Excise on Jewellery

LETTER D.O.F. NO.334/8/2016-TRU, DATED 29-2-2016 Explaining Excise on Jewellery

3.2.1 Excise duty of 1% (without CENVAT credit) or 12.5% (with CENVAT credit) is being levied on articles ofjewellery [excluding silver jewellery, other than studded with diamonds/other precious stones] with a higher threshold exemption upto Rs. 6 crore in a year and eligibility limit of 12 crore. Thus, a jewellery manufacturer will be eligible for exemption from excise duty on first clearances upto Rs. 6 Crore during a financial year, if his aggregate domestic clearances during preceding financial year were less than Rs. 12 crore. In other words,jewellery manufacturer having aggregate value of clearances in a financial year exceeding Rs. 12 crore, will not be eligible for this threshold exemption in the subsequent financial year. Necessary amendments have been made in notification No.8/2003-Central Excise, dated 1-3-2003 in this regard.

3.2.2 The SSI exemption for the month of March, 2016 for jewellery manufacturers will be Rs.50 lakh, subject to the condition that value of clearances for home consumption from one or more manufacturer from one or more factory or premises of production or manufacture during the financial year 2014-15 should not be more than Rs. 12 crore. Computation for this purpose shall be done in accordance with the provisions of Para 3A of notification No. 8/2003- CE. For this purpose, a certificate from a Chartered Accountant, based on the books of accounts for 2014-15, shall suffice.

3.2.3 Similarly, for determining the eligibility for availing of the SSI exemption from 2016-17 onwards, a certificate from a Chartered Accountant, based on the books of accounts for 2015-16, shall suffice.

3.2.4 Excisable goods which were produced on or before 29-2-2016 but lying in stock as on 29-2-2016 shall attract excise duty upon clearance. Jewellery manufacturer shall keep a stock declaration of finished goods, goods-in-process and inputs as on 29-2-2016 in their records duly certified by a Chartered Accountant so as to enable the manufacturers to claim CENVAT credit on inputs or inputs contained in goods lying in stock as already provided for in Rule 3(2) of the CENVAT Credit, Rules, 2004, if he so desires. No stock declaration, will, however, be required to be made to the jurisdictional central excise authorities.

3.2.5 Further, the following simplified procedure and guidelines are being issued for strict compliance:

| i. | Registration once applied for shall be granted within two working days, along with simplified registration procedure as prescribed under Notification No. 35/2001-CE. | |

| ii. | Further, the requirement of post registration physical verification of the premises has been also done away with in this case. Necessary amendments have been made to Notification No. 35/2001-CE for this purpose. | |

| iii. | Moreover, documents being maintained by the jewellery manufacturers for State VAT or Bureau of Indian Standards (in the case of hallmarked jewellery) shall suffice for Excise purposes also. | |

| iv. | The private records of the jewellery manufacturers, giving details of daily stock for his own purposes, shall be accepted for the purposes of Rule 10 of the Central Excise Rules 2002. | |

| v. | A notification, providing for an optional centralized central excise registration for jewellerymanufacturers with centralized billing or accounting system is being issued under Rule 9 (2) of the Central Excise Rules, 2002. | |

| vi. | Also, jewellery manufacturers will be eligible for a simplified return applicable for optional exciseduty of 1%/2% without CENVAT credit under notification No.1/2011-CE, under Rule 12 of the Central Excise Rules, 2002. | |

| vii. | Rule 12AA of the Central Excise Rules, 2002 provides that in case of goods falling under chapter heading 7113, every person (not being an EOU or SEZ unit) who gets jewellery made from any other person, and supplies the raw materials such as gold/silver/gemstones to the job-worker for such manufacture, the duty liability would be on such person who gets articles of jewellery made from the job worker. In such cases, the principal manufacturer (and not job worker) will be required to get Central Excise registered, pay duty and follow other compliance requirements. This will ensure that small artisans/goldsmiths are not required to take any excise registration. | |

| viii. | The levy is based on self-assessment and therefore, no physical visits shall be made to registered units in the normal course. |

