e-Verification User Manual For Form 35

- e-Verify Form 35 (Individuals)

- e-Verify Form 35(other than Individuals)

Electronic Verification Code (EVC) has been enabled for online filing of appeal before Commissioner (Appeal) in Form 35 for taxpayers not required to file using DSC.

Related Post

1, Online filing of Appeal before CIT (appeals) enabled

2. How to e -file appeal with CIT (appeals)

3 E filing of Income tax Appeal to CIT (appeals)

4. Challan for Income Tax Appeal Fees

e-Verify Form 35 (Individuals)

Login to e-Filing Portal (www.incometaxindiaefiling.gov.in)

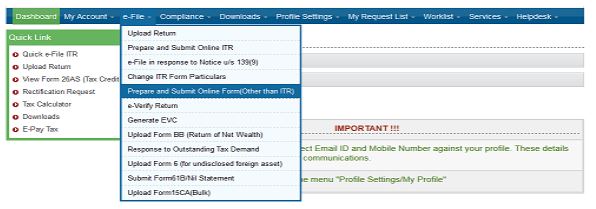

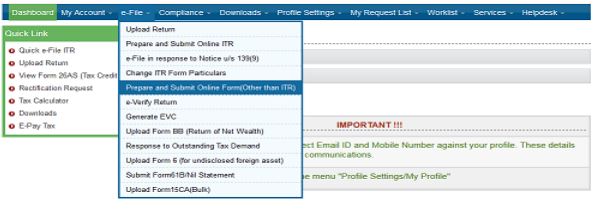

Click “e-File” Select “Prepare and Submit Online Form(other than ITR)”

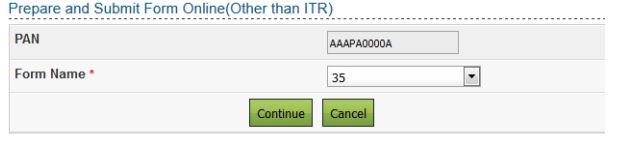

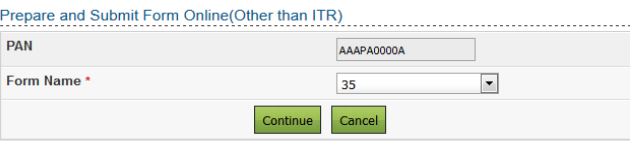

Select the Form Name as 35 from the drop down and click “Continue”.

Carefully read the instructions and fill the Form accordingly. Once the Form is filled, Click on “Submit”.

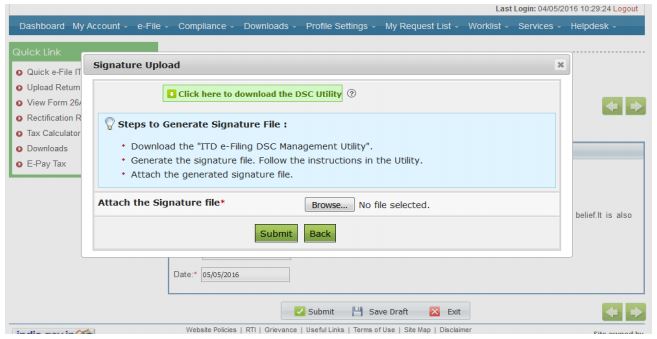

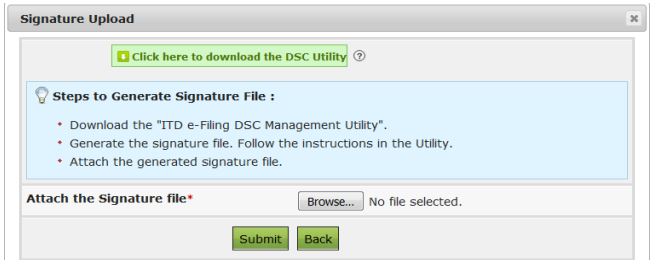

After the successful submission of the form, the below screen will be displayed if the taxpayer has a DSC registered in the profile.

Attach the signature file generated using DSC Management Utility and click “Submit”.

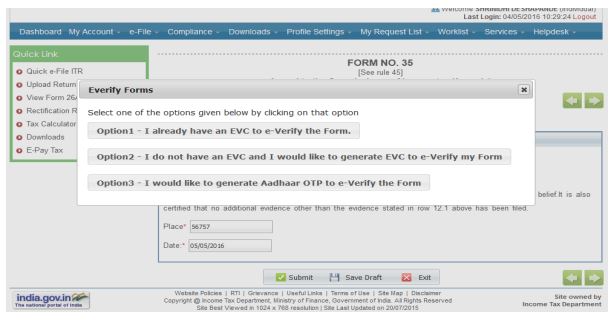

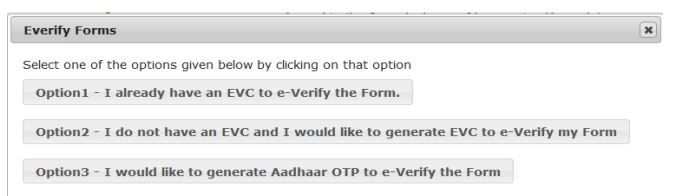

If the taxpayer does not have a DSC registered in the profile then the following screen will be displayed.

