When a person Can not Claim ITC under GST

Here is the list of cases under which you can not claim Input Tax Credit under GST

1 Person not registered :

If a person is not registered under GST , he can not claim Input Tax Credit.

Eligibility and conditions for taking input tax credit Section 16 (1)of CGST Act 2017 : :.

(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

2. If Supplies not used by Registered person in his business :-

Eligibility and conditions for taking input tax credit Section 16 (1)of CGST Act 2017 :

(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

Example : Mr A has Office in Punjab and Chandigarh . Hotel is booked in Punjab by Chandigarh Office and conference is conducted. CGST and PGST is charged by Hotel.

Chandigarh Office can not claim Input tax Credit of CGST and PGST because tax paid in Punjab will not be creditable in Chandigarh

Punjab Office will not be able to claim Input tax Credit of CGST and PGST because supply is ‘used ‘ in the business of Chandigarh Office.

3. Tax Invoice / Other tax paying document Not received :

Eligibility and conditions for taking input tax credit Section 16 (1)of CGST Act 2017 :

…No registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, –

(a) he is in possession of a tax invoice or debit note issued by a supplier registered under this Act, or such other tax paying documents as may be prescribed;

Tax paying documents : Refer Rule 36 CGST Rules

- Debit Note u/s 34 of CGST Act

- Bill of Entry

- Input Service Distributor invoice or Input Service Distributor credit not

4. Goods or Services not received :-

If the registered person has not received the Goods or Services or both, he can not claim Input Tax Credit.

Eligibility and conditions for taking input tax credit Section 16 (1)of CGST Act 2017 :

…No registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, –

(b) he has received the goods or services or both

Explanation- For the purposes of this clause, it shall be deemed that the registered person has received the goods where the goods are delivered by the supplier to a recipient or any other person on the direction of such registered person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to goods or otherwise;

Example : registered person can not take Input Tax Credit

i) on Advance Paid for Goods or Services.

ii) If supplier has dispatched Goods but the recipient has not received the goods and Goods are in transit.

5. Supplier has not paid the Tax

If the Supplier has not paid the Tax charged on Goods or Services or both, recipient can not claim Input Tax Credit.

Eligibility and conditions for taking input tax credit Section 16 (1)of CGST Act 2017 :

…No registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, –

c) subject to the provisions of section 41 [Claim of input tax credit and provisional acceptance thereof ] , the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilization of input tax credit admissible in respect of the said supply; and

6 . If GSTR 1 and GSTR 2 ( Return of Inward and outward Supply) not filed

Eligibility and conditions for taking input tax credit Section 16 (1)of CGST Act 2017 :

…No registered person shall be entitled to the credit of any input tax in respect of any supply of goods or services or both to him unless, –

…..

d) he has furnished the return under section 39

As per Section 39 (1) of CGST Act 2017

Every registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 shall, for every calendar month or part thereof, furnish, in such form and manner as may be prescribed, a return, electronically, of inward and outward supplies of goods or services or both, input tax credit availed, tax payable, tax paid and such other particulars as may be prescribed, on or before the twentieth day of the month succeeding such calendar month or part thereof.

7. Goods received in lots or instalments

Registered person shall not claim ITC on Goods received in lots or instalments. It will be available for all goods only on receipt of Last Installment of those goods.

Eligibility and conditions for taking input tax credit Section 16 (1)of CGST Act 2017 :

….

PROVIDED that where the goods against an invoice are received in lots or instalments, the registered person shall be entitled to take credit upon receipt of the last lot or installment:

8. Payment not made to supplier

Provision to Section 16(2) of CGST Act :

Payment not made to supplier of goods or service or both, the value of supply and tax thereon: –

If recipient of goods or service or both has not paid the supplier within 180 days from date of invoice, the amount of input tax credit availed of proportionate to such amount not paid to supplier along with the interest will be added to output liability of the recipient.

Such non-payment of the value of invoice must be admitted in the return filed in FORM-GSTR 2 (Rule 37 of CGST Rules, 2017) for the month immediately following the period of 180 days from the date of issue of invoice.

The said input tax credit can be re-availed on payment of value of supply and tax payable thereon.

Note : This condition will not apply to supplies which are payable under reverse charge basis..

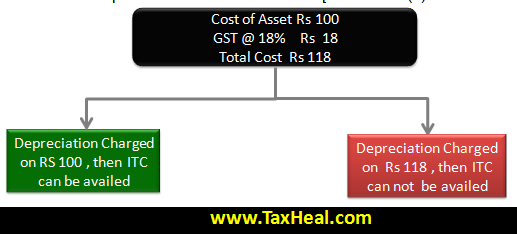

9. Depreciation claimed under Income Tax Act

Where the registered person has claimed depreciation on the tax component of the cost of capital goods and plant and machinery under the provisions of the Income Tax Act, 1961, the input tax credit on the said tax component shall not be allowed. [ Section 16(3) of CGST Act 2017]

10. Time Limit to Avail Input Tax Credit:

Section 16(4) of CGST Act 2017 :

A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both

- after the due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertains or

- furnishing of the relevant annual return,

whichever is earlier.