Chapter 71: Excise relating to Excise on Jewellery

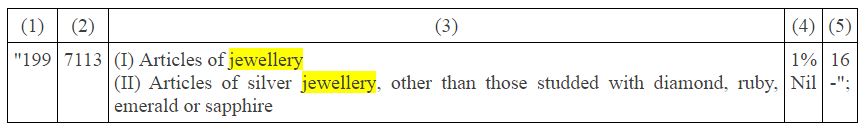

| (1) | Basic Excise Duty of 1% (without Cenvat Credit) and 12.5% (with Cenvat Credit) is being imposed on Articles of Jewellery [excluding articles of silver jewellery, other than those studded with diamonds, ruby, emerald or sapphire]. S. No. 199 of Notification No. 12/2012-Central Excise, dated 17th March, 2012 as amended by notification No. 12/2016-Central Excise dated 1st March, 2016 refers. | |

| (2) | SSI threshold exemption for Articles of Jewellery [excluding articles of silver jewellery, other than those studded with diamonds, ruby, emerald or sapphire] is being increased to Rs. 6 crore in a year, with an eligibility limit of Rs. 12 crore in the preceding financial year. For the month of March, 2016, the SSI exemption for such articles of jewellery is being restricted to Rs. 50 lakh. Notification No. 8/2003-Central Excise, dated 1st March, 2003 as amended by notification No. 8/2016-Central Excisedated 1st March, 2016 refers. | |

| (3) | Optional centralized registration is being extended to manufacturers of Articles of Jewellery[excluding articles of silver jewellery, other than studded with diamonds, ruby, emerald or sapphire]. Notification No. 5/2016- Central Excise (N.T.) dated 1st March, 2016 refers. | |

| (4) | Requirement of post registration physical verification for manufacturers of Articles of Jewellery[excluding articles of silver jewellery, other than studded with diamonds, ruby, emerald or sapphire] is being done away with. Notification No. 35/2001-Central Excise (N.T.), dated 26th June, 2001 is being amended suitably by notification No. 6/2016- Central Excise (N.T.) dated 1st March, 2016 refers. | |

| (5) | Basic Excise duty on Gold Bars manufactured from gold ore or concentrate; gold dore bar and silver dore bar is being increased from 9% to 9.5%. S. No. 189 of Notification No.12/2012- Central Excise, dated 17th March, 2012 as amended by notification No. 12/2016- Central Excise dated 1st March, 2016 refers. | |

| (6) | Basic Excise duty on Gold bars and gold coins of purity not below 99.5%, produced during the process of copper smelting is being increased from 9% to 9.5%. S. No. 191 (i) of Notification No.12/2012- Central Excise, dated 17th March, 2012 as amended by notification No. 12/2016- CentralExcise dated 1st March, 2016 refers. | |

| (7) | Basic Excise duty on silver manufactured from silver ore or concentrate; silver dore bar and gold dore bar is being increased from 8% to 8.5%. S. No. 190 of Notification No. 12/2012-Central Excise, dated 17th March, 2012 as amended by notification No. 12/2016-Central Excise dated 1st March, 2016 refers. | |

| (8) | Basic Excise duty on silver in any form, except silver coins of purity below 99.9%, produced during the process of copper smelting is being increased from 8% to 8.5%. S. No. 191 (ii) of Notification No. 12/2012- Central Excise, dated 17th March, 2012 as amended by Notification No. 12/2016- CentralExcise dated 1st March, 2016 refers. | |

| (9) | Basic Excise duty on silver produced during the process of zinc or lead smelting is being increased from 8% to 8.5%. S. No. 191A of Notification No. 12/2012- Central Excise, dated 17th March, 2012 as amended by notification No. 12/2016-Central Excise dated 1st March, 2016 refers. |

EXCISE ON JEWELLERY : PROCEDURE FOR OBTAINING CENTRALIZED REGISTRATION FOR MANUFACTURERS OF ARTICLES OF JEWELLERY

NOTIFICATION NO.5/2016-C.E. (N.T.), DATED 1-3-2016

In exercise of the powers conferred by sub-rule (2) of rule 9 of the Central Excise Rules, 2002, the Central Board of Excise and Customs hereby exempts from the operation of said rule, every manufacturing factory or premises engaged in the manufacture or production of articles of jewellery other than articles of silver jewellerybut inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule to the Central Excise Tariff Act, 1985 (5 of 1986) (herein after referred to as the specified goods), where the manufacturer of such goods has a centralised billing or accounting system in respect of such specified goods manufactured or produced by different factories or premises and opts for registering only the factory or premises or office, from where such centralised billing or accounting is done and where the accounts/records showing receipts of raw materials and finished excisable goods manufactured or received back from job workers are kept.

