Condonation of Short Delay in Filing Appeals before ITAT

Summary in Key Points:

- Issue 1 (Condonation of Delay): Whether the delay in filing appeals before the Income Tax Appellate Tribunal (ITAT) can be condoned for the assessment years 2018-19, 2019-20, and 2020-21.

- Issue 2 (Validity of Reassessment): Whether the reassessment proceedings and orders passed for the assessment years 2018-19, 2019-20, and 2020-21 were valid in light of the Supreme Court’s judgment in Union of India vs. Ashish Agarwal.

- Facts: The assessee, a society registered under Section 10(23)(c)(vi), underwent a survey, leading to reassessment proceedings and orders for three assessment years. The assessee’s appeals were dismissed by the CIT(Appeals), and they filed appeals before the ITAT with a 14-day delay. The AO also passed fresh reassessment orders under Section 148A following the Supreme Court’s judgment in Ashish Agarwal.

- Decision on Issue 1: The ITAT condoned the delay in filing appeals, considering the short delay and the assessee’s bona fide misunderstanding.

- Decision on Issue 2: The ITAT held that the original reassessment orders were invalid because they were based on a non-existent notice under Section 148. However, the fresh reassessment orders under Section 148A were valid as they were issued in accordance with the Supreme Court’s judgment in Ashish Agarwal.

Decision:

- Issue 1 (Condonation of Delay): The ITAT, exercising its power under Section 253(5) read with Section 249(3) and Section 5 of the Limitation Act, condoned the 14-day delay in filing appeals. The ITAT emphasized that the expression “sufficient cause” should be interpreted liberally to ensure justice and considered the assessee’s bona fide error as a sufficient cause for condonation.

- Issue 2 (Validity of Reassessment): The ITAT held that the original reassessment orders passed under Section 143(3) read with Section 147 were invalid because they were based on a notice issued under Section 148, which was not in existence at the time of issuance. However, the fresh reassessment orders passed under Section 148A were valid, as they were issued following the procedure laid down in the Supreme Court’s judgment in Ashish Agarwal.

Important Note: This case clarifies the ITAT’s power to condone delays in filing appeals and provides guidance on the validity of reassessment proceedings in light of the Supreme Court’s judgment in Ashish Agarwal. It highlights the importance of following proper procedures and adhering to judicial pronouncements when conducting reassessments.

IN THE ITAT KOLKATA BENCH

G D Mother Educational Society

v.

Assistant Commissioner of Income-tax

Rajpal Yadav, Vice President, (KZ)

and Dr. Manish Borad, Accountant Member

and Dr. Manish Borad, Accountant Member

IT Appeal Nos. 307, 308 & 309 (PAT) of 2024

[Assessment Years 2018-19, 2019-20 & 2020-21]

[Assessment Years 2018-19, 2019-20 & 2020-21]

SEPTEMBER 25, 2024

S.K. Tulsiyan, Adv. and Puja Somani, CA for the Appellant. Smt. Rinku Singh, CIT(DR) for the Respondent.

ORDER

Rajpal Yadav, Vice-President (KZ).- The present three appeals are directed at the instance of assessee against the separate orders of even dated i.e. 28th December, 2023 passed by the ld. Commissioner of Income Tax (Appeals), Patna-3 in Assessment Years 2018-19, 2019-20 and 2020-21.

2. The Registry has pointed out that the present appeals are time barred by 14 days. The assessee has filed an application for condonation of delay in each assessment year. In brief, the contention of the assessee is that a survey was conducted on 17.09.2020 and thereafter the assessment in each assessment year was reopened by issuance of a notice under section 148 on 30.06.2021. The assessment order was passed on 31.03.2022 and the assessee has challenged those assessment orders in appeal before the ld. CIT(Appeals). The ld. CIT(Appeals) has dismissed the appeal by treating them as redundant on the ground that ld. Assessing Officer has passed the fresh reassessment order by issuance of a notice under section 148(a) of the Income Tax Act. At first instance, the assessee thought that there was no need to file the appeal, but later on when it consulted with ld. Sr. Counsel, it was advised to file an appeal. In that process, the delay of 14 days had occurred. The assessee has prayed that delay be condoned and appeals be decided on merit.

