Budget

1. What is Budget?

Budget is an Annual financial statement of the estimated receipts and expenditure of the Government for the financial year. (1st April –31st March). It is presented by the Union Finance Minister in the parliament. Once passed by both the houses of parliament and approved by the President of India, the Budget comes into effect from 1st April.

2. What are the different Budgets presented in the Parliament?

The Union Government presents two budgets in the parliament.

a. Railway Budget: It is the annual estimates of receipts and expenditure of Indian Railways. It is presented by Ministry of Railways every year, few days before the General Budget.

b. General Budget: It is the annual estimates of receipts and expenditure of the Government of India. It also includes the effect of “Railway Budget”

3. When is the Budget Session of Parliament held?

The Budget Session of Parliament is normally held during February to May every year.

4. Why do we need Budget?

The Budget is formulated to optimally allocate the Government’s resources to different sectors and schemes, so that the broad objectives of the government could be achieved. It presents government’s proposed revenues and expenditure for the coming financial year. It also determines how adequately the financial and resource management responsibilities have been discharged in the last financial year. Budget is also a means to ensure financial accountability of the Government to the Parliament. There by maintaining legislative prerogative over taxation and expenditure.

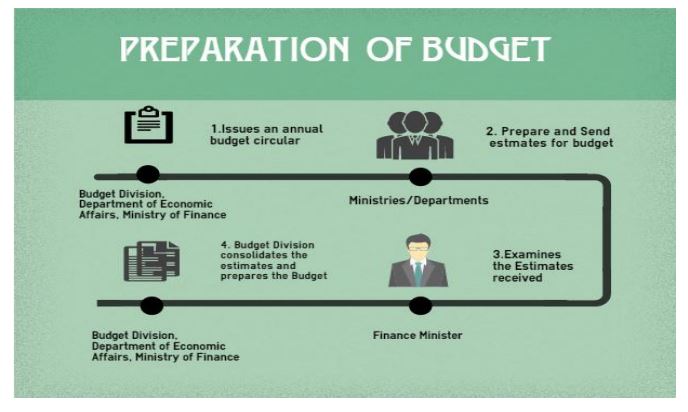

5. How is the Budget Prepared in India?

Budget is prepared by the Budget Division, Department of Economic Affairs, Ministry of Finance.

a) The budget division issues an annual budget circular to all the Union Government ministries/ departments containing guidelines on how to prepare budget estimates.

b) The Ministries/departments prepare and present their estimates for budget allocation.

c) The ministries also provide the estimates for their revenue receipts in the current financial year and next financial year to the finance ministry.

d) The finance minister then examines the proposals received from various ministries and makes necessary changes, if any. The finance minister also consults the prime minister, and briefs the Union Cabinet, about the budget.

e) The budget division then consolidates all the estimates received and prepares the budget documents.

6. When is the Budget Presented in the Lok Sabha?

According to Article 204(1) of Rules of Procedure and Conduct of Business in the Lok Sabha, the Budget is presented on the day as fixed by the President of India. Usually it is presented at 11 am on the last working day of February, about a month before the commencement of financial year. Until the year 2001, it was presented at 5 P.M, a tradition adopted from the colonial era when the British Parliament would pass the budget in the noon followed by India in the evening of the day.

7. What is the Procedure for approval of Union Budget by the Parliament?

Budget is approved by the parliament in the following way:

a) First and foremost, President’s recommendation is obtained under Article 117(1) and 117(3) for introduction and consideration of the Budget in the Lok Sabha.

b) After President’s recommendation, Budget is then laid before the Lok Sabha by the Finance Minister with the “Budget speech”.

c) It is then laid before the Rajya Sabha for discussion, but Rajya Sabha does not have the power to vote on the demands for grants.

d) The Discussion on Budget in the Lok Sabha is conducted in two stages

(i) General Discussion

This includes discussion on the broad aspects of the Budget. No voting takes place at this stage. (ii) Detailed Discussion

After the general discussion, Parliament is adjourned for a period, during which the Department Related Standing Committees examine the detailed estimates of ministries’ expenditure, called Demands for Grants. These committees then prepare the reports on each ministry’s Demands for Grants and submit them to the Lok Sabha. Then, a detailed discussion takes place in Parliament on the each Ministry’s demands for grants.

e) Following the detailed discussion, voting on demands for grants takes place.

f) After the voting, an Appropriation Bill is introduced and voted on, which authorizes the government to spend money from the Consolidated Fund of India.

g) The Finance Bill, which contains provisions for giving effect to financial proposals of Government, is then introduced immediately in the Lok Sabha. The introduction of this Bill cannot be opposed. This completes the budgetary process.

