ORDER

Anubhav Sharma, Judicial Member.- These are appeals preferred by both the Revenue as well as the Assessee against the orders of the Ld. First Appellate Authority in appeals filed before him against the orders of the ld. Assessing Officer (hereinafter referred to as the Ld. AO, for short). Further details of the orders of the lower authorities are as under:-

| ITA No./BMA & Assessment Year | CIT(A) who passed the order | Appeal No. & Date of order of the CIT(A) | AO who passed the assessment order & Date of order | Section of the IT Act/BMA under which the AO passed the order |

| ITAs No.405 to 411/Del/2021 AYs: 2011-12 to 2017-18 | CIT(A)-24, New Delhi | CIT(A), Delhi -24/10270/2018-19 to CIT(A), Delhi -24/10273/2018-19, CIT(A), Delhi -24/10096/2019-20, CIT(A), Delhi -24/10275/2018-19 & CIT(A), Delhi -24/10276/2018-19, dated 26.02.2021 | ACIT, Central Circle-5, New Delhi, date: 31.12.2018 | 153A |

| ITAs No. 153/Del/2022, 716/Del/2021 & 165/Del/2022 AYs.2015-16 to 2017-18 | | CIT(A), Delhi -24/10096/2019-20, CIT(A), Delhi – 24/10275/2018-19 & CIT(A), Delhi -24/10276/2018-19, dated 26.02.2021 | ACIT, Central Circle-5, New Delhi, date: 25.02.2019, 31.12.2018 & 25.02.2019 | 154 r.w.s. 153A/143(3); 153A; & 154 r.w.s. 153A/143(3) |

| ITAs No.412 to 418/Del/2021 AYs 2011-12 to 2017-18 | – | CIT(A), Delhi -24/10259/2018-19 to CIT(A), Delhi -24/10262/2018-19, CIT(A), Delhi – 24/10124/2019-20, CIT(A), Delhi – 24/10264/2018-19 & CIT(A), Delhi -24/10269/2018-19, dated 26.02.2021 | ACIT, Central Circle-5, New Delhi, date: 31.12.2018 | 153A/143(3) |

| ITAs No.l63/Del/20 22, 715/Del/2021 & 164/Del/2022 2015-16 to 2017-18 | | CIT(A), Delhi -24/10124/2019-20, CIT(A), Delhi – 24/10264/2018-19 & CIT(A), Delhi -24/10269/2018-19, dated 26.02.2021 | ACIT, Central Circle-5, New Delhi, date: 25.02.2019, 31.12.2018 & 25.02.2019 | 154 r.w.s. 153A/143(3); 153A; & 154 r.w.s. 153A/143(3) |

| BMA No.05/Del/202 2 2019-20 | CIT(A)-31, New Delhi | 27/BM/21-22, dated 19.09.2022 | DDIT (Inv.), Unit 3(2), Delhi, dated 31.03.2021 | 10(3) |

| BMA No.09/Del/202 2 2019-20 | -DO- | -DO- | -DO- | -DO- |

| BMA No.06/Del/202 2 2019-20 | -DO- | 26/BM/21-22, dated 19.09.2022 | -DO- | -DO- |

| BMA No.l0/Del/202 2 2019-20 | -DO- | -DO- | -DO- | -DO- |

| BMA No.07/Del/202 2 2019-20 | -DO- | 28/BM/21-22, dated 20.09.2022 | -DO- | -DO- |

| BMA No.08/Del/202 2 2019-20 | -DO- | -DO- | -DO- | -DO- |

2. Heard and perused the record. These appeals were heard together as they arise of common set of facts and have common question of law involved. The admitted facts in brief, as per records and as culled out from submissions filed by the ld. Counsel are that, the appellants/assessee were searched u/s 132(1) of the Act on 02/03/2017 through a common /joint search warrants when on their common residence was covered in the search operation. Requisite mandatory notices u/s 153A of the Act were issued to them on 24/09/2018 requiring them to file their returns of income within 15 days thereof for the six preceding years from AYs 2011-12 to 2016-17. The assessment proceedings for the AY 2017-18, being the assessment year relevant to the previous year in which the search took place was also covered for the purpose of limitation under the said section 153A of the Act. In response thereto, the appellants/assessee filed their returns of income on 13/10/2018 for all the assessment years u/s 153A of the Act.

3. The appellants/assessee are individuals and have income from other sources as per returns of income filed by them upto the AY 2015-16 which were completed assessments and for the remaining two AYs i.e 2016-17 and 2017-18, the assessment proceedings were pending and got abated due to the time to issue the notice u/s 143(2) of the Act had not expired as on the date of search.

4. The case of revenue is that as per the information available with the revenue before the date of search on 02/03/2017, Shri Pradeep Wig, Ms. Neera Wig, Ms. Sonu Wig, Ms. Neela Kothari and Ms. Gauri Wig were shareholders of Carmichael Capital Limited (hereinafter referred to as CCL), a British Virgin Island (BVI) registered on 09/03/2005, as per certificate of its incorporation placed at PB page no. 1 Vol. No. 1. The assessee Pradeep Wig and Mrs. Neera Wig, and their 3 daughters including assessee Ms. Sonu Wig, held equal shares of 20% each in CCL. The entire investment was made from the declared and assessed sources remitted from India under the permitted Liberalized Remittance Scheme (LRS) of the Reserve Bank of India from time to time from 04/11/2005 to 31/03/2016. This is an admitted fact by the revenue also as no adverse cognizance of the same in any manner in any of the appellants/assessee has been taken in their respective assessment proceedings under the both the Income Tax Act 1961 or Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act,2015 (BMA).

5. Allegedly as per the information collected from the competent authorities of BVI and Singapore Shri Pradeep Wig and his other family members were the beneficial owner of the bank accounts held in the name of CCL. Further, it was also found that CCL was an investment holding company and was holding flats in London. CCL was also 100% owner of another company Eaton Estates Limited (EEL) incorporated in the UK jurisdiction which had also purchased a flat in London.

6. In the assessment orders, the AO has categorically held that during the pre-search enquiries, the assessee, Mr Pradeep Wig was already confronted with the said information available with the income-tax department. On confrontation, the assessee denied being the beneficial owner of the said company and its bank accounts. The AO has also stated that during the assessment proceedings, after analyzing the documents seized during the search on 02/03/2017, it was found that the appellants/assessee were the beneficial owner of the properties held in the name of CCL and EEL. The Revenue alleges that the appellants/assessee got the said company CCL incorporated only for the purpose acquiring properties in UK by which he could avoid declaration of the ownership in the properties in India. The AO has stated that since the appellants/assessee were willing to avoid payment of income-tax under Indian Income Tax Act, provisions on the said properties, this route of incorporating an overseas company was implemented.

7. The case of assessee is that as per the information itself the date of purchase of the first flat no.63 Eaton House by CCL was 14/02/2008 (for a total value of 17,00,000 GBP with HSBC Bank loan of 11,90,000 GBP and own fund of the company 5,10,000 GBP). The said flat was sold on 18/04/2016 for 28,00,000 GBP. As per assessee, similarly, the date of acquisition of the second flat being the flat no. 53 Eaton Estate London by CCL was 29/01/2010 (total value 13,25,000 + 5,40,000 =18,65,000 GBP with HSBC Bank loan of 12,95,000 GBP and own fund of the company 5,70,000 GBP). The said flat was also sold on 04/08/2014 for 28,50,000 GBP.

8. Further, the actual rent received by the CCL was 72792 GBP only for the property no. 63 at Eaton House from 15/04/2014 for 12 months (Page 18 of the assessment order AY 2011-12) (for the other 2 properties being flat nos. 53 and 61 in the same building, it was NIL but assessed on deemed basis by the AO). It is also an undisputed fact the flat no. 61 belonged to a subsidiary Eaton House of CCL and was never let out.

9. The corresponding details of these transactions are made available on PB and same are not disputed by the Revenue.

10. Thus, as per the appellants/assessee, the said company CCL was not incorporated to acquire the properties as for the almost initial three years the company was only engaged in investment activities of the funds remitted under the permitted LRS from India and which source has been accepted by the revenue as no addition has been made for it. Then as per the case of assessee no dividend was ever declared by those companies to its share holders nor any money otherwise was given to the appellants/ shareholders by the said companies in any manner.