3. The ld. CIT(DR), on the other hand, contended that the ld. CIT(Appeals) has dismissed the appeals by treating it as an academic process and no prejudice has been caused to the assessee, therefore, it has rightly construed that no appeal is to be filed. That decision was taken by the assessee with full deliberation and therefore, delay in filing the appeals be not condoned.

4. We have duly considered the rival contentions and gone through the record carefully. Sub-section 5 of Section 253 contemplates that the Tribunal may admit an appeal or permit filing of memorandum of cross- objections after expiry of relevant period, if it is satisfied that there was a sufficient cause for not presenting it within that period. This expression sufficient cause employed in the section has also been used identically in sub-section 3 of section 249 of Income Tax Act, which provides powers to the ld. Commissioner to condone the delay in filing the appeal before the Commissioner. Similarly, it has been used in section 5 of Indian Limitation Act, 1963. Whenever interpretation and construction of this expression has fallen for consideration before Honble High Court as well as before the Honble Supreme Court, then, Honble Court were unanimous in their conclusion that this expression is to be used liberally. We may make reference to the following observations of the Hon’ble Supreme court from the decision in the case of Collector Land Acquisition v. Mst. Katiji & Others, 1987 AIR 1353:

1. Ordinarily a litigant does not stand to benefit by lodging an appeal late.

2. Refusing to condone delay can result in a meritorious matter being thrown out at the very threshold and cause of justice being defeated. As against this when delay is condoned the highest that can happen is that a cause would be decided on merits after hearing the parties.

3. “Every day’s delay must be explained” does not mean that a pedantic approach should be made. Why not every hour’s delay, every second’s delay? The doctrine must be applied in a rational common sense pragmatic manner.

4. When substantial justice and technical considerations are pitted against each other, cause of substantial justice deserves to be preferred for the other side cannot claim to have vested right in injustice being done because of a non-deliberate delay.

5. There is no presumption that delay is occasioned deliberately, or on account of culpable negligence, or on account of mala fides. A litigant does not stand to benefit by resorting to delay. In fact he runs a serious risk.

6. It must be grasped that judiciary is respected not on account of its power to legalize injustice on technical grounds but because it is capable of removing injustice and is expected to do so.

5. Similarly, we would like to make reference to authoritative pronouncement of Honble Supreme Court in the case of N. Balakrisknan v. M. Krishnamurtky (supra). It reads as under:

“Rule of limitation are not meant to destroy the right of parties. They are meant to see that parties do not resort to dilatory tactics, but seek their remedy promptly. The object of providing a legal remedy is to repair the damage caused by reason of legal injury. Law of limitation fixes a life-span for such legal remedy for the redress of the legal injury so suffered. Time is precious and the wasted time would never revisit. During efflux of time newer causes would sprout up necessitating newer persons to seek legal remedy by approaching the courts. So a life span must be fixed for each remedy. Unending period for launching the remedy may lead to unending uncertainty and consequential anarchy. Law of limitation is thus founded on public policy. It is enshrined in the maxim Interest reipublicae up sit finis litium (it is for the general welfare that a period be putt to litigation). Rules of limitation are not meant to destroy the right of the parties. They are meant to see that parties do not resort to dilatory tactics but seek their remedy promptly. The idea is that every legal remedy must be kept alive for a legislatively fixed period of time. A court knows that refusal to condone delay would result foreclosing a suitor from putting forth his cause. There is no presumption that delay in approaching the court is always deliberate. This Court has held that the words “sufficient cause” under Section 5 of the Limitation Act should receive a liberal construction so as to advance substantial justice vide Shakuntala Devi lain v. Kuntal Kumari [AIR 1969 SC 575] and State of West Bengal v. The Administrator, Howrah Municipality [AIR 1972 SC 749]. It must be remembered that in every case of delay there can be some lapse on the part of the litigant concerned. That alone is not enough to turn down his plea and to shut the door against him. If the explanation does not smack of mala fides or it is not put forth as part of a dilatory strategy the court must show utmost consideration to the suitor. But when there is reasonable ground to think that the delay was occasioned by the party deliberately to gain time then the court should lean against acceptance of the explanation. While condoning delay the Could should not forget the opposite party altogether. It must be borne in mind that he is a looser and he too would have incurred quiet a large litigation expenses. It would be a salutary guideline that when courts condone the delay due to laches on the part of the applicant the court shall compensate the opposite party for his loss”.

