Ayushman Bharat Guidelines on Processes for Hospital Transaction

Guidelines for Pradhan Mantri Rashtriya Swasthya Suraksha Mission (PMRSSM)

1. Guidelines on Processes for Hospital Transaction

PMRSSM would be cashless & paperless at any of the empanelled hospitals. The

beneficiaries shall not be required to pay any charge for the hospitalization expenses. The

benefit also includes pre- and post-hospitalisation expenses. The scheme is an entitlement

based and entitlement of the beneficiary is decided on the basis of family being figured in

SECC database.

The core principle for finalising the Balance Check and providing treatment at empanelled

hospital guidelines for PMRSSM is to construct a broad framework as guiding posts for

simplifying the service delivery under the ambit of the policy and the technology.

1.1. Decision on IT platform to be used for PMRSSM:

Responsibility of – State Government

IT platform for identification of beneficiaries and transactions at the Empanelled Health

Care Provider (EHCP) will be provided by MoHFW/NHA.

For ease of convergence and on boarding, States which have their own IT systems under

their own health insurance/ assurance scheme may be allowed to continue to use their own

IT platform. However, these States will need to map their scheme ID with PMRSSM ID (AHL

TIN) at the point of care and will need to share real time defined transaction data through

API with the Central server with respect to PMRSSM beneficiaries. States will need to also

ensure that no family eligible as per SECC criteria of PMRSSM is denied services under the

scheme and will need to provide undertaking that eligibility under their schemes covers

PMRSSM targeted families as per SECC.

1.2. Preparatory Activities for State/ UT’s:

Responsibility of – State Government

Timeline – within a period of 30 days, after approval of empanelment of health care

provider

The State will need to:

A. Ensure the availability of requisite hardware, software and allied infrastructure

required for beneficiary identification, PMRSSM e-card printing and transactions for

delivery of service at the EHCP. Beneficiary Identification and Transaction Software/

Application/ platform will be provided free of cost by MoHFW/NHA. Specifications

for these will be provided by MoHFW/NHA.

B. Ensure that a Medical Officer as Nodal Officer at EHCP for PMRSSM has been

nominated.

C. Ensure appointment of Ayushman Mitra for the EHCP

D. Ensure that a dedicated helpdesk for PMRSSM at a prominent place at the EHCP

E. Availability of printed booklets, in abundant quantities at the helpdesk, which will be

given to beneficiaries along with the PMRSSM e-cards, if beneficiary has not been

issued the PMRSSM e-card earlier.

F. State/ State Health Agency (SHA) shall identify and set-up team(s) which shall have

the capacities to handle hardware and basic software support, troubleshooting etc.

G. Training of EHCP staff and Ayushman Mitras by the SHA/ Insurer.

The State shall ensure availability of above, in order to carry out all the activities laid down

in this guideline.

1.3. Process for Beneficiary identification, issuance of PMRSSM e-card and transaction for service delivery

Responsibility of – Ayushman Mitra or another authorised person at EHCP

Timeline – Ongoing

A. Beneficiary Verification & Authentication

i) Member may bring the following to the PMRSSM helpdesk:

– Letter from MoHFW/NHA

– RSBY Card

– Any other defined document as prescribed by the State Government

ii) Ayushman Mitra/Operator will check if PMRSSM e-Card/ PMRSSM ID/

Aadhaar Number is available with the beneficiary

iii) In case Internet connectivity is available at hospital

– Operator/Ayushman Mitra identifies the beneficiary’s eligibility and

verification status from PMRSSM Central Server

– If beneficiary is eligible and verified under PMRSSM, server will show the

details of the members of the family with photo of each verified member

– If found OK then beneficiary can be registered for getting the cashless

treatment.

– If patient is eligible but not verified then patient will be asked to produce

Aadhaar Card/Number/ Ration Card for verification (in absence of

Aadhaar)

– Beneficiary mobile number will be captured.

– If Aadhaar Card/Number is available and authenticated online then

patient will be verified under scheme and will be issued a PMRSSM e-Card

for getting the cashless treatment.

– Beneficiary gender and year of birth will be captured with Aadhaar eKYC

or Ration Card

– If Aadhaar Card/Number is not available then beneficiary will advised to

get the Aadhaar Card/number within stipulated time.

iv) In case Internet connectivity is not available at hospital

– PMRSSM Registration Desk at Hospital will call Central Helpline and using

IVRS enters PMRSSM ID or Aadhaar number of the patient. IVRS will speak

out the details of all beneficiaries in the family and hospital will choose the

beneficiary who has come for treatment. It will also inform the verification

status of the beneficiary

– If eligible and verified then beneficiary will be registered for getting

treatment by sending an OTP on the mobile number of the beneficiary

– In case beneficiary is eligible but not verified then she/he can be verified

using Aadhaar OTP authentication and can get registered for getting

cashless treatment

v) In case of emergency or in case person does not show PMRSSM e-Card/ID or

Aadhaar Card/Number and claims to be PMRSSM beneficiary and show some

photo ID proof issued by Government, then beneficiary may get the

treatment after getting TPIN (Telephonic Patient Identification Number) from

the call centre and same will be recorded. Government Photo ID proof need

not be insisted in case of emergency. In all such cases, relevant PMRSSM

beneficiary proof will be supplied within specified time before discharge

otherwise beneficiary will pay for the treatment to the Hospital.

vi) If eligibility, verification and authentication are successful, beneficiary should

be allowed for treatment

These details captured will be available at SHA/ Insurance Company/ Trust level for their

approval. Once approved, the beneficiary will be considered as successfully identified and

verified under PMRSSM.

