E-Way Bill New Analytic Reports in Officer (MIS) Module

(Some are available and others will come in 15 days)

1. Tax Payer-wise outward/inward supplies (Available)

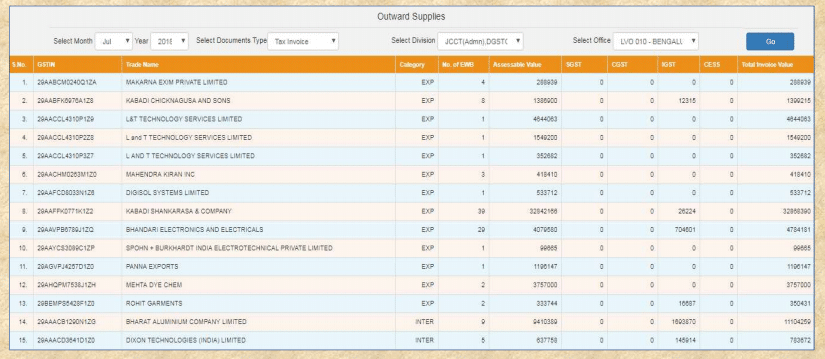

– Using the Outward Supplies option under Summary Reports, officer can view the monthly reports for all the outward supplies for a selected office and month. This can be used to compare with the filing/non-filing of the return 3B by the tax payer and taxable values declared in the return 3B. EWB details prove that he has carried out the business in the said month and might have non-filed return 3B or nil-filed return 3B or less declared in the return 3B.

Similarly, using the Inward Supplies option, officer can view the monthly reports for all the inward supplies for a selected month and office. This also can be used to compare with the input tax claimed in the return 3B.

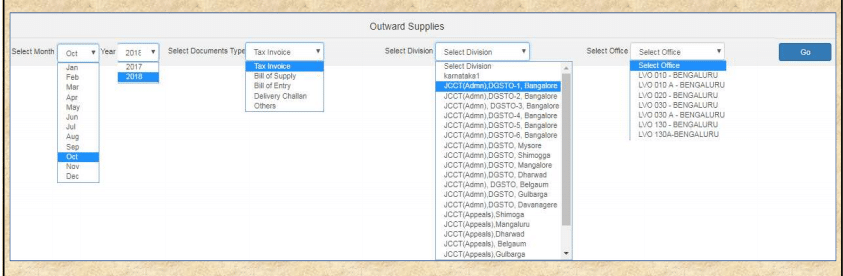

Selection of relevant parameters for Outward Supplies Report

Outward Supplies Report based on selected parameters

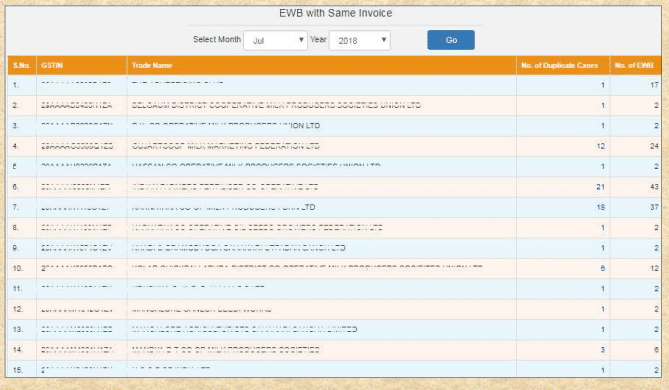

2. Multiple EWBs with same invoice (Available)

• Analytic Report on “Multiple EWBs with same invoice” will identify the number e-Way Bills which have been generated by a tax payer with the same document and same invoice number. This report will assist the officer in identifying the recycling of the invoice number in EWBs which might have eventually led to tax evasion.

E Way Bill with same Invoice

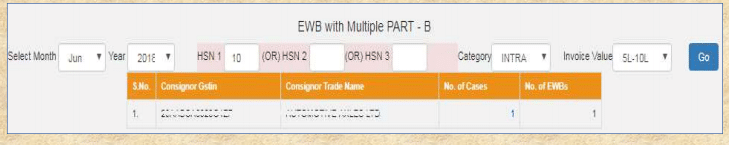

3. EWBs with Multiple Part-B (Available)

• Analytic Report on “EWB with multiple Part-B” will help the officer to get the list of EWBs having invoice value of greater than Rs. 5 Lakhs and has with multiple part-B updations.

Ideally, the high value consignment will move from source location to destination location in one conveyance without transshipment. Based on this report, the officer can examine the EWB in details and investigate the genuineness of the Part-B updation. That is, the EWB is not recycled by moving in multiple vehicles and updating the Part-B. Based on such findings and using his judgement, the officer can ascertain if EWB recycling has been done by the dealer and can take

appropriate action against him if required.

E Way Bill with Multiple Part B.

Next Reports will come around 15th Oct 2018

4. EWBs by newly registered tax payers with high EWB turnover

• This analytic report will give the list of newly registered tax payers, who have generated the EWBs

and turnover of the EWBs is abnormal during last 2-3 months. This list can be used by the enforcement officers to further investigate the genuineness of the transactions and tax payers. This is basically to find out the fly-by operator type of tax payers.

5. EWBs by composition tax payers with high EWB turnover

• This analytic report will show the list of tax payers, who have registered as composition tax payers in GST system, but has EWBs with abnormal turnover. The listed tax payers could have EWBS with large values as supplier or recipient

6. EWBs with ODC transactions

•This analytic report will list the list of tax payers, who have defined the EWBs for movement

under vehicle type as ‘Over Dimensional Cargo’. This will assist the officer to investigate further

to find out whether the commodities moved by these tax payers really need the ODC and ODC

type of vehicle has been used.

7. EWBs by multiple times penalized vehicles

•This analytic report will show the list of penalized vehicles through EWB-03 and it will show the transactions being carried out by them currently.

8. List of Vehicles with recorded as ‘NO EWB’

•This analytic report will display the list of vehicles, caught by the officers without EWBs on the road. This will help to keep the watch on them for repeated frauds.

9. EWBs cancelled for distance of 100 KMs after 2 hours of generation

•This analytic report will give the list of tax payers who have generated the EWBs with 100 KMs,

but have cancelled it after 2 hours. This can be used to investigate further to find out whether

the tax payer is using the rule to his advantage of moving the consignment within 2 hours and

cancelling afterwards

10. EWBs cancelled for distance of 200 KMs after 4 hours of generation

•This analytic report will list the tax payers who have generated the EWBs with 100-200 KMs, but

have cancelled it after 4 hours. This can be used to investigate further to find out whether the tax

payer is using the rule to his advantage of moving the consignment within 4 hours and

cancelling afterwards.

11. EWBs cancelled during last hour of cancellation time

•This is another analytic report on the cancellation. Here, the EWBs have been generated and transactions could have been completed by moving the goods to the destination and at the nth hour, it could have been cancelled. The further investigation will help to pin point the tax evasion, if any.

12. EWBs extended for short distance

•This analytic report will display the list of tax payers who have extended the EWBs for distance of less than 500 KMs and repeatedly also. The investigation will through light on the recycling of the EWBs by the tax payers, if any.

13. EWBs updated with Part-B after verification

•This analytic report will highlight the EWBs which have been updated with the Part-B after verification. The further investigation, of when and where it has been checked and updated, will assist to find out the recycling of the EWBs, if any