6. We do not deem it necessary to re-cite or recapitulate the proposition laid down in other decisions. It is suffice to say that the Honble Courts are unanimous in their approach to propound that whenever the reasons assigned by an applicant for explaining the condonation of delay, then such reasons are to be construed with a justice oriented approach.

7. In the light of above, if we examine the facts, then it will reveal that though ld. CIT(Appeals) has observed that the impugned assessment order becomes non-est. The ld. CIT(Appeals) has dismissed the appeals. It will come in the way of the assessee and, therefore, on a later deliberation, it was felt necessary to challenge these orders. This order could not be challenged well in time by the assessee on account of construction of the provision of law about the status of ld. CIT(Appeals)’s order. On consultation with ld. Senior Counsel, it was deemed fit to file an appeal. Thus, there was some bonafide error at the end of the assessee in not filing the appeals well in time. There was no deliberate attempt to make the appeals time barred. Therefore, we deem it appropriate to condone a short period of delay, namely 14 days and decide the appeals on merit. In view of the above, the delay is condoned and we proceed to decide the appeals on merit.

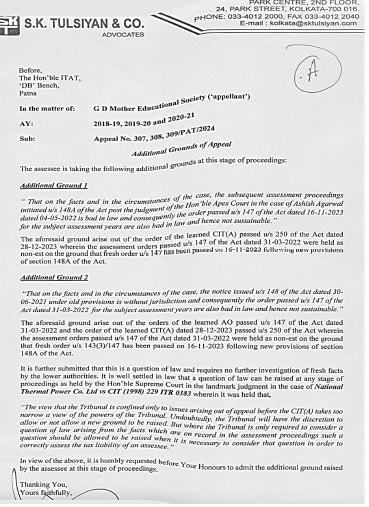

8. The assessee has filed application for permission to raise additional grounds of appeal. The assessee has sought to raise two additional grounds of appeal in each year. The application of the assessee reads as under:-

9. With the assistance of ld. Representatives, we have gone through the record carefully and since both additional grounds sought to be raised by the assessee are legal grounds, which are jurisdictional also. They do not require discovery of any new fact therefore, we allow this application of the assessee and permit it to raise these additional grounds of appeals in each assessment year.

10. In the original grounds of appeals, the assessee has raised three grounds, out of which Ground No. 3 is a general ground, which does not call for recording of any specific finding.

11. Grounds No. 1 & 2 are interconnected with each other. In these grounds, the assessee has pleaded that ld. CIT(Appeals) has erred in dismissing the appeals of the assessee by observing that since fresh assessment orders have been passed by following new provision of section 148(a), therefore, these assessments passed under section 143(3) read with section 147 become non-est.

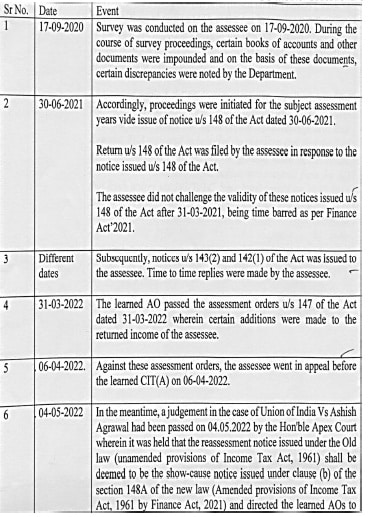

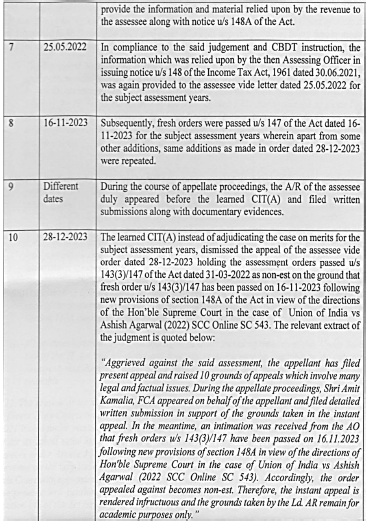

12. The ld. Counsel for the assessee has filed written submission, wherein he has placed on record the list of events, which are common in all the three years. Therefore, we take note of these list of events, which reads as under:-

13. For the purpose of deciding these appeals, further reference to the facts is not required. Dissatisfied with the assessment order, the assessee filed appeals in these three years before the ld. CIT(Appeals). The ld. CIT(Appeals) has observed that these appeals become redundant, hence deserve to be dismissed. The finding recorded by the ld. CIT(Appeals) in A.Y. 2018-19, which is verbatim for other years, reads as under:-

“4. Appellate Findings:

The appellant is registered u/s 10(23)(c)(vi) of the Act. The survey in case of the appellant was conducted on 17.09.2020. During the course of survey proceedings, certain books of accounts and other documents marked as GDMIS-01 to GDMIS-60 were impounded from the premises of the appellant. Subsequent to the survey, the case of the appellant was reopened u/s 147 and the notice u/s 148 of the Act was issued on 30.06.2021. In response to the notice, the appellant filed its ITR on 12.03.2022 declaring the total income of Rs. NIL.

Further, notice u/s 142(1) was issued to the appellant on 29.10.2021. The appellant filed its submission in response to the notices. Considering the submissions of the appellant, the AO completed the assessment on 31.03.2022 u/s 143(3)/147 determining the total income of Rs. 1,23,14,530/.

Aggrieved against the said assessment, the appellant has filed present appeal and raised 10 grounds of appeals which involve many legal and factual issues. During the appellate proceedings, Shri Amit Kamalia, FCA appeared on behalf of the appellant and filed detailed written submission in support of the grounds taken in the instant appeal. In the meantime, an intimation was received from the AO that fresh orders u/s 143(3)/147 have been passed on 16.11.2023 following new provisions of section 148A in view of the directions of Hon’ble Supreme Court in the case of Union of India v. Ashish Agarwal (2022 SCC Online SC 543). Accordingly, the order appealed against becomes non-est. Therefore, the instant appeal is rendered infructuous and the grounds taken by the Ld. AR remain for academic purposes only.

5. In the result, the appeal is dismissed.

RAJIB JAIN

CIT (A), Patna- 3″.

14. The ld. Counsel for the assessee while impugning the above order raised two-folds of contentions. In his first fold of contention, he submitted that the assessee has challenged the assessment order passed under section 143(3) read with section 147 on 31.03.2022. This assessment order was passed on the basis of a notice of reopening the assessment issued under section 148 of the Income Tax Act. The ld. CIT(Appeals) instead of dismissing the appeals ought to have allowed it because ld. CIT(Appeals) was satisfied that notice under section 148 was issued on 30.06.2021 when this section was no more applicable, because w.e.f. 1st April, 2021, a new scheme of reassessment was introduced in the shape of section 148(A). He further contended that a perusal of observation of the ld. CIT(Appeals), it reveals that ld. CIT(Appeals) was satisfied that the impugned assessment orders are non-est but instead of quashing them simply gave an advance authority for legalizing the subsequent assessment orders passed on a notice issued under section 148(A). The finding of the ld. CIT(Appeals) is that since ld. Assessing Officer has passed fresh assessment order on 16.11.2023 under section 143(3) read with section 147, therefore, old assessment becomes non-est. This finding is a conditional one, whereas he should have recorded the independent finding on the assessment orders passed under the old provisions.