2. For availing the exemption contained herein, the manufacturer taking the centralised registration shall give details of all premises (other than those of job worker’s), from where such specified goods are removed for domestic clearance.

3. Notwithstanding anything contained in this notification, a manufacturer of specified goods may also take separate registrations for all factories or premises where the accounts/records showing receipts of raw materials and finished excisable goods manufactured or received back from job workers are kept.

EXCISE ON JEWELLERY :EXTENSION OF TIME LIMIT FOR TAKING CENTRAL EXCISE REGISTRATION OF AN ESTABLISHMENT

CIRCULAR NO.1026/14/2016-CX, DATED 23-4-2016

Kindly refer to the Circular No. 1021/9/2016-CX, dated 21-3-2016 issued vide F. No. 354/25/2016-TRU.

2. In this regard, the time-limit for taking central excise registration of an establishment by a jeweller is being extended up to 1-7-2016. Though, the liability for payment of central excise duty will be with effect from 1st March, 2016, the assessee jewellers may make the payment of excise duty for the months of March, 2016, April, 2016 and May, 2016 along with the payment of excise duty for the month of June, 2016.

3. Wide publicity may be given to this circular. Difficulty, if any, in implementing the circular should be brought to the notice of the Board.

Excise on Jewellery : No post Registration Physical verification of Jeweller

Normally the authorized officer shall verify the premises physically within seven days from the date of receipt of application through online but in case of Jeweller’s Physical verification is not to be done as per the following notification.

NOTIFICATION NO.6/2016-C.E. (N.T.), DATED 1-3-2016

In exercise of the powers conferred by rule 9 of the Central Excise Rules, 2002, the Central Board of Excise and Customs hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 35/2001-Central Excise (N.T.), published in the Gazette of India, Extraordinary, Part II, section 3, sub-section (i) vide number G.S.R. 464 (E), dated the 26th June, 2001, namely :—

In the said notification, in clause (8), after sub-clause (ii), the following sub-clause shall be inserted, namely,—

“(iii) Every manufacturing factory or premises engaged in the manufacture or production of articles ofjewellery other than articles of silver jewellery but inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule to the CentralExcise Tariff Act, 1985 (5 of 1986), shall be exempted from sub-clauses (i) and (ii) above.”.

EXCISE ON JEWELLERY: GRANT EXEMPTION FROM DUTY OF EXCISE (First Clearance of Jewellery upto an aggregate value not exceeding six crore rupees)

NOTIFICATION NO.8/2016-C.E., DATED 1-3-2016

In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excise Act, 1944 (1 of 1944), the Central Government, on being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 8/2003-Central Excise dated the 1st March, 2003, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 138 (E) dated, the 1st March, 2003, namely :—

In the said notification,—

| (a) | in the Table, after serial number 2, and the entries relating thereto, the following serial number and entries shall be inserted, namely:— |

| (1) | (2) | (3) |

“3 | First clearances of the articles of jewellery for home consumption, other than articles of silver jewellery but inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule upto an aggregate value not exceeding six crore rupees made on or after the 1st day of April in any financial year, from the whole of the duty of excise specified thereon in the First Schedule : Provided that during the period starting from 1st March, 2016 and ending on 31st March, 2016, the exemption shall apply to the first clearances of the articles of jewellery for home consumption, other than articles of silver jewellery but inclusive of articles of silverjewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule, up to an aggregate value not exceeding fifty lakh rupees. | Nil.”; |

| (b) | in paragraph 2,— |

| (i) | in sub-paragraph (iii), for the proviso, the following shall be substituted, namely:— |

| “Provided that the manufacturer of the articles of jewellery other than articles of silver jewellerybut inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule shall not avail the credit of duty on inputs under rule 3 or rule 11 of the said rules, paid on inputs used in the manufacture of these goods cleared for home consumption, the aggregate value of first clearances of which, as calculated in the manner specified in the said Table does not exceed six crore rupees : | |

| Provided further that nothing contained in this sub-paragraph shall apply to the inputs used in the manufacture of specified goods bearing the brand name or trade name of another person, which are ineligible for the grant of this exemption in terms of paragraph 4;”; | |

| (ii) | in sub-paragraph (iv), the following proviso shall be inserted, namely:— |

