e-Verify Income tax Returns

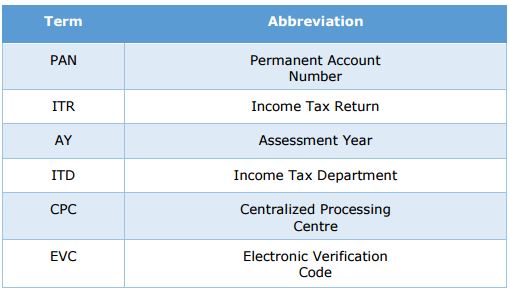

List of Abbreviations

Introduction

Income Tax Return filed by the taxpayer is not treated as valid until it is verified by the taxpayer. In the existing process, taxpayer can verify the return using Digitally Signed Certificate or by sending signed ITR-V to CPC. As per Rule 12 vide Notification No. 41/2015, Income Tax department has introduced e-Verification of returns as an alternate for ITR-V. Taxpayers who are NOT mandated to use DSC are eligible for e-Verification.

e-Verification of Income tax Returns : Process

Taxpayer has an option to e-Verify the return at the time of uploading / after uploading. In case of already uploaded return, tax payer can still e-Verify the same through “e-File e-Verify Return” option after login. Taxpayer can e-Verify the return using the below modes

EVC received in Registered Mobile number and e-mail. Electronic Verification Code (EVC) is a 10 digit alphanumeric code which can be generated through e-Filing portal and is valid for 72 hours.

Aadhaar OTP

Login to e-Filing through Net Banking

Steps to e-Verify Income tax Returns

Login to e-Filing Portal (incometaxindiaefiling.gov.in)

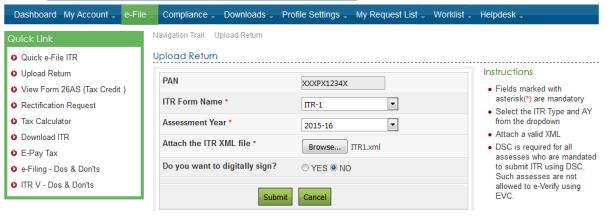

Click “e-File” Select “Upload Return” to upload a return

Select the Assessment year, ITR name from the drop down and browse the XML to be uploaded and click on submit button as shown below.

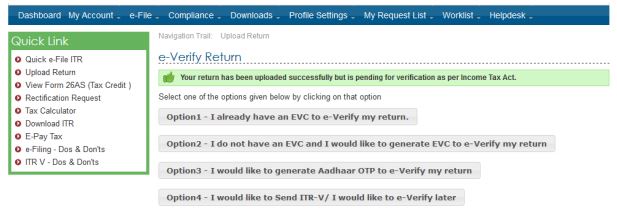

Taxpayers are provided with four options as displayed below.

Option 1 – “I already have an EVC to e-Verify my return.”

Option 2 – “I do not have an EVC and I would like to generate EVC to e-Verify my return.”

Option 3 – “I would like to generate Aadhaar OTP to e-Verify my return.”

Option 4 – “I would like to send ITR-V/ I would like to e-Verify later.”

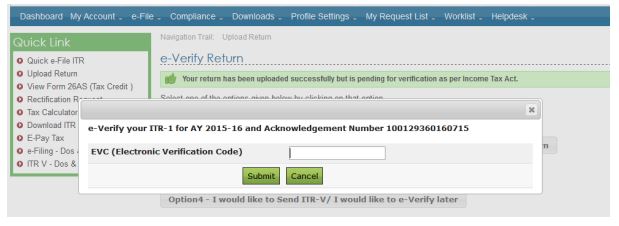

Option 1: “I already have an EVC to e-Verify my return”

Taxpayer once clicks on “I already have an EVC to e-Verify my return” the below screen is displayed

Taxpayer need to enter the pre generated EVC in the provided text box and Click “Submit” to e-Verify. No Further action required.

Option 2: “I do not have an EVC and I would like to generate EVC to e-Verify my return”

Taxpayer once clicks on “I do not have an EVC and I would like to generate EVC to e-Verify my return”.

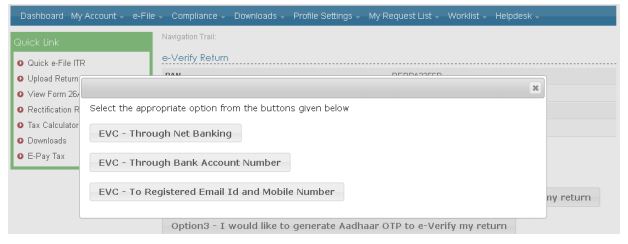

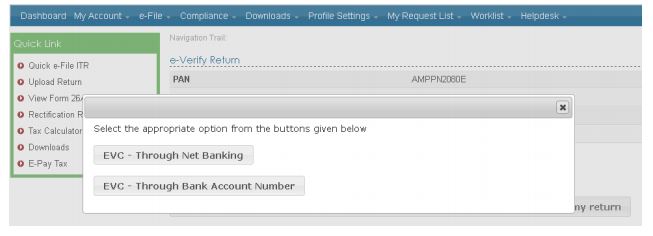

1. If the taxpayer’s income is less than 5 lakhs and if there is no refund, then the below screen is displayed to the taxpayer