11. Thus, all the above Income-tax appeals and the BMA appeals involve common grounds of appeal, and the first issue for consideration is whether the corporate veil of an overseas BVI company in which the assessee and his family members were the only shareholders which company had purchased 2 flats in the UK could be lifted to assess the income of the said company by way of rental including deemed rent and bank interest etc. could be assessed in the hands of the assessee shareholder. Therefore, common submissions have been made by both the sides, particularly, when the issues involved in cross appeals under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act,2015 (BMA) are also the offshoot of the income assessed under the Incometax Act, 1961 as the BMA applies to the foreign income and assets, not hitherto assessed under the Income-tax Act.

12. Ld. Counsel of the appellants/assessee submits that the basic issue is the assessment of income under the Income-tax Act in the hands of the two appellants/assessee herein Mr Pradeep Wig and Mrs. Neera Wig equally by way of rental including deemed rental income of the aforesaid two properties owned by CCL. Ld. Counsel has submitted that originally there were 5 shareholders in the company holding equal shares being the two appellants/assessee and their 3 daughters, Ms. Sonu Wig, Ms. Neela Kothari and Ms. Gauri Chopra, Ms. Sonu Wig has also been as on the date since the year 2013 and was an NRI during the relevant period, prior to becoming British citizen, under provisions of the Act. Since she did not have any income in India, she was not under an obligation to file any return of income. The shares held by her 2 sisters Ms. Neela Kothari and Ms. Gauri Chopra were gifted by them to Ms. Sonu Wig on 24/12/2015.

13. Taking up this first issue regarding assessment of income/ gains in hands of assessee from the properties in London owned by CCL. As per ld. Counsel of the assessee, to escape the clutches of this provision under the Income-tax Act, assessee/appellants have to only satisfy the ownership of an overseas asset for which consideration has been provided by them as the shares held by them overseas in CCL were only paid for by them to the company as per the legal mandate and not for any asset, acquisition of which was not paid for by them nor it is registered in their name. It was submitted that the asset acquired by them was the share capital in CCL and the sources of which was properly declared on year on year basis in the returns of income filed and being from the declared tax paid sources. Thus, the assessee acquired shares in a foreign company which were their foreign asset and were duly disclosed in return of income. Ld. Counsel submitted that it is not the concern of assessee as investor, as to what the said company did with the amount received by it from the assessee after allotting shares to the assessee, which shares are the only asset in their hands and the assets of the company, is beyond the scope of this provision.

14. Further, ld. Counsel submits that as per the Explanation 5 u/s 139(1), a beneficiary of an asset can only be an individual who derives benefit from the asset during the previous year, the consideration for which was provided by a person other than such beneficiary. Thus, here the use of word ‘and’, repeat ‘and’, in the respective limbs clearly means, the consideration for such asset has to be provided by someone else other than the beneficiary. Since, here the consideration was provided by the assessee only, he could not at all be termed as a beneficiary and on the same analogy, the assessee can also not be considered as a beneficial owner of the asset registered in the name of the company to stretch him in the fold of the beneficial owner of the company considering disclosure of this very fact in the income-tax return form for the AY 2016-17, copy placed in PB page no. 116-178. Ld. Counsel states that in the Foreign Assets column, two words are used differently, one Direct (Registered Owner of shares) and second, if not registered shareholder, then beneficiary. Thus, in terms of the 4th proviso, holding of an overseas asset during the relevant period as a beneficial owner or otherwise is mandatory for the purpose of filing the same in the return of income and if the said asset had already been sold before commencement of the relevant FY 2015-16, then it was not at all mandatory for the assessee to declare the same in his return of income to be filed under the said proviso. Therefore, the BMA cannot extend its fold on those assets which had already been sold and for which the assessee was not required to even declare the beneficial ownership as he did never have on those assets.

15. He pointed out that admittedly here, the assessee never received any dividend or income from the said investment in equity share capital anytime till date and therefore cannot be termed as beneficiary and as explained cannot be termed as a beneficial owner under the provisions of Income-tax Act as well as BMA because he is the registered shareholder only.

16. It was thus submitted that the contention of the AO that BVI was incorporated with an intention to acquire the said properties is not plausible and the ld. Counsel countered that same is incorrect assumption, because the first property was acquired for GBP 17,00,000 almost 3 years after incorporation of the company and with a proven bank loan from the HSBC of GBP 11,90,000 which was 70% of the value of the residential property. Similarly, the second property was acquired for GBP 18,65,000 almost 5 years after incorporation of the company in BVI, with a proven bank loan from the HSBC of GBP 12,95,000 which was again 70% of the value of the residential property.

17. It was submitted that one of the said properties were off and on rented during the intermittent period and for the remaining period those properties were not rented therefore mandatory ATED (Annual Tax on Enveloped Dwelling payable by corporate owners in UK for residential properties owned by them) was paid as compensatory income-tax on the said properties there as per evidence placed at PB page no. 279-290 Vol. 1. The said properties were thus exempted in UK from the capital gains tax on their sales.

18. The basic reason to consider the income from the same in the hand of the appellants/assessee is that during the income-tax search conducted on 02/03/2017 on the appellants/assessee, the revenue came across a calendar events date sheet from the mobile phone of Mr Pradeep Wig as is copied in the assessment orders, showing that Mr Pradeep Wig was indulging in maintaining the activities of the properties including using one of the said properties for own residential use in London besides his daughter Ms. Sonu Wig, who is a British citizen, was also living therein. The revenue has contended that the BVI company was incorporated to acquire properties overseas with the sole intention to bypass taxability of income of those London properties in their hands in India.

19. This is rebutted by the Ld. Counsel by reiterating his submission that it is also an admitted fact and as has been mentioned by the AO also that the incometax department had the information of those properties owned by the overseas companies before the date of search on the appellants/assessee on 02/03/2017. He submitted that a company is an artificial entity so obviously, the activities of the companies are conducted by living persons, whether shareholders or directors or employees or the authorised signatory. It is not necessary that only the directors should conduct the affairs of the company. Even, shareholders whose money is at stake, note down the issues to be resolved through the local assistance or directors of the company. The information found did nowhere state that the appellants/assessee were physically conducting the affairs of the company otherwise. The said list only shows events, as to what happened on the said date and what was desired to happen then by its author. Thus, that does not lead to any conclusion that the appellants/assessee were otherwise managing the companies. However, the Ld. Counsel also submitted that since the shareholders of the company, having invested money in the capital of the company, definitely had a direct right to look into the maintenance of the properties owned by the company as erosion therein will consequently erode their invested capital. In any case otherwise, the issue of Point of Effective Management (POEM) of a company to determine its residential status as has been introduced in the legislature for the purpose of residence by the Finance Act, 2015 w.e.f. AY 2016-17 did not apply to the relevant period and other wise also that leads to the decision whether foreign company is a resident in India or not. It, in no manner, authorizes the Revenue to convert the residential status of a company into a benami status held by its shareholders, which is altogether a different concept as has been introduced in the 4th proviso u/s 139(1) of the Act, which for convenience is reproduced, below:-

“Provided also that a person, being a resident other than not ordinarily resident in India within the meaning of clause (6) of section 6, who is not required to furnish a return under this sub-section and who at any time during the previous year,—

| (a) | | holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has signing authority in any account located outside India; or |

| (b) | | is a beneficiary of any asset (including any financial interest in any entity) located outside India, shall furnish, on or before the due date, a return in respect of his income or loss for the previous year in such form and verified in such manner and setting forth such other particulars as may be prescribed:” |

20. Now as we go through the impugned orders, it can be appreciated from the impugned order of ld. CIT(A) that aforesaid submissions were not found sustainable for following reasons:-

1.1.4 “I have considered facts of the case as well as written submissions of the appellant. From perusal of the assessment order, it is observed that the Assessing Officer has relied upon following seized material:

| (i) | | Seized data titled ‘Carmichael Banc Alliance Invoice june 2005.pdf’ which is an invoice raised by BANC Alliance to Sh. Pradeep Wig for incorporation of CCL |

| (ii) | | Calendar events of the appellant from which it is seen that purchase, sale, renovation, leasing, furnishing, loan arrangements, meeting with brokers / estate managers in connection with purchase / sale of flats 53, 63 & 61, Eaton Estate has active involvement of the appellant |

| (iii) | | Seized documents ‘WORKERS [2210] xls’, WORKERS [11585] xls’, WORKERS [13180] xls’, WORKERS.xls’ as per which the appellant has employed various staff at his residence. |

1.1.5 The above seized material is incriminating in nature and has been duly relied upon by the Assessing Officer to make additions in the hands of the appellant. Hence, it is held that above decisions including decision in the case of CIT v. Kabul Chawla 2015-TIOL-2006-HC-DEL-IT is not applicable in the present appeal and Ground No. 1 is dismissed.

4.2.4 I have considered facts of the case as well as written submission of the appellant. In view of detailed discussion in Ground Nos. 4 to 7 above, it has been upheld that the appellant was beneficial owner of the three properties in UK. The appellant has contended that income from house property should be assessed in the hands of the owner. In this case, the appellant has been held to be beneficial owner after lifting of corporate veil in view of decision of Hon’ble Supreme Court in the case of

Mc Dowell & Co. Ltd. v.

Commercial tax Officer [1985] 154 ITR 148 (SC). The judicial decisions relied upon by the appellant pertain to ownership dispute in assessing income from house property. In the present case, once it is held that the appellant was trying to evade taxes through an avoidance arrangement and corporate veil is lifted, it is held that the Assessing Officer has rightly concluded that income from house property is to be assessed in the hands of the appellant. Hence, Ground No. 2 is dismissed.

4.3.3 I have considered facts of the case as well as written submission of the appellant. In the case of CIT v. Shelly Products, it was held that where there is failure or inability of authorities to frame a regular assessment after earlier assessment is set aside or nullified, tax deposited by an assessee by way of advance tax or self-assessment tax, or tax deducted at source is not liable to be refunded to assessee, since its retention by revenue would not result in breach of article 265 of Constitution which prohibits levy or collection of any tax except by authority of law. This decision has no relevance to the present facts of the case. No detailed arguments with regard to this ground of appeal have been advanced. Hon’ble Supreme Court in the case of Mc Dowell & Co. Ltd. v. Commercial tax Officer [1985] 154 ITR 148 (SC) held that it is not open to everyone to so arrange his affairs as to reduce burden of taxation to minimum and such a process constitutes tax evasion. The operative part of the judgment is reproduced below:

“23. Tax planning may be legitimate provided it is within the framework of law. Colourable devices cannot be part of tax planning and it is wrong to encourage or entertain the belief that it is honourable to avoid the payment of tax by resorting to dubious methods. It is the obligation of every citizen to pay the taxes honestly without resorting to subterfuges.”

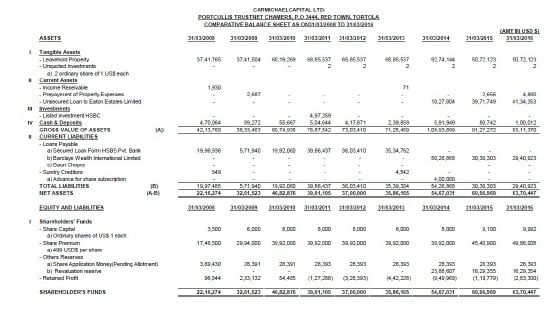

4.4.18 The appellant and his family members remitted USD 51,63,720 (Rs 24,74,96,571) to BVI under Liberalised Remittance Scheme from the FY 2004-05 to 31/03/2016. Copy of relevant bank accounts was submitted during appeal proceedings. The appellant made investments in CCL out of above remittance. A comparative balance sheet of CCL from 31.03.2008 to 31.03.2016 is reproduced below:

4.4.19 From facts available on record, it is observed that remittances sent from India by the appellant and his family members were invested as share capital in CCL. From the remittances, the appellant invested GBP 17,87,197 for purchase of Flat No. 63, Eaton House, UK in FY 2007-08. Investment of GBP 19,86,584 was made in FY 2010-11 for purchase of Flat No. 53, Eaton House, UK. Some loan was taken from banks for purchase of these properties. EEL was incorporated on 29.10.2009 as 100% subsidiary of CCL and Flat No. 61, Eaton House, UK was purchased for GBP 58,50,000 in FY 2014-15.

4.4.20 CCL has not done any substantive business apart from investment in above properties. The above details clearly highlight the fact that the purpose of incorporating CCL and EEL in BVI was to make investment in properties in UK. From the data seized and calendar events of the appellant, the Assessing Officer has rightly held that purchase, sale, renovation, leasing, furnishing, loan arrangements, meeting with brokers/estate managers in connection with purchase/sale of flats 53, 63 & 61, Eaton Estate had active involvement of the appellant. The appellant had appointed nominee directors in CCL and EFL who had no say in the management of the estates of the company. As per information received from the competent authority of Singapore, in bank account no. 91374800 with Barclays bank Singapore, Sh. Pradeep Wig, Ms. Neera Wig and Ms. Sonu Wig are the ultimate beneficial owners of the account of CCL.

4.4.21 In view of the above discussion, it is held that the appellant created the arrangement of registering CCL and EEL in BVI to obtain tax benefit. The arrangement lacks commercial substance and has been carried out in a manner which is not ordinarily employed for bona fide purposes. The apparent is not the real. Under these circumstances, the Assessing Officer has rightly lifted corporate veil to expose the true state of affairs. Hon’ble Supreme Court in the case of Mc Dowell & Co. Ltd. v. Commercial tax Officer [1985] 154 ITR 148 (SC) held that it is not open to everyone to so arrange his affairs as to reduce burden of taxation to minimum and such a process constitutes tax evasion. The operative part of the judgment is reproduced below:

“23. Tax planning may be legitimate provided it is within the framework of law. Colourable devices cannot be part of tax planning and it is wrong to encourage on entertain the belief that it is honourable to avoid the payment of tax by resorting dubious methods. It is the obligation of every citizen to pay the taxes honestly without resorting to subterfuges.”

4.4.22 Hon’ble Karnataka High Court in the case of Yenepoya Resins & Chemicals v. DCIT (Karnataka) held that where assessee had deliberately reduced its taxable income through discounting letter of credit against sale bills issued to sister concern instead of collecting proceeds and bore interest burden of sister concern, said arrangement could not be considered as business prudence and deduction claimed by assessee on account of interest paid to bank and also to its creditors was not allowable under section 36(1)(iii). The operative part of the judgment is reproduced below:

“6…….The Commissioner of Income-tax (Appeals) has upheld the aforesaid finding and has held that the assessee has tried to give the whole arrangement a colour of business expediency falling within the purpose and nexus to business. But on a close scrutiny, it is evident that it is nothing but shouldering the interest burden on itself thereby diverting the benefit in favour of the sister concern. It has further been held that where the borrowing is illusory or colourable, the interest paid on such borrowings is not allowable. Reference has been made to the decision of the Supreme Court in the case of MC-Dowell & Co. Ltd. Commercial Tax Officer. The Tribunal, by the impugned order, in paragraph 6.2 has held that the assessee firm has supplied its finished products to its sister concern for which it has not insisted for the sale proceeds and has availed letter of credit against the bills and paid interest. This arrangement, by no stretch of imagination, can be considered as business prudence and expediency: It has further been held that no prudent businessman pays interest on the payment to his creditors and at the same time does not charge corresponding interest on the delayed payment from its debtor. It has further been held that the aforesaid arrangement has been made with an object to circumvent the provisions of the Act to facilitate its sister concern to rest on the shoulders of the appellant. It has also been held that the appellant has deliberately created an artificial and colourable devise for reducing its income offered for taxation through an arrangement of letter of credit and thus, the deduction claimed by the assessee on account of interest paid to the bank and also to its creditors are not allowable.”