1.4. Package Selection

A. The operator will check for the specialty for which the hospital is empanelled.

Hospitals will only be allowed to view and apply treatment package for the specialty

for which they are empanelled.

B. Based on diagnosis sheet provided by doctor, operator should be able to block

Surgical or Non-Surgical benefit package(s) using PMRSSM IT system.

C. Both surgical and non-surgical packages cannot be blocked together, either of the

type can only be blocked.

D. As per the package list, the mandatory diagnostics/documents will need to be

uploaded along with blocking of packages.

E. The operator can block more than one package for the beneficiary. A logic will be

built in for multiple package selection, such that reduced payment is made in case of

multiple packages being blocked in the same hospitalization event.

F. Certain packages as mentioned will only be reserved for Public EHCPs as decided by

the SHA. They can be availed in Private EHCPs only after a referral from a Public

EHCP is made.

G. Packages as indicated may have differential pricing for NABH and Non-NABH, for

Hospitals running PG/ DNB Course, for rural and urban EHCPs and for EHCPs in

aspirational districts as identified by NITI Aayog.

H. If a registered mobile number of beneficiary family is available, an SMS alert will be

sent to the beneficiary notifying him of the packages blocked for him.

I. At the same time, a printable registration slip needs to be generated and handed

over to the patient or patient’s attendant.

J. If for any reason treatment is not availed for any package, the operator can unblock

the package before discharge from hospital.

1.5. Pre-authorisation

A. There would be defined packages which will require pre-authorization from the

insurance company/ trust. In case any inpatient treatment is not available in the

packages defined, then hospital will be able to provide that treatment upto Rs.

50,000 to the beneficiary only after the same gets approved by the Insurance

company/ trust and will be reflected as unspecified package. Under both scenarios,

the operator should be able to initiate a request to the insurance company/trust for

pre-authorization using the web application.

B. The hospital operator will send all documents required for pre-authorization to the

insurance company/trust using the Centralized PMRSSM/ States transaction

management application.

C. The documents exchanged will not be stored on the PMRSSM server permanently.

Only the information about pre-authorization request and response received will be

stored on the central server. It is the responsibility of the insurance company/ Trust

to maintain the documents at their end.

D. The documents needed may vary from package to package and hence a master list

of all documents required for all packages will be available on the server.

E. The request as well as approval of the form will be done using the PMRSSM IT

system or using API exposed by PMRSSM (Only one option can be adopted by the

insurance Co.), or using State’s own IT system (if adopted by the State).

F. In case of no or limited connectivity, the filled form can also be sent to the insurance

company/ trust either through fax/ email. However, once internet connectivity is

established, the form should also be submitted using online system as described

above.

G. The insurance company/ trust will have to approve or reject the request latest by 6

hours. If the insurance company/ trust fails to do so, the request will be considered

deemed to be approved after 6 hours by default.

H. In case of an emergency or delay in getting the response for pre-authorization

request due to technical issues, provision will be there to get the pre-authorization

code over the phone from Insurance Company/ Trust or the call centre setup by

Insurance Company/ Trust. The documents required for the processing, may be sent

using the transaction system within stipulated time.

I. In case of emergency, insurance company/ trust will provide the pre-authorization

code generated through the algorithm/ utility provided by MoHFW/NHA-NIC.

J. Pre-authorization code provided by the Insurer/ Trust will be entered by the

operator and will be verified by the system.

K. If pre-authorization request is rejected, Insurance Company/ Trust will provide the

reasons for rejection. Rejection details will be captured and stored in the transaction

database.

L. If the beneficiary or the hospital are not satisfied by the rejection reason, they can

appeal through grievance system.

1.6. Balance Check, Treatment, Discharge and Claim Request

A. Based on selection of package(s), the operator will check from the Central PMRSSM

Server if sufficient balance is available with the beneficiary to avail services.

B. States using their own IT system for hospital transaction will be able to check and

update balance from Central PMRSSM server using API

C. If balance amount under available covers is not enough for treatment, then

remaining amount (treatment cost – available balance), will be paid by beneficiary

(OOP expense will also be captured and stored)

D. The hospital will only know if there is sufficient balance to provide the selected

treatment in a yes or no response. The exact amount will not be visible to the

hospital.

E. SMS will be sent to the beneficiary registered mobile about the transaction and

available balance

F. List of diagnostic reports recommended for the blocked package will be made

available and upload of all such reports will be mandatory before discharge of

beneficiary.

G. Transaction System would have provision of implementation of Standard Treatment

Guidelines for providing the treatment

H. After the treatment, details will be saved and beneficiary will be discharged with a

summary sheet.

I. Treatment cost will be deducted from available amount and will be updated on the

Central PMRSSM Server.

J. The operator fills the online discharge summary form and the patient will be

discharged. In case of mortality, a flag will be raised against the deceased member

declaring him as dead or inactive.

K. At the same time, a printable receipt needs to be generated and handed over to the

patient or patient’s attendant.

L. After discharge, beneficiary gets a confirmation and feedback call from the PMRSSM

call centre; response from beneficiary will be stored in the database

M. Data (Transaction details) should be updated to Central Server and accessible to

Insurance Company/ Trust for Claim settlement. Claim will be presumed to be raised

once the discharge information is available on the Central server and is accessible to

the Trust/ Insurance Company

N. SMS will be sent to beneficiary registered mobile about the transaction and available

balance

O. After every discharge, claims would be deemed to be raised to the insurance

company/ Trust. An automated email alert will be sent to the insurance

company/trust specifying patient name, PMRSSM ID, registration number & date

and discharge date. Details like Registration ID, PMRSSM ID, date and amount of

claim raised will be accessible to the insurance company/trust on PMRSSM System/

State IT system. Also details like Registration-ID, PMRSSM-ID, Date and amount of

claim raised, date and amount of claim disbursement, reasons for different in claims

raised and claims settled (if any), reasons for rejection of claims (if any) will be

retrieved from the insurance company/trust through APIs.

P. Once the claim is processed and the hospital gets the payment, the abovementioned

information along with payment transaction ID will be updated on

central PMRSSM system by the insurance company/trust for each claim separately.

Q. Hospital Transaction Management Module would be able to generate a basic MIS

report of beneficiary admitted, treated and claim settled and in process and any

other report needed by Hospitals on a regular basis

R. Upon discharge, beneficiary will receive a feedback call from the Call centre where

he can share his feedback about his/her hospitalisation experience.

1.7. Monitoring of Transaction Process at EHCP

Responsibility of – SHA and Insurance Company/ Trust

Timeline – Continuous

SHA and Insurance Company/ Trust will need to have very close monitoring of the process in

order to ascertain challenges, if any, being faced and resolution of the same. Some

examples of the parameters on which monitoring may be based are as follows:

A. Number of EHCP and Ayushman Mitras

B. Time taken for verification and issuance of e-card of each member

C. Time taken for approval of verification of beneficiaries

D. Percentage of families with at least one member having issued e-card out of total

eligible families in SECC

E. Number of admissions per family

F. Grievances received against Ayushman Mitras or EHCP

G. Proportion of Emergency pre-authorisation requests

H. Percent of conviction of detected fraud.

I. Share of pre-authorisation and claims audited

J. Claim repudiation/ denial/ disallowance ratio

K. PMRSSM Beneficiary satisfaction

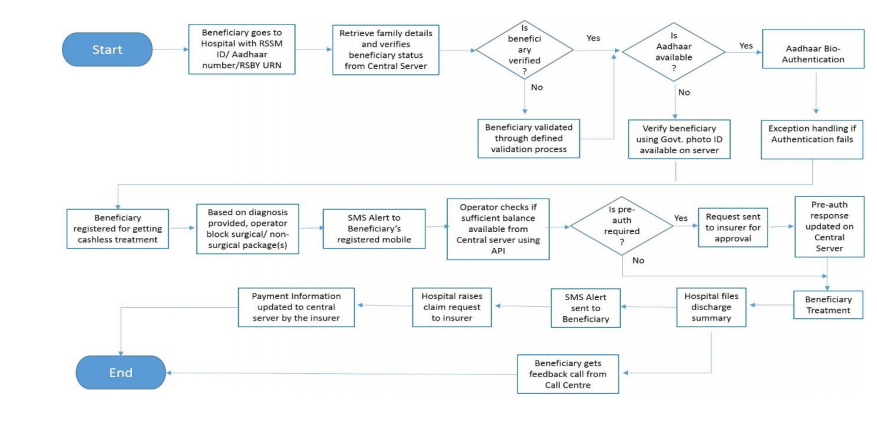

1.8. Transaction Process Flow

Related Post on Ayushman Bharat | PM – Jan Arogya Yojana

Free Study Material on PM – Jan Arogya Yojana

Check Am I Eligible for Ayushman Bharat | PM – Jan Arogya Yojana

Ayushman Bharat : Policy & Guidelines : PM-JAY

Ayushman Mitra : Guidelines under PM-JAY

Ayushman Bharat : Annexure-1 PreAuthorization Form :Download /Print

Ayushman Bharat : Annexure II – Discharge Summary : Download /Print

Website mera.pmjay.gov.in for Ayushman Bharat

Ayushman Bharat launched by PM on 23.09.2018; PMJAY at Ranchi

Ayushman Bharat Yojana :Pradhan Mantri Jan Aarogya Yojana Features :

Use of Aadhaar in Ayushman Bharat – Desirable and not “Must”

Ayushman Bharat – National Health Protection Mission : Features