Circular No. 147/03//2021-GST

CBEC-20/23/03/2020-GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

New Delhi, Dated the 12th March, 2021

To,

The Principal Chief Commissioners/ Chief Commissioners/ Principal Commissioners/

Commissioners of Central Tax (All)

The Principal Director Generals/ Director Generals (All)

Madam/Sir,

Subject: Clarification on refund related issues – Reg.

Various representations have been received seeking clarification on some of the issues relating to GST refunds. The issues have been examined and to ensure uniformity in the implementation of the provisions of law across the field formations, the Board, in exercise of

its powers conferred by section 168 (1) of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as “CGST Act”), hereby clarifies the issues detailed hereunder:

2. Clarification in respect of refund claim by recipient of Deemed Export Supply

2.1 Representations have been received in respect of difficulties being faced by the recipients of the deemed export supplies in claiming refund of tax paid in respect of such supplies since the system is not allowing them to file refund claim under the aforesaid category

unless the claimed amount is debited in the electronic credit ledger.

2.2 Para 41 of Circular No. 125/44/2019 – GST dated 18/11/2019 has placed a condition

that the recipient of deemed export supplies for obtaining the refund of tax paid on such

supplies shall submit an undertaking that he has not availed ITC on invoices for which refund

has been claimed. Thus, in terms of the above circular, the recipient of deemed export supplies

cannot avail ITC on such supplies but when they proceed to file refund on the portal, the system

requires them to debit the amount so claimed from their electronic credit ledger.

2.3 The 3rd proviso to Rule 89(1) of CGST Rules, 2017 allows for refund of tax paid in case

of a deemed export supply to the recipient or the supplier of deemed export supplies. The

said proviso is reproduced as under:

“Provided also that in respect of supplies regarded as deemed exports, the application

may be filed by,

(a) the recipient of deemed export supplies; or

(b) the supplier of deemed export supplies in cases where the recipient does not avail of input tax credit on such supplies and furnishes an undertaking to the effect that the supplier may claim the refund”

From the above, it can be seen that there is no restriction on recipient of deemed export

supplies in availing ITC of the tax paid on such supplies when the recipient files for refund

claim. The said restriction has been placed by the Circular No. 125/44/2019-GST dated

18.11.2019.

2.4 In this regard, it is submitted that in order to ensure that there is no dual benefit to the

claimant, the portal allows refund of only Input Tax Credit (ITC) to the recipients which is

required to be debited by the claimant while filing application for refund claim. Therefore,

whenever the recipient of deemed export supplies files an application for refund, the portal

requires debit of the equivalent amount from the electronic credit ledger of the claimant.

2.5 As stated above, there is no restriction under 3rd proviso to Rule 89(1) of CGST Rules,

2017 on recipient of deemed export supply, claiming refund of tax paid on such deemed export

supply, on availment of ITC on the tax paid on such supply. Therefore, the para 41 of Circular

No. 125/44/2019-GST dated 18.11.2019 is modified to remove the restriction of non-availment

of ITC by the recipient of deemed export supplies on the invoices, for which refund has been

claimed by such recipient. The amended para 41 of Circular no. 125/44/2.019-GST dated

18.11.2019 would read as under:

“41. Certain supplies of goods have been notified as deemed exports vide notification

No. 48/2017-Central Tax dated 18.10.2017 under section 147 of the CGST Act. Further,

the third proviso to rule 89(1) of the CGST Rules allows either the recipient or the

supplier to apply for refund of tax paid on such deemed export supplies. In case such

refund is sought by the supplier of deemed export supplies, the documentary evidences

as specified in notification No. 49/2017- Central Tax dated 18.10.2017 are also required

to be furnished which includes an undertaking that the recipient of deemed export

supplies shall not claim the refund in respect of such supplies and shall not avail any

input tax credit on such supplies. Similarly, in case the refund is filed by the recipient of

deemed export supplies, an undertaking shall have to be furnished by him stating that

refund has been claimed only for those invoices which have been detailed in statement

5B for the tax period for which refund is being claimed and the amount does not exceed

the amount of input tax credit availed in the valid return filed for the said tax period.

