Non-Applicability of Section 56(2)(vii)(c) in a Scheme of Amalgamation for Public Limited Companies

Summary in Key Points:

- Issue: Whether Section 56(2)(vii)(c) of the Income-tax Act, 1961, which deals with the taxation of certain transfers as income from other sources, applies to the issuance of shares by a public limited company in a scheme of amalgamation.

- Facts: The assessee, a public limited company, amalgamated with three private limited companies owned by relatives of the assessee’s promoters. The Assessing Officer (AO) held that the excess value transferred to the shareholders of the amalgamating companies should be taxed under Section 56(2)(vii)(c).

- Decision: The ITAT held that Section 56(2)(vii)(c) does not apply to public limited companies and that the issuance of shares in a scheme of amalgamation does not constitute a ‘transfer’ for the purposes of this provision.

Decision:

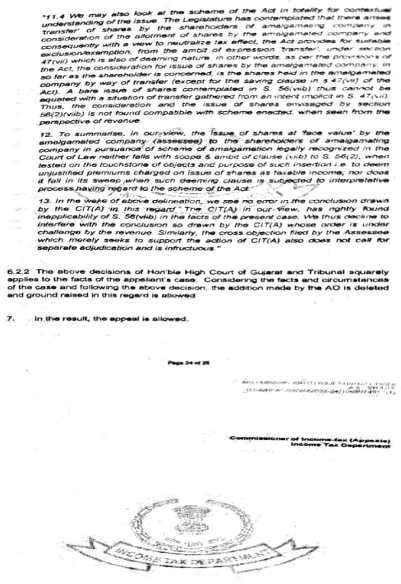

The ITAT ruled in favor of the assessee, deleting the addition made under Section 56(2)(vii)(c). The ITAT clarified the following:

- Applicability to Public Limited Companies: Section 56(2)(vii)(c)(ii) applies only to individual and HUF (Hindu Undivided Family) assessees and not to public limited companies.

- No Transfer of Shares: The issuance of new shares by the amalgamated company does not involve a transfer of shares in the traditional sense, as there is no bilateral transaction between two parties.

- Tripartite Arrangement: In an amalgamation, there is a tripartite arrangement between the amalgamated company, the amalgamating company, and the shareholders of the amalgamating company.

- Not a ‘Transfer’ under Section 47(vii): The transfer of shares in a scheme of amalgamation is specifically excluded from the definition of ‘transfer’ under Section 47(vii) of the Act.

- No Anti-Abuse: The issuance of shares was done in accordance with the scheme of amalgamation approved by the High Court, with no evidence of any anti-abuse provision.

- High Court Approval: The exchange ratio of shares was approved by the High Court after considering the interests of all stakeholders, including the government.

Important Note: This case clarifies that Section 56(2)(vii)(c) does not apply to public limited companies issuing shares in a scheme of amalgamation. The issuance of shares in such a scenario does not constitute a ‘transfer’ for the purposes of this provision, especially when the scheme is approved by the High Court. This decision provides clarity to taxpayers and tax authorities regarding the applicability of Section 56(2)(vii)(c) in the context of amalgamations.

and Dinesh Mohan Sinha, Judicial member

[Assessment Year 2014-15]

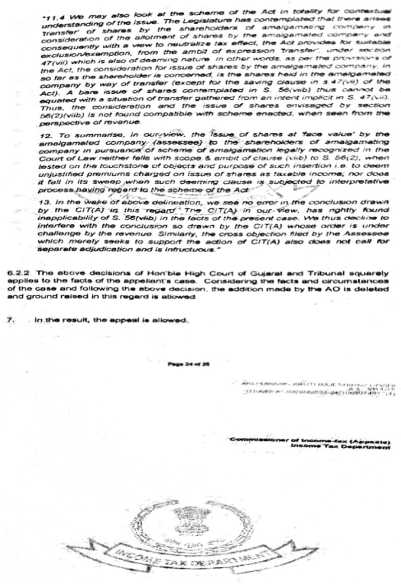

| (a) | . M/s Hitesh Engineers Private Limited: issued 1,21,60,000 equity shares in lieu of the said amalgamation. |

| (b) | . M/s Shruti Engineers Private Limited: issued 61,65,000 equity shares in lieu of the said amalgamation. |

| (c) | . M/s Vishwakarma Fabricators Pvt Ltd: issued 29,85,000 equity shares in lieu of the said amalgamation. |

| Particular | Rajoo Engineers Ltd. | Hitesh Engineers Pvt. Ltd. | Shruti Engineers Pvt. Ltd. | Vishwakarma Engineers Pvt. Ltd. |

| Value as per Equity Shares based on present value of Future Cash Flow | 0.94 | 39.89 | 66.25 | 45.18 |

| Value per Equity based on Adjusted Book value of Fixed Assets | 2.71 | 71.73 | 89.84 | 44.05 |

