GST Impact on Exports

Provision in GST for Export

GST should be paid in the first place by exporters but those exporters who are entitled to exemptions could take refunds.

GST Impact on Export

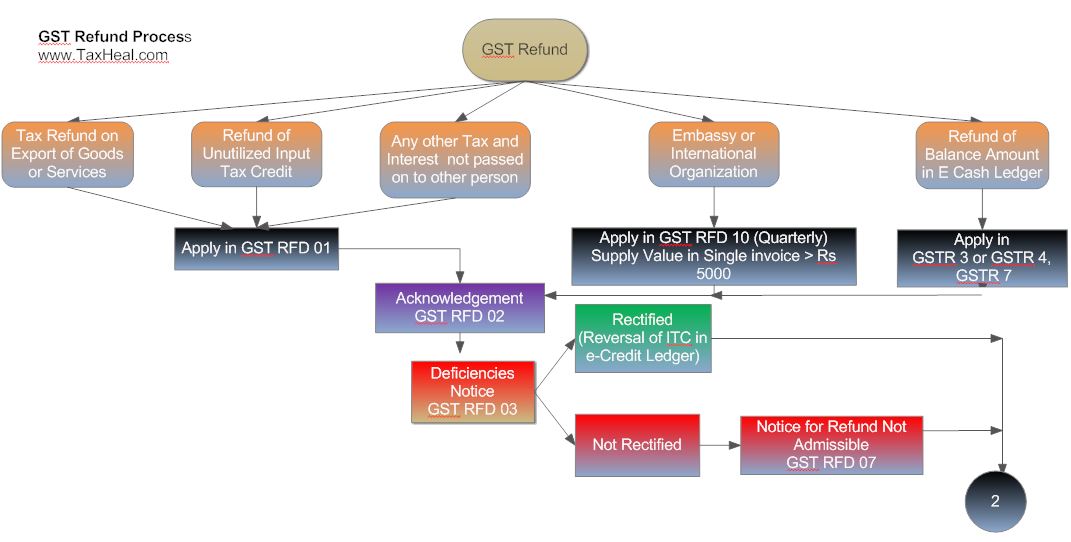

- Substantial amount of working capital would be locked in the process of paying duties and then taking refunds. Form GST RFD 01 has been prescribed under draft rules for claiming refund

- In case of export of goods, application for refund shall be filed only after the export manifest or an export report, as the case may be, in respect of such goods is delivered under section 41 of the Customs Act 1962:

- In respect of supplies made to an SEZ unit or a developer, or supplies regarded as deemed exports, the application shall be filed by the said unit or the developer or the recipient of deemed export supplies

- Refund Application form has to be certified by Chartered Accountant/Cost Accountant to the effect that the incidence of tax and interest claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed is five lakh rupees or more. However t a certificate is not required to be furnished in respect of cases covered under clause (a), (b) or (d) of sub-section (6) of section 38;

- Where the amount of tax has been recovered from the recipient, it shall be deemed that the incidence of tax has been passed on to the ultimate consumer.

- Where any taxable goods or services are exported without payment of tax, under bond or letter of undertaking under section ___ of the IGST Act, 201_, refund of input tax credit shall be granted as per the following formula:

Refund Amount = (Export turnover of goods + Export turnover of services ) x Net ITC Adjusted Total Turnover

Where,-

(A) “Refund amount” means the maximum refund that is admissible;

(B) “Net ITC” means input tax credit availed on inputs and input services during the relevant period;

(C) “Export turnover of goods” means the value of goods exported during the relevant period without payment of tax under bond or letter of undertaking;

(D) “Export turnover of services” means the value of services exported without payment of tax under bond or letter of undertaking, calculated in the following manner, namely:-

Export turnover of services = payments received during the relevant period for export services + export services whose supply has been completed for which payment had been received in advance in any period prior to the relevant period – advances received for export services for which the supply of service has not been completed during the relevant period;

(E) “Adjusted Total turnover” means the value of turnover in a State, as defined under subsection (104) of section 2, excluding the value of exempt supplies, during the relevant period;

(F) “Relevant period” means the period for which the claim has been filed. Provided that no refund of input tax credit shall be allowed if the supplier of goods and / or services avails of drawback allowed under the applicable Drawback Rules or claims rebate of tax paid under the Act or the IGST Act, 201_ in respect of such tax.