2. If the taxpayer’s income is more than 5 lakhs or if there is refund, then the below screen is displayed to the taxpayer

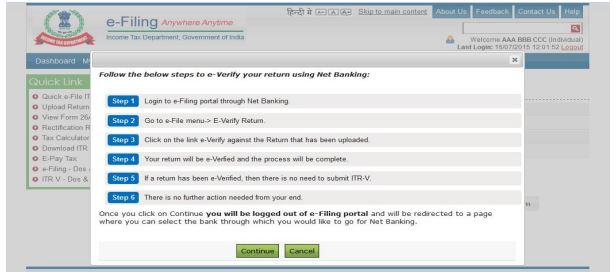

EVC – through Net Banking

Click “EVC – through Net Banking”

Click on “Continue”, Taxpayer is logged out of e-Filing and will be redirected to the list of banks available for Net Banking Login.

Login to e-Filing through Net Banking. The below screen is displayed after login.

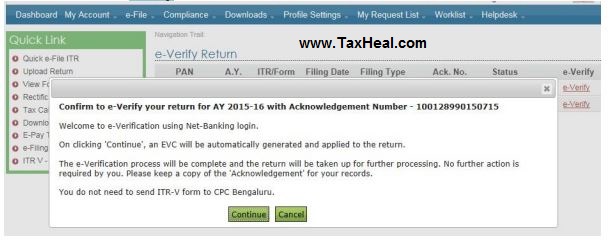

Click on “e-Verify” link.

Confirm to e-Verify by clicking on Continue button.

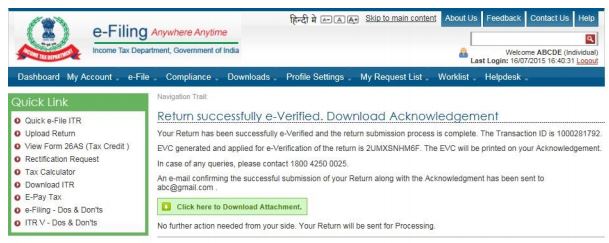

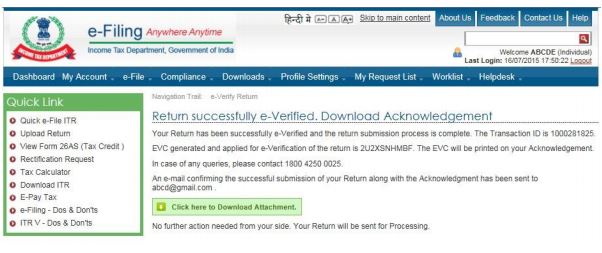

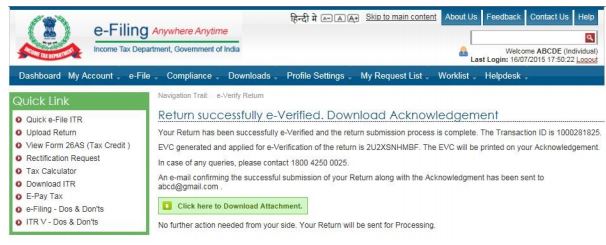

Success message will be displayed. No further action is required.

EVC – Through Bank Account Number

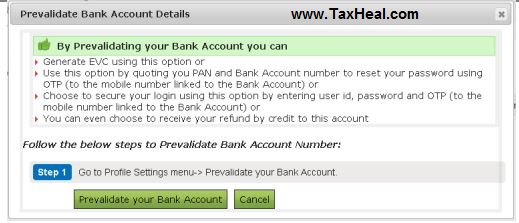

Pre-requisite: To generate EVC – Through Bank Account Number, Bank Account Number must be pre-validated.

Click “EVC – Through Bank Account Number ”

If Bank Account Number is not pre-validated, the below screen appears.

Click “Prevalidate your Bank Account”.

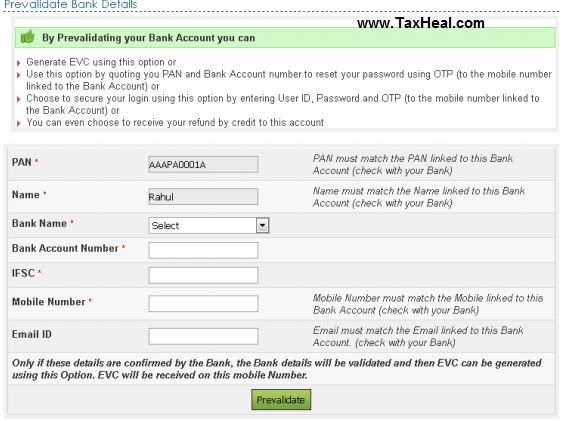

Select the Bank Name, enter the Bank Account Number, IFSC, Mobile Number and click Prevalidate.

