Changes in GST Effective From 1st April 2019

Article discusses changes in

1. GST Provisions related to Threshold Limit for Registration in case of goods , Services and ZBOth Goods & Services

2. Changes in GST Composition Scheme

3. Supply with or without consideration – treated as supply under GST, Changes in TCS Provisions and

4. Proposed New GST Return Formats.

| Provisions Before 1st April 2019 | Provisions After 1st April 2019 |

| Threshold Limit for Registration in case of goods (allover India) except persons engaged in making Supplies in the state of Arunacahal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikim, Telengana, Tripura, Uttrakhanad– Rs. 20 lakhs | Threshold Limit for Registration in case of goods (allover India) except persons engaged in making Supplies in the state of Arunacahal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikim, Telengana, Tripura, Uttrakhanad – Rs. 40 lakhs * |

| Threshold Limit for Registration in case of Services except persons engaged in making Supplies in the state of Arunacahal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikim, Telengana, Tripura, Uttrakhanad – Rs. 20 lakhs | Threshold Limit for Registration in case of Services except persons engaged in making Supplies in the state of Arunacahal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikim, Telengana, Tripura, Uttrakhanad– Rs. 20 lakhs |

| Threshold Limit for Registration in case of Goods & Services engaged in making Supplies in the state of Arunacahal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikim, Telengana, Tripura, Uttrakhanad – Rs. 10 lakhs | Threshold Limit for Registration in case of Goods & Services engaged in making Supplies in the state of Arunacahal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Puducherry, Sikim, Telengana, Tripura, Uttrakhanad – Rs. 10 lakhs |

Composition Scheme- **

| Composition Scheme- **

For Restaurant Service – 5% For Other Service Providers whose turnover in the preceding Financial Year Rs. 50 lakhs – 3% CGST & 3% SGST |

| Supply with or without consideration – treated as supply under GST |

|

| TCS Provisions- Section 15(2) of CGST Act specifies that the value of supply shall include any taxes, duties, cesses, fees and charges levied under any law for the time being in force other than this Act, the SGST Act, The UTGST Act, The GST Act if charged separately by the supplier. | TCS Provisions- For the purpose of determination of value of supply under GST, Tax collected at source under the provisions of Income Tax Act, 1961 would not be includible as it an interim levy not having character of Tax Example |

| Example Gold Ornaments – Rs. 5,00,000 Add – TCS @ 1% – Rs. 5,000 ……………………………………………. Rs. 5,05,000 Add – GST @ 3% – Rs. 15,150 …………………………………………….. Rs. 5,20,150 | Gold Ornaments – Rs. 5,00,000 Add – TCS @ 1% – Rs. 5,000 ……………………………………………. Rs. 5,05,000 Add – GST @ 3% – Rs. 15,000 …………………………………………….. Rs. 5,15,000 |

* Threshold Limit for Registration in case of Goods- Rs. 40 lakhs is not applicable in following cases-

- Persons required to take compulsory registration under section 24(Example – Online Sale , E-Commerce Operator)

- Persons engaged in supply of Ice Cream and other edible ice, whether or not containing cocoa, Pan Masala, Tobacco and manufactured tobacco substitutes.

** Applicability of Composition Scheme-

- Not engaged in making any supply which is not leviable to tax under the CGST Act.

- Not engaged in making any inter state outward supply.

- Neither a Casual Taxable Person nor a Non Resident Taxable Person

- Not engaged in making any supply through an e-commerce operator who is required to collect tax at source under section 52

- Shall not collect any tax from the recipient on supplies made by him nor shall be entitled to any credit of ITC

- Shall issue Bill of Supply instead of Tax Invoice

- The registered person under composition scheme shall mention the following words at the top of the bill of supply namely –“Taxable Person paying tax in terms of Notification No. 2/2019 –Central Tax (Rate) dated 07.03.2019, not eligible to collect tax on supplies” [ Newly Notified]

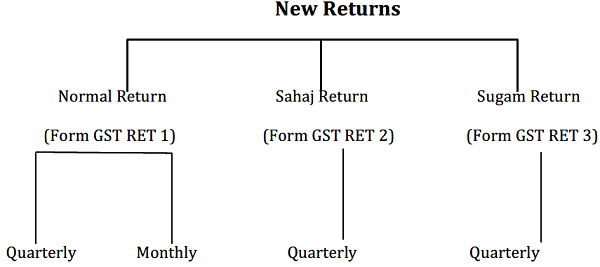

Proposed New Return Formats

- If turnover up to Rs. 5 Crore in preceding Final Year , then Taxpayers can opt for submitting return quarterly using Form GST RET 1 or Form GST RET 2 or Form GST RET 3.

- Quarterly Return submission using Form GST RET 1- ITC on Missing Invoices can be availed.

- Quarterly Return submission using Form GST RET 2 & GST RET 3 – ITC on Missing Invoices cannot be availed.

- Quarterly Return submission using Form GST RET 3- Outward Supply under B2C & B2B category and inward supplies attracting reverse charge are to be informed in this return.

- Quarterly Return submission using Form GST RET 2- Outward Supply under B2C category and inward supplies attracting reverse charge are to be informed in this return.

Source- https://icmai.in/upload/Taxation/PROVISIONS_GST.pdf