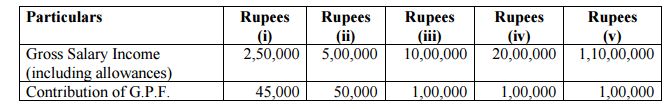

Various Examples to Calculate Income tax for Employee for FY 2015-16 (AY 2016-17)

Example 1

For Financial Year 2015-16

Assessment Year 2016-17

(A) Examples to Calculate Income tax for Employee (Male or Female) below the age of sixty years and having gross salary income of:

i) Rs.2,50,000/- ,

ii) Rs.5,00,000/- ,

iii) Rs.10,00,000/-

iv) Rs.20,00,000/-. and

v) Rs. 1,10,00,000/-

B) What will be the amount of TDS in case of above employees, if PAN is not submitted by them to their DDOs/Offices:

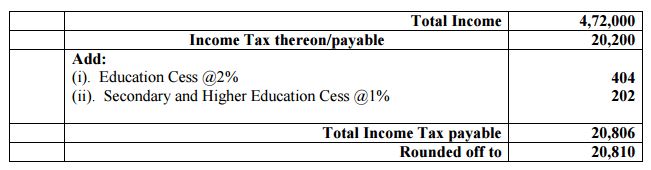

Computation of Total Income and tax payable thereon

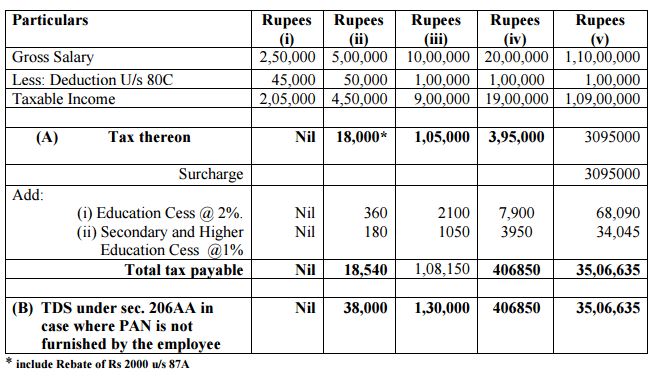

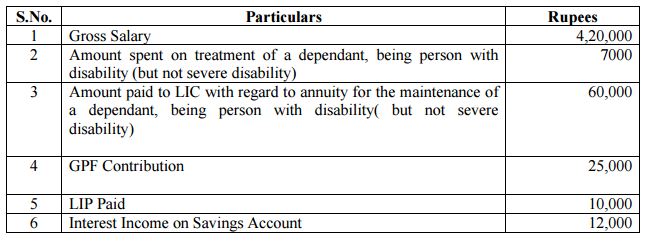

Example 2

For Financial Year 2015-16

Assessment Year 2016-17

Calculation of Income Tax in the case of an employee below the age of sixty years having a handicapped dependent (With valid PAN furnished to employer).

Computation of Tax

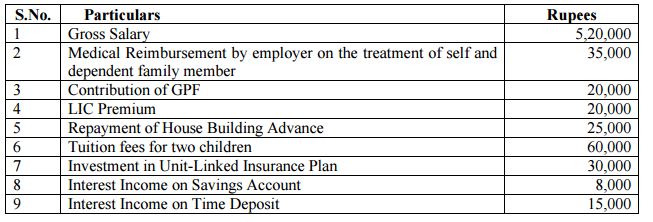

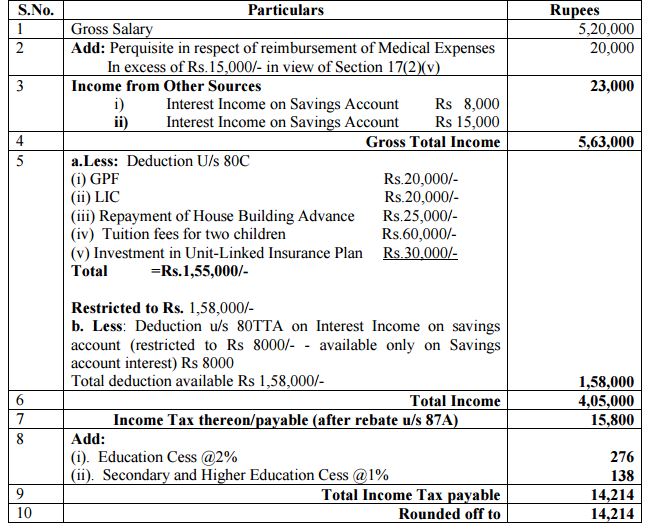

Example 3

For Financial Year 2015-16

Assessment Year 2016-17

Calculation of Income Tax in the case of an employee below age of sixty years where medical treatment expenditure was borne by the employer (With valid PAN furnished to employer).

Computation of Tax

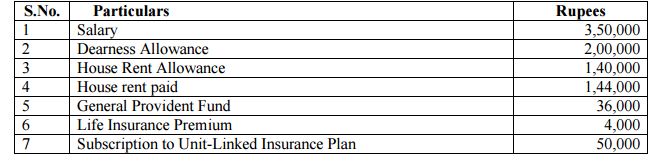

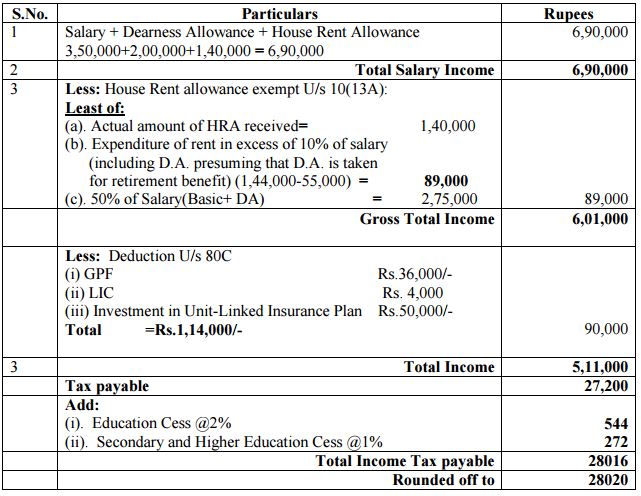

Example 4

For Financial Year 2015-16

Assessment Year 2016-17

Illustrative calculation of House Rent Allowance U/s 10 (13A) in respect of residential accommodation situated in Delhi in case of an employee below the age of sixty years (With valid PAN furnished to employer).

Computation of total income and tax payable thereon

Example 5

For Financial Year 2015-16

Assessment Year 2016-17

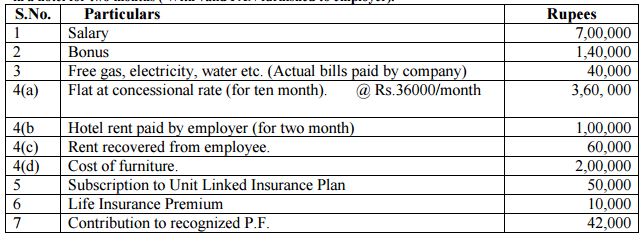

Illustrating valuation of perquisite and calculation of tax in the case of an employee below age of sixty years of a private company in Mumbai who was provided accommodation in a flat at concessional rate for ten months and in a hotel for two months ( With valid PAN furnished to employer).

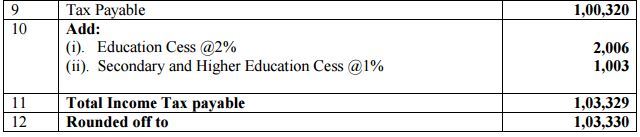

COMPUTATION OF TOTAL INCOME AND TAX PAID THEREON:

Example 6

For Financial Year 2015-16

Assessment Year 2016-17

Illustrating Valuation of perquisite and calculation of tax in the case of an employee below the age of 60 years of a Private Company posted at Delhi and repaying House Building Loan ( With valid PAN furnished to employer).

Computation of total income and tax payable thereon

Example 7

For Financial Year 2015-16

Assessment Year 2016-17

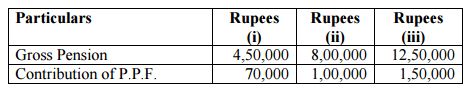

A. Calculation of Income tax in the case of a retired employee above the age of sixty years but below the age of 80 years and having gross pension of:

iv) Rs.4,50,000/-,

v) Rs.8,00,000/- ,

vi) Rs. 12,50,000/-.

