GST Notice invalid as it does not fulfill the ingredients of a proper show cause notice : High Court

HIGH COURT OF JHARKHAND

NKAS Services (P.) Ltd.

v.

State of Jharkhand

APARESH KUMAR SINGH AND DEEPAK ROSHAN, JJ.

W.P.(T) NO. 2659 OF 2021

FEBRUARY 9, 2022

Heard learned counsel for the parties.

2. The present challenge relates to the show cause notice dated 14.06.2021 (Annexure-1) issued under Section 73 of the Jharkhand Goods and Services Tax (JGST) Act, 2017 and the summary of the show cause notice in Form DRC-01 dated 14.06.2021 (Annexure-2) also issued by the respondent no.3 under Rule 142(1)(a) of the JGST Rules, 2017 since the previous show cause notice dated 07.06.2021 (Annexure3) issued under Section 73 of the JGST Act has been withdrawn. The impugned show cause notices are extracted hereunder:

Annexure-1

Office of State Tax Officer

Jurisdiction:Godda:Dumka:Jharkhand

State/UT:Jharkhand

Reference No:ZD200621000420J Date:14/06/2021

To

GSTIN/ID:20AADCN0972E1ZZ

Name:NKAS SERVICES PRIVATE LIMITED

Address: GODDA,LALMATIA AREA, ECL RAJMAHAL, Godda, Jharkhand , 814165

Tax Period : APR 2020-MAR2021 F.Y. 2020-2021

ARN-NA Date-N/A

(Voluntary Payment Intimation details, if applicable)

Act/Rules Provisions:

Section 73 of the CGST/JGST

Show Cause Notice under Section 73

It has come to my notice that tax due has not been paid or short paid or refund has been released erroneously or input tax credit has been wrongly availed or utilized by you or the amount paid by you through the above referred application for intimation of voluntary payment for the reasons and other details mentioned in annexure for the aforesaid tax period

Therefore, you are directed to furnish a reply along with supporting documents as evidence in support of your claim by the date mentioned

You may appear before the undersigned for personal hearing either in person or through authorized representative for representing your case on the date, time and venue, if mentioned in table below.

Please Note that besides tax, you are also liable to pay interest and penalty in accordance with the provisions of the Act.

If you make payment of tax stated above along with up to date interest within 30 days of the issue of this notice with applicable penalty then proceeding may be deemed to have been concluded.

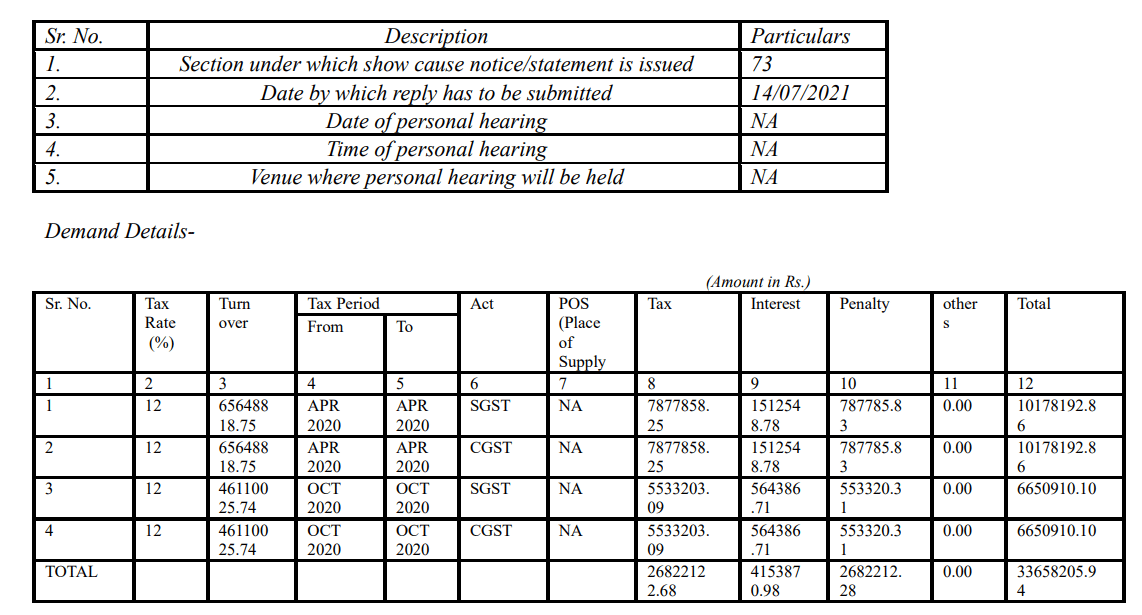

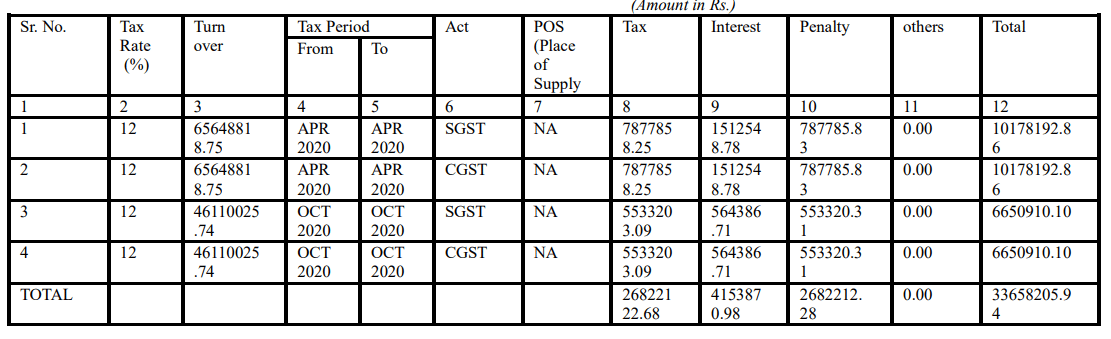

Details of personal hearing etc.

Signature

Name: Anirban Aich

Designation: State Tax Officer

Jurisdiction: Godda:Duma;Jharkhand

Annexure-2

FORM GST DRC-01

[See rule 100(2) & 142(1)(a)]

Reference No:ZD200621000420J Date:14/06/2021

To

GSTIN/ID:20AADCN0972E1ZZ

Name:NKAS SERVICES PRIVATE LIMITED

Address: GODDA,LALMATIA AREA, ECL RAJMAHAL, Godda, Jharkhand , 814165

Tax Period : APR 2020-MAR2021 F.Y.-2020-2021

SCN Reference No. ZD200621000420J 14/06/2021

Section / Sub-section under which SCN is being issued-73

Act/Rules Provisions:

Section 73 of the CGST/JGST

Summary of Show Cause Notice

(a)Brief Fact of the case: According to Statistics received from Headquarter/ Govt. Treasury it has come to our notice that you have received a sum as payment from government treasury against works

Contract services completed / partly completed by you during the above mentioned. Whereas the liability reflected by you through filed returns is less than the above mentioned sum (As peer GSTR-3B).

Kindly ignore the DRC-01 with Reference number ZD200621000153G and ARN/Case ID AD200621000201C dated 07.06.2021

(b)Grounds: Hence it appears that you are not reflecting in your filed returns total payment received and consequently total liability accrued , or you may be reflecting the taxable turnover as exempted turnover, just to evade payment of due tax to the Government. Kindly ignore the DRC-01 with

Reference number ZD200621000153G and ARN/Case ID AD200621000201C dated 07.06.2021 due to an error.

C. Tax and other dues

Signature Name: Anirban Aich

Designation: State Tax Officer

Jurisdiction: Godda:Duma;Jharkhand

3. Mr. Kartik Kurmy, learned counsel for the petitioner has argued in support of the challenge to the impugned show cause notice dated 14th June, 2021 (Annexure-1) issued by the respondent No.3 under Section 73 of the Jharkhand Goods & Services Tax Act, 2017and the summary of show cause notice in FORM- DRC-01 dated 14th June, 2021 (Annexure2) also issued by respondent No.3 in exercise of power under Rule 142 (1) (a) of the Jharkhand Goods and Services Tax Rules, 2017. He submits that the impugned show cause notice Annexure-1 lacks in the very ingredient of a proper show cause notice as required under Section 73 of the Act. It has been issued in a format without striking out any irrelevant portions and without stating the specific contravention committed by the petitioner. The summary of show cause notice in FORM-GST-DRC- 01 is to be issued in an electronic form along with a notice for the purposes of intimation to the assesse and the same by its very nomenclature cannot be a substitute to the show cause notice which if lacks in the essential ingredients of a proper show cause notice. Relying upon the decision rendered by this Court in W.P.(T) No. 2444 of 2021 dated 6th October, 2021 in the case of the same petitioner concerning a similar show cause notice issued under Section 74 of the JGST Act, it is submitted that the respondent no.3 has once again committed the same error in issuing the impugned show cause notice dated 14th June, 2021. While the show cause notice does not even contain the brief facts of the case or the grounds alleged even the summary of the show cause notice does not contain specific facts and allegations showing evasion of payment of due tax to the Government. In the absence of the ingredients of a proper show cause notice the petitioner is being denied proper

opportunity of defending himself. Such a proceeding could end up in vague result and would also not be in the interest of the revenue. The impugned notices at Annexure-1 and 2 therefore, are unsustainable in law and on facts on same principles as has been held in the case of the petitioner in W.P.(T) No. 2444 of 2021.

4. Learned counsel for the petitioner submits that the State Tax Authorities are fixated on the notion that since the show cause notice has to be issued in a format on the GSTN Portal, the ingredients of the show cause notice containing the detail facts and the charges cannot be uploaded or inserted by them and instead a summary of show cause notice would suffice.

5. Learned counsel for the petitioner has specifically referred to Section 75 (7) to indicate that in no case the amount of tax, interest and penalty demanded can be in the excess of the amounts specified in the notice and no demand shall be confirmed on the grounds other than the grounds specified in the notice. The notice does not contain any specific grounds as such.

6. He submits that what constitutes a proper show cause notice, has been elucidated in the case of Gorkha Security Servies Vrs. Government (NCT of Delhi) reported in (2014) 9 SCC 105, para 21 and 22. He has also relied upon a judgment rendered by the Apex Court in the case of Metal Forging & another Vrs. Union of India & others reported in 2003(2) SCC 36 wherein at para 12 the Apex Court has explained the ingredients of a proper show cause notice. Further reliance has been placed on the judgment rendered by the Apex Court in the case of Commissioner of Central Excise, Chandigarh Vrs. Shital International reported in (2011) 1 SCC 109, in particular para 19 in a case under Section 11 A of the Central Excise Act, 1944 where the Apex Court has observed that it is trite law that unless the foundation of the case is laid in the show cause notice, the Revenue cannot be permitted to build up a new case against the assessee. Section 11A of the Central Excise Act is in parameteria to Section 73 of the JGST Act under which the impugned notice has been issued.

7. In order to answer the defence taken by the respondents in their counter affidavit, specifically at para 23, learned counsel for the petitioner has relied upon the judgment of the Apex Court in the case of Union of India Vrs. Bharti Airtel Ltd. reported in 2021(54) G.S.T.L 257 (S.C.), para 23. It is submitted that the Apex Court has observed that the common portal under the GSTN is only a facilitator to feed or retrieve information and that the basic concepts of a proper show cause notice cannot be done away with by the respondents by simply saying that the JGST Rule provides a prescribed online format under DRC-01 in which only the summary of the show cause notice can be issued. The respondent authorities are under a mistaken belief that the ingredients of a proper show cause notice is replaced by the summary of show cause notice under DRC-01.

8. Learned counsel for the petitioner has profusely relied upon the decision rendered by this Court in the W.P.T. No. 2444 of 2021 dated 6.10.2021 in the case of the same petitioner on a similar challenge relating to a show cause notice under Section 74 of the JGST Act, 2017. He has referred to the opinion of this Court at para 14, 15 and 17 of the judgment, in particular. He has summarized his arguments that if show cause notice is vague, not only is the petitioner denied proper opportunity of defending himself, but such a proceeding could end up in vague result, which would also not be in interest of the Revenue. Moreover, no amount of tax, interest or penalty can be imposed on grounds which are not specified in the notice as per Section 75(7) of the JGST Act. The impugned notice at Annexure-1 therefore lacking in the ingredients of a proper show cause notice and therefore deserves to be quashed.