4.4.23 In view of above decisions and facts of the ease, it is held that the appellant created CCL and EEL to avoid payment of legitimate taxes and the Assessing Officer has rightly lifted corporate veil to expose the true state of affairs. The appellant has relied upon various judicial decisions in support of his argument that a company has separate legal status from its shareholders. However, when an arrangement is made to avoid payment of taxes, in view of decision of Hon’ble Supreme Court in the case of Mc Dowell & Co. Ltd. v. Commercial tax Officer [1985] 154 IT’R 148 (SC), the Assessing Officer can lift the corporate veil and income of the company can be assessed in the hands of the real owner, the shareholders in this case. It is held that the appellant had invested in properties through CCL and the company has been used as a tool for holding of investment while the real control lies with the appellant. The Assessing Officer has rightly concluded that the properties are owned by the assessee, the company CCL, is a cover and nominee directors have been appointed for the sake of statutory obligations. Hence, income of properties held by CCI. and EEL is liable to be assessed in the hands of Sh. Pradeep Wig and Smt. Neera Wig, who are beneficial owners of these properties. However, the taxability of income from these properties is subject to Indo-UK Double Taxation Avoidance Agreement as well as provisions of Income Tax Act. Relevant provisions of Indo-UK DTAA are reproduced below:

“Article 6

INCOME FROM IMMOVABLE PROPERTY

1. Income from immovable property may be taxed in the Contracting State in which such property is situated.

Article 14

CAPITAL GAINS

Except as provided in Articles & (Air transport) und 9 (Shipping) of this Convention, each Contracting State may tax capital gains in accordance with the provisions of its domestic law.”

4.4.24 The term ‘may be taxed’ has neither been defined in the Act nor in the treaty.

Section 90(3) of the Act provides that –

“Any term used but not defined in this Act or in the agreement referred to in sub-section (1) shall, unless the context otherwise requires, and is not inconsistent with the provisions of this Actor the agreement. have the same meaning as assigned to it in the notification issued by the Central Government in the Official Gazette in this behalf.”

4.4.25 The Assessing Officer has rightly considered Articles 6, 14 and 24 of Indo-UK DTAA as well as section 90 of Income Tax Act to conclude that income of Indian resident shall include his income from assets located outside India and country of residence also has right of taxation.

……

4.5.4 I have considered facts of the case as well as written submissions of the appellant. As per details available on record, the funds were sourced from the joint accounts of the appellant and his wife. Once corporate veil had been lifted, the income was rightly assessed by the Assessing Officer in the hands of the appellant and his wife since they were the beneficial owners

21. Now in the cases before us the source of the entire share capital invested in the company CCL by the assessee and his family, as above, was tax paid money remitted under the LRS by the assessee and his family members and the flats in London were acquired from the share capital of the said company so available and the bank loan taken from HSBC Bank. Further, the rental income of the properties of CCL assessed is also subject to tax in the UK as per the income-tax returns filed there (PB page nos. 249-333) where the flats were acquired from the declared sources admittedly by the Revenue, as no addition has been made in respect thereof under any of the respective two Acts.

22. Thus as for the purpose of the Explanation 4 u/s 139(1) of the Act, the ‘beneficial owner’ in respect of ‘an asset’ can be one who has provided directly or indirectly consideration for the asset for the immediate or future benefit of himself or/and someone else. This explicitly refers to a particular asset as the word ‘the’ has been used to qualify the particular very asset for which the consideration was given by the assessee and not any other asset acquired by the other person to whom some amount was given but not for the asset acquired by the assessee. Thus, we find substance in the contention of ld. Counsel that the ld. Tax authorities have not given any reason to controvert the submissions of the assessee except to make some general observations, based on assumptions and presumptions. There is substance in the contention that ld. Tax authorities have not appreciated the proposition that the shareholders of a company do not at all have any right in the income of the company but their right in the income of the company is only limited to the extent of the dividend or payouts given by the company to its shareholders as per the law.

23. In aforesaid context, the reliance of the ld. Counsel of the appellants/assessee on the decision of the Coordinate Bench, ITAT Jaipur in the case of Krishna Das Agarwal v. DDIT/ADIT(Inv.) (Jaipur – Trib.), is quite relevant and seems to be squarely applicable where the coordinate bench has held as follows:-

“34. We have carefully considered the rival contentions and perused the material placed on record and the orders of the lower authorities as well as the several judicial precedents relied upon before us. From the record, we noticed that the assessee is an Individual and is engaged in the business of manufacturing and trading of master batch, polymers etc. and for the assessment year under consideration, return of income under section 139(1) of the I.T. Act, 1961 was filed by the assessee for the assessment year 2019-20 on 23-8-2019 declaring total income of Rs. 1,20,17,790/-. As per the revenue, the credible intelligence was received in the month of May, 2018 that the assessee had interests in financial assets held outside India, and also that he is signatory in financial assets held by him outside India. On verification of record, it was seen that the assessee had filed his Indian Income-tax Return u/s 139(1) for the A.Y. 2016-17 and A.Y. 2017-18 in which the assessee had categorically stated that he did not hold, as beneficiary or otherwise, any asset (including financial interest in any entity) located outside India, and also that he did not have signing authority in any account located outside India.

……

38.1 The ld. AR of the assessee further relying on the definition given in the Income-tax Act, 1961 and for all purposes of the assessment, a company is treated to be a separate ‘person’ within the meaning of section 2(31) read with 2(17) of the Income-tax Act. In the case of assessee, company invested its own money and resources in the UAE to earn dividends, interest, gains, which cannot be taxed in the hands of the assessee in any manner. The taxability thereof in the hands of the assessee is not in consonance with the Black Money (Undisclosed Foreign Income and Asset) & Imposition of Tax Act, 2015. More so when, there is no iota of evidence that any funds belonged to and/or pertained to the assessee in his individual capacity. Nor is there any evidence to show that any income of the assessee was taken abroad, or earned in his individual name and was omitted to be taxed in India. Therefore, the taxability of any amount in the hands of the assessee will be unconstitutional as without bringing any evidence so as to prove that the assessee has directly, or indirectly earned any income. In the search, revenue has not found any material in digital or in a seized material which suggest that there is an income accrued or arise to the assessee in his individual capacity. He also submitted that the comparison in the present case, is that of a non-resident foreign company and not an Indian company. The said vital fact has been accepted and never been disputed by the Ld. AO in the Assessment Order dated 31-3-2021 and/or in the Remand Report dated 13-7-2022. He has further submitted that the Place of Effective Management (POEM) of the said foreign company is also situated outside India because of which, the company is a non-resident in India within the meaning of section 6 of the income tax act and none of the assets were liable to be taxed in India [Reliance was made to the CBDT circular dated 23-2-2017 bearing Circular No. 08/2017]. Based on these clarifications by Board that in no view of the manner can taxability arise in the present case even on POEM and that the entire edifice of the case is wholly unjust and illegal.

……

38.3

The ld. A/R argued that the concept of a separate legal entity has been a time old principle, which rather forms the backbone of legal jurisprudence. For ready reference reliance is placed on the following judicial precedents as under: MRS. BACHA F. GUZDAR v.

CIT (1955) 27 ITR 0001 (SC) Agricultural income—Dividend from tea companies— Assessee, a shareholder in a company engaged in manufacture of tea whose income was exempt to the extent of 60 per cent, receiving dividends from such company—Dividends arose to the shareholder due to investment in the company—Shareholder

has no direct relationship with land as the same belongs only to the company, nor to its shareholders, nor directors BHARAT HARI SINGHANIA v.

CWT (SC) Held : Wealth being assessed is that of the shareholder and not of the company. The company may own agricultural assets and if company were to be liable to wealth tax, the said assets may be excludible in its hands. But that has no relevance to the case of a shareholder. The shareholder does not own and cannot claim any portion of the property held by the company of which he is a shareholder. The company is an independent juristic entity. An assessee holding shares in a company whose assets comprise wholly or partly of agricultural land, is not entitled to exclude such shares from his wealth.—Bacha

F. Guzdar v.

CIT (1955) 27 ITR 1 (SC) : 1955 (1) SCR 876

SALOMON v.