| “Provided that the manufacturer of the articles of jewellery other than articles of silver jewellerybut inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule also does not utilise the credit on capital goods under rule 3 or rule 11 of the said rules, paid on capital goods, for payment of duty, if any, on the aforesaid clearances, the aggregate value of first clearances of which does not exceed six crore rupees, as calculated in the manner specified in the said Table;”; | |

| (iii) | in sub-paragraph (vii), for the proviso, the following shall be substituted, namely:— |

| “Provided that aggregate value of clearances of all excisable goods for home consumption by a manufacturer of the articles of jewellery other than articles of silver jewellery but inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule, from one or more factory or premises of production or manufacture, or from a factory or premise of production or manufacture by one or more manufacturers, does not exceed rupees twelve crore in the preceding financial year;”; |

| (c) | in paragraph 3, for the words beginning with “For the purposes of determining”, and ending with “taken into account, namely :—”, the following shall be substituted, namely:— |

| “For the purposes of determining the first clearances upto an aggregate value not exceeding one hundred and fifty lakh rupees made against serial number 1 or upto an aggregate value not exceeding six crore rupees made against serial number 3, of the said Table, as the case may be, on or after the 1st day of April in any financial year, the following clearances shall not be taken into account, namely:—”; | |

| (d) | after paragraph 4B, the following paragraph shall be inserted namely:— |

| “4C. Notwithstanding anything contained in the preceding paragraphs, the exemption in respect of goods bearing a brand name or sold under a brand name and having a retail price (RSP) of Rs. 1000 and above, falling under Chapters 61, 62, 63 (except laminated jute bags falling under 6305, 6309 00 00, 6310), shall be restricted to rupees twelve lakh fifty thousand for the remaining part of the financial year 2015-16.”; | |

| (e) | in the Explanation, for clause (G), the following shall be substituted, namely :— |

| “(G) “clearances for home consumption”, wherever referred to in this notification, shall include clearances for export to Bhutan;”. |

EXCISE ON JEWELLERY : NOTIFICATION NO.8/2016-C.E. (N.T.), DATED 1-3-2016

In exercise of the powers conferred by section 37 of the Central Excise Act, 1944 (1 of 1944), the Central Government hereby makes the following rules further to amend the Central Excise Rules, 2002, namely:—

1. (1) These rules may be called the Central Excise (Amendment) Rules, 2016.

(2) They shall come into force from the 1st April, 2016 except the provisions of rule 2, rule 3, rule 4 and rule 7, which shall come into force from the 1st of March, 2016 and the provisions of clause (v) of rule 5 and rule 6, which shall come into force from such date as the Central Government may, by notification, specify.

—-

—–

3. In the said rules, in rule 8, in the second proviso, for Explanation -1, the following shall be substituted, namely:—

“Explanation-1. – For the removal of doubts, it is hereby clarified that,—

| (a) | an assessee, engaged in the manufacture or production of articles of jewellery, other than articles of silver jewellery but inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule of the Tariff Act shall be eligible, if his aggregate value of clearances of all excisable goods for home consumption in the preceding financial year, computed in the manner specified in the said notification, did not exceed rupees twelve crore; |

| (b) | an assessee, other than (a) above, shall be eligible, if his aggregate value of clearances of all excisablegoods for home consumption in the preceding financial year, computed in the manner specified in the said notification, did not exceed rupees four hundred lakhs.”. |

EXCISE ON JEWELLERY : NOTIFICATION NO.12/2016-C.E., DATED 1-3-2016

In exercise of the powers conferred by sub-section (1) of section 5A of the Central Excise Act, 1944 (1 of 1944), the Central Government, being satisfied that it is necessary in the public interest so to do, hereby makes the following further amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.12/2012-Central Excise, dated the 17th March, 2012, published in the Gazette of India, Extraordinary, Part II, section 3, sub-section (i) vide number G.S.R. 163(E), dated the 17th March, 2012, namely: —

In the said notification,—

—

(B) in the Table,—

—–

(xv) for serial number 199 and the entries relating thereto, the following shall be substituted, namely:—

EXCISE ON JEWELLERY :CENVAT CREDIT (THIRD AMENDMENT) RULES, 2016

NOTIFICATION NO.13/2016-C.E. (N.T.), DATED 1-3-2016

In exercise of the powers conferred by section 37 of the Central Excise Act, 1944 (1 of 1944) and section 94 of the Finance Act, 1994 (32 of 1994), the Central Government hereby makes the following rules further to amend the CENVAT Credit Rules, 2004, namely:—

1. (1) These rules may be called the CENVAT Credit (Third Amendment) Rules, 2016.

(2) Save as otherwise provided, they shall come into force on the 1st day of April, 2016.

…….

………

4. In rule 4 of the said rules,—

| (a) | in sub-rule (2), in clause (a), for the Explanation, the following shall be substituted with effect from 1st day of March, 2016, namely:— |

| “Explanation. – For the removal of doubts, it is hereby clarified that— |

| (i) | an assessee engaged in the manufacture of articles of jewellery, other than articles of silverjewellery but inclusive of articles of silver jewellery studded with diamond, ruby, emerald or sapphire, falling under chapter heading 7113 of the First Schedule of the Excise Tariff Act, shall be eligible, if his aggregate value of clearances of all excisable goods for home consumption in the preceding financial year, computed in the manner specified in the said notification, did not exceed rupees twelve crore; |

| (ii) | an assessee, other than (a) above, shall be eligible, if his aggregate value of clearances of allexcisable goods for home consumption in the preceding financial year, computed in the manner specified in the said notification, did not exceed rupees four hundred lakhs.”. |

EXCISE ON JEWELLERY : CLARIFICATIONS ON LEVY IMPOSED ON JEWELLERY

PRESS RELEASE, DATED 4-3-2016

In this year’s Budget, a nominal excise duty of 1% [without input tax credit] and 12.5% [with input tax credit] has been imposed on articles of jewellery. Even for this nominal 1% excise duty, manufacturers are allowed to take credit of input services, which can be utilised for payment of duty on jewellery.

Some doubts have been expressed by the trade and industry regarding this levy. In that context, salient features of this levy are explained as under:

- Easy compliance with provision for on line application for registration, payment of excise duty and filing of returns, with zero interface with the departmental officers.

- The central excise officers have been directed not to visit the premises of Jewellery manufacturers.

- Articles of silver jewellery [other than those studded with diamonds, ruby, emerald or sapphire] are exempt from this duty.

- An artisan or goldsmith who only manufactures jewellery on job-work basis is not required to register with the Central Excise, pay duty and file returns, as all these obligations will be on the principal manufacturers [Rule 12AA of the Central Excise Rules, 2002].

- There is a substantially high Small Scale Industries excise duty exemption limit of Rs. 6 crore in a year [as against normal SSI exemption limit of Rs. 1.5 crore] along with a higher eligibility limit of Rs. 12 crore [as against normal SSI eligibility limit of Rs. 4 crore].

- Thus, only if the turnover of a jeweler during preceding financial year was more than Rs. 12 crore, he will be liable to pay the excise duty. Jewelers having turnover below Rs. 12 crore during preceding financial year will be eligible for exemption unto Rs. 6 crore during next financial year. Such small jewelers will be eligible for exemptions upto Rs. 50 lakh for the month of March, 2016.

- For determination of eligibility for the SSI exemption for the month of March, 2016 or financial year 2016-17, a certificate from a Chartered Accountant, based on the books of accounts for 2014-15 and 2015-16 respectively, would suffice.

- Further, facility of Optional Centralized Registration has also been provided. Thus, there is no need for a jewellery manufacturer to take separate registrations for all his premises.

- Field formations have been directed to grant hassle free registrations, within two working days of submission of the registration application. Further, there will be no post registration physical verification of the premises [online registration – https://www.aces.gov.in/].

- Jeweler’s private records or records for State VAT or records for Bureau of Indian Standards (in the case of hallmarked jewellery) will be accepted for all Central Excise purposes. Also, there is no requirement to file a stock declaration to the jurisdictional central excise authorities.

- Excise duty is to be paid on monthly basis and not on each clearance, with first installment of duty payment for the month of March, 2016 to be paid by 31st March for March, 2016.

- A simplified quarterly return has also been prescribed, for duty paying jewelers [ER-8].

- Moreover, simplified export procedure is available for exempted units [Part III of chapter 7 of CBEC’s Central Excise Manual].

Useful link:http://www.cbec.gov.in/htdocs-cbec/ub1617/do-ltr-jstru1-revised.pdf

Excise on Jewellery :-Government clarifies to the Jewellery Industry about the issues relating to imposition of Excise Duty on articles of Jewellery with simplified procedures.