Only the Lok Sabha has the power to approve the budget; the Rajya Sabha can only propose amendments which the Lok Sabha may or may not accept.

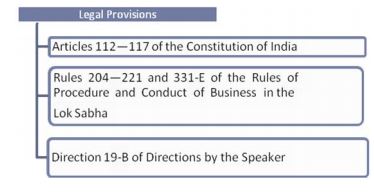

8. What are the legal provisions underlying the Budgetary process?

9. What is the significance of Department Related Standing Committees?

There are 24 Department Related Standing Committees in the parliament. These committees examine each ministry’s demands for grants and prepare a report on them. These reports are submitted to Lok sabha for detailed discussion.

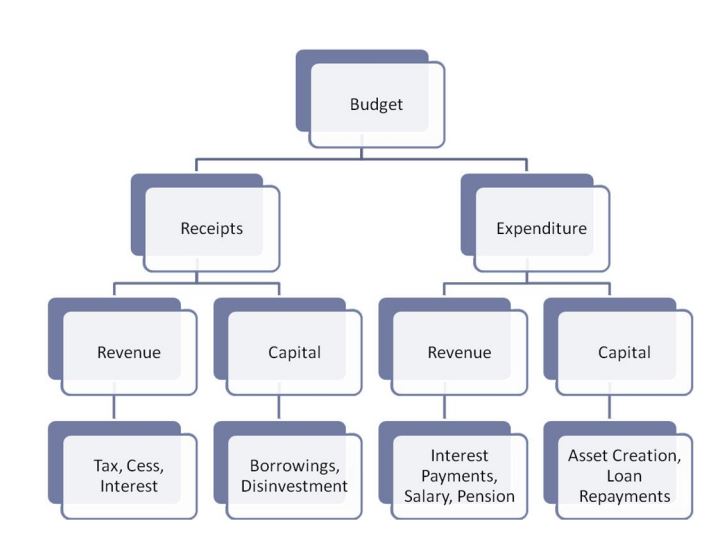

10.How are the Government receipts categorized in the budget?

Government receipts are the income receipts of the government from all the sources in a particular financial year. These are divided in to two different categories:

a) Revenue receipts: Revenue receipts are those receipts, which neither create liability nor reduce the assets of the Government. These include revenue received from taxes, cess, interest payments, dividend on investments etc. They are generally recurring in nature.

b) Capital Receipts: Capital receipts are those which either create liability or reduce the assets of the Government. These include Government borrowings, disinvestment etc.

11.How is the Government expenditure categorized in the budget?

Government expenditure is categorized in two ways:

a) Revenue Expenditure: Expenditure that does not lead to creation of any assets or any reduction in existing liabilities of the government. This includes Salary payments, Pensions, interest payments, other administrative expenditures etc. These are generally recurring in nature and deal with day-to-day administrative costs of the government.

b) Capital Expenditure: This refers to the expenditure that leads to creation of assets or reduction in liabilities of the Government. Examples include infrastructure building, acquiring assets, repayment of loans etc.

12.What are the components of the Budget?

Article 112 of the Constitution of India stipulates that Government should lay before the Parliament an Annual Financial Statement popularly referred to as ‘Budget’. The Union Budget presented to the Parliament, besides the Finance Minister’s Budget speech, consists of the following 14 documents:

1. Annual Financial Statement

2. Demands for Grants

3. Receipts Budget

4. Expenditure Budget Volume 1

5. Expenditure Budget Volume 2

6. Finance Bill

7. Appropriation Bill

8. Memorandum explaining the provisions in the Finance Bill

9. Budget at a Glance

10. Highlights of the Budget

11. Macro-economic policy framework for the relevant financial year

12. Fiscal Policy Strategy Statement for the financial year

13. Medium term Fiscal Policy Statement

14. Medium term Expenditure Framework Statement

Other Budget related documents are:

I. Detailed Demand for Grants

II. Economic Survey

III. Status of implementation of provisions in Finance Minister’s previous Budget speech.

13. What is meant by the term ‘Vote on Account’?

Since Parliament is not able to vote the entire budget before the commencement of the new financial year, the necessity to keep enough finance at the disposal of Government in order to allow it to run the administration of the country remains. A special provision is, therefore, made for “Vote on Account” by which Government obtains the Vote of Parliament for a sum sufficient to incur expenditure on various items for a part of the year.

Normally, the Vote on Account is taken for two months only. But during election year or when it is anticipated that the main Demands and Appropriation Bill will take longer time than two months, the Vote on Account may be for a period exceeding two months

14. What is ‘Guillotine’?

Parliament, unfortunately, has very limited time for scrutinising the expenditure demands of all the ministries. So, once the prescribed period for the discussion on demands for grants is over, the Speaker of Lok sabha puts all the outstanding Demands on Grants, whether discussed or not, to the Vote of the House. This device is popularly known as ‘guillotine’.

15. What is meant by “charged” expenditure on the Consolidated Fund of India?

Charged expenditure includes the emoluments of the President and the salaries and allowances of the Chairman and Deputy Chairman of Rajya Sabha and the Speaker and Deputy Speaker of Lok Sabha, Judges of Supreme Court, Comptroller and Auditor General of India and certain other items specified in the Constitution of India under Article 112(3).

Discussion in Lok Sabha on ‘charged’ expenditure is permissible but such expenditure is not voted by the House.

16. What are ‘Cut Motions’?

Motions for reduction to various Demands for Grants are made in the form of Cut Motions seeking to reduce the sums sought by Government on grounds of economy or difference of opinion on matters of policy or just in order to voice a grievance.

17. How many Budget presentations have been made in Independent India so far?

Independent India has so far seen 86 budget presentations, with the latest being 2016 budget presented by Finance Minister Arun Jaitley. The first Budget presentation of independent India was made by then Finance Minister R K Shanmukham Chetty on November 26, 1947. Of these 86 budget presentations, 69 were normal budget presentations, 13 Interim budgets and four special occasion budgetary proposals, popularly referred as Mini-budgets.

18. Can the budget be passed more than once in a year?

Yes, Budget can be passed more than once in a year. During an election year, the ruling government presents a shorter version of the General Budget, called Interim budget. This is done because a new Government will be formed after the elections, which will then prepare a Budget for the rest of the financial year.

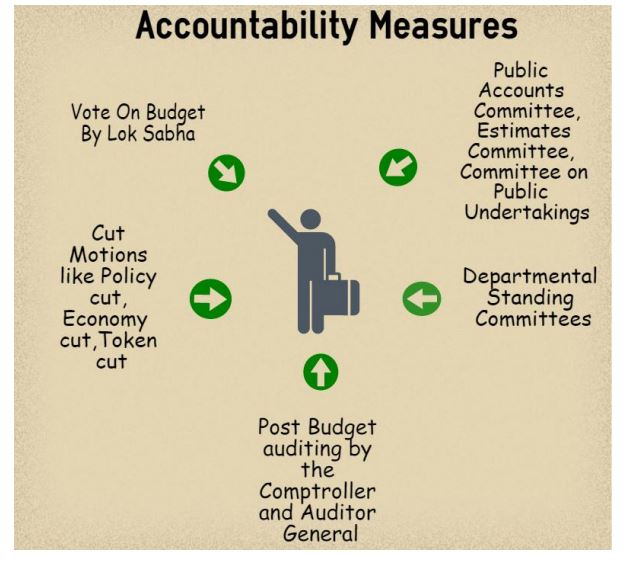

19. How does the Parliament ensure Government’s financial Accountability?

Accountability is enforced through the following mechanisms –

# Vote on Budget by the Lok Sabha.

# Through various Cut Motions like Policy Cut, Economy Cut and Token Cut.

# Through Committees:

Public Accounts Committee, Estimates Committee, Committee on Public Undertakings keep an vigil over Government spending and performance and points out inefficiencies and indiscretion in the implementation of programs and policies approved by Parliament.

# Departmental Standing Committees: They are responsible for the administration and scrutiny of budgetary proposals and Bills of Ministries/Departments.

# Post Budget auditing by Comptroller and Auditor General (CAG)

20. What are the categories of Government Account?

The Government account is categorized into the following –

Consolidated Fund of India

Contingency Fund of India

Public Account

21. What is Consolidated Fund of India?

Under Article 266(1) of the Constitution of India, Consolidated Fund of India is the most important of all government funds. All revenues raised by government, money borrowed and receipts from loans given by government flow into it. All government expenditures other than certain exceptional items met from Contingency Fund and Public Account are made from this account. No money can be appropriated from the fund except in accordance with the law.