SALOMON & CO. LTD. (1897) Mr. Salomon had a boot manufacturing business which he decided to incorporate into a private limited company. He sold his business to the newly formed company, A Salomon & Co Ltd, and took his payment by shares and a debenture or debt of £10,000. Mr Salomon owned 20,000 £1 shares, and his wife and five children owned one share each. Some years later the company went into liquidation, and Mr. Salomon claimed to be entitled to be paid first as a secured debenture holder. The liquidator and the other creditors objected to this, claiming that it was unfair for the person who formed and ran the company to get paid first. However, the House of Lords held that the company was a different legal person from the shareholders, and thus Mr Salomon, as a shareholder and creditor, was totally separate in law from the company A Salomon & Co Ltd. The result was that Mr Salomon was entitled to be repaid the debt as the first secured creditor. In this case, Mr Salomon was the major shareholder, a director, an employee and a creditor of the company he created. It is quite common in Ireland for one person to have such a variety of roles and still be a different legal entity from the company.

LEE v. LEE’S AIR FARMING LTD. (1961)

In this case, Mr. Lee formed his crop spraying business into a limited company in which he was director, shareholder and employee. When he was killed in a flying accident, his widow sought social welfare compensation from the State, arguing that Mr. Lee was a workman under the law. The State argued that Mr. Lee was self-employed and thus not covered by the legislation. The court held that Mr. Lee and the company he had formed were separate entities, and it was possible for Mr. Lee to be employed by Lee’s Air Farming.

STATE TRADING CORPORATION OF INDIA LTD. AIR (1963) SC 1811

It was held that as soon as citizens form a company, the rights guaranteed to them by article 19(1)c has been exercised and no restraint has been placed on the right and no infringement of that right is made. Once a company or corporation is formed, the business which is carried on by the such company or corporation is the business of that company or corporation and is not the business of the citizens who get the company or corporation incorporated and the rights of the incorporated body must be judged on that footing and cannot be judged on the assumption that they are the rights attributed to the business of individual citizens.

38.8 Therefore, considering the facts and circumstances discussed above and various evidences produced by the assessee and respectfully following the case laws cited by the assessee, we are of the view that the nonresident foreign company M/s. Agrasen Polymers FZE based at UAE is a separate legal entity and all the funds/investments etc. belong to the company and no tax liability can be fastened on the assessee. Thus, we allow this ground No.9 of the assessee. GROUND NO. 14 – THE ASSESSEE MADE DUE DISCLOSURES AS ALLOWABLE IN LAW, THAT TOO PRIOR TO THE ISSUANCE OF NOTICES UNDER THE BLACK MONEY (UFIA) & IMPOSITION OF TAX ACT, 2015, PROVING THAT THE ENTIRE CASE IS BASED ON A PRE-CONCEIVED NOTION.”

24. Then we find that the AO has categorically mentioned in para 5.2 page 10 of the assessment order for the AY 2011-12 that in the statement of the assessee, Mr Pradeep Wig recorded by the department on 02/12/2015 i.e. much before the date of search on 02/03/2017, questions were put to him regarding ownership of the Flat nos. 53 and 63, Eaton House, UK and to which as is mentioned in the assessment order, the assessee categorically replied that these properties were owned by CCL, a BVI company and the assessee and nor any of his family members including his wife had any ownership interest in the Flat nos. 53 and 63, Eaton House, UK. Thus, this fact was already in the knowledge of the revenue and as admitted by the AO did not surface during the search on the assessee. It appears that faced with this situation, the AO had made up his mind to assess the appellants/assessee in respect of the properties owned by the companies CCL and EEL by piercing the corporate veil in any case, as the AO observed in the assessment order “to pierce the corporate veil, the seized data has been analysed and the following events / materials are crucial for lifting of corporate veil which range from incorporation of the company to day-to-day affairs of the assets of the company.”

25. Coming to the observations of the AO in para 5.2(a) page 10 of the assessment order for the AY 2011-12 that invoice raised by Banc Alliance for incorporation of Carmichael Capital Ltd was in the name of the assessee, we are inclined to accept the plea raised by the ld. counsel of the assessee that a company is always got incorporated by its promoter only and same has to pay for the cost of incorporation and therefore, the invoice cannot on its own put a burden of assessee to show what was real intention of incorporation of the company. We find substance, in the plea that it is not the case of the revenue that the consideration for the said invoice was paid from some unknown sources as no addition has been made for the same. Thus this by itself cannot be a reason to lift the corporate veil where intention of tax evasion must be proved.

26. Then we find that the authorities below relied on some calendar events found in the mobile of the assessee as elaborated from page 10 to 13 of the said assessment order which do not show any financial transactions much less not recorded in the books of account. Now where the assessee is an old person above 70 years of age at that time and the share in company are held by his wife and daughters, any such record about the maintenance of the property cannot be a reason to lift the corporate veil of the company, on basis of alleged tax evasion.

27. We are of the considered view that there was no basis for lifting of corporate veil by the Assessing officer as there is no allegation of introduction of any tainted money through any of the transaction unearthed during the search. Merely because it is a case of closely held company and shares, there cannot be any presumption that company is shell or bogus entity. Hon’ble Gujrat High Court in the case of Ajay Surendra Patel v. Dy. CIT ITR 321 (Gujarat), while examining the issue of piercing of veil for imposing tax liability has extensively examined the issue as to under what circumstances piercing the corporate veil in tax matter is permissible and it will be beneficial to reproduce certain parts from para 15 to 18 herein below;

“15. The concept of lift or piercing of corporate veil, as sometimes referred to as cracking the corporate shell, is applied by the Courts sparingly. However, it is recognized that boundaries of such principle have not yet been defined and areas where such principle may have to be applied may expand. However, principally, the concept of corporate body being an independent entity enjoying existence independent of its directors, is a well known principle. However, with ever developing world and expanding economic complexities, the Courts have refused to limit the scope and parameters or areas where corporate veil may have to be lifted. Two situations where such principle is consistently applied are one, where the Statute itself so permits and second, where due to glaring facts established on record, it is found that a complex web has been created only with a view to defraud the revenue interest of the State and if it is found that incorporation of an entity is only to create a smoke screen to defraud the revenue and shield the individual who behind the corporate veil is the real operator of the company and beneficiary of the fraud, the Courts cannot hesitate in ignoring the corporate status and strike at a real beneficiary of such complex design. The background of present fact is such that we are not hesitant in any way to apply this principle and are also in conformity with the decision of revenue in applying such a principle and pass a justified order.

16. A further proposition of law is also not possible to be ignored by the Court is that even in case of Tata Engineering & Locomotive Co. Ltd. as also in Life Insurance Corporation V/s. Hari Das Mundhra, reported in 1962 LawSuit (All) 30 as well as in PNB Finance Ltd. V/s. Shital Prasad Jain, reported in 1983 54 Company Cases 66 (Delhi), it has been held by all the Courts consistently that in a given case the Court may lift the corporate veil of a company where it appears that the company was formed only for some fraudulent purpose and to defraud the creditors or to avoid legal obligations. Now in the context of this proposition, if we look at and correlate the clauses contained in Memorandum of Association as well as Articles of Association and correspondingly, to the stand taken by the department, it appears that the company is engaged in altogether other business than the main object for which the company was set up and therefore, in view of settled position of law, if the company has travelled beyond the scope of the object of Memorandum of Association then such transaction has no legal sanctity and can be said to be void and therefore, this improper conduction of business de-hors the main object tantamount to be improper conduct of the company and for that very purpose, it is always open for the Court as well as for the authority to lift the corporate veil.

17. Similarly, the corporate veil can be lifted if it is found that the company is acting as an agent of shareholders though it has got legal entity. In a well known case of Re F.G.Filims Ltd., a British company which was formed with 90% of shares held by American director. The said British company and an American company arranged to produce a films in the name of the British company. The Board of Trade of Great Britain refused to register the firm as British firm by upholding that English company acted as the nominee or agent of the American company and this has taken place upon lifting of corporate veil. Therefore, this is also relevant case law for the subject on hand as the petitioner upon induction has brought share capital to the extent of 98.33% and the certificate of commencement of business was obtained after induction of the petitioner. Therefore, practically the company was to be used as lever to transact a business which is de-hors the Memorandum of Association. Therefore, these are the relevant circumstances in which it can safely be stated that authority has rightly exercised statutory powers to lift the corporate veil to examine behind it and fix the liability for protection of revenue of the department.

