ORDER

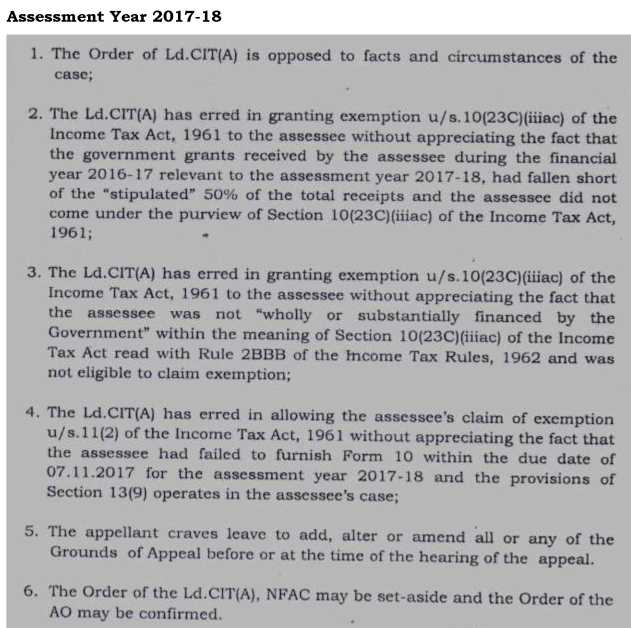

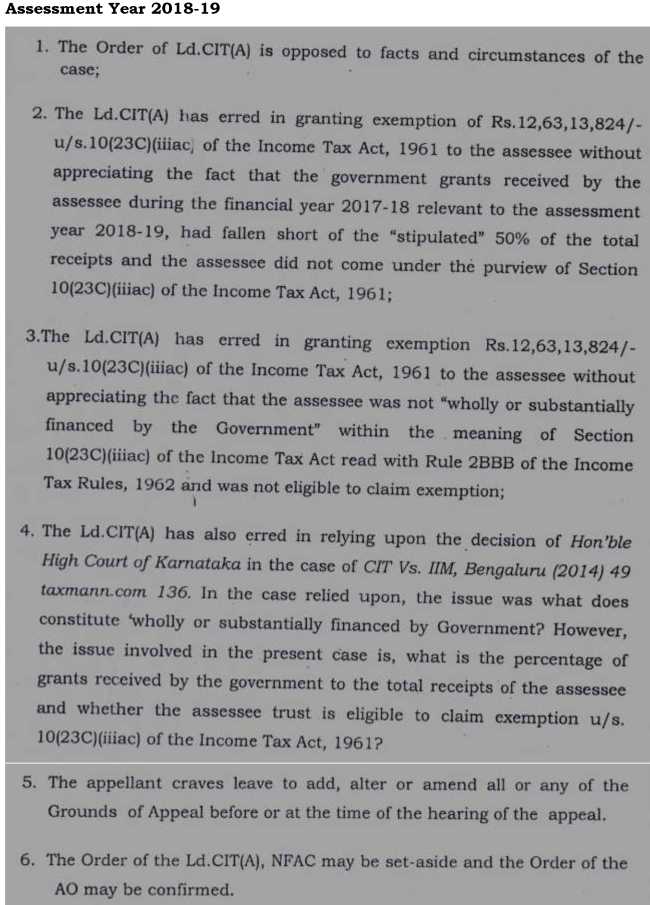

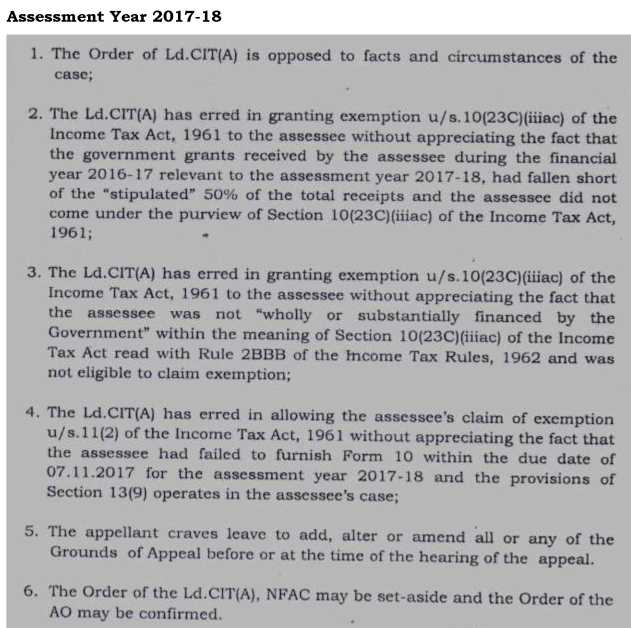

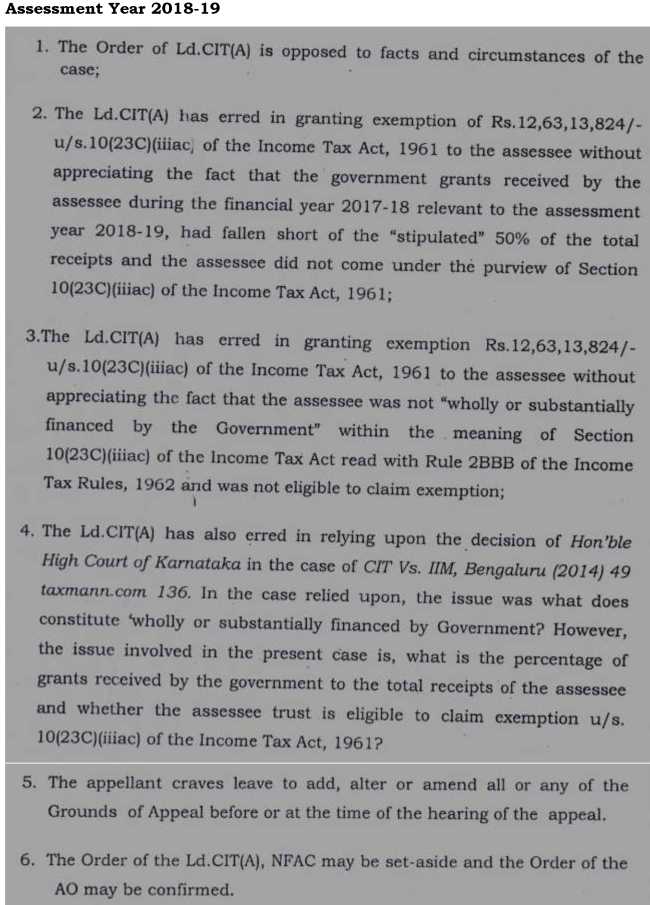

Soundararajan K., Judicial Member. – These are the appeals filed by the revenue challenging the orders of the NFAC, Delhi dated 13/06/2024 in respect of the A.Ys. 2017-18 and 2018-19 on the following grounds of appeal:

2. The brief facts of the case are that the assessee is a registered trust u/s. 12A of the Act and during the assessment year, the assessee claimed the exemption u/s. 10(23C)(iiiac) of the Act. The AO issued notice and stated that the assessee institute has received less than 50% grant from the Government during the year in order to claim the exemption under the above section. Further, the AO had observed that the assessee had not furnished the form 10 within the due date and therefore they are not entitled to claim the exemption u/s. 11(2) of the Act. As against the said order, the assessee filed an appeal before the Ld.CIT(A) and contended that the assessee is an autonomous body set up by the Government for diabetic treatment by providing all the infrastructure and funds and also it was wholly managed by the Government. The assessee further submitted that they had furnished requisite form 10 to communicate the accumulation of income which is falling short by 85% as per the requirement of section 11(2) of the Act and also submitted that the delay to condone the same was also made before the appropriate authority. The Ld.CIT(A) had allowed the appeal and observed in its order that the requirement of filing the audit report with the return is merely a procedural requirement and the exemption would not be denied so long as the report is available before the completion of the assessment. On the above said findings, the Ld.CIT(A) had observed that the assessee is eligible for exemption u/s. 11 of the Act. Insofar as the disallowance u/s. 10(23C)(iiiac) of the Act is concerned, the Ld.CIT(A) considered the records and came to the conclusion that the grants by the Government exceeds more 50% as contemplated under the above section. The Ld.CIT(A) also relied on the Jurisdictional High Court judgment to allow the case of the assessee.