9. Mr. P.A.S. Pati, learned counsel for the State has filed a counter affidavit and defended the impugned notices. According to him, the show cause notice and summary of the show cause notice have been issued in accordance with the JGST Act, 2017 and its rule. Referring to the summary of the show cause notice (Annexure-2), he submits that it is clearly mentioned that petitioner has received payment which it has not disclosed in its return and hence evaded the payment of due tax to the government. The summary of the show cause notice has elaborately stated the violations of the petitioner and is in consonance of Section 73 of the Act. The petitioner cannot be allowed to club the period April 2020 to October 2020 to justify its action. The various returns / abstracts/ certificates such as GSTR-3B and GSTR-7 and GSTR-7A have been framed to ensure that liabilities are properly discharged. Learned counsel for the respondent has further relied upon the statements made at para 23 of the counter affidavit and submitted that the show cause notice issued by the proper officer through the online portal of the GSTN is in the prescribed format DRC-01. The system is designed in a way that the show cause notice is built on standard format and in the summary thereof the proper officer can make his comments. The officer has followed the due procedure by mentioning the violations and charges on the petitioner by which he has resorted to tax evasion. He further contends that form GST ASMT-10 under Section 61 of the JGST Act read with rule 99 of the JGST Rule is not a condition precedent for raising and acquiring jurisdiction under Section 73 by the proper officer. 10. Learned counsel for the respondent submits that the decision rendered by this Court in W.P.(T) No. 2444 of 2021 was in respect of a show cause notice issued under Section 74 of the JGST Act where the charges relating to fraud or any willful misstatement or suppression of fact to evade tax are required to be specifically alleged in the show cause notice. The present notice is under Section 73 of the JGST Act under which no charges of fraud, misrepresentation, suppression of facts etc. are required to be indicated.

11. We have considered the submission of learned counsel for the parties. A perusal of the impugned show cause notice at Annexure-1 creates a clear impression that it is a notice issued in a format without even striking out any relevant portions and without stating the contraventions committed by the petitioner. The summary of the show cause notice under DRC-01 indicates that as per the statistics received from the headquarter/ government treasury, it has come to the notice of the department that the petitioner has received a sum as payment from the government treasury against works contracts services completed / partly completed during the above mentioned period April 2020 to March 2021 whereas the liability reflected by him through filed returns is less than the above mentioned sum as per GSTR-3B. As such, he was not reflecting the total payment received and consequent total liability accrued in the filed returns just to evade payment of due tax to the government. It needs to be mentioned here that even the summary of the show cause notice does not disclose the information as received from the headquarter / government treasury as to against which works contract service completed or partly completed the petitioner has not disclosed its liability in the returns filed under GSTR-3B. We have held in the case of the same petitioner in W.P.(T) No. 2444 of 2021 related to a show cause notice under Section 74 of the JGST Act that a summary of show cause notice as issued in Form GST DRC-01 in terms of rule 142(1) of the JGST Rule, 2017 (Annexure-2 impugned herein) cannot substitute the requirement of proper show cause notice.

12. It would be profitable to reproduce the opinion of this Court in the case of the same petitioner on the general principles governing the issuance of a proper show cause notice. Para 14, 15 and 17 of the judgment is quoted herein below:

14. A bare perusal of the impugned show-case notice creates a clear impression that it is a notice issued in a format without even striking out any irrelevant portions and without stating the contraventions committed by the petitioner i.e. whether its actuated by reason of fraud or any willful misstatement or suppression of facts in order to evade tax. Needless to say that the proceedings under Section 74 have a serious connotation as they allege punitive consequences on account of fraud or any willful misstatement or suppression of facts employed by the person chargeable with tax. In absence of clear charges which the person so alleged is required to answer, the noticee is bound to be denied proper opportunity to defend itself. This would entail violation of principles of natural justice which is a wellrecognized exception for invocation of writ jurisdiction despite availability of alternative remedy. In this regard, it is profitable to quote the opinion of the Apex Court in the case of Oryx Fisheries P. Ltd. (supra) at para 24 to 27 wherein the opinion of the Constitution Bench of the Apex Court in the case of Khem Chand versus Union of India [AIR 1958 SC 300] has been relied upon as well :

“24. This Court finds that there is a lot of substance in the aforesaid contention. It is well settled that a quasi-judicial authority, while acting in exercise of its statutory power must act fairly and must act with an open mind while initiating a show-cause proceeding. A showcause proceeding is meant to give the person proceeded against a reasonable opportunity of making his objection against the proposed charges indicated in the notice.