| BSE Share Market Prices as on 01.04.2010 | Open | High | Low | Close |

| 11.20 | 11.20 | 10.1 | 10.55 |

| (i).As | per clause (vii) of Section 47, transfer of shares in scheme of amalgamation is not considered as a transfer, once there is no transfer of property, section 56(2)(vii) goes out of reckoning altogether. |

| (ii)Actual | cost of Shares received on amalgamation continues to be the actual cost of the shares of the erstwhile company shares [Exp.7 to sec. 43(6)), which means there is no consideration. |

| (iii)Even | the WDV of assets continues to be that of the WDV of the erstwhile company (exp. 2(b) of Sec. 43(6) |

| Sr. No. | Name of the beneficiary | PAN |

| 1. | Kruti Rajeshbhai Doshi | AKLPD9653K |

| 2. | Akhilesh Rameshbhai Jain | BBMPJ5750B |

| 3. | Manishbhai Manubhai amin | MMPA1321M |

| 4. | Dilip Devajibhai Khambhatia | KCYPK4663K |

| 5. | Pallav Kishorbhai Doshi | AJXOD7122N |

| 6. | Khushbu ChandrakantDoshi | LEUPD9687L |

| 7. | Devyaniben Chandrakant Doshi | LBEPD9687L |

| 8. | Utsav Kishorbhai Doshi | RGTPD2281R |

| 9. | Karishma Rajendrabhai Doshi | AUPPD9230Q |

| 10. | Ritaben Rajeshbhai Doshi | ABVPD9686M |

| 11. | Nitaben Kishorbhai Doshi | ABVPD9688F |

“(i) The Transferee Company will issue in the proportion of 304 equity shares offace value of Re.1/- each of the Transferee Company, credited as fully paid-up for every 10 fully paid equity shares of the face value of Rs. 10/- each held by the Equity Shareholders of the Transferor Company No. 1, on such date, as the Board ofDirectors of the Transferee Company may decide.

(ii) The Transferee Company will issue in the proportion of 411 equity shares offace value of Re.1/- each of the Transferee Company, credited as fully paid-up for every 10 fully paid equity shares of the face value of Rs. 10/- each held by the Equity Shareholders of the Transferor Company No. 2 on such date as the Board ofDirectors of the Transferee Company may decide.”

| Sr. No. | Particulars | Raj oo engineers Ltd. | Hitesh Engineers Pvt. Ltd. | Shruti Engineers Pvt. Ltd. |

| 1 | Paid-up value per share | 1 | 10 | 10 |

| 2 | FMV per share (As per Scheme of Amalgamation) | 1.82 | 55.39 | 74.86 |

| 3 | FMV of share at Rs. 10 Paid-up value | 18.20 | 55.39 | 74.86 |

| 4 | No. of shares issued having paid-up value of Re.l per share 1) Hitesh Engineers Pvt. Ltd. 2) Shruti Engineers Pvt. Ltd. | 304 411 | ||

| 5 | Total Consideration (4) * (3) 1) Hitesh Engineers Pvt. Ltd. 2) Shruti Engineers Pvt. Ltd. | 5532.80 7480.20 | 55.39*10 Shares = Rs. 553.90 | 74.86 * 10 Shares = Rs. 748.60 |

| 6 | FMV per share (As per Assessing Officer) | 10.65 | 55.39 | 74.86 |

| 7 | Total Consideration as per Assessing Officer (4) * (6) 1) Hitesh Engineers Pvt. Ltd. 2) Shruti Engineers Pvt. Ltd. | 3237.60 4377.15 | 55.39 * 10 Shares = Rs. 553.90 | 74.86 * 10 Shares = Rs. 748.60 |

“any transfer by shareholder, in the scheme of amalgamation, of a capital asset being share or shares held by him in the amalgamating company if-

(a) the transfer is made in consideration of the allotment to him of any share or shares in the (amalgamated company except where the shareholder itself is the amalgamated company, and)

(b) the amalgamated company is an Indian company Therefore, we find that the transaction of allotment of shares by amalgamated company (Rajoo Engineers Limited, being an Indian Company) to the shareholders of Amalgamating Companies (Hitesh Engineers Pvt. Ltd. and Shruti Engineers Pvt. Ltd) is not a transfer within the meaning of Section 47(vii) of the Act and therefore, provisions of Section 45 of the Act shall not apply for computing capital gain.

“Where an individual or a Hindu Undivided Family receives, in any previous year, from any person or persons on or after the 1” day of October, 2009:

Clause-C-Any property, other than immovable property,

(i) Without consideration, the aggregate fair market value of which exceeds fifty thousand rupees, the whole of the aggregate fair market value of such property.

(ii) For consideration which is less than the aggregate fair market value of the property by an amount exceeding fifty thousand rupees, the aggregate fair market value of such property as exceeds such consideration”

“(h) by way of transaction not regarded as transfer under clause (vicb) or clause (vid) or clause (vii) of section 47.”