18. There is another well known principle which indicates that corporate veil can be lifted if the act of the company found to be ultra vires and as stated above, the Memorandum of Association is the yardstick for which only the company is incorporated or formulated and therefore, any act dehors the object stipulated in Memorandum of Association can be said to be ultra vires and for that purpose, the directors of the company shall be personally liable for all such acts which are beyond the scope for which the company was set up. The corporate veil under the circumstance necessarily to be pierced and the members cannot be allowed to take shelter behind the corporate veil of the company. This proposition is fortified by a decision of the Supreme Court in case of Dr. A. Lakshmanaswami Mudaliar & Ors. v. Life Insurance Corporation of India & Anr. , reported in AIR 1963 SC 1185.”

28. None of the situations as canvassed in the aforesaid judgment of Hon’ble Gujarat High Court are present or alleged in the present case. Though ld. CIT(A) has held calendar information to be ‘incriminating material’ but devoid of any transactions details, it is not justified to make it basis of piercing the corporate veil on basis of alleged tax evasion by use of a shell company. Rather such arrangements to hold shares in company instead of holding share in property are common due to easy liquidity and even for the purpose of saving stamp duty on transfers or any form of statutory liability. But that in itself cannot be basis to presume arrangement to avoid income tax payable in India.

29. Here itself the nature of Annual Tax on Enveloped Dwellings (ATED), which is an annual charge on UK dwellings held by a Non-Natural Person (NNP) e.g. a company, needs to be examined as the same has many facets effecting this issue. The Annual Tax on Enveloped Dwellings was introduced in UK to tax the ownership of high-value residential property in vehicles that allow the property to be sold free of stamp duty. Effectively, it makes it less attractive for companies to hold high-value UK residential properties. There are some genuine reasons why a ‘non-natural person’ may own a residential property other than tax avoidance and exemptions do exist. The ATED applies to properties over a specific value unless a relief is claimed. It does not apply to individuals. Most residential properties (dwellings) are owned directly by individuals. But in some cases, a dwelling may be owned by a company (or other collective investment vehicle). In these circumstances, the dwelling is said to be ‘enveloped’ because the ownership sits within a corporate ‘wrapper’ or ‘envelope’. ATED will not apply where an individual alone, or with other individuals, owns a residential property. A property is an enveloped dwelling for ATED purposes if it is used or can be used as a residence (for example, a house or flat) and owned by a ‘nonnatural person’ (NNP). A non-natural person is a corporate entity, such as a company, limited liability partnership, trust or investment scheme. To be classed as a dwelling, the property must be:

| • | | Used exclusively or in part as a residence |

| • | | In the process of being adapted or constructed as a residence |

If the property has partial residential use, the ATED only applies to the value of that part of the property. For example, a self-contained flat within a mixed-use property would be a separate dwelling for ATED purposes, as would any garden or grounds it includes. Some properties that qualify as dwellings are eligible for ATED relief. A dwelling may be eligible for relief if it is used in a property rental, property development or property trading business and it is, at no point, occupied by anyone connected with the company; (Source; https://taxsummaries.pwc.com/united-kingdom/corporate/other-taxes)

30. Thus ATED being applicable and paid in respect of these properties goes to establish that under the UK law, holding of such dwellings by companies is legal and tax compliant way of holding asset. This completely discards the scope of piercing the veil and to hold that infact these properties were owned by assessee and not by CCL.

31. This also becomes relevant to examine the issue if assessee/appellants had ‘beneficial interest’ or that they were ‘beneficiary’, for the purpose of creating a tax incidence on the assessee as share holders of the companies liable to ATED. In this context we find that the relevant provisions of the Income-tax Act 1961 and Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 are interwoven in respect of any foreign asset and income of a resident person in India. Any amount of foreign asset or income which has not been disclosed in the Income-tax returns in India is subject to imposition of tax and penalties under the BMA w.e.f. AY 2016-17 where this liability arises even in respect of the income and assets pertaining to the earlier periods which were not disclosed earlier and also in the window granted by the Government of India to the resident assessees to avail the immunity from the penal provisions under the BMA at the time of its implementation in the year 2015. Therefore, the relevant provisions introduced under Act to synchronize applicability of the provisions of the Income-tax Act and the BMA w.e.f. AY 2016-17 needs to be appreciated for adjudication of the issue further. We find that definition of ‘beneficial interest’ and ‘beneficiary’ used for assessment of undisclosed foreign income and assets has not been given under the BMA and for the purpose of assessment under the BMA, the same has to be imported from the definition given under the Income-tax Act. The same has been given in the Fourth proviso u/s 139(1) of the Act inserted by the Finance Act, 2015 w.e.f. A.Y. 2016-17 as below:

“Provided also that a person, being a resident other than not ordinarily resident in India within the meaning of clause (6) of section 6, who is not required to furnish a return under this sub-section and who at any time during the previous year, –

| (a) | | holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has signing authority in any account located outside India; or |

| (b) | | is a beneficiary of any asset (including any financial interest in ar4ny entity) located outside India, shall furnish, on or before the due date, a return in respect of his income or loss for the previous year in such form and verified in such manner and setting forth such other particulars as may be prescribed:” |

31.1 It can be further seen that before the said insertion, the said 4th proviso inserted by the Finance Act, 2012 w.e.f. A.Y. 2012-13 was as below:

“Provided also that a person, being a resident other than not ordinarily resident in India within the meaning of clause (6) of section 6, who is not required to furnish a return under this sub-section and who during the previous year has any asset (including any financial interest in any entity) located outside India or signing authority in any account located outside India, shall furnish, on or before the due date, a return in respect of his income or loss for the previous year in such form and verified in such manner and setting forth such other particulars as may be prescribed:”

31.2 Further to make the said proviso applicable, Explanations 4 and 5 in the sub-section (1) also inserted w.e.f. A.Y. 2016-17 by the Finance Act, 2015 are as below:

“Explanation 4 – For the purposes of this section “beneficial owner” in respect of an asset means an individual who has provided, directly or indirectly, consideration for the asset for the immediate or future benefit, direct or indirect, of himself or any other person.

Explanation 5 – For the purposes of this section “beneficiary” in respect of an asset means an individual who derives benefit from the asset during the previous year and the consideration for such asset has been provided by any person other than such beneficiary.

31.3 Thus, it is clear that the words “beneficial” and “beneficiary” were not there in the definition earlier and were introduced w.e.f. 01/04/2016 only.

31.4 Now for the purpose of issues the relevant state of law including about the beneficial holding u/s 4 of the BMA are reproduced below;

Scope of total undisclosed foreign income and asset.

4. (1) Subject to the provisions of this Act, the total undisclosedforeign income and asset of any previous year of an assessee shall be,-

| (a) | | the income from a source located outside India, which has not been disclosed in the return of income furnished within the time specified in Explanation 2 to sub-section (1) or under sub-section (4) or sub-section (5) of section 139 of the Income-tax Act; |

| (b) | | the income, from a source located outside India, in respect of which a return is required to be furnished under section 139 of the Income-tax Act but no return of income has been furnished within the time specified in Explanation 2 to sub-section (1) or under sub-section (4) or sub-section (5) of section 139 of the said Act; and |

| (c) | | the value of an undisclosed asset located outside India. |

(2) Notwithstanding anything contained in sub-section (1), any variation made in the income from a source outside India in the assessment or reassessment of the total income of any previous year, of the assessee under the Income-tax Act in accordance with the provisions of section 29 to section 43C or section 57 to section 59 or section 92C of the said Act shall not be included in the total undisclosed foreign income.

(3) The income included in the total undisclosed foreign income and asset under this Act shall not form part of the total income under the Income-tax Act.

32. Thus, the income from the overseas sources in terms of the clauses (a) and (b) u/s 4(1) of the BMA has to be understood with reference to the provisions under section 139 of the Income-tax Act.

