FAQS ON COMMODITY DERIVATIVES EXCHANGES

Q1. What are the registration requirements for existing members of commodity derivatives exchanges?

Ans: Existing members of commodity derivatives exchanges are required to satisfy the registration related requirements of the exchange of which it holds membership, at the time of making an application for registration to SEBI. They can apply for registration to SEBI, within a period of 3 months from September 28, 2015 (in terms of Section 131 of the Finance Act, 2015). Such existing members of commodity derivatives exchanges shall be required to meet the eligibility criteria as specified under Rule 8 of Securities Contract (Regulation) Rules, 1957 (hereinafter referred to as SCRR), within a period of one year from the date of transfer and vesting of rights and assets of the Forward Market Commission (FMC) with SEBI i.e., by September 28, 2016.

Q2. What are the registration requirements for entities desirous of seeking membership of commodity derivatives exchanges after September 28, 2015?

Ans: Any person desirous of becoming a member of any commodity derivatives exchange(s), on or after September 28, 2015, shall have to meet the eligibility criteria to become a member of an exchange and conditions of registration, as specified in SCRR and Stock Broker Regulations respectively, at the time of making the application of registration. Rule 8 of SCRR provides for the constitution types who are eligible to be registered as members, minimum of directors who must satisfy the requirements for experience, etc.

Q3. Can an entity registered as a commodity derivatives broker, also be registered as a stock broker to deal in other securities such as equities market and vice versa?

Ans: In terms of Rule 8(1)(f) of SCRR, same legal entity cannot be engaged in securities and commodity derivatives. Hence, stock broker dealing in equities cannot conduct broking activities in commodity derivatives and vice versa.

Q4. Whether an entity requires SEBI registration for all commodity derivatives exchanges, if it holds membership with multiple exchanges?

Ans:Existing member of commodity derivatives exchange,having membership with multiple exchanges shall apply separately through each commodity derivatives exchange, where he wants to continue to operate, within three months from September 28, 2015. Under the single registration mechanism, once the existing member of the commodity derivatives exchange is registered by SEBI, the applicant shall be issued one certificate of registration and the registration details shall be intimated to the concerned entity through the concerned commodity derivatives exchange. Further, if there is/are applications of the same entity is/are received through other commodity derivatives exchange(s), such commodity derivatives exchange(s) shall be intimated about the grant of registration to the said entity and such application(s) shall be disposed of accordingly.

Q5. What are the categories of members registered by SEBI in commodity derivatives market?

Ans: As per Stock Broker Regulations, three categories of members are registered with SEBI – Stock broker/ trading member, clearing member and self-clearing member.

Q6. What will be the procedure for making registration application?

Ans: If the entity is already registered as a member with any of the commodity derivatives exchanges as on the date of notification of merger, then the entity may apply for registration with SEBI through all of the concerned commodity derivatives exchanges, in the format prescribed under the Stock Broker Regulations, along with Additional Information prescribed vide SEBI Circular No. SMD/POLICY/CIR- 11/98 dated March 16, 1998, within a period of three months from September 28, 2015 (as per provisions of the Finance Act, 2015).

New members are required to apply through concerned commodity derivatives exchange in the format prescribed under the Stock Broker Regulationsalong with Additional Information prescribed vide SEBI Circular No. SMD/POLICY/CIR-11/98 dated March 16, 1998. The member shall submit the duly filled in and signed application form along with the requisite documents and the requisite application and / or annual fee, to the concerned exchange. The fee shall be payable by the applicant by means of a demand draft in favour of “Securities and Exchange Board of India” payable at Mumbai. The application is required to be submitted in hard format as well as soft format. The members can obtain the format of application from the concerned stock exchange. Each exchange shall then verify and forward the application to SEBI along with its recommendation.

Q7. What is the process required to be followed by the exchange for forwarding the application of its members for registration with SEBI?

Ans: SEBI has provided an online module to the commodity derivatives exchanges for uploading the applications of its members for registration with SEBI. The stock exchange would receive the duly filled in and signed application in hard format and soft format from the member. The exchange shall then verify and forward the application to SEBI along with its recommendation through the online module. The exchange would be required to fill the details of the applicant and upload the relevant supporting documents in the online module. To summarize, the exchange would be required to submit/ upload the following to SEBI in soft format:

a. Application form

b. Scanned copy of net worth/ paid up capital Certificate

c. Scanned copy of undertakings and declaration by the broker

d. Scanned copy of undertakings and recommendation from the exchange

e. Scanned copy of relevant extract of MOA and AOA

f. Scanned copy of MoU/ agreement/ contract with clearing member

g. Scanned copy of the Board Resolution for making application for registration as stock broker and for appointment of authorized signatories for the same

h. Scanned copies of experience certificate and proof of education of all Designated Directors/ proprietor / partner.

