GST

Goods and Services Tax

New Returns

GST Council in its 31st meeting recommended introduction and implementation of a new GST Return System in a phased manner from October 2019 to facilitate taxpayers.

In the new GST Return System, there will be three main components to the new return –

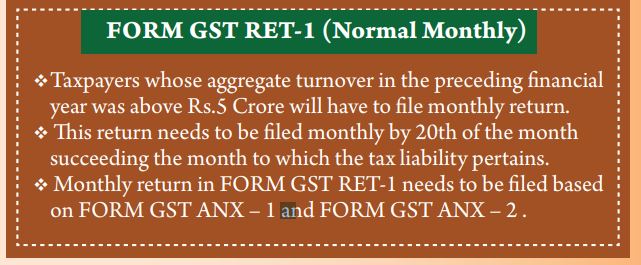

- one main return (FORM GST RET-1) and

- two annexures (FORM GST ANX-1 and FORM GST ANX-2)

From October 2019 onwards, the current FORM GSTR-1 will be replaced by FORM GST ANX-1.

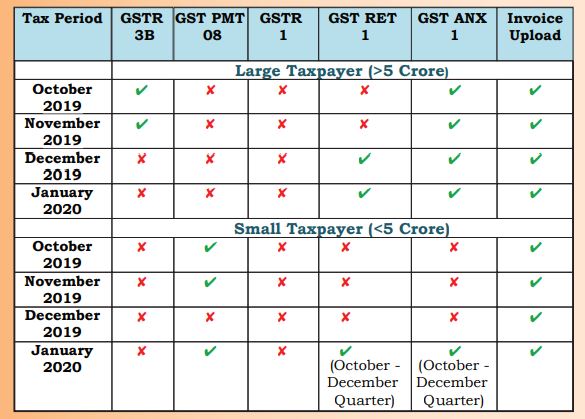

The large taxpayers whose aggregate annual turnover in the previous Financial year

was more than Rs. 5 Crore will upload their monthly FORM GST ANX-1 from October 2019 onwards.

However, the small taxpayers whose aggregate annual turnover in the previous

financial year was upto Rs. 5 Crore will upload their first quarterly FORM GST ANX-1 only in January 2020 for the quarter October to December 2019.

Invoices, etc., can be uploaded in FORM GST ANX-1 on a continuous basis both by large and small

taxpayers from October 2019 onwards.

For October and November, 2019, large taxpayers will continue to file FORM GSTR-3B on monthly basis. they will file their first FORM GST RET-1 for the month of December 2019 by 20th January 2020.

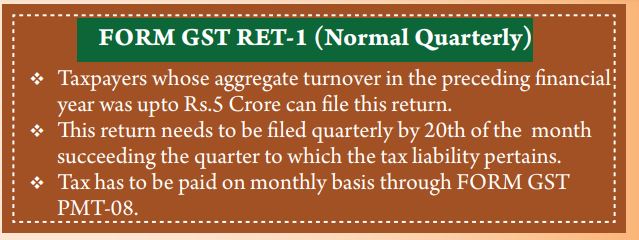

The small taxpayers opting to file FORM GST RET-1 on a quarterly basis will stop fiing FORM GSTR-3B and will start filing FORM GST PMT-08 from October 2019 onwards. they

will file their first FORM GST-RET-1 for the quarter October 2019 to December 2019 by 20th January 2020.

The periodicity of fling return in FORM GST RET-1 will be deemed to be monthly for all taxpayers unless quarterly fling of the return is explicitly opted for by small taxpayers. The aggregate

annual turnover of newly registered taxpayers will be considered as zero and they will have the option to file a quarterly return.