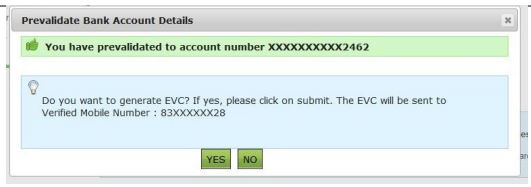

On Pre-validation, the success page appears.

If Bank Account Number is already pre-validated, the below screen appears.

Click on “Yes” to generate EVC.

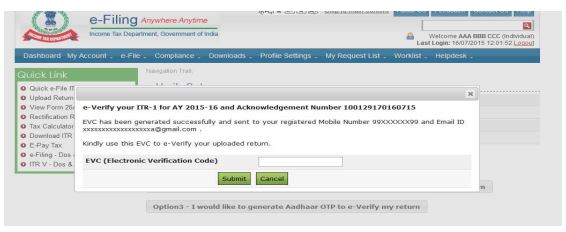

Success message is displayed on the screen.

EVC – To Registered Email Id and Mobile Number

Click “EVC – to Registered Email Id and Mobile Number” (This option would be available for taxpayer whose Total income is Less than 5 Lakhs and there is no Refund)

Enter the EVC received in your Mobile Number and Email Id in the provided text box and Click “Submit”. No Further action is required.

Success message will be displayed. No further action is required.

Option 3: “I would like to generate Aadhaar OTP to e-Verify my return.

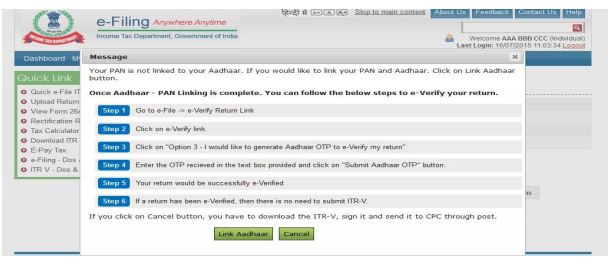

Pre-requisite: To generate Aadhaar OTP, Taxpayer’s PAN and Aadhaar must be linked.

If the Taxpayer’s PAN and Aadhaar are not linked, the below pop up is displayed.

Click Link Aadhaar, taxpayer will be redirected to Link Aadhaar Page under Profile Settings Taxpayer to enter the Aadhaar Number to link his/her Aadhaar to PAN.

If the Taxpayer’s PAN and Aadhaar are linked, the below pop up is displayed.

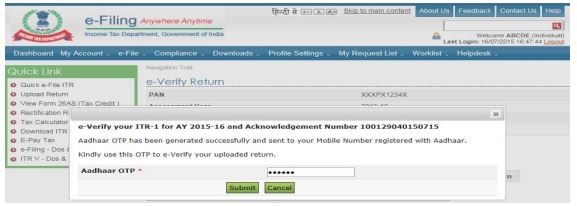

OTP is generated and sent to the Mobile Number registered with Aadhaar.

Enter the OTP received in your Mobile Number in the provided text box.

Enter Aadhaar OTP in the text box provided and click on Submit. Success page is displayed. No further action is required.

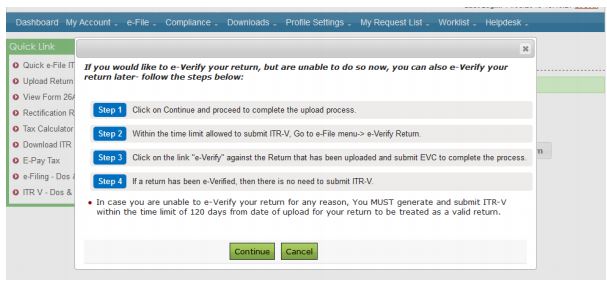

Option 4: “I would like to send ITR-V/ I would like to eVerify later.’

If the taxpayer is not able to e-Verify at this moment because of any reason then tax payer can choose Option 4 – “I would like to send ITR-V/ I would like to e-Verify later.”

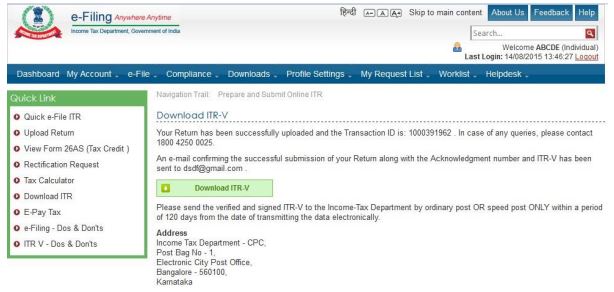

Click on Continue. Success page is displayed where the tax payer can download the ITR-V.

Download the ITR-V, sign it manually and send it to CPC through post within the time limit of 120 days from date of upload for your return to be treated as a valid return.

Related post

SBI ATM to e verify income tax return by EVC

How to e verify ITR (Income Tax Return ) : User Guide

how to generate evc for itr ,how to e verify itr,evc income tax,what is generate evc,

what is evc in itr,how to everify itrv from axis bank,how to get evc for e verify,e verification of itr v,evc in itr,e verify itr,evc not received income tax,evc code generation