15. In his second fold of submission, he contended that the judgment of the Hon’ble Supreme Court in the case of Union of India -vs.- Ashish Agarwal is no longer applicable on the facts of the assessee’s case. The assessment orders passed on the basis of notice issued under section 148(a) are not protected by that judgment. For buttressing his contention, he relied upon the following judgments:-

| (i) | Anindita Sengupta -vs.- ACIT (Delhi HC); |

| (ii) | Arun Khanna -vs.- ITO (Delhi HC); |

| (iii) | Union of India -vs.- Ashish Agarwal (Apex Court); |

| (iv) | Bagaria Properties & Investment (P) Ltd.-vs.- UOI (Calcutta HC). |

16. The ld. CIT(DR), on the other hand, submitted that as far as the assessment orders dated 31.03.2022 passed on the basis of notice issued under old provisions mainly under section 148 is concerned, the ld. CIT(Appeals) has observed that these assessment orders are non-est. Thus, there cannot be any grievance to the assessee for challenging these appeals because ld. CIT(Appeals) has himself declared these assessments as non-est. She further contented that as far as whether the judgment of the Hon’ble Delhi High Court in the case of Anindita Sengupta -vs.-ACIT is applicable or not is an issue, which is to be taken up in the subsequent assessment order dated 16.11.2023. These assessment orders were passed on the basis of a proceeding initiated under section 148(A). The issue whether this notice is protected by the judgment of Hon’ble Supreme Court in the case of Union of India -vs.- Ashish Agarwal could only be contested while challenging those assessments and that issue is pending before the ld. CIT(Appeals). Therefore, for this Tribunal, this issue ought not to be decided.

17. We have duly considered the rival contentions and gone through the record carefully. A perusal of the ld. CIT(Appeals)’s order (finding extracted supra) would indicate that ld. CIT(Appeals) has basically assumed that since fresh assessment orders have been passed on 16.11.2023 after issuance of a notice under section 148(A), therefore, the earlier assessment orders passed would become non-est. To our mind, the ld. 1st Appellate Authority ought to have recorded a categorical finding on the merits of assessment orders impugned before it i.e. sustainability assessment orders dated 31.03.2022 passed vide notice issued on 30.06.2021 under section 148. But ld. CIT(Appeals) in a deeming manner assumed that subsequent proceeding taken by the ld. Assessing Officer is a legal one, therefore, he can simply observe that these assessment orders are non-est and appeals become infructuous. It is pertinent to note that once reassessment order is passed by the ld. Assessing Officer (in the present appeal, such orders were passed on a notice issued under section 148, i.e. old provisions), then, whether an Assessing Officer himself can suo motu treat those orders as non-est and start fresh re-assessment proceeding is a debatable point. It cannot be considered by the ld. CIT(Appeals) in the manner as is done in the impugned order. The legal status of both the re-assessment orders are to be determined independently without getting influenced by the action of the ld. Assessing Officer initiated under section 148(a).

