Ministry of Finance

Policy Changes recommended by the 25th GST Council Meeting

Posted On: 18 JAN 2018 7:49PM by PIB Delhi

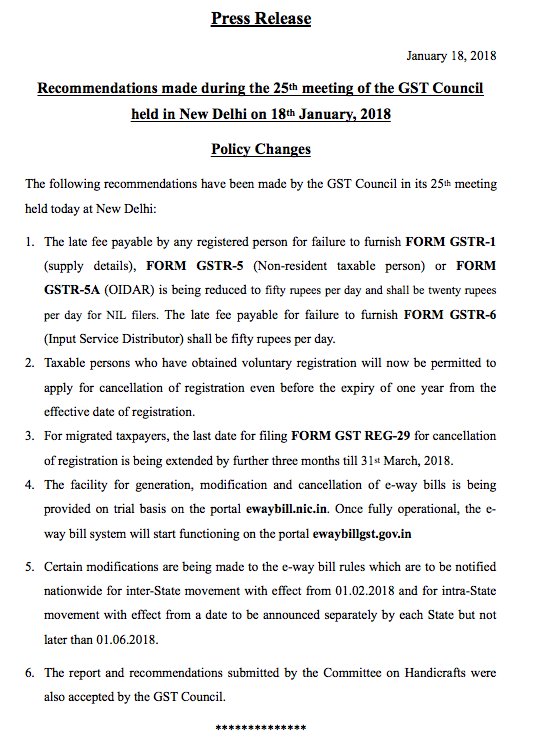

The Union Finance Minister Shri Arun Jaitley Chaired the 25th Meeting of the GST Council in New Delhi today. The following Policy Changes have been recommended by the GST Council in its 25thmeeting held today:

- The late fee payable by any registered person for failure to furnish FORM GSTR-1 (supply details), FORM GSTR-5 (Non-resident taxable person) or FORM GSTR-5A (OIDAR) is being reduced to fifty rupees per day and shall be twenty rupees per day for NIL filers. The late fee payable for failure to furnish FORM GSTR-6 (Input Service Distributor) shall be fifty rupees per day.

- Taxable persons who have obtained voluntary registration will now be permitted to apply for cancellation of registration even before the expiry of one year from the effective date of registration.

- For migrated taxpayers, the last date for filing FORM GST REG-29 for cancellation of registration is being extended by further three months till 31st March, 2018.

- The facility for generation, modification and cancellation of e-way bills is being provided on trial basis on the portal ewaybill.nic.in. Once fully operational, the e-way bill system will start functioning on the portal ewaybillgst.gov.in

- Certain modifications are being made to the e-way bill rules which are to be notified nationwide for inter-State movement with effect from 01.02.2018 and for intra-State movement with effect from a date to be announced separately by each State but not later than 01.06.2018.

- The report and recommendations submitted by the Committee on Handicrafts were also accepted by the GST Council.

**************

DSM/SBS

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |