JUDGMENT

V. Kameswar Rao, J.- This petition has been filed with the following prayers:

“1. Issue a writ of Certiorari or writ of mandamus or appropriate writ, direction or order

a. setting aside the impugned order u/s 148A(d) of the Act and the accompanying notice u/s 148 of the Act both date 31.03.2023 by Respondent No. 1 in the Petitioner’s case for A. Y. 2016-17.

b. Quashing the proceedings initiated vide the impugned notice dated 31.03.2023 u/s 148 of the Act.”

2. The petition relates to the Assessment Year (AY) 2016-17, for which an order under Section 148A(d) of the Income Tax Act,1961 (‘the Act’) and a notice under Section 148 of the Act, both dated 31.03.2023 were issued by the respondent no.1, on the information available with him whereby he has called for the filing of the return of income (ITR) by the petitioner herein, within thirty days.

FACTUAL BACKGROUND

3. At the outset, we may provide a brief factual background of the controversy. The petitioner herein, is a company incorporated under the Companies Act, 1956 and is regularly assessed to income tax at Delhi. For the AY concerned i.e. 2016-17, the petitioner filed its ITR on 08.10.2016, declaring loss of Rs. 10,24,33,542/-. The petitioner’s case was picked up for scrutiny assessment, pursuant to a notice under Section 143(2) being issued. Thereafter, upon conducting the proceedings, the Assessing Officer passed the assessment order under Section 143(3) of the Act, on 09.12.2018, assessing the income at Rs. 14,56,05,630/-. The assessing officer by this order made an addition of Rs. 24,80,39,169/-, on account of alleged premium charged in excess of the fair market value of shares determined by changing the method of valuation of shares from DCF method adopted by the petitioner, to the book value method.

4. Aggrieved by the assessment order, the petitioner filed the first appeal before Commissioner of Income Tax [Appeals]-4, New Delhi [“CIT(A)”], on 07.01.2019. The first appellate authority partly allowed the petitioner’s appeal vide order dated 20.01.2020. The addition made by the assessing officer under Section 56(2)(viib) of the Act was deleted but some related technical grounds were dismissed. Hence, the appeal came to be partly allowed. However, aggrieved by the order of CIT(A), the Revenue filed an appeal before the Income Tax Appellate Tribunal (ITAT), Delhi on 29.06.2020 and the same is pending orders of the ITAT.

5. On 22.03.2023, the respondent no. 1 issued a notice to the petitioner under Section 148A(b) of the Act along with relevant annexures and scanned copy of audit objections raised by the local Audit Party conveying that he has information in his possession which suggests that income chargeable to tax for AY 2016-17 has escaped assessment within the meaning of Section 147 of the Act and called upon the petitioner to show cause as to why notice under Section 148 of the Act should not be issued. Thereafter, the Assessing officer while relying upon Section 148 Explanation-1 (ii) of the Act and the audit objections issued the impugned notice to the petitioner, granting it an opportunity to show cause as to why the assessment in the case of the petitioner must not be reopened. The compliance from the petitioner was sought by 29.03.2023.

6. The annexure to the notice under Section 148A(b) of the Act mentions two primary reasons by the way of two audit objections, which were raised by the local audit party. The same are reproduced as under:

“Audit Para No.:No.CT/IIA/0003

Section56(2)(viib) provides that where a company, not being a company in which the public are substantially interested, receives from any person being a resident, any consideration for issue of shares that exceeds that face value of such shares, the aggregate consideration received for such shares as,exceeds the fair market value of the shares shall be chargeable to tax under the head Income from other sources. The fair market value to be determined by applying the method prescribed under Rule 11 UA of IT Rules. The assessment of M/s.Gamma Pizzakraft(overseas)Private Ltd for AY 2016-17 the assessment “was completed after scrutiny u/s 143(3) in December 2018 at an income of Rs. 14,56,05,630.The assessee issued 54,33,548 equity shares of face value of Rs. 10 each to a company at the rate of Rs. 65.65 (total consideration of Rs. 35,67,12,426)thereby getting premium of Rs.30,23,74,146 at the rate of Rs. 55.65 per share.

Assessing Officer attracted the provisions of Section 56(2)(viib) and worked out the fair market value, in accordance the provisions of Rule 11 UA, as Rs. 10 per share i.e. equal to the face value of the share. As such, no premium was allowable on the equity shares to assesse.

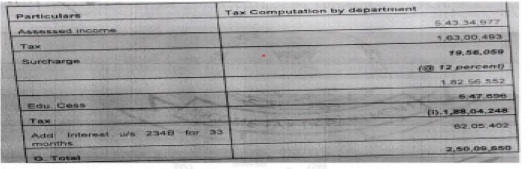

However, the AO disallowed premium only of Rs. 24,80,39,169 in the assessment order by adding it to the income of the assessee, and allowed premium Rs. 5,43,34,977 on equity shares to assessee. Thus, incorrect allowance of share premium on transfer of equity shares,having market value equal to face value (Rs.10), resulted in under assessment of Rs.5,43,34,977 having tax effect ofRs.2,50,09,650 as computed below:

Audit Para No.:CT/IIA/0002

Section 36 (i) (ii) of the Income Tax Act, 1961, provides -that bonus or commission paid to employees is admissible only if it is not payable as profit or dividend. Section 37 of the Act further provides that any expenditure, not being in the nature of capital expenditure, laid out wholly or exclusively for the purpose of business is allowable as deduction in computing income chargeable under the head Profits and gains of business or profession. Thus, all expenditure, other than capital expenditure which is incurred in relation to the business is allowable. The assessment of M/s. Gamma Pizza kraft (overseas) Private Ltd for A Y 2016-17 the assessment was completed after scrutiny u/s 143(3) in December 2018 at an income of Rs. 14,56,05,630. The assesses company, which started operating a bakery restaurant, had turnover of only Rs. 1,75,978 in the first AY and filed ITR at loss of Rs. 10.24 crore. Audit scrutiny noticed that assessee paid Rs. 8.90 crore to Sh. Amar Singh (MD and shareholder) and Rs. 90.81 lakh to Sh. Snadeep Kohli (shareholder) crore on account of Bonus and legal & professional expenses respectively out of total expenses of Rs. 10.51 crore debited to P&L, which worked out to 93 percent. There was no justification available in the file as to why the huge bonus was paid by the assessee to its MD/ shareholders in the very first year when the turnover of the company was negligible. The expenses was not allowable as these were not incurred for business purpose. Further, the bonus and legal & professional expenses paid to MD/shareholders was otherwise payable as profit or dividend to them.

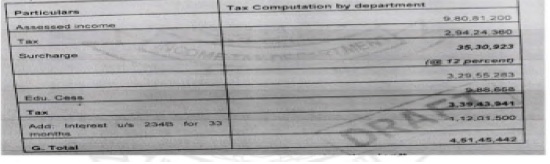

Thus, incorrect allowance expenses resulted in under assessment of Rs.9,80,81,200 (Rs.8,90,00,000 Rs.90,81,200) having tax effect of Rs.4,51,45,442 as computed below:

7. Hence, the assessing officer has relied on these two audit objections to state that petitioner had not disclosed all the facts in the ITR / financial statements for AY 2016-17.

8. It can be noted from the above that the first audit objection is related to escapement of income due to an incorrect allowance of share premium @ Rs.10 per share amounting to Rs.5,43,34,977/- on issue of equity shares. The second audit objection is related to the incorrect allowance of Rs.9,80,81,200/-. In view of the same, the shared premium and expenses (Rs.5,43,34,977/- plus Rs.9,80,81,200/-.) was held to be disallowed and added back to the total income of the petitioner.

9. On the basis of the petitioner’s reply to this notice, the assessing officer dropped the issue raised by the first audit objection and held that there was no escapement of income in relation to the said share premium issue. However, in the second audit objection, it mentioned that two payments made to Mr. Amar Singh (MD & shareholder) and to Mr. Sandeep Kohli (shareholder) constituted 93% of expenses debited to Profit & Loss Account (P&L Account) and that there was no justification available in the file as to why the huge bonus was paid to the MD/shareholder in the very first year when the turnover of the company was negligible. The Audit Party then concluded that the expenses were not allowable as these were not incurred for business purposes. The Audit Party also concluded that the bonus and legal and professional expenses were otherwise payable as profit or dividend to them. Based on this, the Audit Party held that the incorrect allowance from expenses has resulted in under assessment of income amounting to Rs.9,80,81,200/-. Hence, it is the second audit objection which is the basis for the impugned order and impugned notice, which is challenged before us.

SUBMISSIONS ON BEHALF OF THE PETITIONER

10. Mr. T. M. Shivakumar, learned counsel appearing on behalf of the petitioner company stated that the petitioner had already filed its ITR under Section 139(1). However, since the time given in the impugned notice under Section 148 of the Act was fast approaching, as a matter of abundant caution and not to be in default of filing the ITR, the petitioner filed the ITR again. Before filing the ITR again, the petitioner sent an email to the assessing officer reiterating the same stand that it is filing the ITR under protest and is retaining its right to approach this Court against the impugned notice and order.

11. He stated that the petitioner herein, filed a detailed reply on 29.03.2023 to the above show cause notice dated 22.03.2023 along with supporting annexures. Due to typographical errors in the said reply, the reply was resubmitted on 30.03.2023, after making necessary corrections. In this reply, the petitioner made a detailed submission to justify that there was no escapement of income. He stated the assessing officer has wrongly disallowed the expenditure of Rs.9,80,81,200/- as not allowable under Section 37 of the Act.

12. A gist of the submissions made by him in this reply can be summed up as follows:-

| (i) | | The petitioner clarified that unlike the averment in the audit objection, the said Rs.8.90 crore paid to Amar Raj Singh (MD & shareholder) was not on account of “bonus” but it was towards “joining bonus” for the services rendered in the capacity as MD of the company and that the same has been duly disclosed in the Audited Financial Statement. |

| (ii) | | This entire amount is being attributed to legal and professional fees and there is no mention of the words “joining bonus” anywhere in the operative part of the impugned order. |

| (iii) | | The petitioner enclosed with its reply a copy of the Audited Financial Statement and drew reference to note no. 20 [employees benefit expenses] & note no. 31 [related party disclosure] in this regard. |

| (iv) | | This payment to Amar Raj Singh was duly supported by the Employment Agreement executed between him and the petitioner company on 11.09.2015 as per resolution of the Board in its meeting held on 11.09.2015. Petitioner submitted the copy of the Financial Statement of the Company for FY 2015-16 as also the copy of the Employment Agreement which formed part of the original assessment proceedings. |

| (v) | | The petitioner was asked to submit the relevant details in response to a questionnaire attached to the notice under Section 142(1) of the Act, dated 11.09.2018 in which the following details were sought:- |

“14. Please provide details of salary and wages amounting to Rs.8,92,60,513/- such as name of the employee, PAN, address, designation, TDS details etc.

15. You have shown 8,90,00,000/- as director remuneration. Please provide details of director whom payment is being made and his return of income.

xxx xxx xxx

17. Please provide details of legal & professional expenses of Rs.1,24,44,134/- such as name of the person, PAN, bills raised by the persons/parties, payment invoices, brief details of nature of the legal work, TDS details etc.”

| (vi) | | By reply dated 31.10.2018, the petitioner complied with this questionnaire. The petitioner enclosed with its reply, a copy of the Employment Agreement with Amar Raj Singh and the Consulting Agreement with Sandeep Kohli. |

| (vii) | | The payment of Rs. 90.81 Lakh to Sandeep Kohli was made for his appointment as consultant for providing consultancy services for the company, based on his expertise and experience in running outlets such as ‘Pizza Hut’ and ‘Delifrance’. |

| (viii) | | The petitioner appointed Sandeep Kohli for strategic guidance and input on new outlets, new locations, current operations etc., |

| (ix) | | The petitioner duly deducted TDS on payments made to Amar Raj Singh under Section 129 of the Act, and a service tax @ 14 percent to Sandeep Kohli |

| (x) | | Both Amar Raj Singh and Sandeep Kohli have filed their ITRs for AY 2016-17 and thereby declared both the amounts and tax liability has been discharged at the highest slab rate of 30 percent. |

| (xi) | | Hence, these amounts were not payable as profits and dividend as the same were paid towards services to the company. |

13. It is his submission that the expenses were incurred by the petitioner company for the purpose of business and were allowable on the grounds of commercial expediency. Reliance is placed on the judgment in the case of S.A. Builders Ltd. v. CIT (Appeals) (SC)/[2007] 288 ITR 1 (SC).

14. It is also his submission that all the aspects of the petitioner’s case had already been examined by the assessing officer during scrutiny assessment and all the material facts were duly disclosed by the petitioner. Now, the assessment must not be opened on a mere ‘change of opinion’ on the part of the assessing officer. To substantiate this, he has placed reliance on the following judgments:

| a. | | Jt. CIT v. Cognizant Technology Solutions India (P.) Ltd. (SC)/[2023] 452 ITR 224 (SC), |

| b. | | Assistant Commissioner of Income-tax v. CEAT Ltd. (SC)/[2022] 449 ITR 171 (SC) |

| c. | | Deputy/Asstt. CIT v. Financial Software and Systems (P.) Ltd. (SC)/[2022] 447 ITR 370 (SC) |

| d. | | Pr. CIT v. Century Textiles & Industries Ltd. (SC), |

| e. | | Replika Press (P.) Ltd. v. Dy. CIT (Delhi), |

| f. | | NTPC Ltd. v. Dy. CIT (Delhi), |

| g. | | Consolidated Photo & Finvest Ltd. v. Asstt. CIT (Delhi), |

| h. | | Deepak Kapoor v. CIT 2022 SCC Online Del 3724, |

| i. | | Tata Sons Ltd. v. Dy. CIT (Bombay) |

| j. | | Springer Healthcare Ltd. v. Asstt. CIT ITR 268 (Delhi)/W.P.(C) 336/2025 (DHC) |

15. He stated that the assessing officer passed the order under Section 148A(d) of the Act after due examination, wherein, he agreed with the petitioner’s submissions made by it in its reply, that there was income which has escaped assessment on the issue of incorrect allowance of share premium of Rs.5,43,34,977/-. However, the submissions with respect to incorrect allowance of expenditure of Rs.9,80,81,200/- were rejected summarily as having no merit.

