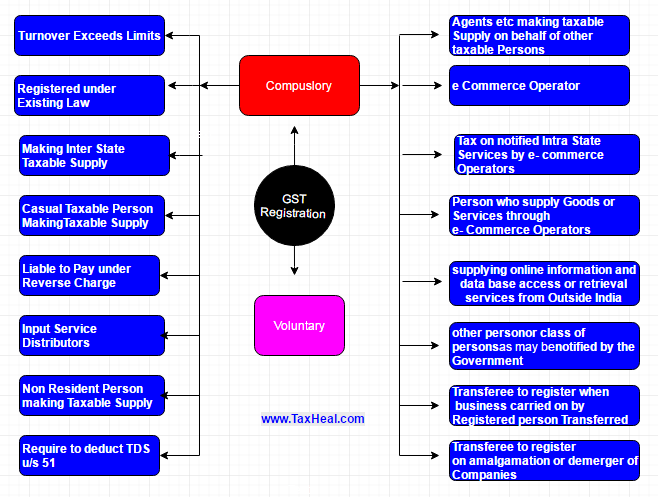

Compulsory Registration under GST

Compulsory Registration under GST ( CGST Act 2017 of India )

Compulsory Registration under GST in India is required as per Section 22 and Section 24 of CGST Act 2017. Section 22 of CGST Act 2017 Explains Persons liable for registration and Section 24 of CGST Act 2017 explains Compulsory registration in certain cases. with graphical presentation which are as follows :-

- Registration based on Turnover :- Every supplier shall be liable to be registered in the State or Union territory from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds 20 lakh rupees . However if supplier makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds 10 lakh rupees. [Section 22 (1)]

- If already Registered under Existing Law:– Every person who, on the day immediately preceding the appointed day, is registered or holds a license under an existing law ( i.e under VAT, Excise ,Service Tax etc) shall be liable to be registered under CGST Act 2017 with effect from the appointed day [Section 22(2)]

- Persons making any inter-State taxable supply;[ Section 24 of CGST Act 2017 ]

- Casual taxable persons making taxable supply;[ Section 24 of CGST Act 2017 ]

- As per Section 2(20) of CGST Act 2017 “casual taxable person” means a person who occasionally undertakes transactions involving supply of goods or services or both in the course or furtherance of business, whether as principal, agent or in any other capacity, in a State or a Union territory where he has no fixed place of business;

- Persons who are required to pay tax under reverse charge;[ Section 24 of CGST Act 2017 ]

- As per Section 2(98) of CGST Act 2017 “reverse charge” means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or sub-section (4) of section 5 of the Integrated Goods and Services Tax Act ;

- Persons who are required to pay tax under sub-section (5) of section 9;[ Section 24 of CGST Act 2017 ]

- Persons required to Pay Tax under Section 9(5) of CGST Act 2017 are:-The Government may, on the recommendations of the Council, by notification, specify categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services: Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax:Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.

- Non-resident taxable persons making taxable supply;[ Section 24 of CGST Act 2017 ]

- As per Section 2(77) of CGST Act 2017 “non-resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or services or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India;

- Persons who are required to deduct tax under section 51 , whether or not separately registered under CGST Act 2017;[ Section 24 of CGST Act 2017 ]

- Section 51 of CGST Act 2017 is as follow :-

(1) Notwithstanding anything to the contrary contained in this Act (CGST Act 2017 ) The Government may mandate,—

(a) a department or establishment of the Central Government or State Government; or

(b) local authority; or

(c) Governmental agencies; or

(d) such persons or category of persons as may be notified by the Government on the recommendations of the Council,

(hereafter in this section referred to as “the deductor”), to deduct tax at the rate of one per cent from the payment made or credited to the supplier (hereafter in this section referred to as “the deductee”) of taxable goods or services or both, where the total value of such supply, under a contract, exceeds two lakh and fifty thousand rupees:

Provided that no deduction shall be made if the location of the supplier and the place of supply is in a State or Union territory which is different from the State or as the case may be, Union territory of registration of the recipient.

Explanation.—For the purpose of deduction of tax specified above, the value of supply shall be taken as the amount excluding the central tax, State tax, Union territory tax, integrated tax and cess indicated in the invoice.

(2) The amount deducted as tax under this section shall be paid to the Government by the deductor within ten days after the end of the month in which such deduction is made, in such manner as may be prescribed.

(3) The deductor shall furnish to the deductee a certificate mentioning therein the contract value, rate of deduction, amount deducted, amount paid to the Government and such other particulars in such manner as may be prescribed.

(4) If any deductor fails to furnish to the deductee the certificate, after deducting the tax at source, within five days of crediting the amount so deducted to the Government, the deductor shall pay, by way of a late fee, a sum of one hundred rupees per day from the day after the expiry of such five day period until the failure is rectified, subject to a maximum amount of five thousand rupees.

(5) The deductee shall claim credit, in his electronic cash ledger, of the tax deducted and reflected in the return of the deductor furnished under subsection (3) of section 39, in such manner as may be prescribed.

(6) If any deductor fails to pay to the Government the amount deducted as tax under sub-section (1), he shall pay interest in accordance with the provisions of sub-section (1) of section 50 , in addition to the amount of tax deducted.

(7) The determination of the amount in default under this section shall be made in the manner specified in section 73 or section74.

(8) The refund to the deductor or the deductee arising on account of excess or erroneous deduction shall be dealt with in accordance with the provisions of section 54:

Provided that no refund to the deductor shall be granted, if the amount deducted has been credited to the electronic cash ledger of the deductee.

- Section 51 of CGST Act 2017 is as follow :-

- Persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;[ Section 24 of CGST Act 2017 ]

- Input Service Distributor, whether or not separately registered under CGST Act 2017;[ Section 24 of CGST Act 2017 ]

- As per Section 2(61) of CGST Act 2017 “Input Service Distributor” means an office of the supplier of goods or services or both which receives tax invoices issued under section 31 towards the receipt of input services and issues a prescribed document for the purposes of distributing the credit of central tax, State tax, integrated tax or Union territory tax paid on the said services to a supplier of taxable goods or services or both having the same Permanent Account Number as that of the said office;

- Persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52;[ Section 24 of CGST Act 2017 ]

- section 52 of CGST Act 2017 is :-

(1) Notwithstanding anything to the contrary contained in this Act, every electronic commerce operator (hereafter in this section referred to as the “operator”), not being an agent, shall collect an amount calculated at such rate not exceeding one per cent, as may be notified by the Government on the recommendations of the Council, of the net value of taxable supplies made through it by other suppliers where the consideration with respect to such supplies is to be collected by the operator.

Explanation.—For the purposes of this sub-section, the expression “net value of taxable supplies” shall mean the aggregate value of taxable supplies of goods or services or both, other than services notified under sub-section (5) of section 9, made during any month by all registered persons through the operator reduced by the aggregate value of taxable supplies returned to the suppliers during the said month.

(2) The power to collect the amount specified in sub-section (1) shall be without prejudice to any other mode of recovery from the operator.

(3) The amount collected under sub-section (1) shall be paid to the Government by the operator within ten days after the end of the month in which such collection is made, in such manner as may be prescribed.

(4) Every operator who collects the amount specified in sub-section (1) shall furnish a statement, electronically, containing the details of outward supplies of goods or services or both effected through it, including the supplies of goods or services or both returned through it, and the amount collected under subsection (1) during a month, in such form and manner as may be prescribed, within ten days after the end of such month.

(5) Every operator who collects the amount specified in sub-section (1) shall furnish an annual statement, electronically, containing the details of outward supplies of goods or services or both effected through it, including the supplies of goods or services or both returned through it, and the amount collected under the said sub-section during the financial year, in such form and manner as may be prescribed, before the thirty first day of December following the end of such financial year.