i. NOC w.r.t. broker from all the exchanges where the broker is a member

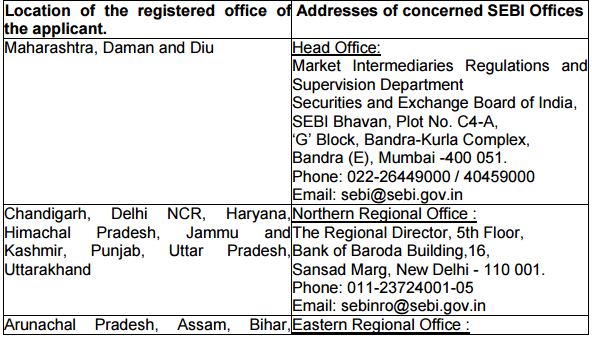

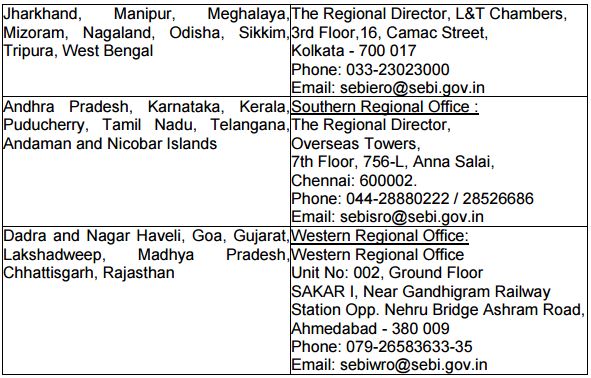

The exchange shall forward the application to SEBI only in soft format through the online module. However, the exchange shall retain the hard formatof the application. The records of the applications viz. Names, Total number of applications uploaded along with time stamp of the exchange must be provided by the concerned exchange to SEBI on a daily basis. The registration application processing at SEBI would be decentralized based on the registered office address of the member, as follows:

Q8. What are the fees to be paid by commodity derivatives brokers?

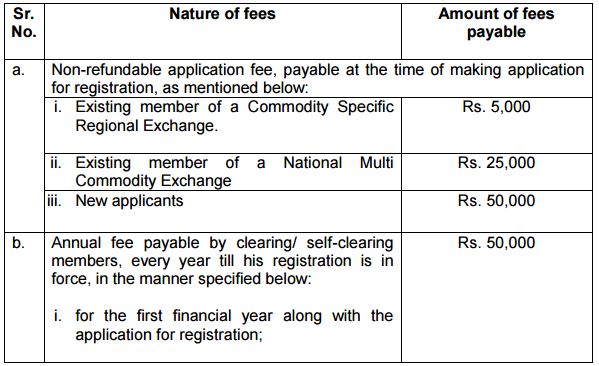

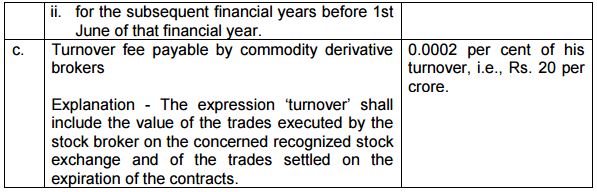

Whether fees have to be paid throughthe Exchange or directly to SEBI? Ans: The Commodity derivative brokers shall be required to pay fees to the Board, as mentioned in the below table through the exchange of which he is a member:

Q9. Whatif the application details uploaded by the exchange are found to be wrongly captured/incomplete?

Ans: The stock exchange shall, while submitting application, confirms that the details provided by the member are correctly captured and uploaded by the Stock Exchange. If the application uploaded by the exchange is found to be incomplete/wrongly captured, the same will be returned to the exchange for uploading revised registration application.

Q10. What is minimum educational qualification required for individuals/ partners/ directors of a partnership/ corporate, seeking membership with a commodity derivatives exchange?

Ans: The applicant has atleast passed 12th standard equivalent examination from an institution recognized by the Government.

Q11. What are the net worth and deposit requirements for seeking registration with SEBI in a commodity derivatives exchange?

Ans: The net worth and deposit requirements, for seeking registration with SEBI are given in Schedule VI to the Stock Broker Regulations. However, the existing members of commodity derivatives exchanges have been given one year from September 29, 2015 to satisfy the said requirements. Net worth shall have to be computed as per the formula prescribed vide SEBI Circular No. FITTC/DC/CIR-1/98 dated June 16, 1998. The networth and deposit requirements have to be fulfilled at the time of registration and on continuous basis as well. Commodity derivative brokers shall be required to furnish a certificate with respect to networth, as per the prescribed computation method, duly certified by a practicing Chartered Accountant

Q12. Whether NISM certification is mandatory at the time of registration?

Ans: NISM certification requirement will have to be fulfilled as and when it is specified by the Board.

Q13.Whether sub-brokers and authorised persons can register in commodity derivatives market?

Ans: Sub-brokers cannot register in commodity derivatives market.Authorized persons are registered with and monitored by commodity derivative exchanges.

Q14. Can a commodity derivative broker engage in other business?

Ans: A member of the commodity derivatives exchange can do the following – a. Business in goods related to the underlying; and/ or b. Business in connection with or incidental to or consequential to trades in commodity derivatives.

Q15. Whether the provisions of The Forward Contracts(Regulation) Act, 1952 continue to be applicable upon the commodity derivatives brokers post September 28, 2015?

Ans: As per the Finance Act, 2015, the bye-laws, circulars, or any like instrument made by a recognised association under the Forward Contracts Act shall continue to be applicable for a period of one year from the date on which that Act is repealed, or till such time as notified by the Security Board, as if the Forward Contracts Act had not been repealed,whichever is earlier.