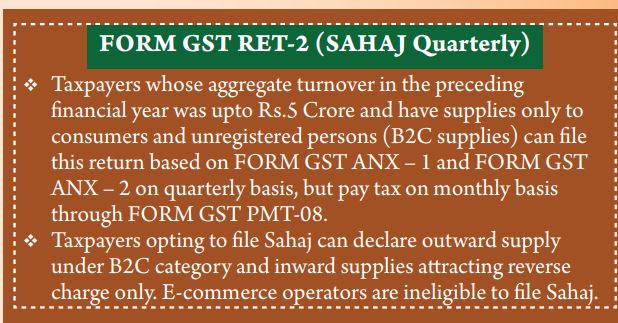

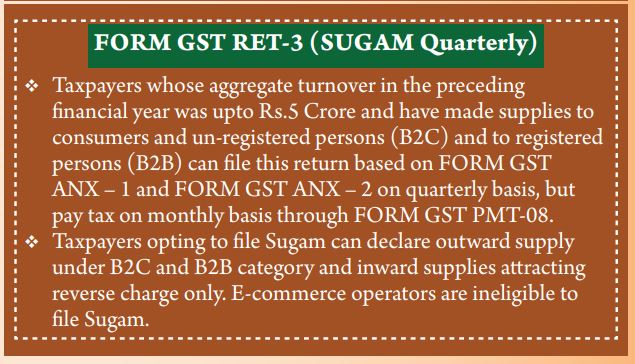

In addition, small taxpayers can choose to file , instead of Form GST RET -1 , any of the other two new quarterly returns , namely sahaj (Form GST RET -2) and Sugam (FORM GST RET -3)

Small Taxpayers opting to file the return on quarterly basis are required to pay tax, either by cash or credit or both, on monthly basis on the taxable supplies made during the month by filing FORM GST PMT – 08 for the first two months of the quarter. Tax must be paid by 20th of the month succeeding the month which the tax liability pertains to.

Salient features of the New GST Return System

- Option to File quarterly return is available for taxpayers whose aggregate annual turnover in the previous Financial year was upto Rs. 5 Crore.

- Option to Fle NIL return through SMS.

- Invoice details can be uploaded by the supplier and the same can be viewed by the recipient on real time basis.

- Matching tool is available which will help the taxpayer to match their Input Tax Credit based on their FORM GST ANX – 2 and purchase register.

GST Anx -1

Three important details need to be declared in FORM GST ANX – 1

- Supplier can upload invoice details and the recipient can view them and

take action on real time basis - Inward supplies a attracting reverse charge will be reported only by the

recipient. - Option is available to include details omitted in the previous tax periods.

Edit/Amendment of uploaded documents FORM GST- ANX-1A

- The amendment of details of earlier tax period can be made in FORM GST ANX-1A before the due date of September return following the end of the financial year or the actual date of furnishing relevant annual return, whichever is earlier

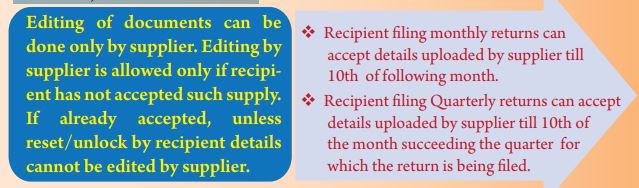

- Documents rejected by the recipient shall be conveyed to the supplier only after filing of the return by the recipient.

- Supplier may edit the rejected documents before filing any subsequent return. However, credit will be made available to recipient through the next FORM GST ANX-2 for the recipient. the tax liability for such edited documents will be accounted for in the same tax period

FORM GST ANX-2

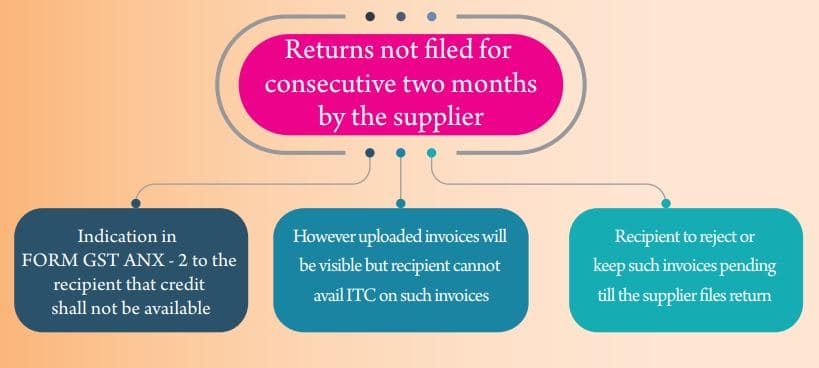

- Details of documents uploaded by the corresponding supplier(s) will be auto populated in FORM GST ANX-2 and recipient can take action on the auto populated documents to – accept, reject or to keep pending on continuous basis after 10th of the following month on which it was uploaded by supplier. Accepted documents would not be available for amendment at the corresponding supplier’s end

- Supplier may edit rejected documents before ling subsequent return. However, credit will be available to recipient through next FORM GST ANX-2. The tax liability will be accounted for in the same tax period