(6) If any operator after furnishing a statement under sub-section (4) discovers any omission or incorrect particulars therein, other than as a result of scrutiny, audit, inspection or enforcement activity by the tax authorities, he shall rectify such omission or incorrect particulars in the statement to be furnished for the month during which such omission or incorrect particulars are noticed, subject to payment of interest, as specified in sub-section (1) of section 50:

Provided that no such rectification of any omission or incorrect particulars shall be allowed after the due date for furnishing of statement for the month of September following the end of the financial year or the actual date of furnishing of the relevant annual statement, whichever is earlier.

(7) The supplier who has supplied the goods or services or both through the operator shall claim credit, in his electronic cash ledger, of the amount collected and reflected in the statement of the operator furnished under sub-section (4), in such manner as may be prescribed.

(8) The details of supplies furnished by every operator under sub-section (4) shall be matched with the corresponding details of outward supplies furnished by the concerned supplier registered under this Act in such manner and within such time as may be prescribed.

(9) Where the details of outward supplies furnished by the operator under subsection (4) do not match with the corresponding details furnished by the supplier under section 37, the discrepancy shall be communicated to both persons in such manner and within such time as may be prescribed.

(10) The amount in respect of which any discrepancy is communicated under sub-section (9) and which is not rectified by the supplier in his valid return or the operator in his statement for the month in which discrepancy is communicated, shall be added to the output tax liability of the said supplier, where the value of outward supplies furnished by the operator is more than the value of outward supplies furnished by the supplier, in his return for the month succeeding the month in which the discrepancy is communicated in such manner as may be prescribed.

(11) The concerned supplier, in whose output tax liability any amount has been added under sub-section (10), shall pay the tax payable in respect of such supply along with interest, at the rate specified under sub-section (1) of section 50 on the amount so added from the date such tax was due till the date of its payment.

(12) Any authority not below the rank of Deputy Commissioner may serve a notice, either before or during the course of any proceedings under this Act, requiring the operator to furnish such details relating to—

(a) supplies of goods or services or both effected through such operator during any period; or

(b) stock of goods held by the suppliers making supplies through such operator in the godowns or warehouses, by whatever name called, managed by such operator and declared as additional places of business by such suppliers,

as may be specified in the notice.

(13) Every operator on whom a notice has been served under sub-section (12) shall furnish the required information within fifteen working days of the date of service of such notice.

(14) Any person who fails to furnish the information required by the notice served under sub-section (12) shall, without prejudice to any action that may be taken under section 122 , be liable to a penalty which may extend to twenty-five thousand rupees.

Explanation.—For the purposes of this section, the expression “concerned supplier” shall mean the supplier of goods or services or both making supplies through the operator.

- section 52 of CGST Act 2017 is :-

- Every electronic commerce operator;[ Section 24 of CGST Act 2017 ]

- As per Section 2(45) of CGST Act 2017 “electronic commerce operator” means any person who owns, operates or manages digital or electronic facility or platform for electronic commerce;

- Every person supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person; and [ Section 24 of CGST Act 2017 ]

- As per Section 2 (17) of IGST Act 2017 “online information and database access or retrieval services” means services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services such as,––(i) advertising on the internet;(ii) providing cloud services;(iii) provision of e-books, movie, music, software and other intangibles through telecommunication networks or internet;(iv) providing data or information, retrievable or otherwise, to any person in electronic form through a computer network;

(v) online supplies of digital content (movies, television shows, music and the like);

(vi) digital data storage; and

(vii) online gaming;

- As per Section 2 (17) of IGST Act 2017 “online information and database access or retrieval services” means services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services such as,––(i) advertising on the internet;(ii) providing cloud services;(iii) provision of e-books, movie, music, software and other intangibles through telecommunication networks or internet;(iv) providing data or information, retrievable or otherwise, to any person in electronic form through a computer network;

- Such other person or class of persons as may be notified by the Government on the recommendations of the Council.[ Section 24 of CGST Act 2017 ]

- Where a business carried on by a taxable person registered under CGST Act 2017 is transferred, whether on account of succession or otherwise, to another person as a going concern, the transferee or the successor, as the case may be, shall be liable to be registered with effect from the date of such transfer or succession. [ Section 22(3) ]

- In a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, demerger of two or more companies pursuant to an order of a High Court, Tribunal or otherwise, the transferee shall be liable to be registered, with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court or Tribunal.[ Section 22(4) ]

Compulsory Registration under Old Draft Model GST Law (Nov 2016) was required for Followings:-

i) Person making inter-state supply of goods and/or services

ii) Person who are required to pay tax under reverse charge

Reverse Charge [Section 2(85)]

“reverse charge’’, means the liability to pay tax by the person receiving goods and / or services instead of the person supplying the goods and / or services in respect of such categories of supplies as the Central or a State Government may, on the recommendation of the Council, by notification, specify;

iii) Non-resident person

Non-resident taxable person [Section 2(69)]

Non-resident taxable person” means a taxable person who occasionally undertakes transactions involving supply of goods and/or services whether as principal or agent or in any other capacity but who has no fixed place of business in India;

iv) Person who are require to deduct tax under section 37

Tax deduction at source [Section 37(1)]

Notwithstanding anything contained to the contrary in this Act, the Central or a State Government may mandate, –

(a) a department or establishment of the Central or State Government, or

(b) Local authority, or

(c) Governmental agencies, or

(d) such persons or category of persons as may be notified, by the Central or a State Government on the recommendations of the Council,

[hereinafter referred to in this section as “the deductor”], to deduct tax at the rate of one percent from the payment made or credited to the supplier [hereinafter referred to in this section as “the deductee”] of taxable goods and/or services, notified by the Central or a State Government on the recommendations of the Council, where the total value of such supply, under a contract, exceeds rupees ten lakh.

Explanation. – For the purpose of deduction of tax specified above, the value of supply shall be taken as the amount excluding the tax indicated in the invoice.

v) Person who supply goods and/or services on behalf of other registered taxable person whether as a agent or otherwise

vi) Input service distributor

Input Service Distributor [Section 2(56)]

“Input Service Distributor” means an office of the supplier of goods and / or services which receives tax invoices issued under section 23 towards receipt of input services and issues tax invoice or such other document as prescribed for the purposes of distributing the credit of CGST (SGST in State Acts) and / or IGST paid on the said services to a supplier of taxable goods and / or services having same PAN as that of the office referred to above; Explanation.- For the purposes of distributing the credit of CGST (SGST in State Acts) and / or IGST, Input Service Distributor shall be deemed to be a supplier of services.

vii) Every E-commerce operator

Electronic commerce operator [Section 43B(e)]

Electronic commerce operator’ shall include every person who, directly or indirectly, owns, operates or manages an electronic platform that is engaged in facilitating the supply of any goods and/or services or in providing any information or any other services incidental to or in connection there with but shall not include persons engaged in supply of such goods and/or services on their own behalf.

viii) Casual taxable person

Casual taxable person [Section 2(21)]

“casual taxable person” means a person who occasionally undertakes transactions involving supply of goods and/or services in the course or furtherance of business whether as principal, agent or in any other capacity, in a taxable territory where he has no fixed place of business;

ix) An aggregator who provide the service under his brand name or his trade name

x) Any person who supply of goods and/or service other than the branded through Ecommerce operator

