Checklist for Registration of GST in India

- 17 Rules for Registration under GST prescribed-The Draft Registration Rules have 17 Rules viz. application for registration, verification, issuance of registration certificate, Grant of registration to non-resident taxable person, Amendment to Registration etcDownload GST -Draft Registration formats released by CBEC

- 26 Forms for Registration of GST prescribed-26 Forms for Registration have been prescribed (Form GST REG-01 to Form GST REG-26)

Download GST -Draft Registration Rules Released by CBEC

- Online filling of application for GST Registration– Application for registration is to be made online either directly on the GSTN Portal or through Facilitation Centres (FC) notified by the Board or Commissioner.

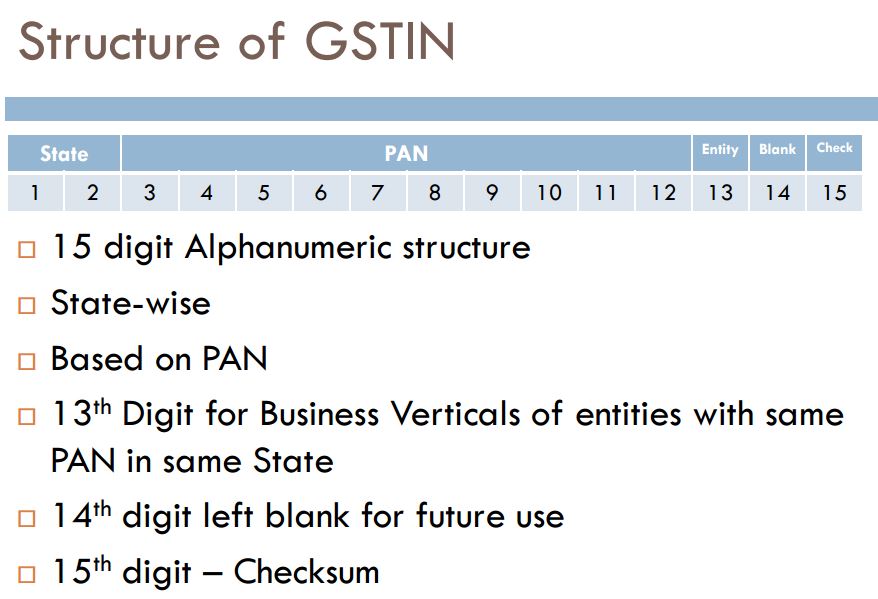

- Verification of Information- For GST Registration, Part A of FORM GST REG-01 (application for registration under Section 19(1) of the Model GST Act) seeks to verify PAN through Income Tax Portal, mobile number and email i.d. through one-time password (OTP) sent to the said mobile number/email address.

- No fee for filling GST registration application-No fee is payable for filing application for registration as nothing regarding fee is mentioned under Draft Registration Rules.

- Time period for GST Registration-The Draft Registration Rules provides that registration will be granted within 3 common working days if no discrepancy is found. If any discrepancy is found, the same will be communicated through the GSTN within the above time limit.

- Registration under GST of Casual taxable persons and Non- resident taxable person- The Model GST Act provides for registration of Casual taxable person and Non-resident taxable person i.e. a person who occasionally undertakes transactions involving supply of goods and/or services and has no fixed place of business in India. The said person are also required todeposit GST in advance on estimated basis and thereafter an acknowledgement will be issued electronically.

- Migration of existing taxpayers to GST – The Draft Registration Rules provides rules for migration of person already registered under earlier law, thereby stating that person registered under an earlier law and having a PAN shall be granted registration on a provisional basis and a certificate of GST registration incorporating the GSTIN therein, shall be made available on the Common Portal.

Thereafter, an application along with the information/documents specified therein shall be submitted electronically. Information asked for shall be furnished within a period of 6 months or such further period as may be extended by the Board or Commissioner. Failure to submit relevant information within prescribed time period can lead to cancellation of provisional registration.

- Physical verification of business premises– Verification of premises may be taken up by the proper officer after granting registration under GST and verification report to be uploaded in Form GST REG-26.

Download Video -GST Registration Process- India

Download GST Draft Payment Rules Released by CBEC

Download GST Draft Payment formats Released by CBEC

Download Draft GST Refund Rules released by Govt

Download Draft GST Refund Forms released by CBEC

Download Draft GST Return Rules Released by Govt

Download Draft GST Return Formats released by Govt

Education Guide on Goods & Service Tax (GST)