16. It is also his submission that the Audit para was issued without receiving a reply from the assessing officer on factual aspects. Had the assessing officer given his reply to the audit para, the objections might have been duly dropped as the assessing officer had already examined the said issue in the course of original assessment proceedings under Section 143(3) of the Act vide points no. 14, 15 and 17 of the questionnaire (reproduced above herein) attached to the notice under Section 142(1) and the claim was allowed only after being satisfied with the reply submitted by the assessee.

17. He stated that the assessing officer has entirely relied on the audit objection and incorrectly held that the petitioner failed to establish a rationale in the payment of a high expense on a dismal turnover for the relevant year. The assessing officer has erroneously held that the expenses were exceptionally high and unrelated to the business.

18. Mr. Shivakumar challenged the report of the Audit Party on the following grounds. Firstly, the Audit Party has used the word “bonus” for the amount paid to the MD. It had erred in not giving the correct description for the amount paid to the MD. The said amount was the “joining bonus” paid to the MD and not a bonus in the usual sense. Such an amount paid would have relevance to the need of the company to engage a particular person as its MD and the roles and responsibilities he is entrusted with and has no relevance to the first year’s turnover. Had it been correctly mentioned, it would have removed any misgivings on the payment made in the first year. Secondly, the Audit Party did not have any evidence before them to give a finding that the expenses were not incurred for business purposes.

19. As per him, the audit observation was defective as the Audit Party had traversed beyond their mandate by seeking justification for allowance of an expense debited to P&L in a completed assessment. The Audit Party cannot question the wisdom and discretion of the assessing officer in deciding which aspects need to be verified. It cannot question what is the level of satisfaction which is to be achieved by the assessing officer while completing the assessment.

20. He also stated that as per the Audit Manual issued by the Comptroller and Auditor General, the calling for information/details during assessment proceedings is within the discretionary domain of the assessing officer. Hence, the Audit Party could not have required the justification to have been called for by the assessing officer while completing the assessment proceedings under Section 143(3) of the Act. Since the assessing officer did not give any reply, the defect of the Audit Party went uncontested for no fault of the petitioner.

21. He reiterated that there was no failure on part of the assessee in disclosing material facts, which were duly examined by the assessing officer during scrutiny assessment. Hence, reopening of assessment cannot be done on mere change of opinion.

22. Another argument raised by Mr. Shivakumar is that the impugned order and notice are barred by limitation prescribed under Section 149 (1)(b) of the Act, as the assessing officer did not have any documents/evidence in his possession which revealed any escapement of income represented in the form of any expenditure in respect of a transaction. The impugned order and notice are also without jurisdiction, having been issued beyond the period of three years from the end of AY 2016-17 without satisfying the conditions imposed by clause (b) of Section 149(1) of the Act.

23. According to him, this is a clear case of change of opinion. In the garb of reassessment, the assessing officer is attempting to review his own order in the absence of any fresh information/material available with him. The assessing officer had already allowed the subject expenses debited to the P&L account after viewing all the relevant facts, and is now only trying to re-appreciate the same. Reliance was placed by him on the judgment in the case ofCIT v. Kelvinator of India Ltd. (SC)/[2010] 320 ITR 561 (SC)/(2010) 2 SCC 723.

24. It is also his submission that the impugned order and notice, having been issued by the jurisdictional assessing officer, are in violation of Section 151A of the Act. It is only the faceless assessment officer who is empowered to issue notice under Section 148 of the Act as per the eAssessment of Income Escaping Assessment Scheme, 2022 notified vide Notification no. 18/2022/F. No.370142/16/2022-TPL(Part1) dated 29.03.2022. As per paragraph 3(b) of the said Scheme, the issuance of notice under Section 148 of the Act shall be through automated allocation, in accordance with the risk management strategy formulated by the Board as referred to in Section 148 of the Act, for issuance of notice, and in a faceless manner, to the extent provided in Section 144B of the Act with reference to making assessment or reassessment of total income or loss of the assessee.

25. It is the petitioner’s case that the assessing officer has held that the escaped income is represented in the form of expenditure in respect of a transaction. However, he has not mentioned which transaction he is referring to, in respect of which income represented in the form of expenditure which, according to him, has escaped assessment. In fact, there is no escaped income in the form of an ‘expenditure-in-respect-of-a-transaction’ which is being brought to tax.

26. He also stated that after amendments to Sections 147 to 151 of the Act with effect from 01.04.2021, in case of assessments completed under Section143(3) of the Act, the audit objection can only be a starting point for enquiry under Section 148A(a) or for issuance of notice under Section 148A(b) of the Act. But in the absence of any fresh material on record, completed assessments cannot be reopened as it would amount to “review” which cannot be done by the assessing officer.

27. He placed reliance on the judgment of the Supreme Court in the case of CIT v. Financial Software & Systems (P) Ltd. 2022 SCC OnLine SC 1411 wherein it was held that the Revenue was wrong in reopening the assessment proceedings as the original assessment under Section 143(3) of the Act was done wherein specific queries were raised to the petitioner which were answered by it.

28. He stated that the impugned order was passed by brushing aside the detailed reply given by the petitioner to the show cause notice under Section 148A(b) of the Act. The assessing officer should have considered the reply and then proceeded to pass the impugned order. The purpose of Section 148A is to give opportunity is to the assessee to justify and present arguments to the assessing officer to prevent the reopening of a completed assessment. The provision is an important safeguard introduced through the Finance Act, 2021 against the arbitrary and opaque process of reopening assessments. However, it has been reduced to a mere mechanical formality by the assessing officer who has simply dismissed the objection with a cryptic observation -“no merit”. Reliance is placed on the judgment of in the case of Surender Kumar Jain v. Principal Commissioner Delhi [W.P.(C) 17700 (Del) of 2020, dated 25-1-2023].

