GST Circular No 162/18/2021 GST

Circular No. 162/18/2021-GST

F. No. CBIC-20001/8/2021-GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

****

New Delhi, dated the 25th September, 2021

To,

The Principal Chief Commissioners/Chief Commissioners/Principal Commissioners/

Commissioners of Central Tax (All)

The Principal Directors General/ Directors General (All)

Madam/Sir,

Subject: Clarification in respect of refund of tax specified in section 77(1) of the CGST

Act and section 19(1) of the IGST Act -Reg

Representations have been received seeking clarification on the issues in respect of

refund of tax wrongfully paid as specified in section 77(1) of the Central Goods and Services

Tax Act, 2017 (hereinafter referred to as “CGST Act”) and section 19(1) of the Integrated

Goods and Services Tax Act, 2017 (hereinafter referred to as “IGST Act”). In order to clarify

these issues and to ensure uniformity in the implementation of the provisions of law across the

field formations, the Board, in exercise of its powers conferred by section 168 (1) of the CGST

Act, hereby clarifies the issues detailed hereunder:

2.1 Section 77 of the CGST Act, 2017 reads as follows:

“77. Tax wrongfully collected and paid to Central Government or State

Government. — (1) A registered person who has paid the Central tax and State tax

or, as the case may be, the Central tax and the Union territory tax on a transaction

considered by him to be an intra-State supply, but which is subsequently held to be

an inter-State supply, shall be refunded the amount of taxes so paid in such manner

and subject to such conditions as may be prescribed.

(2) A registered person who has paid integrated tax on a transaction considered by

him to be an inter-State supply, but which is subsequently held to be an intra-State

supply, shall not be required to pay any interest on the amount of central tax and State

tax or, as the case may be, the Central tax and the Union territory tax payable.”

Section 19 of the IGST Act, 2017 reads as follows:

“19. Tax wrongfully collected and paid to Central Government or State

Government——(1) A registered person who has paid integrated tax on a supply

considered by him to be an inter-State supply, but which is subsequently held to be

an intra-State supply, shall be granted refund of the amount of integrated tax so paid

in such manner and subject to such conditions as may be prescribed.

(2) A registered person who has paid central tax and State tax or Union territory tax,

as the case may be, on a transaction considered by him to be an intra-State supply,

but which is subsequently held to be an inter-State supply, shall not be required to

pay any interest on the amount of integrated tax payable.”

3. Interpretation of the term “subsequently held”

3.1 Doubts have been raised regarding the interpretation of the term “subsequently held”

in the aforementioned sections, and whether refund claim under the said sections is available

only if supply made by a taxpayer as inter-State or intra-State, is subsequently held by tax

officers as intra-State and inter-State respectively, either on scrutiny/ assessment/ audit/

investigation, or as a result of any adjudication, appellate or any other proceeding or whether

the refund under the said sections is also available when the inter-State or intra-State supply

made by a taxpayer, is subsequently found by taxpayer himself as intra-State and inter-State

respectively.

3.2 In this regard, it is clarified that the term “subsequently held” in section 77 of CGST

Act, 2017 or under section 19 of IGST Act, 2017 covers both the cases where the inter-State

or intra-State supply made by a taxpayer, is either subsequently found by taxpayer himself as

intra-State or inter-State respectively or where the inter-State or intra-State supply made by a

taxpayer is subsequently found/ held as intra-State or inter-State respectively by the tax officer

in any proceeding. Accordingly, refund claim under the said sections can be claimed by the

taxpayer in both the above mentioned situations, provided the taxpayer pays the required

amount of tax in the correct head.

4. The relevant date for claiming refund under section 77 of the CGST Act/ Section 19 of

the IGST Act, 2017

4.1 Section 77 of the CGST Act and Section 19 of the IGST Act, 2017 provide that in case

a supply earlier considered by a taxpayer as intra-State or inter-State, is subsequently held as

inter-State or intra-State respectively, the amount of central and state tax paid or integrated tax

paid, as the case may be, on such supply shall be refunded in such manner and subject to such

conditions as may be prescribed. In order to prescribe the manner and conditions for refund

under section 77 of the CGST Act and section 19 of the IGST Act, sub-rule (1A) has been

inserted after sub-rule (1) of rule 89 of the Central Goods and Services Tax Rules, 2017

(hereinafter referred to as “CGST Rules”) vide notification No. 35/2021-Central Tax dated

24.09.2021. The said sub-rule (1A) of rule 89 of CGST Rules, 2017 reads as follows:

“(1A) Any person, claiming refund under section 77 of the Act of any tax paid by him,

in respect of a transaction considered by him to be an intra-State supply, which is

subsequently held to be an inter-State supply, may, before the expiry of a period of two

years from the date of payment of the tax on the inter-State supply, file an application

electronically in FORM GST RFD-01 through the common portal, either directly or

through a Facilitation Centre notified by the Commissioner:

Provided that the said application may, as regard to any payment of tax on

inter-State supply before coming into force of this sub-rule, be filed before the expiry

of a period of two years from the date on which this sub-rule comes into force.”

