, the loan in question was assigned to it by ECL Finance Limited, and there was no waiver, remission or reduction of the amount recoverable from the assessee. It is pertinent to note that CMC ARC is an Asset Reconstruction Company duly approved by the Reserve Bank of India, and upon assignment, a merely stepped into the shoes of ECL. Finance Limited as lender. The assignment of the loan at a discounted value between ECL Finance Limited and CMC ARC was a commercial transaction inter se the lenders and did not confer any benefit whatsoever upon the assessee-borrower. Since the liability of the assessee remained unchanged in its entirety, no income arose in the hands of the assessee. Therefore, the ground raised by the Department in Ground No. 4 is misconceived. factually incorrect, and liable to be rejected.

16.10 In view of the above facts and settled legal position, the learned CIT(A) has rightly concluded that there was neither remission nor cessation of a trading liability, nor was there any prior allowance of deduction. Consequently, no income could be deemed to arise under Section 41(1), and the deletion of the addition of 71,34,21,000/- is fully justified in this regard we are relying upon the following case laws

(a) (SC) SUPREME COURT OF INDIA Principal Commissioner of Income Tax v. Gujarat State Financial Corporation*

Section 41(1) of the Income-tax Act, 1961-Remission or cessation of trading liability(Loan waiver)-Assessment year 2009-10 -During year, under one time settlement scheme, assessee-company got a waiver of principal amount of loan due to a bank A.0.opined that waiver of loan amount would be considered as cessation of trading liability and such loan amount was income of assessee under section 41(1) High Court by impugned order held that since loan amount was never claimed by assessee as expenditure in its accounts, waiver of same could not amount to cessation of trading liability and was not chargeable to tax under section 41(1) Whether special leave petition filed against impugned order was to be dismissed – Held, yes [Para 1] [In favour of assessee)

(b) (SC) SUPREME COURT OF INDIA Commissioner of Income-tax v. Compaq Electric Ltd. ”

Section 41(1) of the Income-tax Act, 1961- Remission or cessation of trading liability(Allowance or deduction)- Assessment year 2003-04- Assessee-company was a wholly owned subsidiary company of DRL In view of huge losses suffered by assessee-company, operations of company were funded by way of unsecured loans from DRL from year to year-During relevant assessment year, assessee-company proposed and DRL accepted a request to agree for conversion of unsecured loan partly into equity share capital and waived balance as not recoverable – A.O was of view that loans were received during course of assessee’s business with DRL, and that liability of assessee was a trading liability Assessing Officer, thus, held that provisions of section 43(1) were attracted in respect of amount of unsecured loan written off High Court by impugned order held that in view off act that in respect of amount in question, there was no allowance or deduction claimed by assessee for previous years, when creditor waived repayment of said amount, it amounted to capital receipt not liable to tax – Whether Special Leave Petition filed against impugned order was to be dismissed Held, yes [Para 7][in favour of assessee]

(c) (SC) SUPREME COURT OF INDIACommissioner v. Mahindra And Mahindra Ltd. ”

Section 28(iv), read with section 41(1), of the Income-tax Act, 1961-Business income-Value of any benefit or perquisite arising from business or exercise of profession (Waiver of loan)- Assessment year 1976-77-Assessee had acquired certain tooling and equipment from KJC for which KIC agreed to provide loan to assessee, however, subsequently, another entity took over KJC and agreed to waive outstanding loan amount – Revenue claimed that waived amount represented income under section 28(iv) or alternatively, under section 41(1)- Assessee however, pointed out that sum waived could not be brought to tax as it represented waiver of a loan liability which was on capital account and, thus, was not in nature of income -Whether, for invoking provisions of section 28(iv), benefit received has to be in some form other than in shape of money and since waiver amount represented cash/money, provisions of section 28 (iv) were inapplicable Held, yes Whether further, for application of section 41(1), it is sine qua non that there should be an allowance or deduction claimed by assessee in respect of loss, expenditure or trading liability incurred, however, assessee had not claimed deduction under section 36(1)(ii) for interest on loan and loan was obtained for acquiring capital assets, hence, waiver was on account of liability other than trading liability and, thus, provisions of section 41(1) were inapplicable – Held, yes(Paras 13, 15, 15 and 17] in favour of assessee)

(d) (Gujarat) HIGH COURT OF GUJARAT Principal Commissioner of Income-tax v. Gujarat State Co-Op Bank Ltd.

