Rule – 8A of Employees’ Deposit-Linked Insurance Scheme 1976

1 Recovery of damages for default in payment of any contribution

8A. 2[(1) Where an employer makes default in the payment of any contribution to the Insurance Fund, or in the payment of any charges payable under any other provisions of the Act or the Scheme, the Central Provident Fund Commissioner or such officer as may be authorised by the Central Government, by notification in the Official Gazette, in this behalf, may recover from the employer by way of penalty, damages at the rates given in the table below :

TABLE

| S. No. | Period of default | Rates of damages (percentage of arrears per annum) |

| (1) | (2) | (3) |

| (a) | Less than two months | Five |

| (b) | Two months and above but less than four months | Ten |

| (c) | Four months and above but less than six months | Fifteen |

| (d) | Six months and above | Twenty-five] |

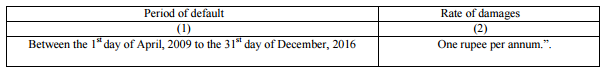

[ Above Table substituted by following Table by Notification No G.S.R. 1192(E). 30th December, 2016 ]

“TABLE

(Applicable for remittances in respect of valid declarations under Employees’ Enrolment Campaign, 2017)

(2) The damages shall be calculated to the nearest rupee, 50 paise or more to be counted as the nearest higher rupee and a fraction of a rupee less than 50 paise to be ignored.