PRESS RELEASE, DATED 18-3-2016

In the General Budget for 2016-17, a nominal excise duty of 1% [without input tax credit] and 12.5% [with input tax credit] has been imposed on articles of jewellery with simplified procedures. Salient features of the simplified procedures for this levy have been explained vide press release issued by the Government on 4th of March, 2016.

In this connection, on 17th of March, 2016, a number of representatives of jewellery industry met Secretary (Revenue), Government of India and Chairman (Central Board of Excise &Customs) to discuss the concerns regarding imposition of this levy.

During the meeting, the aforesaid representatives inter-alia raised the following issues:

a) Re-imposition of levy will bring back regime of erstwhile Gold control Act leading to harassment of Jewellers, especially artisans and small goldsmiths.

b) This will also result in visits of Inspectors to the Jewellers thereby bringing back the days of Inspector Raj.

c) Who has to take excise registration and file return?

d) What documents are to be maintained for excise purposes?

The representatives of industry also requested for increase in exemption limit of Rs. 6 crore in a year to Rs.10 crore, and urged for an early consideration of the same.

Regarding concerns relating to procedures and compliance to the levy, the representatives of industry were informed that all these issues have already been clarified vide Chairman’s D.O. letter dated 3rd March, 2016 to field formations and the Press release dated 4th March, 2016, copies of which were also provided to them.

Further, in the meeting, the following was clarified:

a) In case of jewellery manufactured on job work basis, the liability to take registration, pay duty and to file return is on the principal manufacturer and not on the job worker.

b) Further, exemption from excise duty up to the clearance limit of Rs. 6 crore is available to a jewellery manufacturer if his aggregate value of domestic clearances is less than Rs. 12 crore in the preceding financial year.

c) Artisans and job-workersare not covered within the ambit of this duty and thus they are not required to take registration, pay duty, file returns and maintain any books of account.

d) A jewellery manufacturer having turnover less than Rs. 12 crore during the preceding financial year and less than Rs. 6 crore in the current financial year is not required to take registration and file return.

e) Application for excise registration as well as returns can be filled online [https://www.aces.gov.in/].

f) Directions have been issued to the field formations to provide hassle free registration within two working days. There will be no post registration physical verification of the jeweller’s premises.

g) There is no requirement of declaring pre-budget stocks. Directions have also been issued barring any visits to the jeweller’s premises.

h) Jeweller’s private records or his records for State VAT or for Bureau of Indian Standards (in the case of hallmarked jewellery) would be accepted for all Central Excise purposes.

Useful links:

1) http://www.cbec.gov.in/htdocs-cbec/ub1617/do-ltr-jstru1-revised.pdf

EXCISE ON JEWELLERY :CONSTITUTION OF SUB-COMMITTEE OF HIGH LEVEL COMMITTEE TO INTERACT WITH TRADE & INDUSTRY ON TAX LAWS

CIRCULAR NO.1021/9/2016-CX, DATED 21-3-2016

In the Budget 2016-17, Central Excise duty at the rate of 1% (without input tax credit) and 12.5% (with input tax credit) has been imposed on all articles of jewellery (except for silver jewellery, other than those studded with diamond, ruby, emerald or sapphire).

2 In this regard, it has been decided to constitute a Sub-Committee of the High Level Committee to Interact with Trade & Industry on Tax Laws, chaired by Dr. Ashok Lahiri, which will consist of:

| a. | three representatives of the trade [to be decided by the Government]; | |

| b. | one legal expert [to be decided by the Government]; | |

| c. | officer concerned from the Ministry of Commerce & Industry [MoC&I] to be nominated by the MoC&I; and | |

| d. | high level officials from the central excise department to be nominated by the Central Board of Exciseand Customs. |

The composition of the Sub-Committee will be circulated once the names of its members are finalized.

3. All associations will be given an opportunity to submit representation before the sub-committee in writing and the all India associations to state their case in person.

4. Terms of reference of the Sub-Committee will include the issues related to compliance procedure for theexcise duty, including records to be maintained, forms to be filled including Form 12AA, operating procedures and any other issued that may be relevant. The Sub-Committee will submit its report within 60 days of its constitution.