Taxpayer can select any one of the options listed above.

If the taxpayer has pre-generated the EVC, click on the “Option 1 – I already have an EVC to e-Verify the Form”. The following pop up will be displayed.

Enter the pre-generated EVC (all the types of EVC are accepted except e-Filing OTP) and click on Submit. The Form gets submitted and the taxpayer will be redirected to the success screen.

If the Taxpayer does not have a pre-generated EVC, click on the button “Option2 – I do not have an EVC and I would like to generate EVC to e-Verify my Form”, the pop up will be displayed as shown below.

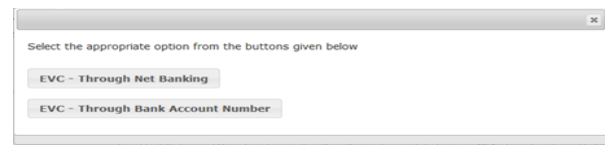

There are two options available for the Taxpayer.

1. EVC – through Net Banking

2. EVC – through Bank Account Number

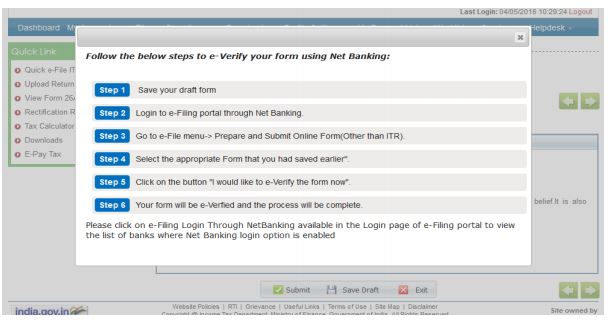

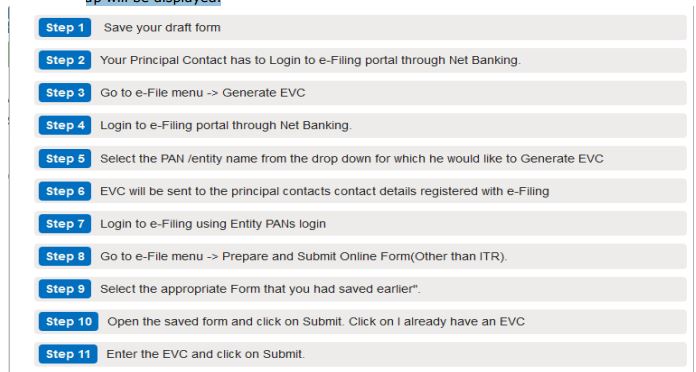

If the taxpayer clicks on the button “EVC – through Net Banking”, following are the steps to e-Verify your form using Net Banking.

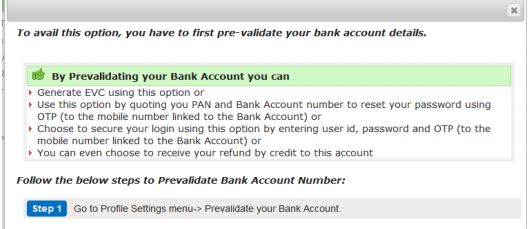

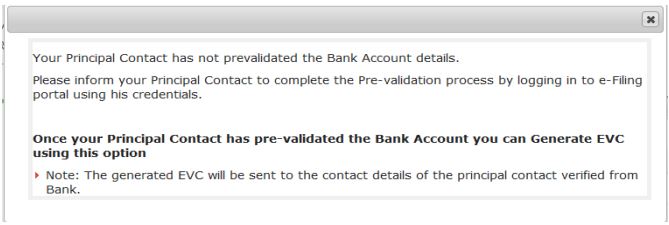

The taxpayer should have pre validated the bank account details in order to avail the option “EVC-Through Bank Account Number”.

If the taxpayer has not pre-validated the bank account details, then the below pop up will be displayed.

Go to Profile Settings Pre validate Your Bank Account

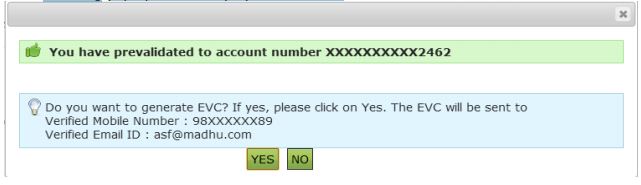

If the taxpayer has successfully pre-validated the bank account details then the following pop up will be displayed on submit.

If the taxpayer proceeds by clicking on YES, then the EVC is generated and sent to the Verified Email ID and Mobile Number. The below pop up will be displayed.