18. Before deliberating further, we find that Hon’ble Delhi High Court in the case of Anindita Sengupta -vs.- ACIT has examined this aspect in details which cover this issue. The facts in this case are that the assessee has filed her return of income for A.Y. 201314 on 27.03.2014 declaring an income of Rs.4,83,099/-. The ld. Assessing Officer has passed a scrutiny assessment under section 143(3) on 12.01.2016. The ld. Assessing Officer thereafter reopened the assessment on 31.03.2021 by issuance of a notice under section 148 of the Income Tax Act. The Hon’ble Court has observed that though notice was dated 31.03.2021, but was issued on 01.04.2021. The ld. Assessing Officer had thereafter issued notices under sections 143(2) and 142(1). He ultimately passed the reassessment order on 28.03.2022. The ld. Assessing Officer thereafter on the strength of the judgment of Hon’ble Supreme Court in the case of Union of India -vs.- Ashish Agarwal issued a notice under section 148(a) on 30.05.2022. This notice was challenged by the assessee by way of a Writ Petition bearing no. 12542 of 2022. This Writ Petition has been decided by the Hon’ble Delhi High Court on 01.04.2024. The Hon’ble Delhi High Court has examined the aspect whether a reassessment order passed by the ld. Assessing Officer could deem to be nullified by the directions issued by the Hon’ble Supreme Court in the case of Union of India -vs.- Ashish Agarwal. In other words, can the ld. Assessing Officer simply ignore the assessment order passed on the basis of a notice issued under section 148 and re-start the reassessment proceedings under the new provision of section 148(a) of the Income Tax Act? In this background, Hon’ble Court has examined the issue elaborately and thereafter concluded that the directions issued under Article 142 of the Constitution of India by the Hon’ble Supreme Court in Ashish Agarwal’s case would not be applicable on the cases like in the hand. The Hon’ble Delhi High Court had made reference to a subsequent decision of the Constitutional Bench in the case of High Court Bar Association -vs.- State of U.P. (2024) . The finding of the Hon’ble Delhi High Court in paragraphs no. 25 to 29 deserves to be noticed by us, which reads as under:-

“25. However, we are of the firm opinion that Ashish Agarwal neither intended nor mandated concluded assessments being reopened. The respondent clearly appears to have erred in proceedings along lines contrary to the above as would be evident from the reasons which follow. Firstly, Ashish Agarwal was principally concerned with judgments rendered by various High Courts’ striking down Section 148 notices holding that the respondents had erred in proceeding on the basis of the unamended family of provisions relating to reassessment. They had essentially held that it was the procedure constructed in terms of the amendments introduced by Finance Act, 2021 which would apply. None of those judgements were primarily concerned with concluded assessments. It is this indubitable position which constrained the Supreme Court to frame directions requiring those notices to be treated as being under Section 148A(b) and for the AO proceeding thereafter to frame an order as contemplated by Section 148A(d) of the Act. The Supreme Court significantly observed that the High Courts’ instead of quashing the impugned notices should have framed directions for those notices being construed and deemed to have been issued under Section 148A. Ashish Agarwal proceeded further to observe that the Revenue should have been “permitted to proceed W.P.(C) 12542/2022 further with the reassessment proceedings as per the substituted provisions……”. Our view of the judgement being confined to proceedings at the stage of notice is further fortified from the Supreme Court providing in para 8 of the report that “The respective impugned Section 148 notices issued to the respective assessees shall be deemed to have been issued under section 148A of the Income Tax Act as substituted by Finance Act, 2021 and treated to be show cause notices in terms of Section 148A(b).” As would be manifest from the aforesaid extract, the emphasis clearly was on the notices which formed the subject matter of challenge before various High Courts’ and the aim of the Supreme Court being to salvage the process of reassessment. This is further evident from the Supreme Court observing that the AO would thereafter proceed to pass orders referable to Section 148A(d). We consequently find ourselves unable to construe Ashish Agarwal as an edict which required completed assessments to be invalidated and reopened. Ashish Agarwal cannot possibly be read as mandating the hands of the clock being rewound and reversing final decisions which may have come to be rendered in the interregnum.

26. Regard must also be had to the undisputed fact that the petitioner never questioned the validity of the original notices on grounds which were urged before the various High Courts and where assessees had questioned the invocation of the unamended provisions. The petitioner chose to contest the reassessment proceedings on merits. It is also admitted before us that the petitioner was also not a party to the Man Mohan Kohli batch of matters. There was therefore no justification for the respondent to have issued notices afresh seeking to reopen proceedings which had been rendered a closure prior to the judgment W.P.(C) 12542/2022 rendered in Ashish Agarwal. At the cost of being repetitive we deem it appropriate to observe that the Ashish Agarwal judgment neither spoke of completed assessments nor did it embody any direction that could be legitimately or justifiably construed as mandating completed assessments being reopened and moreso where the assessee had raised no objection to the initiation of proceedings.