B What will be the amount of TDS in case of above employees, if PAN is not submitted by them to their DDOs/Offices

Computation of Total Income and tax payable thereon

Example 8

For Financial Year 2015-16

Assessment Year 2016-17

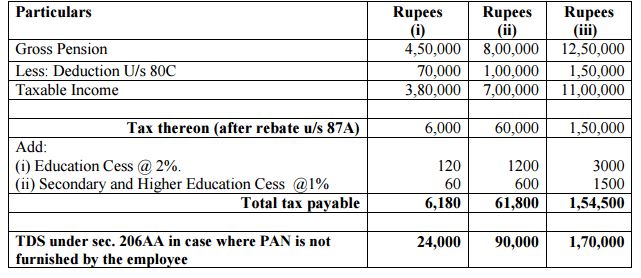

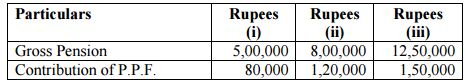

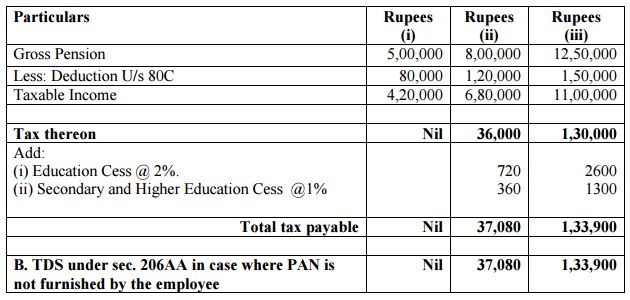

A. Calculation of Income tax in the case of a retired employee above the age of 80 years and having gross pension of:

i) Rs.5,00,000/-,

ii) Rs.8,00,000/- ,

iii) Rs. 12,50,000/-.

B What will be the amount of TDS in case of above employees, if PAN is not submitted by them to their DDOs/Offices:

Computation of Total Income and tax payable thereon

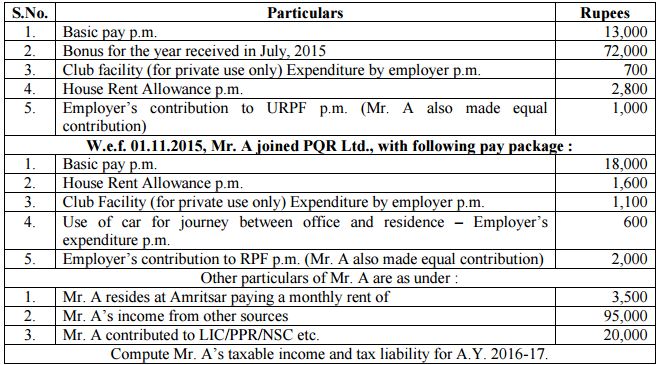

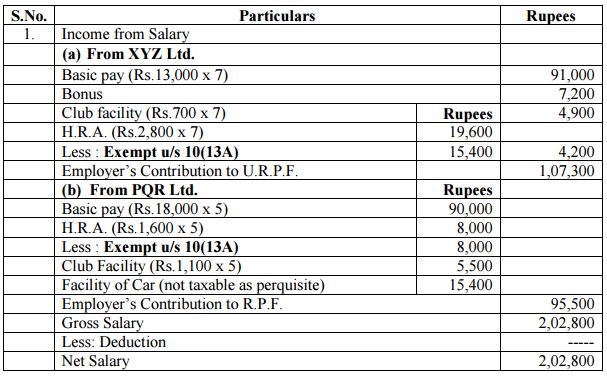

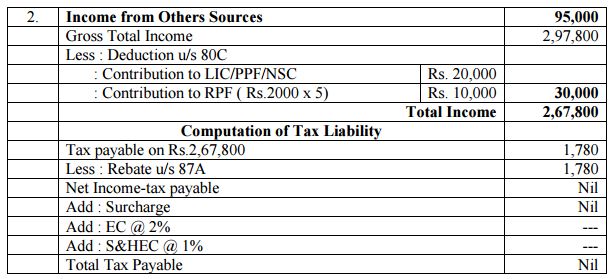

Example 9

For Financial Year 2015-16

Assessment Year 2016-17

Exemption u/s 10 (13A)