33. Section 2(15) of the BMA specifies that all other words and expressions used in the BMA if not defined in the BMA, shall have the meaning as assigned to those words in the Income-tax Act, 1961.

34. Undisclosed assets located outside India has been defined u/s 2(11) of the BMA as below:

“undisclosed asset located outside India” means an asset (including financial interest in any entity) located outside India, held by the assessee in his name or in respect of which he is a beneficial owner, and he has no explanation about the source of investment in such asset or the explanation given by him is in the opinion of the Assessing Officer unsatisfactory;

35. Undisclosed foreign income and asset as per the BMA has been defined u/s 2(12) as below:

“undisclosed foreign income and asset” means the total amount of undisclosed income of an assessee from a source located outside India and the value of an undisclosed asset located outside India, referred to in section 4, and computed in the manner laid down in section 5;

36. Further, computation of the total undisclosed foreign income and asset has been defined u/s 5 of the BMA as below:

5. (1) In computing the total undisclosed foreign income and asset of any previous year of an assessee,-

| (i) | | no deduction in respect of any expenditure or allowance or set off of any loss shall be allowed to the assessee, whether or not it is allowable in accordance with the provisions of the Income-tax Act; |

| (a) | | which has been assessed to tax for any assessment year under the Income-tax Act prior to the assessment year to which this Act applies; or |

| (b) | | which is assessable or has been assessed to tax for any assessment year under this Act |

shall be reduced from the value of the undisclosed asset located outside India, if, the assessee furnishes evidence to the satisfaction of the Assessing Officer that the asset has been acquired from the income which has been assessed or is assessable, as the case may be, to tax.

(2) The amount of deduction referred to in clause(ii) of sub-section (1) in case of an immovable property shall be amount which bears to the value of the asset as on the first day of financial year in which it comes to the notice of the Assessing Officer, the same proportion as the assessable or assessed foreign income bears to the total cost of the asset.

37. Therefore, what can be concluded is that any income included u/s 5(1) of the BMA shall be reduced from the value of undisclosed asset located outside India if the said assets have been acquired from the income which has been assessed or is assessable as the case may be to tax in India under the Income-tax Act 1961. Thus, for the purpose of excluding such asset from the rigors of the BMA is that the assessee proves the source of acquisition the foreign asset from a tax paid money. Ld. Counsel has submitted that the said section does not refer at all to the tax paid money in India and if the said income was assessed overseas, the benefit of exclusion would be very much available.

38. These provisions when considered in the light of fact of properties being subject to ATED make us hold firmly that while examining the factor of ‘beneficial interest’ or ‘beneficiary’ for the purpose of the Act or BMA, what should be material is how the country where the impugned property is located abroad, treats the property or interests in such property for the purpose of estate and taxation. Thus where the law of UK levies Annual Tax on Enveloped Dwellings (ATED), as an annual charge on UK dwellings held by a Non-Natural Person (NNP) e.g. a company and admittedly such levy was paid for the impugned properties by CCL then, there was no legal sanctity with the Indian authorities to hold that assessee had any beneficial interest or were beneficiary for the purposes of aforesaid provision under the Act or BMA. There is no presumption against the assessee which assessee is supposed to rebut by virtue of being a share holder in a company to allege that property held by a company is giving some advantage, profit, or privilege exclusively to the assessee but the revenue is supposed to establish the beneficial interest of an assessee or assessee being beneficiary by some sort of direct evidences of the advantage, profit, or privilege derived by the assessee from something, often a contract or agreement. Rather it appears that failing to find any incriminating material from books or accounts the AO went to resorting to piercing the veil of company and draw inference of beneficial interest of assessee or assessee being beneficiary.

39. Further, the definition of beneficial owner introduced by the legislature w.e.f. AY 2016-17 has a different specific connotation and expresses the intention of Legislature unambiguously. In terms of the said definition, the assessee can be said to be the beneficial owner of the shares in CCL as he paid for the same and not of the assets of CCL. The assessee could be held to be beneficiary of any asset if the same was acquired for the benefit of the assessee out of funds remitted by some other person. However here, the assessee was the registered shareholder of the company and acquired those shares by remitting his own declared sources money through the permitted LRS form India since the year 2005 till 2016, as has been admitted by the AO also as for which no addition has been made under the Income-tax Act as well as the BMA. It is also undisputed legal position that the share capital of any company is its own money and which was used by the UK company to acquire properties there in its own name. It is also a settled legal position that the amounts received in its share capital by a company is irreversible during the existence of the company, and it remains its own money. The shareholder loses all his right over the money invested in the share capital of the company and also on all the assets which the company acquires by using the said share capital amount. The shareholder of the company is only entitled to receive dividends as and when the company declares or on the winding up of the company to the residual value as may be portioned to the shareholder by the liquidator. In both the situations, the shareholders do not have any right over the assets of the company in any manner whether direct or beneficial. Ownership of the shares in and ownership of the assets of the company are two different connotations and are not synonymous at all. Assets are owned by the company and shares are held by the shareholders that too, only to the extent of the percentage, a shareholder holds in the total equity share capital of the company. On the contrary, the ownership of the assets owned by the company is indivisible and the entire assets are held and owned by the company. No shareholder has a right to claim any part of the sale proceeds of the assets of the company nor has any right at all in any legal manner to seek its division or alienation or appropriation in his favour. A shareholder has only a right to sell his shareholding to another person but has no right to sell the assets of the company which only the company can sell. Therefore, there is no access on the assets of the company to any shareholder.

39A Then the AO has also mentioned in para 5.2.1 on the page nos. 13-14 of the assessment order that information received from Barclays Bank Singapore in respect of the bank account no. 913748000 of CCL reveals that Ultimate Beneficial Owners of CCL were Mr Pradeep Wig, Ms. Neera Wig and Ms. Sonu Wig. In response to the same the ld. counsel has stated that the concept of Ultimate Beneficial Owners (UBO) is not parallel to holding assets beneficially as mentioned in the definition given u/s 139(1) of the Act. We are of considered view that this itself distinguishes the two entities altogether as in respect of a company, the Ultimate Beneficial Owners of the said company are its shareholders only but that by itself does not lead to the conclusion that the shareholders are also the Ultimate Beneficial Owner of the assets of the company. The beneficial interest of assessee as shareholder of a company is not synonymous to beneficial interest in the assets of the company, which the AO has considered, to pierce the veil.

40. The ld. Counsel, has pointed out that in the next para on page nos. 13-14 of the assessment order, the AO has alleged that in the application filed for online banking dated 08/03/2013, the assessee and his daughter Ms Sonu Wig have been shown as first and second user with their email ids. However, in response to which the learned counsel of the assessee stated that this averment is incorrect because they were not the users but only had a viewing right with no authority to operate as per certificate from the bank filed before the lower authorities also placed at PB page no. 238 which categorically stated “To clarify your below request; the Authorised Signatories have completed the online banking for PW and SW to have view access only.”

41. Then the ld. Counsel for the assessee submits that even otherwise the income from the said properties could not be assessed at all in India because of the Article 6 of the DTAA with the UK and same is mentioned in para 6 on the page no. 15 of the assessment order and para 4.4.23 on the page 78 of the CIT(A)’s order and reproduced here in below:

“1. Income from immovable property may be taxed in the Contracting State in which such property is situated. “

42. Thus, on a plain reading of the above, it is clear the said clause is not at all a person based but is only the property based. No interpretation of the same vis a vis the person (assessee) can be drawn by relying on the said Article as such. It only refers to the income from a property where to be assessed, not in whose hands. However, the revenue has considered the word used “may” be assessed in the said DTAA as may be assessed in the country of residence other than the country where the property held as against the specific mandate of the DTAA by relying on the circular no. 91/2008 dated 28/08/2008 of the CBDT as below:-

“SECTION 90 OF THE INCOME TAX ACT, 1961 – DOUBLE TAXATION RELIEF – AGREEMENT WITH FOREIGN COUNTRIES – NOTIFIED AGREEMENT Notification No. 91/2008, Dated 28-8-2008 In exercise of the powers conferred by sub-section (3) of section 90 of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby notifies that where an agreement entered into by the Central Government with the Government of any country outside India for granting relief of tax or as the case may be, avoidance of double taxation, provides that any income of a resident of India “may be taxed” in the other country, such income shall be included in his total income chargeable to tax in India in accordance with the provisions of the Income-tax Act, 1961 (43 of 1961), and relief shall be granted in accordance with the method for elimination or avoidance of double taxation provided in such agreement.

