Challan For Deposit of Goods and Services Tax

GST PMT 4

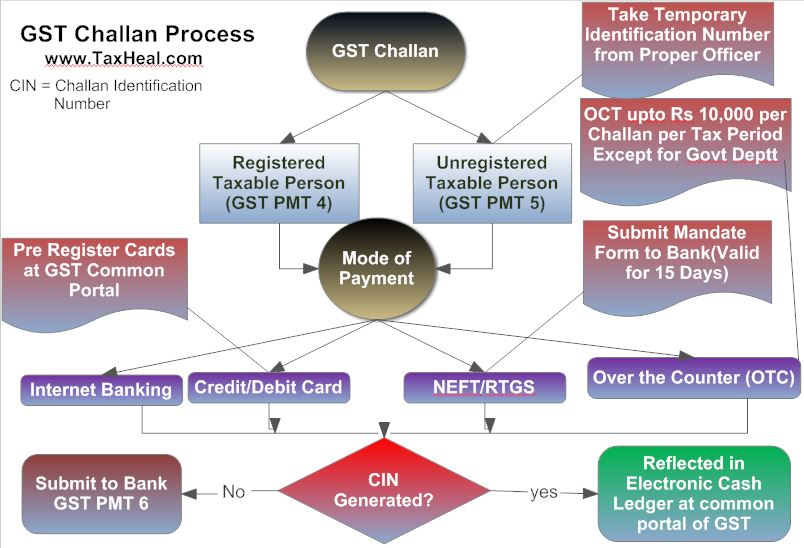

Who has to pay Challan for Deposit of Goods and Services Tax ?

A registered taxable person, or any other person on his behalf, shall generate a challan in FORM GST PMT-4 on the Common Portal and enter the details of the amount to be deposited by him towards tax, interest, penalty, fees or any other amount.

Download GST PMT 4

What is the period of Validity of GST Challan ?

Challan in FORM GST PMT-4 generated at the Common Portal shall be valid for a period of fifteen days.

Mode of Deposit of GST Challan ?

Deposit of GST challan shall be made through any of the following modes:

(i) Internet Banking through authorized banks;

(ii) Credit card or Debit card after registering the same with the Common Portal through the authorised bank;

(iii) National Electronic Fund Transfer (NeFT) or Real Time Gross Settlement (RTGS) from any bank;

(iv) Over the Counter payment (OTC) through authorized banks for deposits up to ten thousand rupees per challan per tax period, by cash, cheque or demand draft:

The restriction for deposit up to ten thousand rupees per challan in case of an Over the Counter (OTC) payment shall not apply to deposit to be made by–

(a) Government Departments or any other deposit to be made by persons as may be notified by the Board/Commissioner (SGST) in this behalf;

(b) Proper officer or any other officer authorised to recover outstanding dues from any person, whether registered or not, including recovery made through attachment or sale of movable or immovable properties;

(c) Proper officer or any other officer authorized for the amounts collected by way of cash or cheque, demand draft during any investigation or enforcement activity or any ad hoc deposit:

Who will bear expenses of making GST Challan Payment ?

For making payment of any amount indicated in the challan, the commission, if any, payable in respect of such payment shall be borne by the taxable person making such payment.

How to pay through GST Challan when the person is not registered under the Act ?

Any payment required to be made by a person who is not registered under the Act, shall be made on the basis of a temporary identification number generated by the proper officer through the Common Portal and the details of such payment shall be recorded in a register in FORM GST PMT 5 (Payment Register of Temporary IDs/Un-registered Taxpayers), to be maintained on the Common Portal.

How to Pay GST Challan through NEFT or RTGS ?

Where the payment is made by way of NeFT or RTGS mode from any bank, the mandate form shall be generated along with the challan and the same shall be submitted to the bank from where the payment is to be made

Note :- The mandate form shall be valid for a period of fifteen days from the date of generation of challan.

What is the Receipt Format after payment of GST Challan ?

On successful credit of the amount to the concerned government account maintained in the authorised bank, a Challan Identification Number (CIN) will be generated by the collecting Bank and the same shall be indicated in the challan:

Note :-where the bank account of the concerned taxable person, or the person making the deposit on his behalf, is debited but no Challan Identification Number (CIN) is generated, the said person may represent electronically in FORM GST PMT 6 through the Common Portal to the Bank or electronic gateway through which the deposit was initiated

How a person will ensure that GST Challan has been paid to the Govt ?

On receipt of CIN from the authorized Bank, the said amount shall be credited to the electronic cash ledger of the registered taxable person who, or on whose behalf, the deposit has been made and the Common Portal shall make available a receipt to this effect.\

GST Payment Formats

| Sr No. | Form No. | Title of the Form |

| 1. | Form GST PMT 1 | Electronic Tax Liability Register of Taxpayer (Part–I: Return related liabilities) Electronic Tax Liability Register of Taxpayer (Part–II: Other than return related liabilities) |

| 2. | Form GST PMT 2 | Electronic Credit Ledger |

| 3. | Form GST PMT 2A | Order for re-credit of the amount to cash or credit ledger |

| 4. | Form GST PMT 3 | Electronic Cash Ledger |

| 5. | Form GST PMT 4 | Challan For Deposit of Goods and Services Tax |

| 6. | Form GST PMT 5 | Payment Register of Temporary IDs/Un-registered Taxpayers |

| 7. | Form GST PMT 6 | Application For Credit of Missing Payment (CIN not generated) |

Free Education Guide on Goods & Service Tax (GST)