Example : If your forgot to claim your Inward Supply Bill in Particular month in GSTR 2, then you can claim it at any time upto :-

i) due date of furnishing of the return under section 39 for the month of September following the end of financial year to which such invoice or invoice relating to such debit note pertain

ii) furnishing of the relevant annual return,

whichever is earlier.

11. Tax Invoice / tax paying document not correct

If Tax Invoice / tax paying document does not contain all specified particulars (e.g GSTIN No not mentioned on Invoice etc ) or these particulars not filed in GSTR 2 ( Inward Supply return) .. Then registered person can not claim Input Tax Credit.

Section 74 of CGST Act 2017 – Input tax credit wrongly availed or utilised by reason of fraud or any wilful-misstatement or suppression of facts

Documentary requirements and conditions for claiming input tax credit

Rule 36(2) of CGST Rules 2017 :

Input tax credit shall be availed by a registered person only if all the applicable particulars as specified in the provisions of Chapter VI [TAX INVOICE, CREDIT AND DEBIT NOTES] are contained in the said document, and the relevant information, as contained in the said document, is furnished in FORM GSTR-2 by such person.

12. Tax Paid due to Demand confirmed

If Tax Paid due to Demand confirmed for fraud, wilful misstatement or suppression of facts ,then registered person can not claim Input Tax Credit.

Documentary requirements and conditions for claiming input tax credit

Rule 36(2) of CGST Rules 2017 :

No input tax credit shall be availed by a registered person in respect of any tax that has been paid in pursuance of any order where any demand has been confirmed on account of any fraud, wilful misstatement or suppression of facts.

13 Time Limit to Avail Input Tax Credit in case taking GST Registration

Section 18(2) of CGST Act 2017 :

A taxable person shall not be entitled to take input tax credit in respect of any supply of goods and / or services to him after the expiry of one year from the date of issue of tax invoice relating to such supply in following cases :- –

- Person who has applied for registration under CGST Act within 30 days from the date on which he becomes liable to registration

- A person who takes registration under sub-section (3) of section 25 ( Voluntary Registration)

- where any registered person ceases to pay tax under Composition Scheme and he becomes liable to pay tax under section 9 (Regular Scheme):

- where an exempt supply of goods or services or both by a registered person becomes a taxable supply

14 Fraud, Seizure and Confiscation

Input tax credit is not available on any tax paid under the circumstances of the following sections:

Section 74 of CGST Act 2017 – Input tax credit wrongly availed or utilised by reason of fraud or any wilful-misstatement or suppression of facts

Section 129 of CGST Act 2017 – Input tax credit on the goods seized

Section 130 of CGST Act 2017 – Input tax credit on the goods confiscated

15. Lost, Stolen, Destroyed, Free Samples, Gifts

Input tax credit is not available on the goods which are lost, stolen, destroyed, written off or disposed of by way of gift or free samples.

16. Used for Personal Consumption

When the goods or services are used for personal consumption, input tax credit is not available.

17. Composition Scheme

Composition dealers who pay tax under section 10, cannot take input tax credit on the goods or services or both received by them.

GST Input Tax Credit : Free Study Material

we have compiled Free Study Material on GST Input Tax Credit . Click on the Following Topics to study in details

- Input tax Credit on capital goods purchased before GST Registration

- Input Tax Credit in GST ( India )

- When you Can not Claim ITC under GST

- Example on Rule 5 of GST Input Tax Credit Rule – ITC on Capital Goods

- Example on Rule 7 of GST Input Tax Credit Rule – Inputs Partly used for business and partly for other purposes

- Example Rule 8 of GST Input Tax Credit Rule – Capital Goods Partly used for Business and partly for other purposes

- Example Rule 9 GST Input Tax Credit Rules – Reversal of ITC on Inputs & Capital Goods

- Video : GST Input Tax Credit wrongly availed : GST News [Part 228]

- Video : GST ITC 4 : Goods to Job Worker :GST News [ Part 166 ]

- Circular No 42/16/2018 GST : CBIC clarify recovery of arrears under existing law &; reversal of inadmissible input tax credit

- GST Manual : Steps to Use Cash/ ITC for Payment of GST Demand

- How legal heir can transfer GST ITC in new entity in case of death of sole proprietor.

- GST Refund of ITC accumulated due to Inverted Tax Structure (RFD-01A)

- How to get GST Refund of ITC paid on Exports without payment of Integrated Tax

- Receiving Intimation of ITC Blocked by GST Tax Official

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |