Goods Sold Prior to GST but Returned after GST Act comes into force

Implication for Goods Sold prior to Appointed Day But Returned After Appointed Day – As per Section 142( 1) of CGST Act

Section 142( 1) of CGST Act says

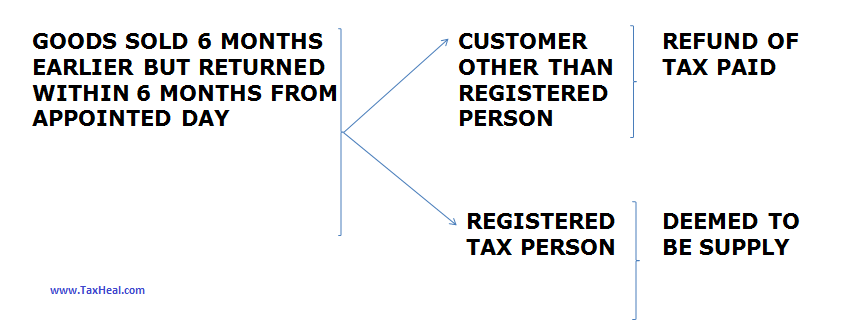

Where any goods on which duty, if any, had been paid under the existing law at the time of removal thereof, not being earlier than six months prior to the appointed day, are returned to any place of business on or after the appointed day, the registered person shall be eligible for refund of the duty paid under the existing law where such goods are returned by a person, other than a registered person, to the said place of business within a period of six months from the appointed day and such goods are identifiable to the satisfaction of the proper officer:

Provided that if the said goods are returned by a registered person, the return of such goods shall be deemed to be a supply.

Read Related Post on GST Transition