43. To challenge the said action, the assessee relies on the decision of the Coordinate Bench in the case of Natasha Chopra v. Dy. CIT ITD 185 (Delhi – Trib.)/ITA No. 6121-6122/Del/2018 dated 30/06/2022 where the facts were identical as of the assessee as therein also the property was held in UK. The said decision holds as below:

“9. Thus, we find that in the absence of an express provision, the right of the resident country to tax its residents cannot be taken away under the DTAA. Therefore, the expression “may be taxed” cannot be construed to mean “shall be taxable only in the resident state”, unless it is expressly stated. Provisions of section 90(1)(a)(i) is clearly applicable to the facts of the case.”

44. Then we find that the ld. tax authorities below have considered the appellants/assessee as beneficial owners of those properties and while assessing the deemed income in their hands. Now, as per our understanding, the deemed income, if any, could only be assessed in the case of a registered owner of the property which was the company and not in the hands of the shareholders under the deeming provisions. To become an owner of a property, a person must hold the legal title of the property in his name. He should be able to exercise the rights of the owner, not on behalf of the owner but in his own right. The deeming ownership provision u/s 27 of the Act specifically refer to category of persons to whom deemed rental income can be attributed and by piercing corporate veil deeming ownership could not have been alleged. A deeming income provision needs strict application and by way of adverse presumption or principle of piercing of veil the property of company cannot be held to be lying with the share holders or directors, so as to add income in their hands. If the registered owner does not exploit its property, then it is its choice and not of the beneficial owner. In this context reliance can be placed on the following decisions:-

| (i) | | R.B. Jodha Mal Kuthiala v. Commissioner of Income-tax |

| (ii) | | CIT v. Poddar Cement (P.) Ltd |

| (iii) | | New Cotton and Wool Pressing Factory v. CIT |

45. It can be further seen that the entire information about the investment in the overseas companies holding of properties by the overseas company in UK, purchased from its own capital received from the assessee and his family and bank loan borrowed from the HSBC Bank in UK and other relevant factors were well-known to the Revenue much before the date of search on 02/03/2017 as the statements u/s 131(1A) of the Act of the assessee and his family members were recorded by the Investigation Unit besides even prosecution notice dated 27/10/2015 had been issued by the Revenue alleging non-disclosure of the same in the returns. Thus actually no information at all was found during the course of search as to substantiate any addition in respect of the said information by relying on Pr. CIT v. Abhisar Buildwell (P.) Ltd. ITR 212 (SC) dated 24/04/2023. The evidence relied by the Revenue by way of date sheet does not show the calendar events as mentioned in the assessment order do not contain any incriminating information to sustain additions because the calendar events just explain as to what the assessee did there or wished to be done there with no financial implications corroborated from any material found otherwise in search or post search enquiry. We find no substance in drawing a inference of incriminating material for the reasons assessee family was living for a few days in the property of the company. Rather the ATED paid by the company is only for the reasons of keeping the dwelling vacant. Thus, in no manner the same can be considered as incriminating so as to initiate action against the directions of the Hon’ble Supreme Court in the case of Abhisar Buildwell (P.) Ltd. (supra).

46. There is substance also in the contention of appellants/assessee that the Revenue did not find any single amount having being invested in those companies by anyone from undisclosed sources much less by the appellants/assessee. Thus, there was no purpose to impugn that the company was incorporated with an intention to avoid assessment of income of the properties overseas in the hands of the appellants/assessee. At the same time there is substance in the contention that the allegation of the Revenue, that the company was incorporated only for the purpose of acquiring the properties in UK falls on the face of it as the company CCL was incorporated on 9th March, 2005 whereas the first property was acquired in London by the said company on 14/02/2008 and both the properties had been sold on 04/08/2014 before even conceptualization of the BMA or the beneficial ownership provisions in the Income-tax Act w.e.f. AY 2016-17. Thus, the Revenue has no case to make any such allegation as at the time of incorporation of the company or acquiring the properties the concept of beneficial holders under the Income-tax Act was absolutely absent rather not concealed of.

47. Then we find that the 3 daughters of the assessee were majors and those shares were registered in their own names only with no beneficial interest of anyone else. No evidence has been brought on record by the AO that the daughters ever tried to exit from their respective interest in their shareholdings in favour of the assessee. It is also seen that Ms. Sonu Wig, one of the daughters of the assessee was an NRI rather became British citizen, holding a British passport since the year 2013 and was residing in the said property overseas off and on. That only shows natural course of events and nothing incriminating.

48. We are thus inclined to hold that the assessee/appellants were not the beneficial owner of any property or asset of CCL and therefore neither any income arising from the property of the said company as rent nor as capital gains and also the bank interest nor any other income of the company form any source, was assessable in the hands of the assessee or any family member who had never had any beneficial ownership or holding any beneficial interest in the assets of the company. Thus, the action of the both the authorities in considering the assessee Mr. Neeraj Wig and his spouse as the beneficial owners in equal proportions of the assets of the BVI company CCL and then assessing all income from those assets of the said company from any source is illegal ab initio and is quashed in toto. All the amounts, assessed as income under the two respective Acts from any source or under any head, allegedly germinating from any of the properties / bank accounts of and from the company are deleted in the hands of the assessee and his spouse as they are held to be not the beneficial owner of the assets of the company CCL at all. In conclusion, this issue no. 1 is decided in favour of appellants/assessee and all the grounds of appeal of the assessee in this regard are allowed and all the grounds of appeal of the Department in this regard are dismissed.

49. The second issue is specific in the case of Ms Neera Wig for AY 2012-13, the grounds of appeal No.12 to 15 read as under:-

“12. Without prejudice to the above grounds, if the rental income of the said properties is to be assessed in the hands of the assessee under the Income-tax Act, then the benefit u/s 23(1)(b) of the Act i.e. one selfoccupied residential property should be allowed to the assessee who does not have any other residential property. Thus, necessary directions should be issued in this regard.

13. The CIT(A) has erred in law and on facts in confirming the addition of Rs. 43,90,240/- as income from other sources ignoring the fact that the amount received as advance for sale of the property at Green Field Colony Faridabad Haryana was refunded to the buyer and the said property was sold to another buyer without bringing any adverse evidence on record to prove otherwise and ignoring the evidence placed on record. Thus, the said addition should be deleted.

14. Without prejudice to the above ground no. 13, even if the amount was forfeited by the assessee, then only 50% of the said amount could only be considered in the hands of the assessee as she was the owner of the said plot for 50% share. Thus necessary directions should be issued in this regard.

15. Without prejudice to the above ground nos. 13 and 14, even if the amount was forfeited by the assessee, then the said amount could only be considered for the purpose of computing the cost of acquisition in the year of its actual sale as per the provisions of section 51 of the Act and could not be treated as ‘income from other sources’ in this year of receipt of advance in the absence of any such provision under the Act. Thus, the addition so made should be deleted.”

50. In respect of the addition of Rs 43,90,240/- made in the AY 2012-13 in the hands of Ms. Neera Wig by the AO claiming that the assessee failed to prove the refund of the advance of Rs 45,00,000/- received besides not able to identify the prospective buyer of the property of Plot No. BD-5, Sector-B, part of Khasra no. 88/3 in the residential colony known as Greenfields at Faridabad (Haryana) and then making an addition u/s 51 of the Act we reproduce the relevant provision below:-

“Section 51 of the Act provides that –

Where any capital asset was on any previous occasion the subject of negotiations for its transfer, any advance or other money received and retained by the assessee in respect of such negotiations shall be deducted from the cost for which the asset was acquired or the written down value or the fair market value, as the case may be, in computing the cost of acquisition.”