I. Writ Not Maintainable When Appealable Order Shows Due Consideration and Personal Hearing

Issue:

Whether a writ petition challenging a summary show cause notice and summary order passed under Section 73 of the Central Goods and Services Tax Act, 2017 (CGST Act), is maintainable on the ground that the assessee’s reply was not duly considered, even when the record indicates otherwise and an appellate remedy is available.

Facts:

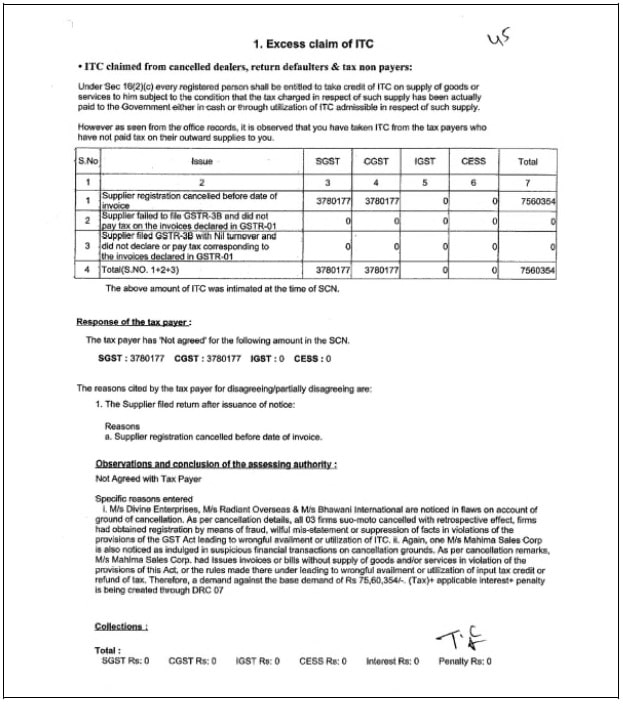

The petitioner-assessee challenged a summary show cause notice and a summary order issued under Section 73 of the CGST Act, 2017. The primary contention was that the impugned order was passed without proper consideration of the reply filed by the assessee. However, upon review, it was found that a reply had indeed been filed, and a personal hearing was granted, with the proprietor of the petitioner appearing before the adjudicating authority. Furthermore, the impugned order itself provided clear reasons for its issuance, indicating that the assessee’s reply was duly considered.

Decision:

The court held that since the assessee’s reply was duly considered and a personal hearing was granted, the impugned order was appealable under Section 107 of the CGST Act. Consequently, the matter did not warrant interference under writ jurisdiction.

Key Takeaways:

- Availability of Alternate Remedy: The existence of an effective alternative remedy, such as an appeal under Section 107 of the CGST Act, generally precludes the exercise of writ jurisdiction.

- Compliance with Natural Justice: When the adjudicating authority demonstrates that it has considered the assessee’s reply and provided a personal hearing, the principles of natural justice are deemed to have been observed.

- Reasons in Order: The provision of clear reasons in the impugned order indicates due application of mind by the adjudicating authority to the facts and submissions, including the assessee’s reply.

- Limited Scope of Writ: Writ jurisdiction is extraordinary and is typically invoked only in cases of fundamental rights violations, clear lack of jurisdiction, or patent illegality where no efficacious alternate remedy exists.

II. Validity of GST Limitation Period Extension Notifications Sub Judice Before Supreme Court

Issue:

Whether the validity of CBIC Notification No. 56/2023-Central Tax, dated 28-12-2023, and corresponding state notifications (likely extending limitation periods for demand orders under Section 168A of the CGST Act) is legally sound.

Facts:

The assessee challenged the validity of CBIC Notification No. 56/2023-Central Tax, dated 28-12-2023, and its corresponding state notification. These notifications are typically issued under Section 168A of the CGST Act, which allows for extensions of time limits in cases of force majeure or other specified circumstances. The legality of such extensions often centers on whether the conditions for invoking Section 168A were met and if the extensions were within the permissible legal framework.

Decision:

The court noted that the matter concerning the validity of these notifications was already pending consideration before the Supreme Court in S.L.P. No. 4240/2025, dated 21-2-2025. Therefore, the challenge made by the assessee to the notification in the present proceedings would be subject to the outcome of the Supreme Court’s decision.

Key Takeaways:

- Doctrine of Sub Judice: When a legal issue is already pending adjudication before a higher court, particularly the Supreme Court, lower courts generally defer their decision on that specific point, making their outcome contingent on the higher court’s ruling.

- Legal Uncertainty of Extensions: The challenge to these notifications indicates ongoing legal scrutiny regarding the power of the CBIC to extend limitation periods for demand and recovery proceedings under GST. The final word on the validity of these extensions rests with the Supreme Court.

- Impact on Assessees: For assessees whose demand notices or orders fall within these extended periods, the final liability will hinge on the Supreme Court’s judgment on the validity of these notifications. Until then, their cases are effectively stayed or proceeded with subject to the higher court’s decision.

- Section 168A: This case highlights the practical application and legal challenges related to Section 168A, which is a critical provision for managing time limits in exceptional circumstances within the GST regime.

CM APPL. No. 29589 OF 2025

| (i) | summary of Show Cause Notice in form DRC-01 dated 15th December 2023, (hereinafter, ‘the impugned SCN’); and |

| (ii) | the summary order dated 29th April, 2024 (hereinafter, ‘the impugned order’) passed by the Sales Tax Officer Class II/AVATO, Ward 32, Zone 1, Delhi (hereinafter ‘Respondent-Department’) under Section 73 of the Delhi/Central Goods and Services Tax Act, 2017 vide which a demand to the tune of Rs. 1,53,66,782/- has been confirmed. |

“1. The subject matter of challenge before the High Court was to the legality, validity and propriety of the Notification No.13/2022 dated 5-7-2022 & Notification Nos.9 and 56 of 2023 dated 31-3-2023 & 8-12-2023 respectively.

2. However, in the present petition, we are concerned with Notification Nos.9 & 56/2023 dated 31-3-2023 respectively.

3. These Notifications have been issued in the purported exercise of power under Section 168 (A) of the Central Goods and Services Tax Act. 2017 (for short, the “GST Act”).

4. We have heard Dr. S. Muralidhar, the learned Senior counsel appearing for the petitioner.

5. The issue that falls for the consideration of this Court is whether the time limit for adjudication of show cause notice and passing order under Section 73 of the GST Act and SGST Act (Telangana GST Act) for financial year 2019-2020 could have been extended by issuing the Notifications in question under Section 168-A of the GST Act.

6. There are many other issues also arising for consideration in this matter.

7. Dr. Muralidhar pointed out that there is a cleavage of opinion amongst different High Courts of the country. 8. Issue notice on the SLP as also on the prayer for interim relief, returnable on 73-2025.”

“65. Almost all the issues, which have been raised before us in these present connected cases and have been noticed hereinabove, are the subject matter of the Hon’ble Supreme Court in the aforesaid SLP.

66. Keeping in view the judicial discipline, we refrain from giving our opinion with respect to the vires of Section 168-A of the Act as well as the notifications issued in purported exercise of power under Section 168-A of the Act which have been challenged, and we direct that all these present connected cases shall be governed by the judgment passed by the Hon’ble Supreme Court and the decision thereto shall be binding on these cases too.

67. Since the matter is pending before the Hon’ble Supreme Court, the interim order passed in the present cases, would continue to operate and would be governed by the final adjudication by the Supreme Court on the issues in the aforesaid SLP-4240-2025.

68. In view of the aforesaid, all these connected cases are disposed of accordingly along with pending applications, if any.”