11. Section 41(1) of the Income-tax Act, 1961 Remission or cessation of trading liability(General) Whether primary requirement of applicability of section 41(1) is that an allowance or reduction has to be made in assessment for any year in respect of loss or expenditure or trading liability and where no such allowance or deduction is made, question of applicability of section 41(1) will not arise – Held, yes [Para 7] [In favour of assessee)

(e) Principal Commissioner of Income-tax v. Soorajmull Nagarmull (SC)/[2024] 466 ITR 248 (SC)(09-07-2024]

(f) Commissioner of Income-tax – I v. Pradeshiya Industrial & Investment Corp. U.P. (Picup) (Allahabad) [23-07-2013)

E) Commissioner of Income-tax v. Tosha International Ltd. (Delhi)/(2011) 331 ITR 440 (Delhi (23-09- 2008]

(h) Commissioner of Income-tax-II v. Shivali Construction (P.) Ltd. (Delhi) (Mag.)/[2013] 355 ITR 218 (Delhi) [01-05-2013)

In view of the settled legal position, uncontroverted factual findings, and absence of any waiver, remission, cessation, or prior allowance of liability, the learned CIT(A) has rightly deleted the addition under section 41(1), and the Department’s appeal being devoid of merit deserves to be dismissed in toto.

Thanking You.

10. Heard both the parties and perused the materials available on record. The sole issue before us is that assessee company has taken financial assistance of Rs. 85.00 Crs. from M/s ECL Finance Limited in terms of the agreement dated 18.12.2017. Thereafter, the lender company M/s ECL Finance Ltd. has transferred all its rights, title, interests and benefits of the loan facility given to the assessee to one company M/s CFM Asset Reconstruction Private Limited Company registered with RBI u/s 3 of the SARFAESI Act, 2002. The said company has taken over the loan on 07.05.2021 for Rs. 9238.44 lacs when the outstanding amount of loan along with interest was Rs.16372.65 lacs and there was haircut of Rs.7134.21 lacs (16372.65 -9238.44). The AO alleged that this reduction in the value of loan was transferred to the assessee company as haircut benefit and made the addition. Claim of the assessee is that this arrangement is between the lender company and M/s CFM Asset Reconstruction Pvt. Ltd. who bought the loan and no benefit whatsoever was passed to the assessee. Ld. AR drew our attention to the verification done by Ld. CIT(A) u/s 254(2) directly from the company and after getting confirmation of these facts, had deleted the addition. The relevant observations of Ld. CIT(A) as contained in para-5 of its order are reproduced as under:

“5. It is an undisputed fact that the Assessee initially availed a loan of Rs. 85 crores from ECL Finance Limited, which subsequently increased to Rs. 163 crores, inclusive of Rs. 2.10 crores in accrued interest. The AO’s assertion that the ‘haircut’ of Rs. 1.34 crores waspassed on to the Assessee is entirely Nodi speculative and lacks substantive evidence. The communication relied upon by the AO pertains exclusively to the agreement between the original lender, ECL Finance Limited, and CFM Asset Reconstruction Private Limited, and no documentation supports the contention that the benefit of the haircut was extended to the Assessee. It is a matter of record that the alleged ‘haircut’ was never passed on to the assessee, and the addition made by the learned Assessing Officer (AO) is based on surmises and conjectures, without any factual or legal basis, by presuming that such a haircut was transferred to the Assessee. Consequently, the income alleged by the AO under Section 41(1) is wholly misplaced, especially in light of the facts of the case.

11. Before us, the Revenue has failed to controvert such findings of Ld. CIT(A) who has reached to such conclusion after taking clarification from M/s CFM Asset Construction Pvt. Ltd. i.e. the company who purchased the loan from the lender company. The response given by the M/s CFMARC is at para 4.4 of the appellate order wherein it is clarified that no one time settlement (OTS) was granted to the borrower during the financial year 2021-22 to 2022-23 and in absence of the OTS, no haircut could have been granted. It is also a matter of fact that this reply of CFM Asset Construction Pvt. Ltd. was confronted to the AO through email by ld. CIT(A), however, no reply was given by the AO.

12. In view of these facts, we are of the considered view that Ld. CIT(A) has rightly deleted the addition made by the AO which order is hereby upheld. Accordingly, all the grounds of appeal taken by Revenue are dismissed.

13. Now, we take up the ITA No.4118/Del/2025 in the case of M/s Rudra Buildwell Projects Pvt. Ltd.

14. As observed above, admittedly the facts of this case in ITA No.4118/Del/2025 in the case of M/s Rudra Buildwell Projects Pvt. Ltd. are identical to the facts in the case of M/s Rudra Buildwell Homes Pvt. Ltd. in ITA No.4119/Del/2025 and both the parties have made common submissions for both the appeals.

15. Looking to the facts, that the allegations made by the AO for making the additions and observations by the Ld. CIT(A) while deleting the additions are identical in both the appeals, thus, by following the observations made by us in ITA No.4119/Del/2025 while dismissing the appeal of the Revenue which are applicable mutatis mutandis to the present case, all the grounds of appeal taken by the Revenue are dismissed.

16. In the final result, both the appeals filed by the Revenue are dismissed.