Annex-5 / जुड़ा-5 पुरातन उच्च मूल्यवर्ग बैंक नोटों (रुपये 500 / – और रुपये 1000 / -) के अदला बदली के लिए अनुरोध पर्ची/ Request Slip in Hindi

English Requisition Slip / Request Slip/ Annex 5 for exchange of Old High Denomination Bank Notes in denominations of Rs 500/- and Rs 1000/-

Rs 500 and Rs 1000 Bank Notes of aggregate value upto Rs. 4000 only held by a person can be exchanged by him/her at any bank branch or Issue Office of Reserve Bank of India for any other denomination of Banknotes, provided a Requisition Slip as per format is presented with proof of identity along with the High Denomination Banknotes.

Download Request Slip /annex 5 for exchange of Rs 500/- and Rs 1000/ Bank Note Annex 5

Proof of Identity /Documents required along with Requisition slip/ Request Slip /Annex 5 for exchange of Rs 500/- and Rs 1000/ Bank Note

Any of the following Identity Proof Original to be shown at the counter of the Bank for Exchange of Bank Notes of Rs 500 and Rs 1000:-

Aadhaar Card,

Driving License,

Voter ID Card,

Pass Port,

NREGA Card,

PAN Card,

Identity Card Issued by Government Department, Public Sector Unit to its Staff,

Banks where Requisition slip/ Request Slip can be presented for exchange of Rs 500/- and Rs 1000/ Bank Note

Rs 500 and Rs 1000 held by a person other than a bank or Government Treasury may be exchanged at the 19 Issue Offices of the Reserve Bank of India and all branches of public sector banks, private sector banks, foreign banks, Regional Rural Banks, Urban Cooperative Banks and State Cooperative banks only upto and including December 30, 2016, on tender of the Rs 500 and Rs 1000 Bank Notes.

Details of the Scheme for Exchange of Bank Note of Rs 500 and Rs 1000 are as follow

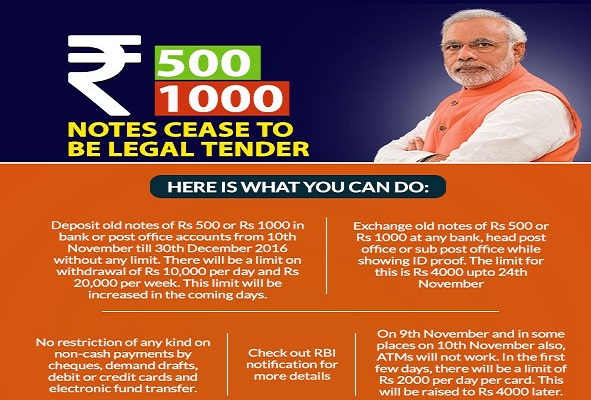

1. In terms of Gazette Notification No 2652 dated November 08, 2016 issued by Government of India, existing series of banknotes in the denominations of Rs. 500/- and Rs. 1000/- issued by the Reserve Bank of India upto November 8, 2016, hereinafter referred to as Rs 500 and Rs 1000 , shall cease to be legal tender in payment or on account at any place with effect from the 9th November, 2016.

2. Rs 500 and Rs 1000 held by a person other than a bank or Government Treasury may be exchanged at the 19 Issue Offices of the Reserve Bank of India and all branches of public sector banks, private sector banks, foreign banks, Regional Rural Banks, Urban Cooperative Banks and State Cooperative banks only upto and including December 30, 2016, on tender of the Rs 500 and Rs 1000 Bank Notes subject to the following conditions:

(a) Rs 500 and Rs 1000 Bank Notes of aggregate value upto Rs. 4000 only held by a person can be exchanged by him/her at any bank branch or Issue Office of Reserve Bank of India for any other denomination of Banknotes, provided a Requisition Slip as per format prescribed in Annex-5 is presented with proof of identity (as indicated in Annex-5 ), along with the High Denomination Banknotes.

(b) Where the aggregate value of the Rs 500 and Rs 1000 Bank Notes tendered exceeds Rs. 4000, the equivalent value will be credited to the account of the tenderer maintained with the bank where the High Denomination Banknotes are tendered. The limit of Rs. 4000/- for exchanging Rs 500 and Rs 1000 Bank Notes at bank branches or at Issue Offices of Reserve Bank of India will be reviewed after 15 days.

(c) There will be not be any limit on the quantity or value of Rs 500 and Rs 1000 Bank Notes to be credited to the account of the tenderer, maintained with the bank where the Rs 500 and Rs 1000 Bank Notes are tendered.

(d) The equivalent value of the Rs 500 and Rs 1000 Bank Notes tendered can be credited to an account maintained by the tenderer at any bank in accordance with standard banking procedure and on production of valid proof of Identity.

(e) The equivalent value of the Rs 500 and Rs 1000 Bank Notes tendered can be credited to a third party account provided specific authorization therefor accorded by the said account holder is presented to the bank, following standard banking procedure and on production of valid proof of Identity of the person actually tendering.

(f) In accounts where compliance with extant Know Your Customer (KYC) norms is not complete, a maximum value of Rs. 50,000/- of Rs 500 and Rs 1000 Bank Notes can be deposited.

(g) Cash Withdrawal from a bank account over the counter will be restricted to Rs. 10,000/- subject to an overall limit of Rs. 20,000/- in a week for the first fortnight.

(h) There will be no restriction on the use of any non-cash method of operating the account which will include cheques, demand drafts, credit/debit cards, mobile wallets and electronic fund transfer mechanisms.

(i) Withdrawal from ATMs would be restricted to Rs. 2,000/- per day per card up to November 18, 2016. The limit will be raised to Rs. 4,000/- per day per card from November 19, 2016 onwards. All ATMs will dispense Rs. 100 and/or Rs. 50 denomination Banknotes only until further instructions from RBI.

(j) For those who are unable to exchange their Rs 500 and Rs 1000 Bank Notes on or before December 30, 2016, an opportunity will be given to them to do so at specified offices of the RBI until a later date, along with necessary documentation as may be specified by the Reserve Bank of India.

- How to Exchange Rs 500 / Rs 1000 Bank Notes w.e.f 10.11.2016

- Banks open on Saturday (November 12) and Sunday (November 13 2016 ) for public

- 8 Use of Rs 500 and Rs 1000 Bank Notes allowed w.e.f 09.11.2016

- RBI FAQs on Withdrawal of ₹ 500/- and ₹ 1000/- Bank Notes

- Salient features of scheme of Withdrawal of Rs. 500 and Rs. 1000

- New Rs 500 Bank Note Key Security Features

- Action to be taken by banks on November 09, 2016 sepcified by RBI

- Video:-PM’s address to Nation on Black Money (Hindi) -Bank Note Rs 500 and 1000 Ban

- Video:-PM’s address to Nation on Black Money (English) 08.11.2016

- Rs 500 / 1000 Notes banned : Text of Indian PM Address to Nation on 08.11.2016

- Withdrawal of ₹ 500 and ₹ 1000 Notes: RBI Notice

- Banks closed on November 9, 2016

- New Rs 500 Bank Notes issued by Reserve Bank of India

- New Rs 2000 banknotes issued by Reserve Bank of India

- ₹ 2000 Banknotes Key Features

- Rs 2000 Bank Note Notification by Govt of India

- ATMs Closed on 09.11.2016 in India, ATMs to resume functioning from November 11, 2016

- Rs 500 / Rs 1000 Bank Note withdrawal Notification of Govt of India