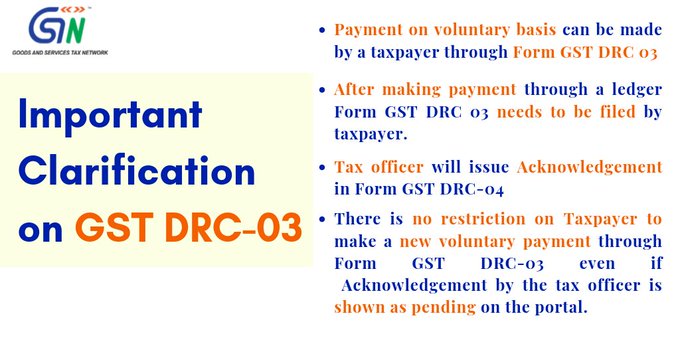

CBIC Clarification on GST DRC-03 for Payment of tax on voluntary basis

Payment on Voluntary Basis is a facility given to tax payers to make payment u/s 73 or 74 of the CGST Act, 2017 within 30 days of issuance of Show Cause Notice (SCN).

Payment could also be made by taxpayers before SCN is issued. This Tax can be paid by Form GST DRC-03.

After making the payment via ledger, taxpayer is required to file GST Form DRC 3.

Tax Officer will issue acknowledgement in Form GST DRC-04.

There is no restriction on the taxpayer to make a new voluntary payment through Form GST DRC-03, even if acknowledgement by the tax official is shown pending on the portal.