29. Reliance is also placed by him on the case of Triveni Rubber & Plastics v. CCE AIR 1994 SC 1341, wherein the Supreme Court held that the order impugned therein suffers from perversity inasmuch as some relevant evidence had not been considered or that certain inadmissible material had been taken into consideration or where it could be said that the findings of the authorities were based on no evidence or that they were so perverse that no reasonable person would have arrived at those findings.

30. In reply to the stand taken by the Revenue that the writ petition is premature, Mr. Shivakumar stated that the present petition is not against the show cause notice but against the impugned order under Section 148A(d) and impugned notice under Section 148 of the Act. The present petition is not limited to the sufficiency or correctness of the material available with the assessing officer but also about the lack of jurisdiction with the assessing officer to review his own order in the garb of reassessment, for which the assessing officer lacked authority.

31. Concluding his submissions, Mr. Shivakumar stated that all the facts, documents and records were duly examined by the assessing officer and there was no fresh material with the assessing officer which was not already considered at the time of assessment. Hence, the reassessment is merely on a change of opinion and an attempt to review the earlier order. In view of the above, the impugned notice and impugned order must be set aside.

SUBMISSIONS ON BEHALF OF THE RESPONDENTS

32. Contesting these submissions, Mr. Abhishek Maratha, learned Senior Standing Counsel appearing on behalf of the respondents/Revenue, stated that the information in this case was received by the assessing officer after a field audit was carried out by the Revenue Audit team of the Comptroller and Auditor General of India. The assessee was provided adequate opportunity to provide its reply under Section 148A(b) of the Act. After duly considering the reply furnished by the petitioner/assessee under Section 148A(c) of the Act, the order under Section 148A(d) of the Act was passed and the case of the assessee was found to be fit to issue the notice under Section 148 of the Act. It was found that the turnover of the assessee company for the Financial year (FY) 2015-16 was only Rs. 1,75,978/-. However, the petitioner company paid an amount of Rs. 8.90 crore to Amar Singh (MD and shareholder) and Rs 90.81 lakh to Sandeep Kohli (shareholder) on account of bonus and legal & professional expenses. As per the assessing officer, these amounts were exceptionally high and not directly related to the business and therefore the combined expenditure was disallowed under Section 37 of the Act.

33. He stated at the outset that this petition is premature. As per the law laid down by the Supreme Court and various High Courts, unless there is an absolute lack of jurisdiction, a writ petition against a show cause notice is not maintainable. Reliance was placed on the judgments in the cases of Than Singh Nathmal v. Superintendent of Taxes (1964) 6 SCR 654; Titaghur Paper Mills v. State of Orissa 1983(2) SCC 743 ; andRaj Kumar Shivhare v. Asst. Director, Enforcement Directorate 2010 (4) SCC 772.

34. He stated that the objections of the assessee were duly considered and disposed of and only then was the order under Section 148A(d) of the Act passed. As per the information with the assessing officer, the transaction amounting to Rs.9,80,81,200/- relatable to AY 2016-17 was beyond 3 years but not beyond 6 years. The income chargeable to tax in this case was more than threshold limit i.e. Rs.50,00,000/- as prescribed in Act and such income is represented in the form of an expenditure in respect of transaction. Therefore, the notice issued under Section 148 of the Act is in compliance with the first proviso to Section 149(1)(b) of the Act. Hence, the contention of the assessee is incorrect.

35. As per Section 149(1), expenditure means that which is incurred in respect of a transaction or in relation to an event or occasion but it is not mentioned whether the same should be routed through P&L account or not.

36. To the argument that the impugned notice is contrary to the “eAssessment of Income Escaping Assessment Scheme, 2022” notified under Section 151A of the Act and is barred by limitation as per first proviso to Section 149(1) of the Act, Mr. Maratha stated that this ground does not hold any merit as Section 151A states the proceedings are to happen in faceless manner as given in Section 144B and Section 144B does not cover any procedure under Section 148A in its scope. Moreover, pursuant to reopening of the case, the reassessment proceedings are taking place in a faceless manner only. Hence, there is no contravention in following any procedure.

37. It is his submission that no decision was passed on the issue of incorrect allowance of expenses of Rs. 9,80,81,200/- in consonance with the speaking order which was passed under Section 143(3) of the Act dated 09.12.2018. It is trite law that under Section 36(i)(ii) of the Act, the bonus or commission paid to an employee for services rendered by them is allowed as deduction if it is not paid as dividend or profits. In the present case, the assessing officer has observed that the amount of Rs. 8.90 crore paid by the assessee to Amar Raj Singh (MD & shareholder) and Rs 90.81 lakh to Sandeep Kohli (shareholder) on account of bonus and legal & professional expenses respectively out of the total expenses of Rs.10.51 crore debited to P&L, account which worked out to 93 percent was detected only after the completion of the scrutiny assessment, as a result of the investigation. This being new material coming to the knowledge of the assessing officer which was not considered at the time of the original assessment proceedings, the initiation of reassessment proceedings is justified.

38. Additionally, he stated that the payments made were not wholly and exclusively for the purpose of business and profession under Section 37 of the Act. This issue was raised in the audit objection and hence the impugned order was passed. Moreover, in its reply, the assessee failed to prove the genuineness of such high expenses on a dismal turnover for the relevant year under consideration because of which the expenses were not allowed.

39. He has referred to Explanation 1 to Section 148, which describes income chargeable to tax being escaped to mean:

“(ii) any audit objection to the effect that the assessment in the case of the assessee for the relevant assessment year has not been made in accordance with the provisions of this Act;”

40. Thus, the contention of the assessee is false and invalid as the proceedings under Section 148 were initiated considering and analysing the facts highlighted in the audit objections, with proper application of mind and therefore, the notice under Section 148 was issued.

41. The information received by the assessing officer was according to the risk management strategy formulated by the Board as per which income had allegedly escaped assessment. Mr. Maratha reiterated that the assessing officer before initiating proceedings under Section 148A of the Act, provided sufficient opportunity to the assessee and examined its reply. The assessment was reopened after due application of mind by the assessing officer. The material available with the assessing officer which arose from the audit objections raised by the audit team is tangible and significant and was not considered at the time of the original assessment. Moreover, the information is not general but specific and has a nexus with the escaped income on the part of the assessee. Therefore, in light of the same, the initiation of the reassessment proceedings is justified and does not constitute a change of opinion. Reliance is placed by him on the case of Kelvinator of India Ltd. (supra) to state that the assessing officer has the power to reopen assessment in cases where tangible material has come to his knowledge suggesting escapement of income.

42. He stated that CBDT instruction/Circular F. No. 225/40/2021/ITA-II, dated 15.03.2021, prescribes guidelines regarding categories of cases to be considered as ‘potential cases’ for taking action under Section 148 of the Act, for AY 2013-14 to AY 2017-18 which includes cases where there are audit objections (Revenue/Internal). The present case of the petitioner is covered under clause-1(i) of the aforesaid circular. The relevant extract of the circular is reproduced as under:

“F. No. 225140/20211/TA-l/

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, the 4th March, 2021.