22. What is Contingency Fund of India?

Any urgent or unforeseen expenditure is met from this fund. It is constituted under Article 267 of the Constitution of India. It is a Rs.500cr fund which is at the disposal of the President of India. Any expenditure from this fund requires subsequent approval from the Parliament and any amount withdrawn must be returned to the Contingency Fund from the Consolidated Fund of India.

23. What is Public Account?

Under provisions of Article 266(1) of the Constitution of India, Public Account is used in relation to all the fund flows where Government is acting as a banker. Examples include Provident Funds and Small Savings. This money does not belong to government but is to be returned to the depositors. The expenditure from this fund need not be approved by the Parliament.

24. What is the accounting system followed by the Government?

The Constitution of India envisages the accounts of the Union and the States to be kept in such a form as the President may prescribe on the advice of the Comptroller and Auditor General of India. The government accounts are kept on cash basis. Only actual receipts and payments during the financial year are taken into account. However, commercial units under a ministry or a department may be allowed to adopt commercial basis of accounting. Each division in Consolidated Fund and Public Accounts is divided into sectors, which may be divided into sub-sectors and then into six tiers of accounting classification. Detailed Demands for Grants presented by the Ministries to the Parliament should also adopt the same six tier numeric codification pattern.

25. What are Appropriation and Finance accounts?

The annual accounts of the Government, comprising of Union Government Finance Accounts and the Appropriation Accounts, are prepared by the Controller General of Accounts. These documents are presented before the Parliament after their statutory audit by the Comptroller and Auditor General of India.

Preparation and submission of Appropriation Accounts to the Parliament completes the cycle of budgetary process.Through Appropriation Accounts, the Parliament is informed about the expenditure incurred against the appropriations made by the Parliament in the previous financial year. All the expenditures are duly audited and excesses or savings in the expenditure are explained.

The Finance Accounts show the details of receipts and expenditures for all the three funds (the Consolidated Fund of India, the Contingency Fund of India and the Public Account) in the form of various statements including liabilities of the government such as guarantees and loans given to the States, Union Territories and Public Sector Undertakings.

26. What is FRBM act?

The Fiscal Responsibility and Budget Management Act or the FRBM Act, 2003 is an Act mandating Central Government to ensure intergenerational equity in fiscal management and long term macro-economic stability.

The Act also aims at prudential debt management consistent with fiscal sustainability through-