4.2 The aforementioned amendment in the rule 89 of CGST Rules, 2017 clarifies that the

refund under section 77 of CGST Act/ Section 19 of IGST Act, 2017 can be claimed before the

expiry of two years from the date of payment of tax under the correct head, i.e. integrated tax

paid in respect of subsequently held inter-State supply, or central and state tax in respect of

subsequently held intra-State supply, as the case may be. However, in cases, where the taxpayer

has made the payment in the correct head before the date of issuance of notification

No.35/2021-Central Tax dated 24.09.2021, the refund application under section 77 of the

CGST Act/ section 19 of the IGST Act can be filed before the expiry of two years from the

date of issuance of the said notification. i.e. from 24.09.2021.

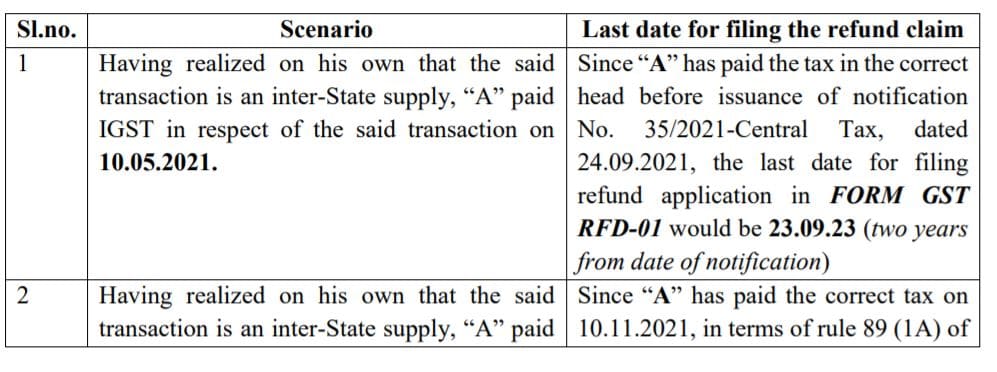

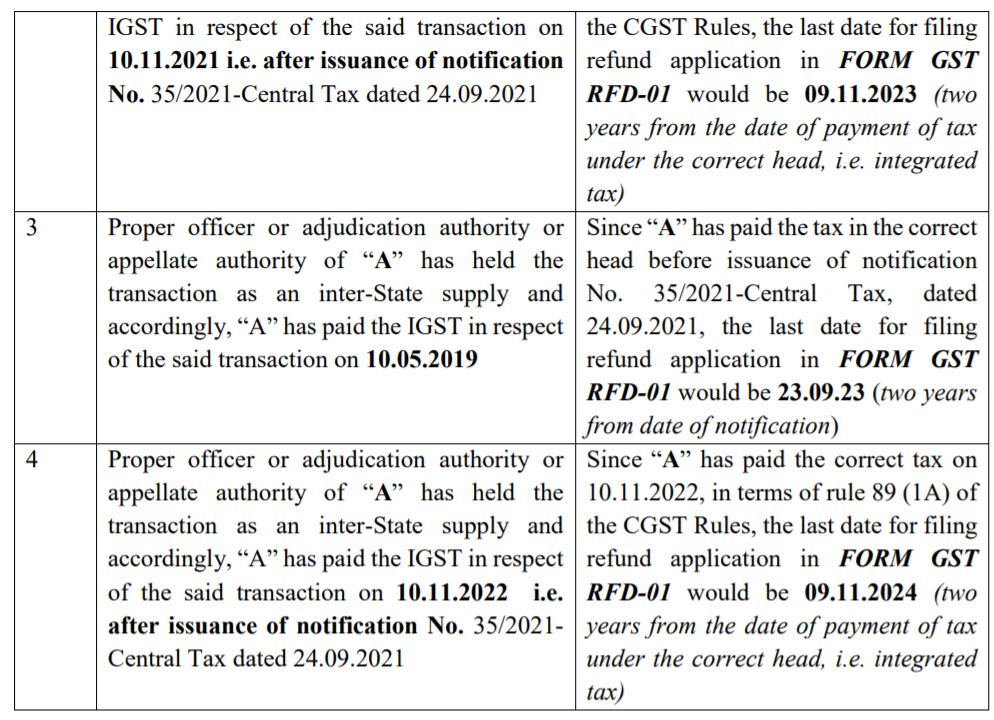

4.3 Application of sub-rule (1A) of rule 89 read with section 77 of the CGST Act / section

19 of the IGST Act is explained through following illustrations.

A taxpayer “A” has issued the invoice dated 10.03.2018 charging CGST and SGST on a

transaction and accordingly paid the applicable tax (CGST and SGST) in the return for March,

2018 tax period. The following scenarios are explained hereunder:

The examples above are only indicative one and not an exhaustive list. Rule 89 (1A) of

the CGST Rules would be applicable for section 19 of the IGST Act also, where the taxpayer

has initially paid IGST on a specific transaction which later on is held as intra-State supply and

the taxpayer accordingly pays CGST and SGST on the said transaction. It is also clarified that

any refund applications filed, whether pending or disposed off, before issuance of notification

No.35/2021-Central Tax, dated 24.09.2021, would also be dealt in accordance with the

provisions of rule 89 (1A) of the CGST Rules, 2017.

4.4 Refund under section 77 of the CGST Act / section 19 of the IGST Act would not be

available where the taxpayer has made tax adjustment through issuance of credit note under

section 34 of the CGST Act in respect of the said transaction.

5. It is requested that suitable trade notices may be issued to publicize the contents of this

circular.

6. Difficulty, if any, in implementation of this Circular may please be brought to the notice

of the Board. Hindi version would follow.

(Sanjay Mangal)

Principal Commissioner (GST)

Download Click here