27. We are also of the firm opinion that even para 25.5 of Ashish Agarwal would not sustain the stand taken by the respondent since the same clearly confines itself to decisions or judgments rendered by a High Court invalidating a notice under Section 148 and the manifest intent of the Supreme Court being that its judgment would apply and govern irrespective of whether an appeal had been laid before it.

28. It is in the aforesaid context that we also bear in mind the pertinent observations rendered by the Constitution Bench in High Court Bar Association when it held that a direction under Article 142 of the Constitution should not impact the substantive rights of those litigants who are not even parties to the lis. The Constitution Bench while acknowledging the amplitude of the Article 142 power placed a significant caveat when it observed that benefits derived by a litigant based on a judicial order validly passed cannot be annulled especially when they may not even have been parties to the cause. This too convinces us to hold in favour of the petitioner and come to the inevitable conclusion that the writ petition must succeed.

29. Accordingly, and for all the aforesaid reasons, we allow the present writ petition and quash the impugned SCN dated 30 May 2022 issued under Section 148A(b), the order dated 19 July 2022 issued W.P.(C) 12542/2022 under Section 148A(d) as well as the notice referable to Section 148 of the Act dated 20 July 2022″.

19. The Hon’ble High Court has propounded that direction in the case of Ashish Agarwal under Article 142 would not be applicable in those cases where assessments have been passed on the basis of a notice issued under section148 of the Income Tax Act. Those assessments would not be automatically nullified to enable the ld. Assessing Officer to start fresh reassessment proceeding under section 148(a) of the Income Tax Act. The Hon’ble Delhi High Court has further observed that neither those directions are applicable nor Hon’ble Supreme Court could have issued those directions. The second observation of the Hon’ble Delhi High Court is based upon the decision of the Constitutional Bench of the Hon’ble Supreme Court in High Court Bar Association’s case. The conclusion of that judgment has also been taken note by the Hon’ble Delhi High Court in this judgment.

20. Further judgments referred by the ld. Counsel for the assessee are almost on the same line.

21. In the light of judgment of the Hon’ble Delhi High Court, if we examine the impugned order, then, it would reveal that suo motu it cannot be construed by the ld. Assessing Officer that earlier assessments passed on 31.03.2022 on a notice issued under section 148 would automatically obliterate or extinguish by the guidelines issued by the Hon’ble Supreme Court in the case of Ashish Agarwal. The Hon’ble Delhi High Court has held that those orders would remain unaffected and their status is to be decided on the basis of their own merits. It cannot be a case that they would automatically extinguish and ld. Assessing Officer will be enable to pass the fresh assessment under section 148(a) of the Income Tax Act. Therefore, ideally ld. CIT(Appeals) should have not assumed, as if subsequent proceeding initiated by the ld. Assessing Officer under section 148(a) and assessment orders passed thereon are valid and, therefore, earlier assessment orders deserve to be just ignored. This understanding of the ld. CIT(Appeals) is not in accordance with law.

22. Taking note of the additional grounds of appeal, we are of the view that old assessments have been passed on the strength of a notice issued under section 148, which was not in existence on the day of its issuance, which was not inexistence on the day when notice was issued on 30.06.2021. Therefore, on this very foundation, no assessment orders could be passed. These assessment orders ought to have been quashed by the ld. CIT(Appeals). Therefore, we vacate the finding of the ld. CIT(Appeals) in paragraph no. 4 reproduced above. The assessment orders passed under section 143(3) read with section 147 on 31.03.2022 are invalid assessments. They are quashed in all these three years. The appeals of the assessee are allowed. Rest of the directions justifying the action under section 148(a) are impliedly vacated.

23. In the result, all the appeals of the assessee are allowed.