Limits on the Central Government borrowings, debt and deficits,

Greater transparency in fiscal operations of the Central Government

Conducting fiscal policy in a medium term framework and

Other matters connected therewith or incidental thereto

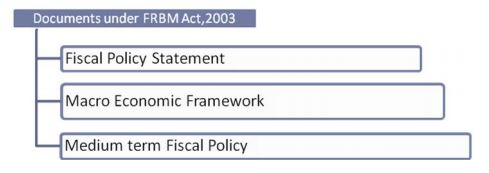

27. What documents are laid before the Parliament under the FRBM Act 2003?

28. What is Outcome Budget?

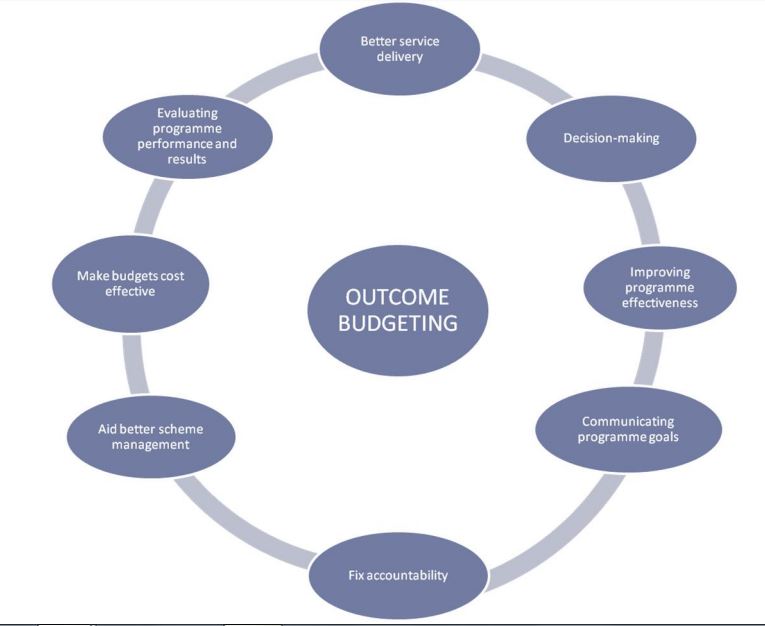

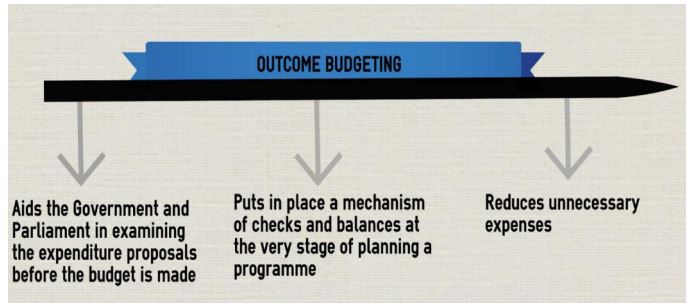

From the fiscal year 2006-07, every Ministry presents a preliminary Outcome Budget to the Finance Ministry, which is responsible for compiling them. The Outcome Budget is a progress card on what various Ministries and Departments have done with the outlays in the previous annual budget. It measures the development outcomes of all government programs and whether the money has been spent for the purpose it was sanctioned including the outcome of the fund usage.

For instance, it will tell a citizen if money allocated for building a primary health centre, has indeed come up. It is a means to develop a linkage between the money spent by a government and the results which follow. It is expected to change the mindsets of government officials to become more result oriented, instead of outlay centric. Outcome budget is a performance measurement tool as shown in below figure:

29. How does outcome budgeting help the Government?

30. How are grants and appropriations communicated and distributed during budget implementation?

31. What are the role and responsibilities of departments with respect to spending?

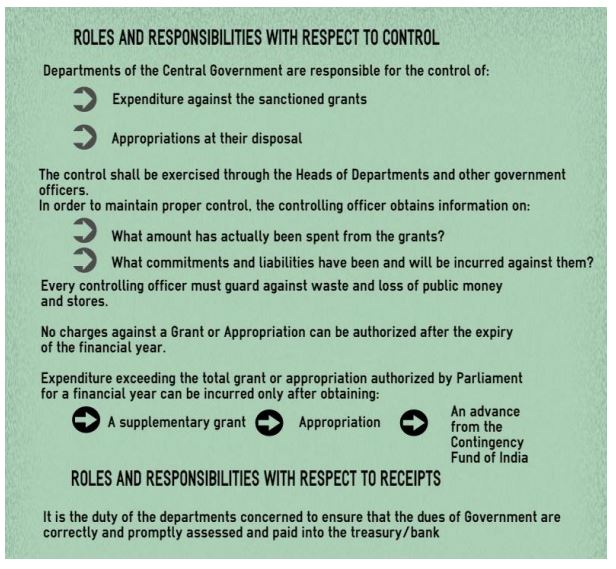

32. What are the role and responsibilities of departments with respect to control and receipts?

33. What are Re-appropriations?

Re-appropriations allow the Government to re-appropriate provisions from one sub-head to another within the same Grant. Re-appropriation provisions may be sanctioned by a competent authority at any time before the close of the financial year to which such grant or appropriation relates.

The Comptroller & Auditor General and the Public Accounts Committee reviews these re- appropriations and comments on them for taking corrective actions.

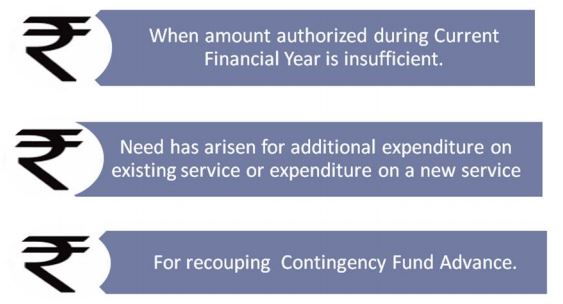

34. What are Supplementary demands for grants?

Supplementary Demands for Grants are normally presented in each session of the Parliament, in the following circumstances:

Broad guidelines, before firming up their proposals for the supplementary demands for grants are as follows:

Need for economy and rationalisation of expenditure.

A thorough review of expenditure to explore the possibility of meeting the requirements through Token or Technical supplementary.