To

All. Pr. Chief Commissioner of Income

Tax/Chief Commissioners of

Income Tax.

Madam/Sir,

Subject:- Instructions regarding selection of cases for issue of notice under section 148 of the Income Tax Act, 1961-regarding.

I. The Central Board of Direct Taxes (Board), in exercise of its power under section 119 of the Income Tax Act, 1961 (Act), with an objective of streamlining the process of selection of cases for issue of notice under section 148 of the Act, hereby directs that the following categories of cases be considered as ‘potential cases’ for taking action under section 148 of the Act by 31.03.2021 for the A. Y 2013-14 to A. Y 2017-18 by the jurisdiction Assessing Officer (JAG):

(i) Cases where there are Audit Objection (Revenue/Internal) which require section under section 148 of the Act;

(ii) Cases of information from any other Government Agency/Law Enforcement Agency which require action under section 148 of the Act;

(iii) Potential cases including:-

a. Reports of Directorate of Income – tax (Investigation),

b. Reports of Directorate of Intelligence & Criminal Investigation.

c. Cases from Non-Filer Management System (NMS) & other cases as flagged by the Directorate of Income -tax (System) as per risk profiling;”

43. He further stated that as per the Revenue Audit Manual Direct Taxes issued by Office of Comptroller and Auditor General of India, whereby in the last line it is stated “unless there is clear evidence of misuse.” Therefore, it is possible for the Audit Party to question the order of the assessing officer when there is clear evidence that there was some income that escaped assessment, on the basis of which reassessment proceedings can be initiated.

44. He stated that the cases relied upon by the petitioner are distinguishable on facts from the present case. Merely stating the law does not justify how the same has been violated in the case of the petitioner. Concluding his submissions, he reiterated that the assessment proceedings in the case of the petitioner are under progress/pending, and in light of the same, the petition being immature, needs to be dismissed.

45. Mr. Maratha stated that the contention of the assessee that the petitioner was not given any opportunity pursuant to the notice, and the order under Section 148A(d) was passed without considering its reply, is incorrect as the petitioner was given an opportunity of being heard via the notice dated 22.03.2023 under Section 148A(b). The reply of the assessee was duly considered in paragraphs 7 and 8 of the impugned order dated 31.03.2023. It is after considering all the facts that the conclusion was arrived at, establishing that income has escaped assessment and the notice under Section 148 was issued.

ANALYSIS AND CONCLUSION

46. Having heard the learned counsel for the parties and perused the record, we may state that the petition has been filed by the petitioner company challenging the order passed under Section 148A(d) of the Act and notice under Section 148 of the Act, both dated 31.03.2023 in respect of AY 2016-17.

47. At the outset, we may deal with the submission made by Mr. Maratha that the present petition filed by the petitioner is premature inasmuch as the petitioner has come only against the notice under Section 148 of the Act, and there is no other jurisdictional issue or violation of the principles of natural justice. In other words, there being no order passed on the proceedings initiated pursuant to the notice under Section 148 of the Act, the petition needs to be dismissed.

48. We are not in agreement with the said submission of Mr. Maratha, as when reassessment proceedings are initiated pursuant to the issuance of notice under Section 148A(b) of the Act, order under Section 148A(d) of the Act and notice under Section 148 of the Act, surely, remedy would lie with the assessee to approach the Court of law, provided that the case is of lack of jurisdiction of the assessing officer to initiate proceedings on the ground that the notice itself is barred by time. When such an issue is raised that would go to the root of the maintainability of the proceedings, the Court shall entertain the same and decide the issue.

49. The subject matter of the notice under Section 148 of the Act is the amount of Rs.9,80,81,200/-, which according to the Revenue, has escaped assessment, as flagged by the Audit Party. We note that the assessing officer had made the assessment for the concerned AY 2016-17 under Section 143(3) of the Act, as is clear from the assessment order dated 09.12.2018. It is the case of the assessee that during the assessment proceedings, specific queries were put by the assessing officer to the petitioner regarding the aforesaid amount, which according to the assessee consists of Rs.8,90,00,000/- paid to the MD and Rs.90,81,200/- paid to the shareholder as joining bonus and legal & professional expense respectively. The queries as put by the assessing officer were answered by the petitioner by submitting the Employment Agreement with the MD Amar Raj Singh and the Consulting Agreement with the shareholder Sandeep Kohli. The case of the petitioner is that, as the assessing officer had all the information relating to the said expenditure/amounts at the time of assessment, the Revenue cannot initiate reassessment citing the same issue, even pursuant to audit objections.

50. Mr. Maratha has relied upon the judgment in CIT v. P.V.S. Beedies (P.) Ltd. (SC)/[1999] 237 ITR 13 (SC) to contend that an Audit Party is entitled to point out a factual error or omission in the assessment, and reopening of the case on the basis of such factual error pointed out by the Audit Party is permissible under law.

51. No doubt, the notice under Section 148A(b) was issued on the basis of the audit objection. Now the question is, whether the issue can be reopened based on such audit objection on the ground that expenses were not allowable, when the assessing officer had all the material/ documents before him with respect to the transactions made to the MD and the shareholder while passing the assessment order.

52. It is apparent from the records that the petitioner had given all information with respect to the amounts and did not withhold any document. Further, the assessing officer had also specifically asked the petitioner to submit relevant details on the said amounts through the questionnaire attached to the notice under Section 142 of the Act. The petitioner replied to the questions put by the assessing officer by submitting the Employment Agreement with the MD Amar Raj Singh and the Consulting Agreement with the shareholder Sandeep Kohli, stating that the said amounts were in the nature of ‘joining bonus’ and ‘professional fees’. As such, the assessing officer was very much aware of the said amounts/transactions, and was also in possession of the relevant documents, though he failed to return any specific finding with regard to the same in the assessment order. If that be so, it must necessarily be inferred that the said amounts of Rs. 8.90 crore had already been subjected to assessment.

53. We note that as contended by Mr. Shivakumar for the petitioner, the Supreme Court in Financial Software Systems (P) Ltd. (supra) had held that when specific queries were raised, which were answered by the assessee, it was not open for the Revenue to reopen the assessment proceedings on the same ground.

54. His submission is that the attempt of the Revenue to initiate reassessment proceedings is in fact an attempt to review the order of the assessing officer, which is impermissible in law.

55. We agree with this submission. We are of the view that reopening the assessment on the basis of the objections of the Audit Party, shall in the above facts, amount to reviewing the assessment already made, as the relevant material was available with the assessing officer during that assessment. It is necessary to draw a distinction between a case where the assessee failed to provide some material /information during the assessment, which was flagged by the Audit Party, as against a case where all information was provided by the assessee, but was not considered or commented upon by the assessing officer in the assessment order, resulting in a subsequent audit objection. The latter cannot be subject matter of reassessment, as it shall have the effect of reconsidering the same material to arrive at a different conclusion, which cannot be permitted. The attempt of the Revenue to now hold that the amounts are chargeable to tax certainly amounts to a change of opinion, which cannot be sustained.