5. Till the recommendations of the Sub-Committee are finalized, the following shall be adhered to:

| (a) | All payments of central excise duty will be based on first sale invoice value; | |

| (b) | The central excise authorities will not challenge the valuation given in the invoice provided the caratage purity and weight of the gold/silver with precious stones; and carats of diamond/precious stones are mentioned on the invoice; | |

| (c) | The central excise officers will not visit the manufacturing units/ shops/ place of business/residence of the jewellers; | |

| (d) | No arrest or criminal prosecution of any jeweller will be done; | |

| (e) | No search or seizure of stocks by any central excise official will be effected; | |

| (f) | Exporters will be allowed to export on self declaration and submission of LUT to customs without the need to get LUT ratified by central excise. Prevailing system will continue. |

6 The registration of the establishment with the central excise department can be taken within 60 days from 1st March, 2016. However, the liability for payment of central excise duty will be with effect from 1st March, 2016, and as a special case for the month of March, 2016, the assessee jewellers will be permitted to make payment ofexcise duty along with the payment of excise duty for the month of April, 2016.

7. Any further communications with the regard to the aforesaid Sub-Committee may be addressed to the office of the High Level Committee (HLC), Suite NO. 215, the Janpath Hotel, Janpath Road, opp. BSNL Building, New Delhi-110001.

8. Wide publicity may be given to this circular. Difficulty, if any, in implementing the circular should be brought to the notice of the Board.

EXCISE ON JEWELLERY : CONSTITUTION OF SUB-COMMITTEE OF HIGH LEVEL COMMITTEE TO INTERACT WITH TRADE AND INDUSTRY THEREON

CIRCULAR NO.1025/13/2016-CX, DATED 22-4-2016

In continuation to the Circular No. 1021/9/2016-CX dated 21-3-2016, issued vide F. No. 354/25/2016-TRU, the composition of the Sub-Committee referred to therein would be as under:

| (i) | Dr. Ashok Lahiri, Chairman. | |

| (ii) | Shri Gautam Ray, Member. | |

| (iii) | Shri Rohan Shah, Legal expert [Managing Partner, Economic Laws Practice]. | |

| (iv) | Shri Manoj Kumar Dwivedi, Joint Secretary [Department of Commerce]. | |

| (v) | Shri Alok Shukla, Joint Secretary [Tax Research Unit, Central Board of Excise and Customs, Department of Revenue]. |

2. Names of the trade representatives in the Sub-Committee would be decided in consultation of with Dr. Ashok Lahiri, Chairman of the Sub-Committee.

3. Terms of reference of the Sub-Committee will include the issues related to compliance procedure for theexcise duty, including records to be maintained, operating procedures and any other issues that may be relevant.

4. All associations will be given an opportunity to submit representation before the Sub-Committee in writing and the all India associations to state their case in person.

5. Any further communications with the regard to the aforesaid Sub-Committee may be sent through e-mail to highlevelcommittee@gmail.com or by post addressed to the Office of the High Level Committee (HLC), Suite No. 215, The Janpath Hotel, Janpath Road, Opp. BSNL Building, New Delhi-110 001.

6. Wide publicity may be given to this circular.

Excise on Jewellery :nominated members of Sub-Committee:

CIRCULAR NO.1030/18/2016-CX, DATED 18-5-2016

In continuation to the Circular No. 1025/13/2016-CX, dated 22-4-2016 issued vide F. No. 354/25/2016-TRU, the following trade representatives are nominated as members of the aforesaid Sub-Committee:

| i. | Shri Konal Doshi, past Convenor, Jewellery panel, GJEPC [Mobile-9820124106; Mail- doshi.konal@gmail.com]; | |

| ii. | Shri Ashok Minawala, past Chairman, AIGJF, [Mobile- 9821020011; Mail-ashok.minawala@gmail.com]; and | |

| iii. | Shri Fatehchand Ranka, Chairman, All India Action Committee on Jewellery, AIACJ [Mobile- 9823082661; Mail- fatehchand@rankajewellerspvtltd.com, fatehchand@gmail.com]. |

2. Wide publicity may be given to this circular.

Related Post

- Jeweller may send representation on procedural issues regarding imposition of Excise duty on Jewellery

- Excise duty on jewellery,Trade representatives in Committee

- Govt framed committee for excise duty on Jewellery

- Central Excise Law for Jewellery (105 FAQ )

- Govt Committee on issues of excise duty on Jewellery

- Govt clarify Excise Duty on Jewellery