No new schemes and programmes, except those that are part of the Budget announcements should normally be introduced during the course of the financial year.

Additional expenditure over and above the prescribed approved ceiling for individual schemes may not be ordinarily permitted.

If there is an amendment to the existing scheme leading to requirements for additional funds, Ministries/Departments should explore and locate matching savings from other schemes/projects in the Demand.

The mandatory cuts in terms of the austerity instructions should be enforced before determining the requirements for additional funds.

The proposal for Supplementary Demand should be made only when the programme/scheme for which additional provision is sought has been approved by competent authority and should be limited to the funding requirements within the relevant financial year.

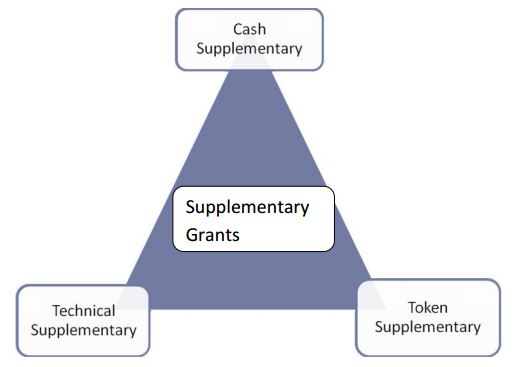

35. What are the various types of Supplementary Grants?

1. CASH SUPPLEMENTARY: This supplementary is over and above the original budget provisions and results in enhancement of the allocation for the Demand/Grant. Cash Supplementary impacts the fiscal/revenue deficit. Cash supplementary should be obtained as a last resort and after proper due diligence. Cash supplementary is required to have specific approval of Secretary (Expenditure).

2. TECHNICAL SUPPLEMENTARY: There are 4 Sections in each Demand viz., Revenue- Voted, Revenue-Charged, Capital-Voted and Capital-Charged. When there is a saving in one of the Sections and the same is proposed to be utilized for another scheme under a different section, it can be done after obtaining approval of Parliament through ‘Technical Supplementary’.

3. TOKEN SUPPLEMENTARY: Token supplementary is obtained when approval of Parliament is required for Reappropriation towards utilizing the savings.

36. What are Revised Estimates?

Revised Estimates are mid-year review of possible expenditure, taking into account the trend of expenditure, New Services and New Instrument of Services etc. Revised Estimates are not voted by the Parliament, and hence by itself do not provide any authority for expenditure. Any additional projections made in the Revised Estimates need to be authorized for expenditure through the Parliament’s approval or by Re-appropriation order.

37. What are Excess grants?

If the total expenditure under a Grant exceeds the provision allowed through its original Grant and Supplementary Grant, then, the excess requires regularization by obtaining excess Grant from the Parliament under Article 115 of the Constitution of India. It will have to go through the whole process as in the case of the Annual Budget, i.e. through presentation of Demands for Grants and passing of Appropriation Bills.

38. What is Disinvestment ?

By disinvestment we mean the sale of shares of public sector undertakings by the government. The shares of government companies held by the government are earning assets at the disposal of the government. If these shares are sold to get cash, then earning assets are converted into cash. So it is referred to as disinvestment.

39. What are the Provisions of the General Financial Rules (GFR)?

The controlling officer should maintain a Liability Register for effecting proper control over expenditure. Control of expenditure against grant/appropriation and ultimate responsibility of the authority administering it.

Departments of the Central Government shall surrender to the Finance Ministry, by the dates prescribed by that Ministry before the close of the financial year, all the anticipated savings noticed in the Grants or Appropriations controlled by them.

The funds provided during the financial year and not utilized before the close of that financial year shall stand lapsed at the close of the financial year.

The savings as well as provisions that cannot be profitably utilised should be surrendered to Government immediately when they are foreseen, without waiting till the end of the year.

Rush of expenditure, particularly in the closing months of the financial year, shall be regarded as a breach of financial propriety and shall be avoided.

No expenditure shall be incurred during a financial year on a “New Service” not contemplated in the Annual Budget for the year except after obtaining a supplementary grant or appropriation or an advance from the Contingency Fund during that year.

Subject to the Constitution of India, money indisputably payable by the Government of India shall not ordinarily be left unpaid. Anticipated liabilities should invariably be made in Demands for Grants to be placed before the Parliament.

Source http://pib.nic.in/eventsite/budget2016/BudgetFAQ.pdf