3. As against the said order of the Ld.CIT(A), the revenue is in appeals before this Tribunal.

4. At the time of argument, the Ld.DR submitted that the grant received by the assessee during the assessment year 2017-18 falls short of the 50% of the total receipts and therefore they are not eligible for exemption u/s. 10(23C)(iiiac) of the Act. The Ld.DR also submitted that the assessee failed to submit form 10 within the due date and therefore they are not entitled for exemption u/s. 11(2) of the Act.

The Ld.AR had submitted a paper book enclosing a brief facts and notes on the issues and also filed some documents along with the case laws and contended that the order of the Ld.CIT(A) is based on the records submitted by the assessee and unless and until the revenue had produced some other records, contrary to the documents filed by the assessee, the order of the Ld.CIT(A) is in order and prayed to dismiss the appeals filed by the revenue.

5. We have heard the arguments of both sides and perused the material available on record.

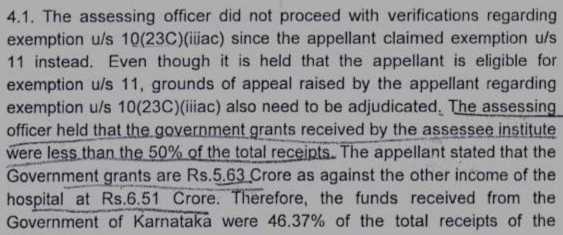

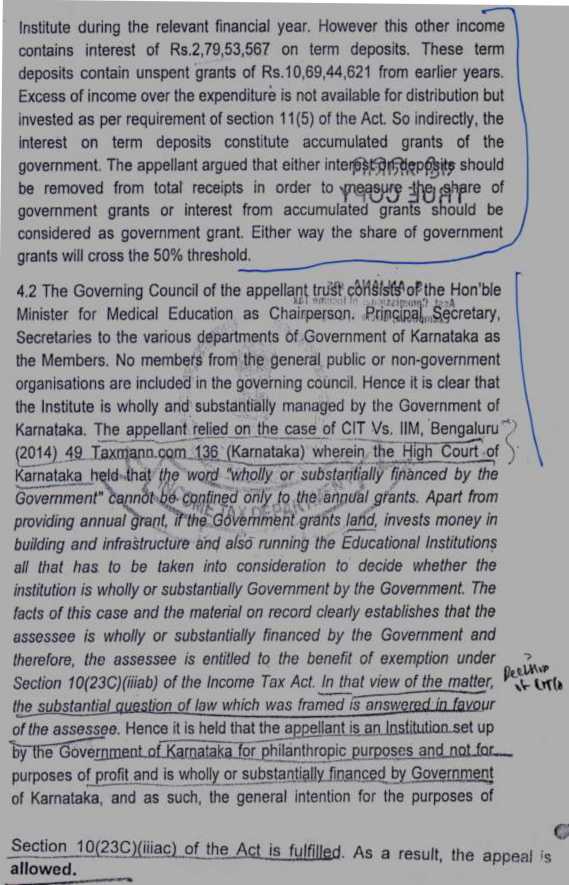

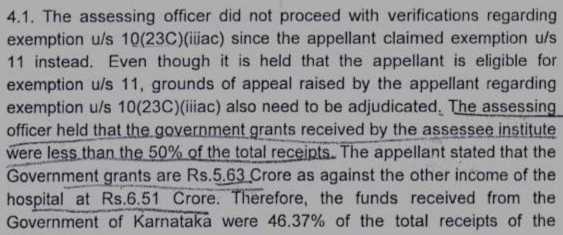

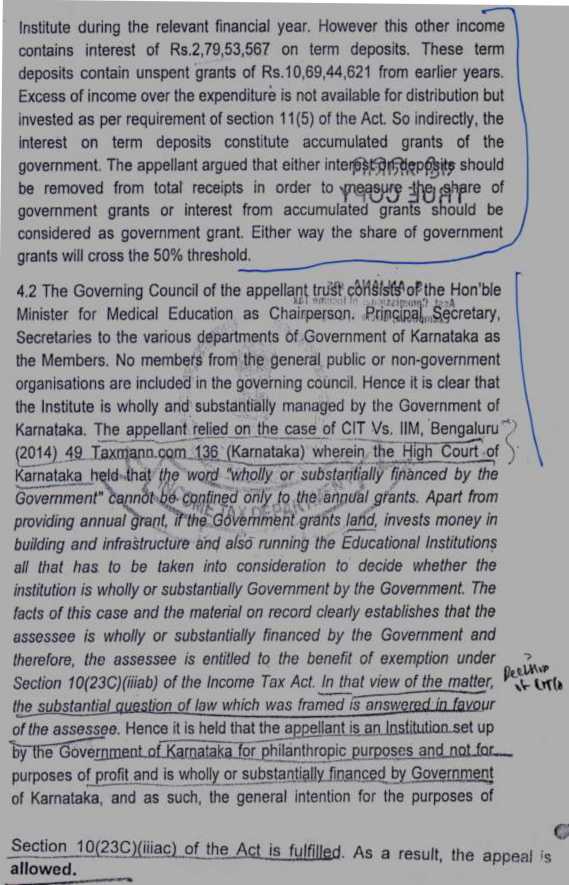

6. As seen from the details furnished by the assessee, during the Assessment Year 2017-18, the assessee had received a grant of Rs. 5.63 crores. Apart from the said grants, the assessee had also received an interest of Rs. 2,79,53,567/- on the term deposits made by the assessee. The said interest has been accrued from the excess credits of unspent grant of Rs. 10,69,44,621/- as on 31/03/2017. The total term deposits as on 31/03/2017 is Rs. 39,85,99,141/-. Therefore the interest received on the fixed deposits made out of the unspent grants also would be treated as a grant and if the said interest amount is added to the total grants received during the Assessment Year, it will exceed the 50% prescribed u/s. 10(23C)(iiiac). Therefore we