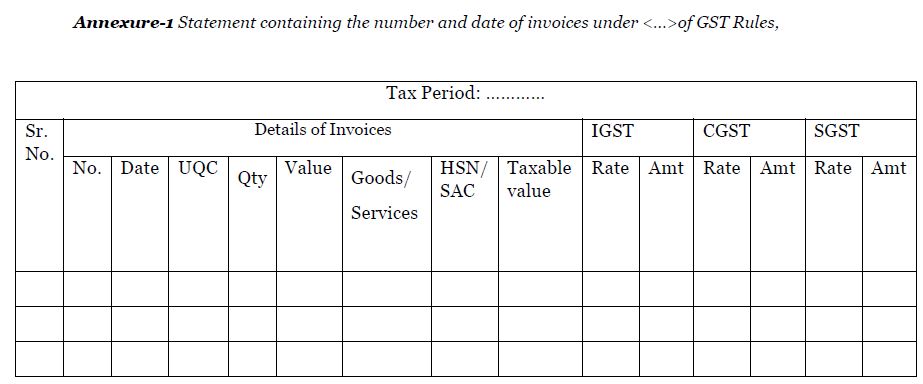

- Proposed procedure of paying taxes and then claiming the refunds by exporters under the Goods and Services Tax (GST) would cause hardships for the exporters. Following details has to be provided to in the GST RFD 01 -Annexure-1 -containing the number and date of invoices received and issued during a tax period in a case where the claim pertains to refund of any unutilized input tax credit under sub-section (2) of section 38 where the credit has accumulated on account of rate of input tax being higher than the rate of output tax;

- Documentary evidences for claiming refund in case of export

- statement containing the number and date of shipping bills or bills of export and the number and date of relevant export invoices, in a case where the refund is on account of export of goods;

- Statement containing the number and date of invoices as prescribed in rule Invoice._ in case of supply of goods made to an SEZ unit or a developer;

- Statement containing the number and date of invoices, in a case where the refund is on account of deemed exports;

- Statement containing the number and date of invoices and the relevant Bank Realization Certificates or Foreign Inward Remittance Certificates, as the case may be, in a case where the refund is on account of export of services;

- Statement containing the number and date of invoices and the details of payment, along with proof thereof, made by the claimant to the supplier for authorized operations as defined under the SEZ Act, 2005, in a case where the refund is on account of supply of services made to an SEZ unit or a developer;

- Reference number of the final assessment order and a copy of the said order in a case where the refund arises on account of finalisation of provisional assessment;

- Declaration to the effect that the incidence of tax and interest claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed is less than five lakh rupees . However declaration is not required to be furnished in respect of cases covered under clause (a), (b) or (d) of sub-section (6) of section 38;

- Reference number of the payment of the amount claimed as refund;

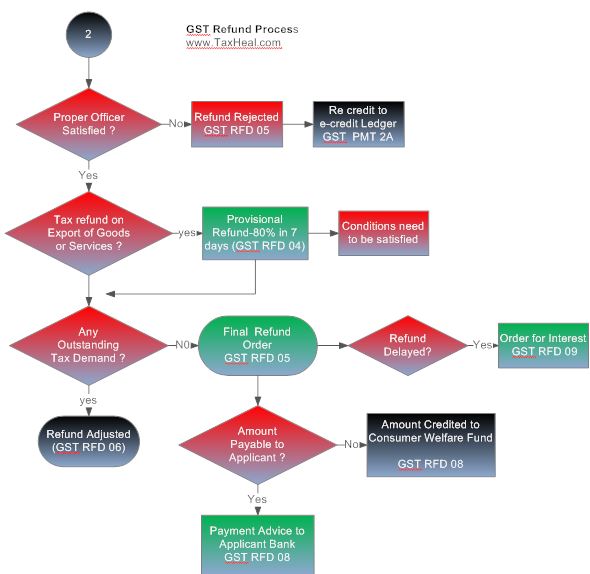

- Grant of provisional refund (i.e 80%) :-The provisional refund under sub-section (4A) of section 38 shall be granted subject to the following conditions

(a) the person claiming refund has, during any period of five years immediately preceding the tax period to which the claim for refund relates, not been prosecuted for any offence under the Act or under an earlier law where the amount of tax evaded exceeds two hundred and fifty lakh rupees;

(b) the GST compliance rating of the applicant is not less than five on a scale of ten;

(c) no proceeding of any appeal, review or revision is pending on any of the issues which form the basis of the refund and if pending, the same has not been stayed by the appropriate authority or court.

The proper officer, after scrutiny of the claim and the evidence submitted in support thereof and on being prima facie satisfied that the amount claimed as refund is due to the applicant in accordance with the provisions of sub-section (4A) of section 38, shall make an order in FORM GST RFD 04 , sanctioning the amount of refund due to the said applicant on a provisional basis within a period not exceeding seven days from the date of acknowledgement .

The proper officer shall issue a payment advice in FORM GST RFD 08 for the amount sanctioned to be electronically credited to any of the bank accounts of the applicant mentioned in his registration particulars and as specified in the application for refund.

Free Education Guide on Goods & Service Tax (GST)