GST Assessment and Appellate Orders Quashed as No Separate date fixed for reply to SCN and Date of Hearing

Issue: Whether the assessment order passed under Section 73 of the GST Act and the subsequent appellate order are valid when the assessee was not provided with a proper opportunity of hearing, violating the principles of natural justice.

Facts:

- The assessee challenged both the original assessment order passed under Section 73 and the appellate order dismissing their appeal.

- The assessee claimed that no separate hearing dates were fixed for submitting a reply and for the actual hearing, thereby denying them the opportunity of being heard as required under Section 75(4) of the GST Act.

Decision:

- The court referred to a previous decision by a Division Bench of the same court in Mahaveer Trading Company v. Deputy Commissioner, State Tax.

- Following the reasoning in the Mahaveer Trading Company case, the court quashed both the impugned assessment order and the appellate order.

- The court directed the authorities to pass fresh orders in accordance with the law, ensuring that the assessee is given a proper opportunity of hearing.

Key Takeaways:

- This case reiterates the importance of providing a proper opportunity of hearing to assessees in GST proceedings, including separate opportunities for submitting a reply and for a personal hearing.

- Failure to provide such an opportunity violates the principles of natural justice and can lead to the quashing of assessment and appellate orders.

- The decision emphasizes the need for consistency in judicial pronouncements and reliance on precedents to ensure fairness and predictability in GST assessments.

HIGH COURT OF ALLAHABAD

Puneet Kesharwani

v.

State of U.P.

Pankaj Bhatia, J.

WRIT TAX No. – 18 of 2025

JANUARY 16, 2025

Ajay Pratap Singh, Mohd. Sheraj, for the Petitioner. C.S.C., for the Respondent.

ORDER

Pankaj Bhatia, J. – Heard learned counsel for the parties and perused the record.

2. The present petition has been filed challenging the order dated 26.12.2023 passed under Section 73 of the GST Act as well as order dated 30.11.2024 whereby the appeal preferred by the petitioners was dismissed.

3. The submission of the counsel for the petitioners is that no separate dates were fixed for submission of reply and for hearing which is contrary to the circular. It is thus proposed to be argued that the hearing as is required under Section 75(4) of the GST Act was not provided.

4. The said issue was considered by the Division Bench of this Court in the judgment dated 04.03.2024 passed in Writ Tax No. 303 of 2024. The said reasoning is squarely applicable to the facts of the present case. Adopting the said reasoning, the impugned orders are quashed. The respondents would be at liberty to pass a fresh order in accordance with law after giving opportunity of hearing to the petitioners.

5. The petition is disposed of in terms of the above.

_______________________

Mahaveer Trading Company

v.

Deputy Commissioner, State Tax

Saumitra Dayal Singh AND Surendra Singh-I, JJ.

WRIT TAX NO. 303 OF 2024

MARCH 4, 2024

Pooja Talwar, Sr. Adv. for the Petitioner. Nimai Das, Ld. Addl. Chief Standing Counsel, Ankur Agarwal, Ld. Standing Counsel for the Respondent.

ORDER

1. Heard Sri Navin Sinha, learned Senior Advocate assisted by Ms. Pooja Talwar, learned counsel for the petitioner, Sri Nimai Das, learned Additional Chief Standing Counsel assisted by Sri Ankur Agarwal, learned Standing Counsel for the State-respondents.

2. Challenge has been raised to the order dated 9.11.2023 passed by the Deputy Commissioner, State Tax, Ghaziabad under Section 74 read with Section 122 of the Uttar Pradesh Goods and Services Tax Act, 2017 (hereinafter referred to as ‘the Act’).

3. At the very outset, learned Additional Chief Standing Counsel has raised a preliminary objection as to the availability of remedy of appeal under Section 107 of the Act.

4. That objection has been met by the learned Senior Counsel appearing for the petitioner on the strength of (violation of) Section 75(4) of the Act.

5. It is basic to procedural law under taxing statutes that opportunity of personal hearing must be provided to an assessee before any assessment/adjudication order is passed against him. Thus, we find it strange and wholly unacceptable merely because the substantive law has changed, the revenue authorities have changed their approach and are failing to observe that mandatory requirement of procedural law. They have thus denied opportunity of hearing to the assessee.