56. It is trite law that the Revenue can reopen assessments based on audit objections to the effect that the assessment in the case of the assessee for the relevant assessment year has not been made in accordance with the provisions of the Act. In fact, Clause (ii) to Explanation 1 of Section 148 of the Act, which was incorporated into the Act by virtue of the Finance Act, 2022 empowers the assessing officer to issue notice reopening the assessment when audit objections suggests that income has escaped assessment. However, the first proviso to Section 148 states that no notice shall be issued under the provision, unless the assessing officer has information with him which suggests that income chargeable to tax has escaped assessment in the case of the assessee for the relevant assessment year. The question that arises now is whether notice can be issued under Section 148, notwithstanding the fact that the issue flagged by the Audit Party was subject matter of examination in the assessment proceedings and a final decision in terms of an assessment order. We are of the view that the mere fact that objections were raised by the Audit Party cannot change or expand the nature of the power vested in the assessing officer to assess/reassess the income of the assessee to a power to review an already concluded assessment.

57. A similar issue had come up for consideration before a co-ordinate bench of this Court in Springer Healthcare Limited (supra). The Court, after discussing the relevant provisions, held as under:

“21. In the present case, the fact that the petitioner had received an aggregate amount of 31,44,34,773/- during the previous year relevant to AY 2017-18, which was not surrendered to tax, was not only within the AO’s knowledge, but was subject matter of examination as to whether the said amount was now held to be chargeable to tax under the Act. Concededly, all relevant facts regarding the aspect of taxability of the aforesaid amount were examined by the AO. There is no additional material that has been discovered subsequently, which was not within the knowledge of the AO at the material time.

22. Undeniably, this would be a case of change of opinion, if the said amount is now held as chargeable to tax under the Act.

23. We must, at this stage, note that there is no cavil that the exercise initiated pursuant to the impugned notice is for all intents and purpose an attempt to review the decision the AO in the assessment proceedings. However, it is contended by the Revenue that the same is permissible as the initiation was triggered by audit observations and the same constitutes information that can trigger the reassessment proceedings. We find no merit in the said contention. The fact that audit observation may be deemed to be information suggestive of the assessee’s income escaping assessment does not enhance or expand the power available with the AO to assess/ reassess the assessee’s income that has escaped assessment. It does not alter the very nature of power to assess/reassess under Section 147 of the Act, to a power to review a concluded assessment.

24. We consider it relevant to refer to Section 148 of the Act and in particular the Explanation 1 to Section 148 of the Act, as was in force at the material time (that is, prior to the amendment by Finance Act, 2023). The relevant extract of said section is set out below: –

“148. Issue of notice where income has escaped assessment.— Before making the assessment, reassessment or recomputation under Section 147, and subject to the provisions of Section 148-A, the Assessing Officer shall serve on the assessee a notice, along with a copy of the order passed, if required, under clause (d) of Section 148-A, requiring him to furnish within such period, as may be specified in such notice, a return of his income or the income of any other person in respect of which he is assessable under this Act during the previous year corresponding to the relevant assessment year, in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed; and the provisions of this Act shall, so far as may be, apply accordingly as if such return were a return required to be furnished under Section 139:

Provided that no notice under this section shall be issued unless there is information with the Assessing Officer which suggests that the income chargeable to tax has escaped assessment in the case of the assessee for the relevant assessment year and the Assessing Officer has obtained prior approval of the specified authority to issue such notice.

Provided further that no such approval shall be required where the Assessing Officer, with the prior approval of the specified authority, has passed an order under clause (d) of Section 148-A to the effect that it is a fit case to issue a notice under this section. Explanation 1.—For the purposes of this section and Section 148-A, the information with the Assessing Officer which suggests that the income chargeable to tax has escaped assessment means,— (i) any information in the case of the assessee for the relevant assessment year in accordance with the risk management strategy formulated by the Board from time to time;

(ii) any audit objection to the effect that the assessment in the case of the assessee for the relevant assessment year has not been made in accordance with the provisions of this Act; or.”

25. It is clear from the above that in terms of clause (ii) to Explanation I to Section 148 of the Act, an audit objection to the effect that the assessment in the case of an assessee was not made in accordance with the provisions of the Act, is information for the purpose of Section 148 as well as Section 148A of the Act.

26. The contention advanced on behalf of the Revenue is founded on interpreting Explanation I as a mandatory command to issue a notice under Section 148 of the Act notwithstanding the issue flagged under the audit objection has been subject matter of the examination in assessment proceedings and a final decision in terms of an assessment order. This requires us to examine Section 148 of the Act in the light of the import of word “information” as used in the main provision.

27. The term “information” is used in the first proviso to Section 148 of the Act. The said proviso proscribes issuance of notice under Section 148 of the Act unless there is “information” with the AO, which suggests that an assessee’s income chargeable to tax has escaped the assessment for the relevant AY. Thus, if the AO is in receipt of an audit objection, the same is required to be construed as information that suggests that the income of the assessee has escaped assessment. The proviso to Section 148 of the Act is couched in the negative. Whilst, the AO is proscribed from issuance of the notice under Section 148 of the Act, unless it has the “information” that suggests that the assessee’s income has escaped assessment, it is not mandatory for the AO to issue such a notice, or to review the assessment order merely because issues were flagged in an audit objection. The AO is required to apply its mind to the audit objection and form an independent, informed view.

28. The provisions of Section 148A of the Act are also required to be construed by imputing the meaning of the term “information” as provided under Explanation I to Section 148 of the Act. Section 148A of the Act prescribes the procedure to be followed prior to issuance of notice under Section 148 of the Act. Section 148A as was in in force prior to Amendment Act 15 of 2024, is reproduced below:-

“148-A. Conducting inquiry, providing opportunity before issue of notice under Section 148.—The Assessing Officer shall, before issuing any notice under Section 148,—

(a) conduct any enquiry, if required, with the prior approval of specified authority, with respect to the information which suggests that the income chargeable to tax has escaped assessment;

(b) provide an opportunity of being heard to the assessee, [* * *], by serving upon him a notice to show cause within such time, as may be specified in the notice, being not less than seven days and but not exceeding thirty days from the date on which such notice is issued, or such time, as may be extended by him on the basis of an application in this behalf, as to why a notice under Section 148 should not be issued on the basis of information which suggests that income chargeable to tax has escaped assessment in his case for the relevant assessment year and results of enquiry conducted, if any, as per clause (a);

(c) consider the reply of assessee furnished, if any, in response to the show-cause notice referred to in clause (b);

