Form 12BB Download for Tax Saving Proof required from Employee

Presently, employees who wanted to claim tax deductions are required to file self-declarations of tax savings/deductions to employer along with the evidences of such tax savings for every financial year. Employer was liable to deduct tax at sources on the estimated income of employees after considering such self-declarations of tax savings. Now the CBDT has notified new form 12BB for such purposes. Employees are now required to submit evidences/particulars of tax savings to employer in Form no. 12BB .Employee is also required to submit evidence of deductions / allowances along with Form 12BB.

The CBDT has also notified revised due dates for filing of quarterly TDS returns by persons (other than government). Due dates for filing TDS return for the quarter ended30th June, 30th September, 31st December and 31st March has been extended to 31st July, 31st October, 31st January and 31st May respectively (old dates were 15th July,15th October, 15th January and 15th May respectively).

Submit new Form 12BB to claim Income tax deductions from your employer w.e.f 01.06.2016

below is the format of new Form 12BB . Click to download Form 12BB

Download Form 12BB PDF ( Blank Format)

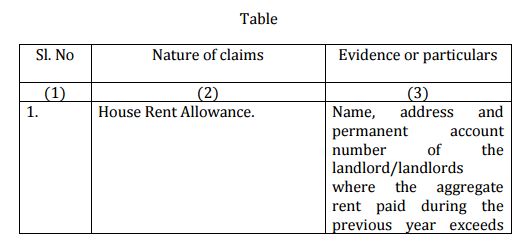

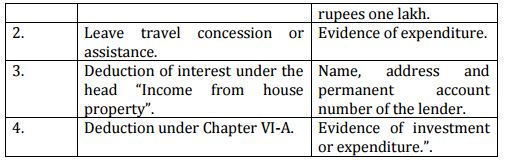

Form no 12BB is required to be submitted for

- House Rent allowance under section 10 (13A) of Income tax act

- Leave Travel Allowance w.e.f 01.6.2016 it is mandatory for the salaried employee to submit leave related expenditure proofs to their employer

- Interest Payment on Home Loan :you have to furnish details of interest amount payable/paid, lender’s name & address & PAN number of the lender in Form 12BB.

Notification for Form No 12BB of Income tax Act

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART-II, SECTION 3, SUB-SECTION (ii)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

(CENTRAL BOARD OF DIRECT TAXES)

NOTIFICATION

New Delhi, the 29th April, 2016

INCOME-TAX

S.O. ___(E).— In exercise of the powers conferred by sections 192, 200 and 206C, read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules, 1962, namely:-

1. (1) These rules may be called the Income-tax (11th Amendment) Rules, 2016.

(2) They shall come into force from the 1st day of June, 2016.

2. In the Income-tax Rules, 1962 (hereafter referred to as the said rules), after rule 26B, the following rule shall be inserted, namely:- “26C. Furnishing of evidence of claims by employee for deduction of tax under section 192.—

(1) The assessee shall furnish to the person responsible for making payment under sub-section (1) of section 192, the evidence or the particulars of the claims referred to in sub-rule (2), in Form No.12BB for the purpose of estimating his income or computing the tax deduction at source.

(2) The assessee shall furnish the evidence or the particulars specified in column

(3), of the Table below, of the claim specified in the corresponding entry in column(2) of the said Table:—

To Download Form 12BB click [Notification No.30/2016, F.No.142/29/2015-TPL]

Related post on Tax Savings and Income Tax

- Tax Saving Investments

- Right of Employee to get TDS Certificate

- Employee can file winding up of Employer Company for unpaid salary

- Contract of Company (in liquidation) with its employees comes to an end on the passing of the winding up order

- Compensation received by prospective employee on termination of employment

- Leave Travel Concession Procedure simplified for Govt Employees

- Download Form 16 for TDS on salary

- TDS on withdrawal from Employees Provident Fund Scheme

- Employer not liable to deduct TDS @ 20% for non furnishing of PAN by Employees

- Tax Saving Tips on sale and purchase of Property

- Tax benefits for girl child under Sukanya Samriddhi Account Scheme

- Interest on Loans to Govt. employees for construction/Purchase of houses/flats

- Minimum Pension under Employees’ Pension Scheme (EPS)

- EPFO One Employee-One Account Mission

- Hotel Tips collected from Cusotmer and Paid to employee not taxable as salary

- Paternity Leave to Bank Employees

- Apprentice is a trainee and not an employee : Supreme court

- Govt to pay EPS contribution of 8.33% for all new employees : Budget 2016

- Employee can report any other income to Employer for Tax deduction

- E-File of Income tax Return : check points

- How to calculate income tax in case of Employee with handicapped dependent

- Your 7 Transactions which goes to income tax department

- Good News for pension Savings in Budget 2016

- on Divorce Lump sum payment received are Tax free and monthly payments received are taxable

- FAQ on E payment of Income tax and other direct taxes

- Income tax deductions for Employees as per Section 80C

- DEDUCTIONS IN INCOME TAX

- Govt allowed to withdraw entire amount from provident fund

- All about National Pension System and PRAN

- Be aware of using online tax return filing portals

- Downloads Income Tax Return Utility AY 2016-17 (FY 2015-16)

- Save Income Tax by Tax planning

- e -KVP and NSC

- Sukanya Samriddhi Account Rules 2016 Notified

- Senior Citizens Welfare Fund Rules 2016 notified by Govt

- PENSION Questions and Answers