xi) Other person notified by the Government on the recommendation of council

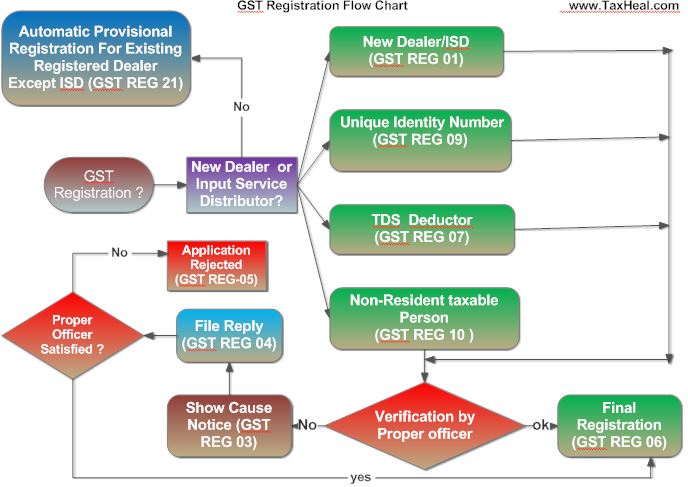

Read Flow Chart for GST Registration in India

26 Forms for Registration prescribed-26 Forms for Registration have been prescribed (Form GST REG-01 to Form GST REG-26), namely-

| Sr. No | Form Number | Content |

| 1 | GST REG 01 | Application for Registration under Section 19(1) of Goods and Services Tax Act, 20– |

| 2 | GST REG 02 | Acknowledgement |

| 3 | GST REG 03 | Notice for Seeking Additional Information/ Clarification/ Documents relating to Application for<<Registration/Amendment/Cancellation>> |

| 4 | GST REG 04 | Application for filing clarification/additional information/ document for <<Registration/Amendment/Cancellation/ Revocation of Cancellation>> |

| 5 | GST REG 05 | Order of Rejection of Application for <<Registration /Amendment / Cancellation/ Revocation of Cancellation>> |

| 6 | GST REG 06 | Registration Certificate issued under Section 19(8A) of the Goods and Services Tax Act, 20– |

| 7 | GST REG 07 | Application for Registration as Tax Deductor or Tax Collector at Source under Section 19(1) of the Goods and Service Tax Act, 20– |

| 8 | GST REG 08 | Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source under Section 21 of the Goods and Service Tax Act, 20–. |

| 9 | GST REG 09 | Application for Allotment of Unique ID to UN Bodies/Embassies /any other person under Section 19(6) of the Goods and Service Tax Act, 20–. |

| 10 | GST REG 10 | Application for Registration for Non Resident Taxable Person. |

| 11 | GST REG 11 | Application for Amendment in Particulars subsequent to Registration |

| 12 | GST REG 12 | Order of Amendment of existing Registration |

| 13 | GST REG 13 | Order of Allotment of Temporary Registration/ Suo Moto Registration |

| 14 | GST REG 14 | Application for Cancellation of Registration under Goods and Services Tax Act, 20–. |

| 15 | GST REG 15 | Show Cause Notice for Cancellation of Registration |

| 16 | GST REG 16 | Order for Cancellation of Registration |

| 17 | GST REG 17 | Application for Revocation of Cancelled Registration under Goods and Services Act, 20–. |

| 18 | GST REG 18 | Order for Approval of Application for Revocation of Cancelled Registration |

| 19 | GST REG 19 | Notice for Seeking Clarification/Documents relating to Application for << Revocation of Cancellation>> |

| 20 | GST REG 20 | Application for Enrolment of Existing Taxpayer |

| 21 | GST REG 21 | Provisional Registration Certificate to existing taxpayer |

| 22 | GST REG 22 | Order of cancellation of provisional certificate |

| 23 | GST REG 23 | Intimation of discrepancies in Application for Enrolment of existing taxpayer |

| 24 | GST REG 24 | Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Services Tax Act 20– |

| 25 | GST REG 25 | Application for extension of registration period by Casual / Non-Resident taxable person. |

| 26 | GST REG 26 | Form for Field Visit Report |

Free Education Guide on Goods & Service Tax (GST)

Pingback: Notification No 31/2019 Central Tax : CGST (Fourth Amendment)