(d) decide, on the basis of material available on record including reply of the assessee, whether or not it is a fit case to issue a notice under Section 148, by passing an order, with the prior approval of specified authority, within one month from the end of the month in which the reply referred to in clause (c) is received by him, or where no such reply is furnished, within one month from the end of the month in which time or extended time allowed to furnish a reply as per clause (b) expires:

Provided that the provisions of this section shall not apply in a case where,—

(a) a search is initiated under Section 132 or books of account, other documents or any assets are requisitioned under Section

132-A in the case of the assessee on or after the 1st day of April, 2021; or

(b) the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any money, bullion, jewellery or other valuable article or thing, seized in a search under Section 132 or requisitioned under Section 132-A, in the case of any other person on or after the 1st day of April, 2021, belongs to the assessee; or

(c) the Assessing Officer is satisfied, with the prior approval of the Principal Commissioner or Commissioner that any books of account or documents, seized in a search under Section 132 or requisitioned under Section 132-A, in case of any other person on or after the 1st day of April, 2021, pertains or pertain to, or any information contained therein, relate to, the assessee; or

(d) the Assessing Officer has received any information under the scheme notified under Section 135-A pertaining to income chargeable to tax escaping assessment for any assessment year in the case of the assessee.

Explanation.—For the purposes of this section, specified authority means the specified authority referred to in Section 151.”

29. It is apparent from the above, the term “information” is used in clause (a), clause (b) of Section 148A of the Act and proviso (c) of the said Section. Clause (a) of Section 148A of the Act requires the AO to conduct the enquiry, if necessary, with respect to the information which suggests the income chargeable to tax has escaped assessment. Accordingly, when an audit objection is raised, the AO would have such information in respect of which an enquiry may be conducted under clause (a) of Section 148A of the Act, if required. However, this does not mandate that the AO proceeds to issue a notice under Section 148A of the Act merely on the basis of the audit objection. Clause (b) of Section 148A of the Act requires the AO to provide the assessee with the basis of the information, which suggests that the income chargeable to tax has escaped assessment, in order to enable to the assessee to respond to the said notice.

30. This clearly, establishes that the purpose of an audit objection cannot be considered as a command to issue a notice under Section 148A of the Act irrespective of what such information is. On the contrary, it requires the AO to furnish the information to the assessee and elicit the assessee ‘s response. Thereafter, the AO is required – in terms of clause (d) of Section 148A of the Act – to take an informed decision whether it is afit case for issuance of notice under Section 148 of the Act “on the basis of the material available on record including the reply of the assessee”. Obviously, if the AO is satisfied with the reply furnished by the assessee and the material on record, the AO is bound to hold that it is not afit case for issuance of notice under Section 148 of the Act.

31. In a case such as this, the AO was required to take an informed decision whether the issue raised had been considered and concluded in the assessment proceedings as contended by the petitioner. The said issue cannot be brushed aside by construing an audit objection as a ground of issuing a notice under Section 148 of the Act regardless of whether the assessee’s income had escaped assessment. The expression “escaped assessment” by its very nature, means that the income has not been subjected to an assessment. The expression would not include a case where the AO made an informed assessment of the assessee’s income.

32. Clause (c) of the proviso to Section 148A of the Act excludes the procedure under Section 148A of the Act where the information available with the AO is contained in the books of accounts, documents or material seized in a search conducted under Section 132 of the Act or requisitioned under Section 132A of the Act on or after 01.04.2021. This clause is not applicable to the facts of the present case.”

(emphasis supplied)

58. From the bedrock of the aforesaid, it is clear that the audit objection pointing out that there is no justification available in the file as to why the amounts were paid, cannot be said to be ‘information’ for the respondent to initiate reassessment proceedings, when the assessing officer was in possession of the information and necessary documents at the time of the assessment proceedings. As such, the impugned action of the respondents is unsustainable.

59. At this stage, we may also refer to the plea of Mr. Shivakumar that the assessing officer has not referred to any transaction, which has resulted in escapement of income represented in the form of expenditure. This plea is unmerited as there are transactions in the nature of the payments to the MD Mr. Amar Singh for Rs 8.90 crore and Rs 90.81 lakh to the shareholder Mr. Sandeep Kohli on account of joining bonus and legal & professional expenses. However, the stand of the Revenue that these payments have escaped assessment in the nature of expenditure also cannot be accepted in view of our findings above.

60. Now we shall come to the plea advanced by Mr. Shivakumar that the notice under Section 148 of the Act is barred by time under Section 149(1) of the Act. Mr. Maratha had submitted that the transactions to the tune of Rs.9,80,81,200/- relatable to AY 2016-17 was beyond four years, but not beyond the period of six/ten years, as provided by the Act, and are therefore within limitation.

61. It is apposite to note that the first proviso to Section 149(1) of the Act expressly provides that no notice under Section 148 of the Act shall be issued in case of the relevant assessment year beginning on or before 1st day of April, 2021, if such a notice could not be issued at that time on account of being beyond the time limit as specified under provisions of Clause (b) of Section 149(1) of the Act as it stood immediately prior to the commencement of the Finance Act, 2021. As such, it is necessary to examine whether the notice under Section 148 would be time-barred as per Section 149 as it existed at the relevant time. The same read as under:

“Time limit for notice.

149. (1) No notice under section 148 shall be issued for the relevant assessment year,—

(a) if four years have elapsed from the end of the relevant assessment year, unless the case falls under clause (b) or clause (c);

(b) if four years, but not more than six years, have elapsed from the end of the relevant assessment year unless the income chargeable to tax which has escaped assessment amounts to or is likely to amount to one lakh rupees or more for that year;

(c) if four years, but not more than sixteen years, have elapsed from the end of the relevant assessment year unless the income in relation to any asset (including financial interest in any entity) located outside India, chargeable to tax, has escaped assessment.

Explanation.—In determining income chargeable to tax which has escaped assessment for the purposes of this sub-section, the provisions of Explanation 2 of section 147 shall apply as they apply for the purposes of that section.

(2) The provisions of sub-section (1) as to the issue of notice shall be subject to the provisions of section 151.

(3) If the person on whom a notice under section 148 is to be served is a person treated as the agent of a non-resident under section 163 and the assessment, reassessment or recomputation to be made in pursuance of the notice is to be made on him as the agent of such nonresident, the notice shall not be issued after the expiry of a period of six years from the end of the relevant assessment year.

Explanation.—For the removal of doubts, it is hereby clarified that the provisions of sub-sections (1) and (3), as amended by the Finance Act, 2012, shall also be applicable for any assessment year beginning on or before the 1st day of April, 2012.”

62. A reading of Section 149(1) of the Act as it existed prior to 2021 would reveal that no notice under Section 148 of the Act shall be issued if four years, but not more than six years have elapsed from the end of the relevant assessment year unless the income chargeable to tax has escaped assessment amounts to or is likely to amount to 1 lakh rupees or more for that year.

