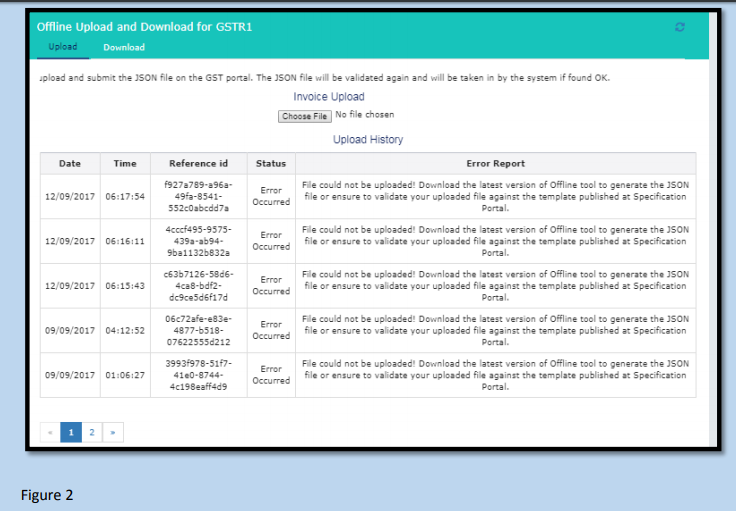

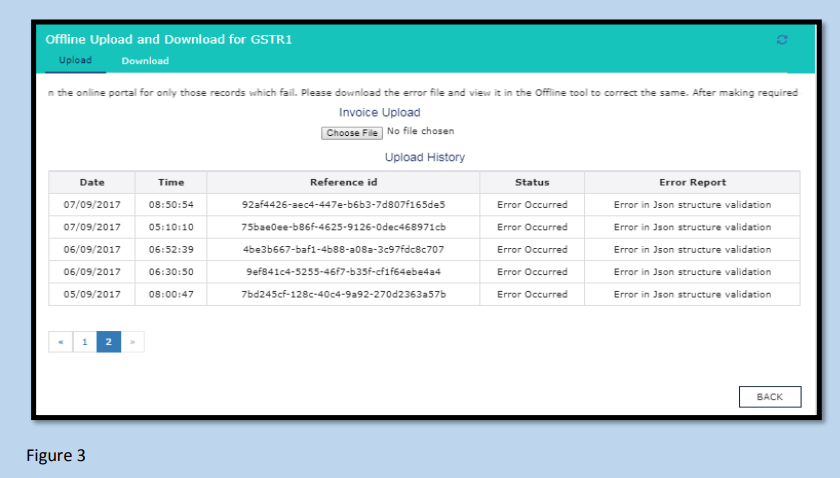

Checklist to avoid json error (for figure 2,3 ) especially point 4 & 8:

1. GSTIN should be valid and 15 alphanumeric characters,

2. Invoice length should not be more than 16 characters and only characters allowed are numeric,

alphabets , / and –

3. In b2cl, invoice value should be more than 250000,

4. Invoice Date, Note date, and shipping bill Date format should be dd-mmm-yyyy in excel/csv (

For eg: 04-Jul-2017)

5. In case of CDNR (Credit/Debit Note Registered)/CDNUR (Credit/Debit Note unregistered), Invoices and Note number are only allowed with the numeric, alphabets, / and – No other character is allowed.

6. In case of export, if shipping bill is mentioned then shipping date is mandatory.

7. Shipping bill date should be on or after the invoice date.

8. Only 2 decimal digit (eg: 1234.89) is allowed in values entered in excel/csv.

Directorate of Commercial Taxes, West Bengal

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |