THE GAZETTE OF INDIA : EXTRAORDINARY [PART III—SEC. 4]

INSURANCE REGULATORY AND DEVELOPMENT AUTHORITY OF INDIA

NOTIFICATION

Hyderabad, the 13th June, 2016

Insurance Regulatory and Development Authority of India

(Issuance of e-Insurance Policies) Regulations, 2016

F .No. IRDAI/Reg/16/128/2016 – In exercise of the powers conferred by section 14 (2) read with clause (gb) of sub section 2 of section 114A of “The Insurance Act, 1938” and subsection (1) of Section 26 of the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999), the Insurance Regulatory and Development Authority of India, in consultation with the Insurance Advisory Committee, hereby makes the following Regulations for Issuance of electronic policy and submission of electronic proposal form of insurance policies:

CHAPTER I

Preliminary

1. Short title and commencement

(i) These Regulations may be called the Insurance Regulatory and Development Authority of India (Issuance of e-Insurance Policies) Regulations, 2016.

(ii) They shall come into force from 1st October, 2016.

2. Definitions

In these regulations, unless the context otherwise requires:-

(i) “Act” means the Insurance Act, 1938 (4 of 1938) as amended from time to time;

(ii) “Authority” means the Insurance Regulatory and Development Authority of India established under the provisions of Section 3 of the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999);

(iii) “e-Insurance Account” or “eIA” is an electronic account opened by a person with an insurance repository wherein the portfolios of insurance policies of a policyholder are held in an electronic form.

(iv) “e-signature or electronic signature” shall have the same meaning as specified in the IT (Information Technology) Act, 2000 as amended from time to time.

(v) “Digital Signature” shall have the same meaning as specified in the IT Act, 2000 as amended from time to time.

(vi) “e-proposal” or “electronic proposal” means a proposal form for an insurance policy filed in electronic form by the prospect with his electronic signature.

(vii) “e-insurance policy” or electronic insurance policy” shall mean a policy document which is an evidence of insurance contract issued by an insurer and digitally signed in accordance with the applicable provisions prescribed by law and issued in an electronic form either directly to the policyholder by the insurer or through the platform of registered Insurance repository.

(viii) All words and expressions used herein and not defined in these Regulations but defined in the Insurance Act, 1938(4 of 1938), or in the Insurance Regulatory and Development Authority Act, 1999 (41 of 1999) or Rules or Regulations made thereunder shall have the same meanings respectively assigned to them in those Acts, Rules or Regulations

CHAPTER II

e- Proposal Form & Issuance of e-Insurance Policy

3. e-proposal form

(i) Every insurer soliciting insurance business through electronic mode shall create an e-proposal form similar to the physical proposal form approved by the Authority. Such form should enable capture of information in electronic form that would enable easy processing and servicing.

(ii) The e-Proposal form shall also have a provision to capture the electronic Insurance Account (eIA) number which shall be filled by prospect wherever available.

(iii) Every such insurer shall also make available physical version of e-proposal form as mentioned at (i) & (ii) above. Where the information is captured in physical form, then the insurer shall make necessary arrangements to convert the information furnished by prospects into electronic version.

(iv) In case the prospect does not have an eIA number, the insurer shall facilitate the creation of eIA number wherever the electronic insurance policy is proposed to be issued through the Insurance Repository System.

(v) When the prospect furnishes the details in e-proposal form, it shall carry his electronic signature.

4. Issuance of electronic Insurance Policies:

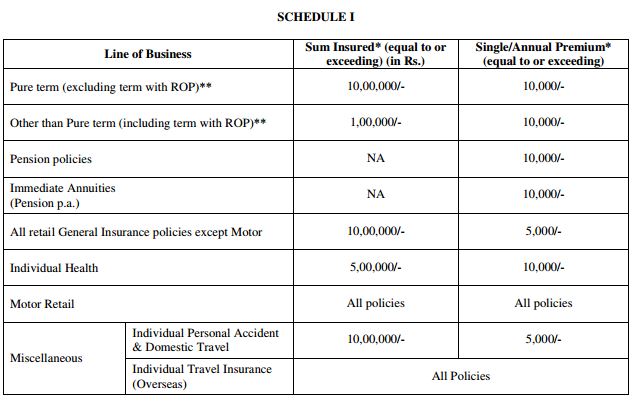

(i) Every insurer shall issue electronic insurance policies that fulfill the criteria given in Schedule I in terms of Sum Assured or Premium.

(ii) Electronic insurance policies may be issued by the Insurers either directly to the policyholders or through the registered Insurance Repositories.

(iii) All policies issued in electronic form by the Insurer directly to the policyholder shall also be issued in physical form. In all such cases, copies of the proposal form, etc shall also be sent in physical form : Provided that the Authority, on being satisfied that it is in the interests of policyholders and for orderly growth of Insurance Industry, exempts such issuance in physical form: Provided further that such exemptions may stipulate conditions specified to be fulfilled by the Insurer.

(iv) Physical version of the electronic insurance policies need not be issued when electronic insurance policies are issued through the platform of registered Insurance Repositories. Similarly, copies of the proposal form etc may also be sent in electronic form to the insured along-with electronic insurance policies.

(v) The electronic insurance policies not exempt by the Authority as stipulated at (iii) above shall, if issued only in electronic form, be only through the registered Insurance repositories.

(vi) Electronic Insurance Policies shall be deemed compliant only when issued with digital signature in accordance with applicable provisions prescribed by law.

(vii) The physical form of the electronic Insurance Policy referred in (iii) above shall be a replica of the electronic form.

(viii) For the issue of electronic insurance policies, the operational framework would be as specified by the Authority under the guidelines on Insurance repositories and electronic issuance of insurance policies issued in this behalf.

(ix) For the issue of electronic insurance policies that are outside the ambit of the stipulations prescribed in Schedule-I, the guidelines referred in (viii) above shall also apply

5. Miscellaneous

i. Discount on electronic insurance policies – An insurer may offer discount in the premium rates to the policyholders for such electronic insurance policies exempt from issuance in physical form. Such discount shall be in accordance with the discount rates filed under the Product Approval or the File & Use guidelines or as specified by the Authority.

ii. Existing policies – The policyholders who wish to avail the facility of electronic insurance policy may register their choice with the insurer.

iii. Mandatory issuance of e-insurance policies in disaster prone and other vulnerable areas – Every insurer shall mandatorily issue electronic insurance policies in disaster prone and vulnerable areas as specified by the Authority.

6. Power of the Authority to issue clarifications etc:

In order to remove any difficulties in application or interpretation of any of the provisions of these Regulations, the Chairperson of the Authority may issue clarifications, directions and guidelines in the form of circulars/guidelines.

* Electronic policy shall be issued if either the Sum Insured or Single/Annual Premium criteria is met.

** Micro-insurance policies are exempted :

T .S. VIJAYAN, Chairman

[ADVT. III /4/Exty./161/16]

Related Post

- Tax benefits of Life Insurance Policy

- Tax on maturity of Insurance Policy

- IRDA Assets, Liabilities, and Solvency Margin of Life Insurance Business Regulations 2016

- IRDA Expenses of Management of Insurers transacting General or Health Insurance business Regulations 2016

- Assets, Liabilities, and Solvency Margin of General Insurance Business Regulations, 2016

- IRDA Appointment of Insurance Agents Regulations 2016

- AUDITORS’ REPORT OF INSURANCE COMPANIES

- INSURANCE : MASTER DIRECTION