63. Now we shall examine Section 147 of the Act, as it existed during the relevant time. The same is reproduced as under:

“Income escaping assessment.

147. If the Assessing Officer has reason to believe that any income chargeable to tax has escaped assessment for any assessment year, he may, subject to the provisions of sections 148 to 153, assess or reassess such income and also any other income chargeable to tax which has escaped assessment and which comes to his notice subsequently in the course of the proceedings under this section, or recompute the loss or the depreciation allowance or any other allowance, as the case may be, for the assessment year concerned (hereafter in this section and in sections 148 to 153 referred to as the relevant assessment year) :

Provided that where an assessment under sub-section (3) of section 143 or this section has been made for the relevant assessment year, no action shall be taken under this section after the expiry of four years from the end of the relevant assessment year, unless any income chargeable to tax has escaped assessment for such assessment year by reason of the failure on the part of the assessee to make a return under section 139 or in response to a notice issued under sub-section (1) of section 142 or section 148 or to disclose fully and truly all material facts necessary for his assessment, for that assessment year:

Provided further that nothing contained in the first proviso shall apply in a case where any income in relation to any asset (including financial interest in any entity) located outside India, chargeable to tax, has escaped assessment for any assessment year:

Provided also that the Assessing Officer may assess or reassess such income, other than the income involving matters which are the subject matters of any appeal, reference or revision, which is chargeable to tax and has escaped assessment.

Explanation 1.—Production before the Assessing Officer of account books or other evidence from which material evidence could with due diligence have been discovered by the Assessing Officer will not necessarily amount to disclosure within the meaning of the foregoing proviso.

Explanation 2.—For the purposes of this section, the following shall also be deemed to be cases where income chargeable to tax has escaped assessment, namely:—

(a) where no return of income has been furnished by the assessee although his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeded the maximum amount which is not chargeable to income-tax;

(b) where a return of income has been furnished by the assessee but no assessment has been made and it is noticed by the Assessing Officer that the assessee has understated the income or has claimed excessive loss, deduction, allowance or relief in the return;

(ba) where the assessee has failed to furnish a report in respect of any international transaction which he was so required under section 92E; (c) where an assessment has been made, but—

(i) income chargeable to tax has been underassessed; or

(ii) such income has been assessed at too low a rate; or

(iii) such income has been made the subject of excessive relief under this Act ; or

(iv) excessive loss or depreciation allowance or any other allowance under this Act has been computed;

[(ca) where a return of income has not been furnished by the assessee or a return of income has been furnished by him and on the basis of information or document received from the prescribed income-tax authority, under sub-section (2) of section 133C, it is noticed by the Assessing Officer that the income of the assessee exceeds the maximum amount not chargeable to tax, or as the case may be, the assessee has understated the income or has claimed excessive loss, deduction, allowance or relief in the return;]

(d) where a person is found to have any asset (including financial interest in any entity) located outside India.

Explanation 3.—For the purpose of assessment or reassessment under this section, the Assessing Officer may assess or reassess the income in respect of any issue, which has escaped assessment, and such issue comes to his notice subsequently in the course of the proceedings under this section, notwithstanding that the reasons for such issue have not been included in the reasons recorded under sub-section (2) of section 148.

Explanation 4.—For the removal of doubts, it is hereby clarified that the provisions of this section, as amended by the Finance Act, 2012, shall also be applicable for any assessment year beginning on or before the 1st day of April, 2012.

64. As seen above, the first proviso to Section 147 of the Act mandates that when assessment under Section 143(3) of the Act has been made for the relevant assessment year, reassessment on the ground that income has escaped assessment is only possible up to four years from the end of the assessment year unless any income chargeable to tax has escaped for such assessment year by reason of the failure on the part of the assessee to make a return or to disclose fully and truly all material facts necessary for his assessment.

65. Suffice it to state, in the present case, the assessee had made a return of its income on 18.10.2016 for the relevant assessment year and had provided all necessary material for its assessment. As such, the extended period of six years for reopening the assessment would not be available to the Revenue under Section 147 of the Act as it existed prior to April 1, 2021. The period of limitation is thus, four years from the end of AY 2016-17. It is a matter of record that the notice under Section 148 has been issued on 31.03.2023, which is beyond the said period of four years. Therefore, in view of the first proviso to Section 149 of the Act, no notice could have been issued under Section 148, as no such notice could have been issued under the provisions that were in force prior to April 1, 2021. We hold that the notice dated 31.03.2023 and the subsequent proceedings are barred by limitation.

66. Yet another plea that has been raised by Mr. Shivakumar for the petitioner is that the notice under Section 148 of the Act has been issued by the jurisdictional assessing officer, and not in a faceless manner, as contemplated by Section 151A of the Act and the e-Assessment of Income Escaping Assessment Scheme, 2022. Any discussion on the issue in this case would only be academic in view of our decision that the impugned notice under Section 148 of the Act is barred by limitation and even otherwise untenable. Nevertheless, we deem it appropriate to state here that the plea is devoid of merit, as this Court has in a catena of judgments, including in T.K.S. Builders (P.) Ltd. v. ITO (Delhi)/[2024] 469 ITR 657 (Delhi), categorically held that both the jurisdictional and the faceless assessing officers shall have concurrent jurisdiction to issue notices under Section 148 of the Act, at least insofar as the jurisdiction of Delhi is concerned. We must state, the judgment in TKS Builders (supra) has been taken in appeal, along with judgments of this Court and other High Courts and the issue is pending consideration before the Supreme Court. Therefore, the said plea of Mr. Kumar does not impress upon us.

67. Though Mr. Maratha had drawn our attention to the judgment in PVS Beedis (supra) to contend that objections raised by the audit party can be grounds to reopen assessment under law. While we have no cavil with the judgment, it is quite distinguishable on facts. The reopening in that case was done because in the original assessment, donations made to a body known as P.V.S. Memorial Charitable Trust was held by the Income-tax officer to be eligible for deduction under Section 80G of the Act. But subsequently, it was pointed out by the Audit Party that the recognition which had been granted to the P.V.S. Memorial Charitable Trust had expired. Therefore, in the relevant year of assessment, the trust was not a recognised charitable trust, and as such did not qualify for deduction under Section 80G as a donation made to a recognised charity. In that case, the assessing officer at the time of the original assessment was not aware of this fact, whereas in the case before us, he was aware of the transactions and had all relevant material before him while making the assessment. As such, this case would not come to the aid of the Revenue.

68. In view of the foregoing discussion, we are of the view that the impugned notice and order, both dated 31.03.2023 need to be set aside. The assessment proceedings initiated pursuant to the same also need to be quashed. We order accordingly.

69. The petition is disposed of on the above terms, along with the pending application.