The recipient shall also be required to declare that the supplier has not claimed refund

with respect to the said supplies. The procedure regarding procurement of supplies of

goods from DTA by Export Oriented Unit (EOU) / Electronic Hardware Technology

Park (EHTP) Unit / Software Technology Park (STP) Unit / Bio-Technology Parks (BTP)

Unit under deemed export as laid down in Circular No. 14/14/2017-GST dated

06.11.2017 needs to be complied with.”

3. Extension of relaxation for filing refund claim in cases where zero-rated supplies has

been wrongly declared in Table 3.1(a).

3.1 Para 26 of Circular No. 125/44/2019-GST dated 18th November 2019 gave a

clarification in relation to cases where taxpayers had inadvertently entered the details of export

of services or zero-rated supplies to a Special Economic Zone Unit/Developer in table 3.1(a)

instead of table 3.1(b) of FORM GSTR-3B of the relevant period and were unable to claim

refund of the integrated tax paid on the same through FORM GST RFD-01A. This was

because of a validation check placed on the common portal which prevented the value of refund

of integrated tax/cess in FORM GST RFD-01A from being more than the amount of integrated

tax/cess declared in table 3.1(b) of FORM GSTR-3B. The said Circular clarified that for the

tax periods from 01.07.2017 to 30.06.2019, such registered persons shall be allowed to file the

refund application in FORM GST RFD-01A on the common portal subject to the condition

that the amount of refund of integrated tax/cess claimed shall not be more than the aggregate

amount of integrated tax/cess mentioned in the tables 3.1(a), 3.1(b) and 3.1(c) of FORM

GSTR-3B filed for the corresponding tax period.

3.2 Since the clarification issued vide the above Circular was valid only from 01.07.2017

to 30.06.2019, taxpayers who committed these errors in subsequent periods were not able to

file the refund applications in FORM GST RFD-01A/ FORM GST RFD-01.

3.3 The issue has been examined and it has been decided to extend the relaxation provided

for filing refund claims where the taxpayer inadvertently entered the details of export of

services or zero-rated supplies to a Special Economic Zone Unit/Developer in table 3.1(a)

instead of table 3.1(b) of FORM GSTR-3B till 31.03.2021. Accordingly, para 26 of Circular

No. 125/44/2019-GST dated 18.11.2019 stands modified as under:

“26. In this regard, it is clarified that for the tax periods commencing from

01.07.2017 to 31.03.2021, such registered persons shall be allowed to file the refund

application in FORM GST RFD-01 on the common portal subject to the condition that

the amount of refund of integrated tax/cess claimed shall not be more than the aggregate

amount of integrated tax/cess mentioned in the Table under columns 3.1(a), 3.1(b) and

3.1(c) of FORM GSTR-3B filed for the corresponding tax period.”

4. The manner of calculation of Adjusted Total Turnover under sub-rule (4) of Rule

89 of CGST Rules, 2017.

4.1 Doubts have been raised as to whether the restriction on turnover of zero-rated supply

of goods to 1.5 times the value of like goods domestically supplied by the same or, similarly

placed, supplier, as declared by the supplier, imposed by amendment in definition of the

“Turnover of zero-rated supply of goods” vide Notification No. 16/2020-Central Tax dated

23.03.2020, would also apply for computation of “Adjusted Total Turnover” in the formula

given under Rule 89 (4) of CGST Rules, 2017 for calculation of admissible refund amount.

4.2 Sub-rule (4) of Rule 89 prescribes the formula for computing the refund of unutilised

ITC payable on account of zero-rated supplies made without payment of tax. The formula

prescribed under Rule 89 (4) is reproduced below, as under:

“Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated

supply of services) x Net ITC ÷Adjusted Total Turnover”

4.3 Adjusted Total Turnover has been defined in clause (E) of sub-rule (4) of Rule 89 as

under:

“Adjusted Total Turnover” means the sum total of the value of-

(a) the turnover in a State or a Union territory, as defined under clause

(112) of section 2, excluding the turnover of services; and

(b) the turnover of zero-rated supply of services determined in terms of

clause (D) above and non-zero-rated supply of services,

excluding-

(i) the value of exempt supplies other than zero-rated supplies; and

(ii) the turnover of supplies in respect of which refund is claimed under

sub-rule (4A) or sub-rule (4B) or both, if any,

during the relevant period.