found that apart from the grants received during the assessment year, the assessee is also receiving interest income on the unspent grants which is also a grant and in that circumstances, the Ld.CIT(A) had granted the relief which is in accordance with law. The Ld.CIT(A) in his order in paragraph no. 4.1 had considered the said facts and also considered the fact that the assessee is an institute wholly and substantially managed by the Government of Karnataka and therefore they are entitled for deduction u/s. 10(23C)(iiiac) of the Act. The relevant finding of the Ld.CIT(A) is as follows:

Similar facts are also available in respect of the A.Y. 2018-19 and the Ld.CIT(A) also considered the grants as well as the interest received from the deposits and come to the conclusion that the assessee is entitled for deduction u/s. 10(23C)(iiiac) of the Act.

7. The Ld.DR appearing for the revenue has not brought out any fresh facts in order to treat the order of the Ld.CIT(A) as illegal but only raised general grounds which are not sufficient for setting aside the order of the Ld.CIT(A). Insofar as the filing of form 10 belatedly by the assessee, the Ld.CIT(A) had relied on the judgment of Hon’ble Calcutta High Court reported in (Calcutta) and held that the requirement of the audit report to be filed along with the return of income is only a procedural requirement and therefore exemption would not be denied when the said audit report is available with the AO before the completion of the assessment. This finding is also in accordance with the principles laid down by the Hon’ble Calcutta High Court and therefore we hold that the assessee is eligible for exemption u/s. 10(23C)(iiiac) of the Act and also u/s. 11(2) of the Act. In these circumstances, we find no merit in the contention of the Ld.DR and therefore we dismiss the appeals filed by the revenue as devoid of merits.

8. In the result, both the appeals filed by the revenue are dismissed.