1. Mr. A, employed with XYZ Ltd. Up to 31.10.2015, received following emoluments :

Computation of Tax

Example 10

For Financial Year 2015-16

Assessment Year 2016-17

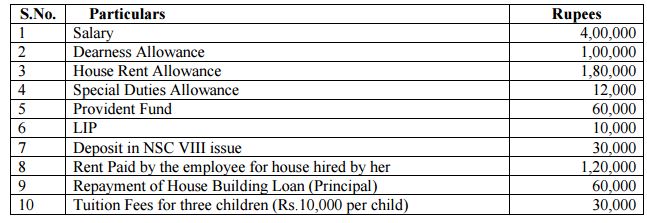

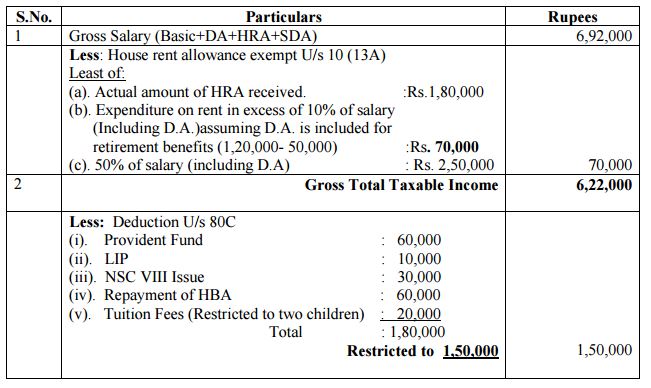

2. One Computation of Taxable Salary and allowances, Deduction for Interest on Housing Loan and Deduction u/s 80C.

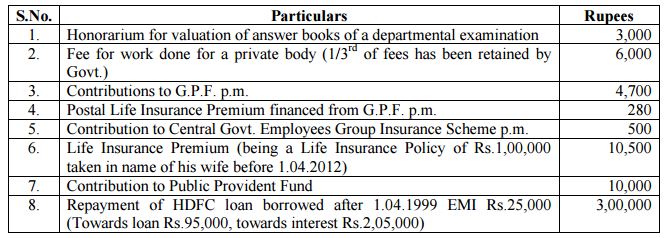

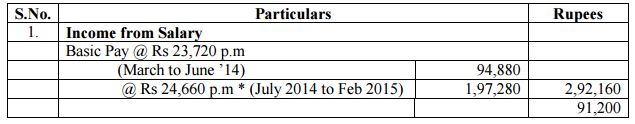

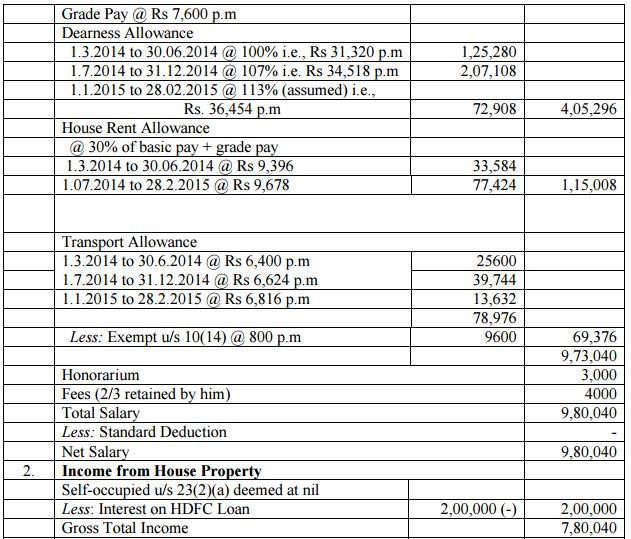

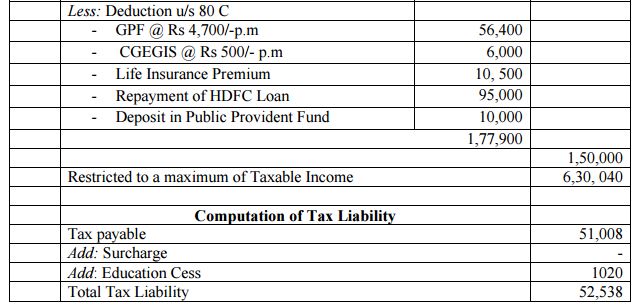

Mr. X, a Central Govt. Officers in Delhi, is receiving Basic Pay Rs.23,720, grade Pay Rs.7,600, DA at prescribed rates, transport allowances @ Rs.3200+DA thereon, and HRA 30% of basic pay + grade pay (though living in his own house). His date of increment is Ist July. The following are other particulars of his income. Compute his taxable income and tax payable, for A.Y.2015-16.

Computation of Tax