4.4 “Turnover in state or turnover in Union territory” as referred to in the definition of

“Adjusted Total Turnover” in Rule 89 (4) has been defined under sub-section (112) of Section

2 of CGST Act 2017, as:

“Turnover in State or turnover in Union territory” means the aggregate value of all

taxable supplies (excluding the value of inward supplies on which tax is payable by a

person on reverse charge basis) and exempt supplies made within a State or Union

territory by a taxable person, exports of goods or services or both and inter State

supplies of goods or services or both made from the State or Union territory by the said

taxable person but excludes central tax, State tax, Union territory tax, integrated tax

and cess”

4.5 From the examination of the above provisions, it is noticed that “Adjusted Total

Turnover” includes “Turnover in a State or Union Territory”, as defined in Section 2(112) of

CGST Act. As per Section 2(112), “Turnover in a State or Union Territory” includes turnover/

value of export/ zero-rated supplies of goods. The definition of “Turnover of zero-rated supply

of goods” has been amended vide Notification No.16/2020-Central Tax dated 23.03.2020, as

detailed above. In view of the above, it can be stated that the same value of zero-rated/ export

supply of goods, as calculated as per amended definition of “Turnover of zero-rated supply of

goods”, need to be taken into consideration while calculating “turnover in a state or a union

territory”, and accordingly, in “adjusted total turnover” for the purpose of sub-rule (4) of Rule

89. Thus, the restriction of 150% of the value of like goods domestically supplied, as applied

in “turnover of zero-rated supply of goods”, would also apply to the value of “Adjusted Total

Turnover” in Rule 89 (4) of the CGST Rules, 2017.

4.6 Accordingly, it is clarified that for the purpose of Rule 89(4), the value of export/ zerorated supply of goods to be included while calculating “adjusted total turnover” will be same

as being determined as per the amended definition of “Turnover of zero-rated supply of goods”

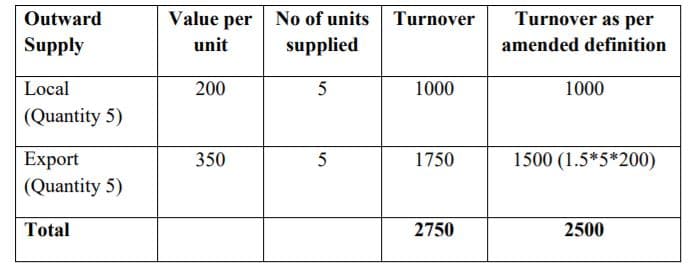

in the said sub-rule. The same can explained by the following illustration where actual value per unit of goods exported is more than 1.5 times the value of same/ similar goods in domestic market, as declared by the supplier:

Illustration: Suppose a supplier is manufacturing only one type of goods and is supplying the

same goods in both domestic market and overseas. During the relevant period of refund, the

details of his inward supply and outward supply details are shown in the table below:

Net admissible ITC = Rs. 270

All values in Rs.

The formula for calculation of refund as per Rule 89(4) is :

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of

services) x Net ITC ÷Adjusted Total Turnover

Turnover of Zero-rated supply of goods (as per amended definition) = Rs. 1500

Adjusted Total Turnover= Rs. 1000 + Rs. 1500 = Rs. 2500 [and not Rs. 1000 + Rs. 1750]

Net ITC = Rs. 270

Refund Amount = Rs. 1500*270 = Rs. 162

2500

Thus, the admissible refund amount in the instant case is Rs. 162.

5. It is requested that suitable trade notices may be issued to publicize the contents of this

Circular.

6. Difficulty, if any, in implementation of this Circular may please be brought to the notice

of the Board. Hindi version would follow.

(Sanjay Mangal)

Commissioner (GST

Download Click here