6. Section 75(4) of the Act reads as below:

“An opportunity of hearing shall be granted where a request is received in writing from the person chargeable with tax or penalty, or where any adverse decision is contemplated against such person.”

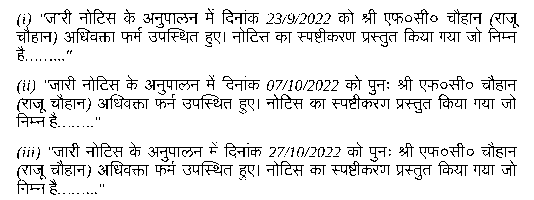

7. Perusal of the impugned order reveals, the petitioner appeared before the competent authority on three dates. With respect to those dates, the impugned order reads as below:

8. Thus, it is established on record that on all three dates, the petitioner had been called to file its reply on the points specified in the respective show-cause notice issued. The petitioner submitted its reply on each occasion. Those replies have been extracted in the impugned order. After recording the reply submitted on 27.10.2022, the adjudicating authority has chosen to deal with the merits of the replies submitted and passed a merit order.

9. It transpires from the record, neither the adjudicating authority issued any further notice to the petitioner to show cause or to participate in the oral hearing, nor he granted any opportunity of personal hearing to the petitioner.

10. On query made, the learned Additional Chief Standing Counsel fairly submits, in light of similar occurrences, noticed in other litigation, he had apprised the Commissioner, Commercial Tax. In turn, the Commissioner, Commercial Tax, Uttar Pradesh, has issued Office Memo No. 1406 dated 12.11.2024. The same has been addressed to all Additional Commissioner to be communicated to all field formations for necessary compliance. A copy of the same has been made available to this Court. It reads as below:

“1. The column in which date of personal hearing has to be mentioned, only N.A. is mentioned without mentioning any date.

2. The column in which time of personal hearing has to be mentioned, only N.A. is mentioned without mentioning time of hearing.

3. In some cases, the date of personal hearing is prior to which reply to the Show Cause Notice has to be submitted this is non-est and this practice has to be discontinued. The date of reply to the Show Cause Notice has to be definitely prior to the date of personal hearing.

4. In some cases, the date of personal hearing is on the same date to which reply to the Show Cause Notice has to be submitted-this is non-est and this practice has to be discontinued. The date of reply to the Show Cause Notice has to be definitely prior to the date of personal hearing.

5. In all cases observed, the date of passing order either u/s 73(9)/74(9) etc. of the Act is not commensurate to the date of personal hearing. It is trite law that the date of the order has to be passed on the date of personal hearing. For eg.,the date of furnishing reply to SCN is 15.11.2023 and date of personal hearing is 17.11.2023, then the date of order has to be 17.11.2023″

11. In view of the facts noted above, before any adverse order passed in an adjudication proceeding, personal hearing must be offered to the noticee. If the noticee chooses to waive that right, occasion may arise with the adjudicating authority, (in those facts), to proceed to deal with the case on merits, ex-parte. Also, another situation may exist where even after grant of such opportunity of personal hearing, the noticee fails to avail the same. Leaving such situations apart, we cannot allow a practice to arise or exist where opportunity of personal hearing may be denied to a person facing adjudication proceedings.

12. Thus, the impugned order cannot be sustained in the eyes of law. It has been passed in gross violation of fundamental principles of natural justice. The self imposed bar of alternative remedy cannot be applied in such facts. If applied, it would be of no real use. In fact, it would be counter productive to the interest of justice. Here, it may be noted, the appeal authority does not have the authority to remand the proceedings.

13. Accordingly, the writ petition succeeds and is allowed. The impugned order dated 9.11.2023 passed by the respondent no.1 -Deputy Commissioner, State Tax, Ghaziabad is, hereby, set-aside.

14. The matter is remitted to the respondent no.1 – Deputy Commissioner, State Tax, Ghaziabad to pass a fresh order, in accordance with law, after affording due opportunity of hearing to the petitioner.

15. While, we proposed to impose heavy costs for the conduct offered by the respondent no.1, we have been assured by the learned Additional Chief Standing Counsel, such occurrences will not be repeated in future.

16. Accordingly, we direct the Commissioner, Commercial Tax, Uttar Pradesh to undertake remedial measures including providing for disciplinary proceedings against erring officials, where fundamental principles of natural justice may be violated by the adjudicating authorities, without justifiable reason.