25. Expressions like “a reasonable opportunity of making objection” or “a reasonable opportunity of defence” have come up for consideration before this Court in the context of several statutes. A Constitution Bench of this Court in Khem Chand v. Union of India, of course in the context of service jurisprudence, reiterated certain principles which are applicable in the present case also.

26. S.R. Das, C.J. speaking for the unanimous Constitution Bench in Khem Chand held that the concept of “reasonable opportunity” includes various safeguards and one of them, in the words of the learned Chief Justice, is: (AIR p. 307, para 19) “(a) An opportunity to deny his guilt and establish his innocence, which he can only do if he is told what the charges levelled against him are and the allegations on which such charges are based;

27. It is no doubt true that at the stage of show cause, the person proceeded against must be told the charges against him so that he can take his defence and prove his innocence. It is obvious that at that stage the authority issuing the charge-sheet, cannot, instead of telling him the charges, confront him with definite conclusions of his alleged guilt. If that is done, as has been done in this instant case, the entire proceeding initiated by the show-cause notice gets vitiated by unfairness and bias and the subsequent proceedings become an idle ceremony.”

15. The Apex Court has held that the concept of reasonable opportunity includes various safeguards and one of them is to afford opportunity to the person to deny his guilt and establish his innocence, which he can only do if he is told what the charges leveled against him are and the allegations on which such charges are based.

17. As observed herein above, the impugned notice completely lacks in fulfilling the ingredients of a proper show-cause notice under Section 74 of the Act. Proceedings under Section 74 of the Act have to be preceded by a proper show-cause notice. A summary of show-cause notice as issued in Form GST DRC-01 in terms of Rule 142(1) of the JGST Rules, 2017 (Annexure-2 impugned herein) cannot substitute the requirement of a proper show-cause notice. This court, however, is not inclined to be drawn into the issue whether the requirement of issuance of Form GST ASMT-10 is a condition precedent for invocation of Section 73 or 74 of the JGST Act for the purposes of deciding the instant case. This Court finds that upon perusal of Annexure2 which is the statutory form GST DRC-01 issued to the petitioner, although it has been mentioned that there is mismatch between GSTR-3B and 2A, but that is not sufficient as the foundational allegation for issuance of notice under Section 74 is totally missing and the notice continues to be vague.”

13. The Apex Court in the case of Gorkha Securities (supra) concerning an order of blacklisting has laid down the ingredients of a proper show cause notice at para 21 and 22 of the report, which are extracted herein below:

“21. The central issue, however, pertains to the requirement of stating the action which is proposed to be taken. The fundamental purpose behind the serving of show-cause notice is to make the noticee understand the precise case set up against him which he has to meet. This would require the statement of imputations detailing out the alleged breaches and defaults he has committed, so that he gets an opportunity to rebut the same. Another requirement, according to us, is the nature of action which is proposed to be taken for such a breach. That should also be stated so that the noticee is able to point out that proposed action is not warranted in the given case, even if the defaults/breaches complained of are not satisfactorily explained. When it comes to blacklisting, this requirement becomes all the more imperative, having regard to the fact that it is harshest possible action.

22. The High Court has simply stated that the purpose of showcause notice is primarily to enable the noticee to meet the grounds on which the action is proposed against him. No doubt, the High Court is justified to this extent. However, it is equally important to mention as to what would be the consequence if the noticee does not satisfactorily meet the grounds on which an action is proposed. To put it otherwise, we are of the opinion that in order to fulfil the requirements of principles of natural justice, a show-cause notice should meet the following two requirements viz:

(i) The material/grounds to be stated which according to the department necessitates an action;

(ii) Particular penalty/action which is proposed to be taken. It is this second requirement which the High Court has failed to omit.

We may hasten to add that even if it is not specifically mentioned in the show-cause notice but it can clearly and safely be discerned from the reading thereof, that would be sufficient to meet this requirement.”

As held there in, the requirement of principles of natural justice can only be met if (i) a show cause notice contains the materials / grounds, which according to the Department necessitate an action; (ii) the particular penalty/ action which is proposed to be taken. Even if it is not specifically mentioned in the show cause notice, but it can be clearly and safely discerned from the reading thereof that would be sufficient to meet this requirement.

14. We find that the show cause notice is completely silent on the violation or contravention alleged to have been done by the petitioner regarding which he has to defend himself. The summary of show cause notice at annexure-2 though cannot be a substitute to a show cause notice, also fails to describe the necessary facts which could give an inkling as to the contravention done by the petitioner. As noted herein above, the brief facts of the case do not disclose as to which work contract, services were completed or partly completed by the petitioner regarding which he had not reflected his liability in the filed return as per GSTR-3B for the period in question. It needs no reiteration that a summary of show cause notice in Form DRC-01 could not substitute the requirement of a proper show cause notice. At the same time, if a show cause notice does not specify the grounds for proceeding against a person no amount of tax, interest or penalty can be imposed in excess of the amount specified in the notice or on grounds other than the grounds specified in the notice as per section 75(7) of the JGST Act.

15. Learned counsel for the petitioner has relying upon the case of Bharti Airtel Ltd. (supra) and contended that the Apex Court has observed that the common portal of GSTN is only a facilitator. The format GST DRC-01 or 01A are prescribed format on the online portal to follow up the proceedings being undertaken against an assessee. They themselves cannot substitute the ingredient of a proper show cause notice. If the show cause notice does not specify a ground, the Revenue cannot be allowed to raise a fresh plea at the time of adjudication, as has been held by the Apex Court in a matter arising under Central Excise Act in the case of Shital International (supra) at para 19, extracted herein below:

“19. As regards the process of electrifying polish, now pressed into service by the Revenue, it is trite law that unless the foundation of the case is laid in the show-cause notice, the Revenue cannot be permitted to build up a new case against the assessee. (See Commr. of Customs v. Toyo Engg. India Ltd., CCE v. Ballarpur Industries Ltd. and CCE v. Champdany Industries Ltd.) Admittedly, in the instant case, no such objection was raised by the adjudicating authority in the showcause notice dated 22-6-2001 relating to Assessment Years 1988-1989 to 2000-2001. However, in the show-cause notice dated 12-12-2000, the process of electrifying polish finds a brief mention. Therefore, in the light of the settled legal position, the plea of the learned counsel for the Revenue in that behalf cannot be entertained as the Revenue cannot be allowed to raise a fresh plea, which has not been raised in the show-cause notice nor can it be allowed to take contradictory stands in relation to the same assessee.”

In a notice under Section 74 of the JGST Act, the necessary ingredients relating to fraud or willful misstatement of suppression of fact to evade tax have to be impleaded whereas in a notice under Section 73 of the same act the Revenue has to specifically allege the violations or contraventions, which has led to tax not being paid or short paid or erroneously refunded or Input Tax Credit wrongly availed or utilized. It is trite law that unless the foundation of a case is laid down in a show cause notice, the assessee would be precluded from defending the charges in a vague show cause notice. That would entail violation of principles of natural justice. He can only do so, if he is told as to what the charges levelled against him are and the allegations on which such charges are based. Reliance is placed on the opinion of the Constitution Bench of the Apex Court in the case of Khem Chand versus Union of India [AIR 1958 SC 300], which has also been relied upon in the case of Oryx Fisheries P. Ltd. Vs. Union of India reported in (2010) 13 SCC 427 and profitably quoted in our decision rendered in the case of the same petitioner in W.P (T) No. 2444 of 2021

16. We are thus of the considered view that the impugned show cause notice as contained in Annexure-1 does not fulfill the ingredients of a proper show cause notice and amounts to violation of principles of natural justice. The challenge is entertainable in exercise of writ jurisdiction of this Court on the specified grounds as clearly held by the decision of the Apex Court in the case of Magadh Sugar & Energy Ltd. Vrs. State of Bihar & others reported in 2021 SCC Online SC 801, para 24 and 25. Accordingly, the impugned notice at annexure-1 and the summary of show cause notice at annexure-2 in Form GST DRC-01 is quashed. This Court, however is not inclined to be drawn into the issue whether the requirement of issuance of Form GST ASMT-10 is a condition precedent for invocation of Section 73 or 74 of the JGST Act for the purposes of deciding the instant case. Since the Court has not gone into the merits of the challenge, respondents are at liberty to initiate fresh proceedings from the same stage in accordance with law within a period of four weeks from today.

17. The writ petition is allowed in the manner and to the extent indicated hereinabove.

(Aparesh Kumar Singh, J.)

(Deepak Roshan, J.)