As per CBDTs Notification 36/2019, dated 12th Apr 2019 the format of TDS statement in Form No. 24Q, Annexure – II has been revised. The notification shall come into force w.e.f. 12th May 2019.

The revised Form 24Q, Annexure – II has brought certain changes with regard to the reporting of transactions while filing the TDS statements. It is therefore advised that due diligence may be exercised to ensure accurate TDS statement filing so as to avoid possible defaults / mismatch in TDS certificate (Form 16 – Part B) which shall be available for download from TRACES.

Also Refer

Salary TDS Certificate : New Process to issue Form 16

Salary TDS certificate part B to be issued from TRACES portal: CBDT Notification No 9/2019

A. Important Information regarding revised Form No. 24Q Annexure-II.

Applicability of The Notification –

As per “CBDTs Notification 36/2019”, dated 12th April, 2019 the format of TDS Statement in Form No. 24Q, Annexure-II has been revised. The Notification shall come into force w.e.f. 12th May’2019.

The Form 16 and 24Q have been amended to make them more elaborative and informative. The same has been done to bring the Forms in parity with latest changes made in ITR Forms such as disclosure of deductions and exemptions. This will ensure that Form 16 shall be in conformity with the IT return forms making it easy for the taxpayers to file their Income tax returns.

B. Changes/ New requirements in Form No. 24Q Annexure-ll

Revised Form 24Q seeks more details on salary paid or credited during the year. Also furnishing of Lender’s PAN is mandatory in the cases where housing loan is taken from a person other than a Bank/ Financial Institution/ Employer. New format requires the tax deductors to furnish following additional information-

1. Detailed break-up for exempt Income u/s 10–

a. Travel concession or assistance u/s 10(5)

b. Death-cum-retirement gratuity u/s 10(10)

c. Commuted value of Pension u/s 10(10A)

d. Cash equivalent of leave salary encashment u/s 10(10AA)

e. House rent allowance under u/s 10(13A)

f. PAN of landlord, if exemption is claimed u/s 10(13A)

g. Amount of any other exemption u/s10

2. Section-wise disclosure of deductions u/ Chapter VI-A (viz. Sec 80C, 80CCC, 80CCD (1), 80CCD (1B), 80CCD (2), 80D, 80E, 80G, 80TTA etc.)

3. Deductible limits will be applicable as per deductions under Chapter VI-A.

4. Rebate under section 87A (If Applicable)

5. Standard deduction u/s 16(ia) as introduced by Finance Act, 2018.

C. Column wise changes in Form No. 24Q Annexure-ll

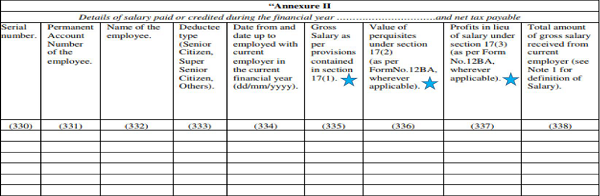

As per Notification 36/2019, in Form No. 24Q, for “Annexure II”, the following “Annexure” shall be substituted, namely:–

Note:

◊ New Columns introduced for reporting the following information:

- Gross Salary as per provisions contained in section 17(1). (Column No. 335)

- Value of perquisites under section 17(2). (Column No. 336)

- Profits in lieu of salary under section 17(3) (Column No. 337)

- For further details, CBDTs Circular No. 01/2019 dated 01/01/2019 may be referred.

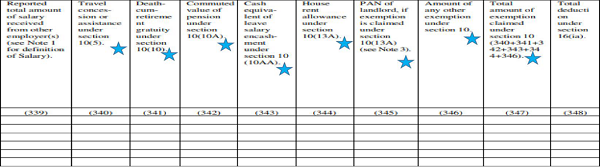

Note: Columns introduced for reporting Incomes claimed as exempt u/s 10 :

- Travel concession or assistance under section 10(5). (Column No. 340)

- Death-cum-retirement gratuity under section 10(10) (Column No. 341)

- Commuted value of pension under section 10(10A) (Column No. 342)

- Cash equivalent of leave salary encashment under section 10 (10AA) (Column No. 343)

- House rent allowance under section 10(13A) (Column No. 344)

- PAN of landlord, if exemption is claimed u/s 10(13A) (Column No. 345)

- Amount of any other exemption under section 10. (Column No. 346)

- Total amount of exemption claimed under section 10 (340+341+3 42+343+34 4+346). (Column No. 347)

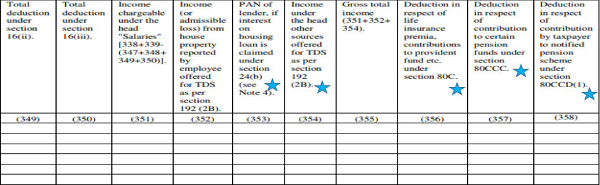

Note: Columns introduced for reporting:

- PAN of lender, if interest on housing loan is claimed under section 24(b). ( Column No. 353)

- Income under the head other sources offered for TDS as per section 192(2B). ( Column No. 354)

◊ Columns introduced for reporting Deductions under Chapter VI-A :

- Deduction in respect of life insurance premium, contributions to provident fund etc. (section 80C) ( Column No. 356)

- Deduction in respect of contribution to certain pension funds (section 80CCC) ( Column No. 357)

- Deduction in respect of contribution by taxpayer to notified pension scheme [section 80CCD(1) ( Column No. 358)

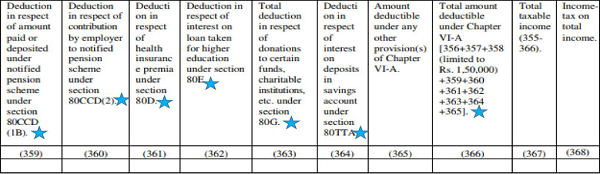

Note: Columns introduced for reporting Deductions under Chapter VI-A : (Contd.)

- Deduction in respect of amount paid/deposited under notified pension scheme [section 80CCD(1B) ( Column No. 359)

- Deduction in respect of contribution by employer to notified pension scheme [section 80CCCD(2) ( Column No. 360)

- Deduction in respect of health insurance premium (section 80D) ( Column No. 361)

- Deduction in respect of interest on loan taken for higher education (section 80E) ( Column No. 362)

- Total deduction in respect of donations to certain funds, charitable institutions, etc. (section 80G) ( Column No. 363)

- Deduction in respect of interest on deposits in savings account (section 80TTA) ( Column No. 364)

- Total amount deductible under Chapter VI‐A (a+b+c+d+e+f+g+h+i+j) ( Column No. 366)

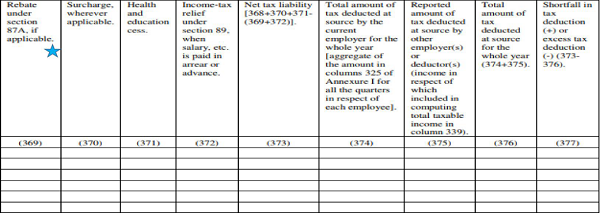

Note: Column introduced for reporting Rebate under section 87A, (if applicable) (Column no .369)

Notes:

1. Salary includes wages, annuity, pension, gratuity (other than exempted under section 10(10)), fees, commission, bonus, repayment of amount deposited under the Additional Emoluments (Compulsory Deposit) Act, 1974 (8 of 1974), perquisites, profits in lieu of or in addition to any salary or wages including payments made at or in connection with termination of employment, advance of salary, any payment received in respect of any period of leave not availed (other than exempted under section 10 (10AA)), any annual accretion to the balance of the account in a recognised provident fund chargeable to tax in accordance with rule 6 of Part A of the Fourth Schedule of the Income-tax Act, 1961, any sums deemed to be income received by the employee in accordance with sub‐rule (4) of rule 11 of Part A of the Fourth Schedule of the Income-tax Act, 1961, any contribution made by the Central Government to the account of the employee under a pension scheme referred to in section 80CCD or any other sums chargeable to income-tax under the head ‘Salaries’.

2. Where an employer deducts from the emoluments paid to an employee or pays on his behalf any contributions of that employee to any approved superannuation fund, all such deductions or payments should be included in the statement.

3. Permanent Account Number of landlord shall be mandatorily furnished where the aggregate rent paid during the previous year exceeds one lakh rupees.

4. Permanent Account Number of lender shall be mandatorily furnished where the housing loan, on which interest is paid, is taken from a person other than a Financial Institution or the Employer.