Taxpayer has to enter the EVC in the text box provided and click on Submit. Form gets submitted and the taxpayer will be redirected to the success screen

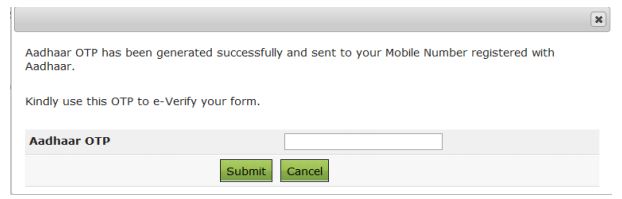

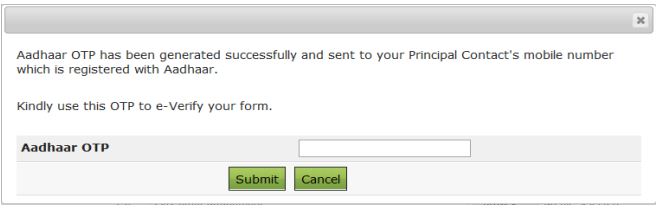

If Taxpayer clicks on the button “Option 3 – I would like to generate Aadhaar OTP to e-Verify the Form”, the below pop up will be displayed.

Taxpayer enters the Aadhaar OTP in the text box provided and clicks on Submit. Form gets submitted and the taxpayer will be redirected to the success screen

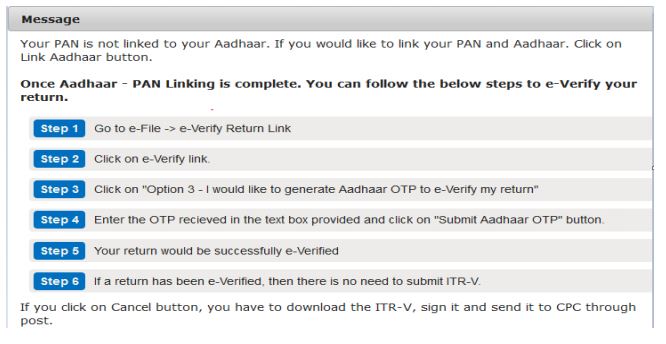

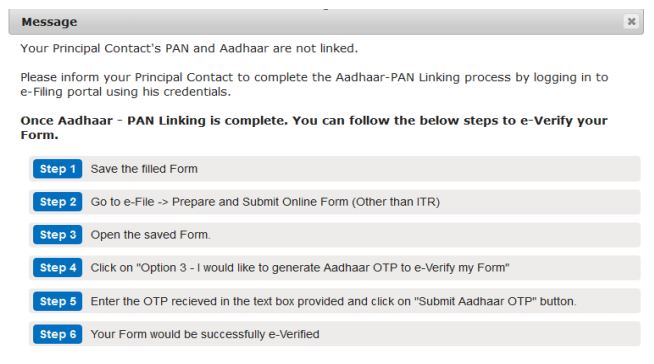

If Aadhaar PAN is not linked, then the following screen appears

Upon the successful submission of the form, transaction id is generated and the confirmation mail is sent to the registered email id.

e-Verify Form 35(other than Individuals)

Login to e-Filing Portal Click “e-File”

Select “Prepare and Submit Online Form(other than ITR)”

Select the form name as 35 from the drop down and click “Continue”

Carefully read the instructions and fill the form accordingly. Once the form is filled, click on “Submit”. If the entity’s profile has a DSC registered then the below screen will be displayed.

Attach the signature file generated using DSC Management Utility and Submit.

If the entity’s profile does not have a DSC registered, then the below screen will be displayed.

If the entity has pre-generated the EVC, then “Option 1 – I already have an EVC to e-Verify the Form” can be clicked. The below pop up will be displayed.

Enter the EVC and Click on Submit

If the entity does not have a pre-generated EVC, click on the button “Option2 – I do not have an EVC and I would like to generate EVC to e-Verify my Form”, the below pop will be displayed with the two options.

1. EVC – through Net Banking

2. EVC – through Bank Account Number

If the entity clicks on the button “EVC – through Net Banking”, the below pop up will be displayed.

The entity can avail the option “EVC – through Bank Account Number”, if the principal contact has pre validated bank account details.

If the bank account details are not pre validated, then the following pop up gets displayed.

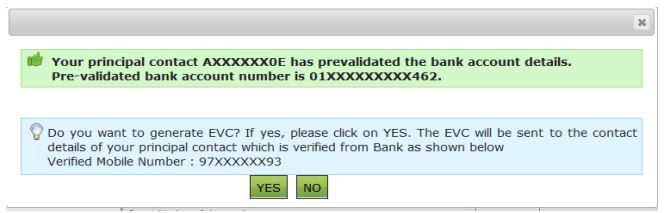

Upon the successful pre validation of the bank account details, the following message is displayed on the screen

If the entity proceeds by clicking on YES, then the EVC is generated and sent to the principal contact’s Verified Email ID and Mobile Number. The below pop up will be displayed.

Entity has to enter the EVC in the text box provided and click on Submit. Form gets submitted and the taxpayer will be redirected to the success screen

Entity can avail the “Option3 – I would like to generate Aadhaar OTP to eVerify the Form”, if the principal contact has completed the Aadhaar PAN linking process.

If the Entity’s principal contact has not completed the Aadhaar PAN linking procedure then the below screen will be displayed.

Upon the linking successfully, generate EVC by logging in from principal contact’s e-Filing personal login through Net banking.

Transaction ID is generated and the confirmation mail is sent to the registered mail id as shown below.