Offences and Penalties, Prosecution and Compounding

Q 1. What are the prescribed offences under MGL?

Ans. The Model GST Law codifies the offences and penalties in Chapter XVI. The Act lists 21 offences in section 66, apart from the penalty prescribed under section 8 for availing compounding by a taxable person who is not eligible for it. The said offences are as follows:-

1) Making a supply without invoice or with false/ incorrect invoice;

2) Issuing an invoice without making supply;

3) Not paying tax collected for a period exceeding three months;

4) Not paying tax collected in contravention of the MGL for a period exceeding 3 months;

5) Non deduction or lower deduction of tax deducted at source or not depositing tax deducted at source under section 37;

6) Non collection or lower collection of or nonpayment of tax collectible at source under section 43C;

7) Availing/utilizing input tax credit without actual receipt of goods and/or services;

8) Fraudulently obtaining any refund;

9) Availing/distributing input tax credit by an Input Service Distributor in violation of Section 17;

10) Furnishing false information or falsification of financial records or furnishing of fake accounts/ documents with intent to evade payment of tax;

11) Failure to register despite being liable to pay tax;

12) Furnishing false information regarding mandatory fields for registration;

13) Obstructing or preventing any official in discharge of his duty;

14) Transporting goods without prescribed documents;

15) Suppressing turnover leading to tax evasion;

16) Failure to maintain accounts/documents in the manner specified in the Act or failure to retain accounts/documents for the period specified in the Act;

17) Failure to furnish information/documents required by an officer in terms of the Act/Rules or furnishing false information/documents during the course of any proceeding;

18) Supplying/transporting/storing any goods liable to confiscation;

19) Issuing invoice or document using GSTIN of another person;

20) Tampering/destroying any material evidence;

21) Disposing of /tampering with goods detained/ seized/attached under the Act.

Q 2. What is meant by the term penalty?

Ans. The word “penalty” has not been defined in the MGL but judicial pronouncements and principles of jurisprudence have laid down the nature of a penalty as:

• a temporary punishment or a sum of money imposed by statute, to be paid as punishment for the commission of a certain offence;

• a punishment imposed by law or contract for doing or failing to do something that was the duty of a party to do.

Q 3. What are the general disciplines to be followed while imposing penalties?

Ans. The levy of penalty is subject to a certain disciplinary regime which is based on jurisprudence, principles of natural justice and principles governing international trade and agreements. Such general discipline is enshrined in section 68 of the Act. Accordingly—

• no penalty is to be imposed without issuance of a show cause notice and proper hearing in the matter, affording an opportunity to the person proceeded against to rebut the allegations levelled against him,

• the penalty is to depend on the totality of the facts and circumstances of the case,

• the penalty imposed is to be commensurate with the degree and severity of breach of the provisions of the law or the rules alleged,

• the nature of the breach is to be specified clearly in the order imposing the penalty

, • the provisions of the law under which the penalty has been imposed is to be specified.

Section 68 further specifies that, in particular, no substantial penalty is to be imposed for —

• any minor breach (minor breach has been defined as a violation of the provisions in a case where the tax involved is less than Rs.5000), or

• a procedural requirement of the law, or

• an easily rectifiable mistake/omission in documents (explained in the law as an error apparent on record) that has been made without fraudulent intent or gross negligence.

Further, wherever penalty of a fixed amount or a fixed percentage has been provided in the MGL, the same shall apply.

Q 4. What is the quantum of penalty provided for in the MGL?

Ans. Section 66(1) provides that any taxable person who has committed any of the offences mentioned in section 66 shall be punished with a penalty that shall be higher of the following amounts:

• The amount of tax evaded, fraudulently obtained as refund, availed as credit, or not deducted or collected or short deducted or short collected, or

• A sum of Rs.10,000/-

Further Section 66(2) provides that any registered taxable person who repeatedly makes a short payment of tax shall be a liable to penalty which will be the higher of :

• 10% of the tax short paid, or

• Rs.10,000.

Q 5. What will be considered as ‘repeated short payments’ for the purpose of levy of penalty?

Ans. Section 66(2) explains that three short payment in respect of three returns during any six consecutive tax periods shall be considered as repeated short payment for the purpose of levy of penalty.

Q 6. Is any penalty prescribed for any person other than the taxable person?

Ans. Yes. Section 66(3) provides for levy of penalty extending to Rs.25,000/- for any person who-

• aids or abets any of the 21 offences,

• deals in any way (whether receiving, supplying, storing or transporting) with goods that are liable to confiscation,

• receives or deals with supply of services in contravention of the Act,

• fails to appear before an authority who has issued a summon,

• fails to issue any invoice for a supply or account for any invoice required to be issued under law.

Q 7. What is the penalty provided for any contravention for which no separate penalty has been prescribed under MGL?

Ans. Section 67 of the MGL provides that any person who contravenes any provision of the Act or the rules made under this Act for which no separate penalty has been prescribed shall be punishable with a penalty that may extend to Rs.25,000/-

Q 8. What action can be taken for transportation of goods without valid documents or attempted to be removed without proper record in books?

Ans. If any person transports any goods or stores any such goods while in transit without the documents prescribed under the Act (i.e. invoice and a declaration) or supplies or stores any goods that have not been recorded in the books or accounts maintained by him, then such goods shall be liable for detention along with any vehicle on which they are being transported. Such goods may be released only after payment of the applicable tax, interest and penalty or upon furnishing of security equivalent to the said amount.

Q 9. What is the penalty prescribed for a person who opts for composition scheme despite being ineligible for the said scheme?

Ans. Section 8(3) provides that if a person who has opted for composition of his tax liability is found as not being eligible for compounding then such person shall be liable to penalty to an amount equivalent to the tax payable by him under the provisions of the Act i.e. as a normal taxable person and that this penalty shall be in addition to the tax payable by him.

Q 10. What is meant by confiscation?

Ans. The word ‘confiscation’ has not been defined in the Act. The concept is derived from Roman Law wherein it meant seizing or taking into the hands of emperor, and transferring to Imperial “fiscus” or Treasury. The word “confiscate” has been defined in Aiyar’s Law Lexicon as to “appropriate (private property) to the public treasury by way of penalty; to deprive of property as forfeited to the State.”

Q 11. Under which circumstances can goods be confiscated under MGL?

Ans. Under Section 70 of the MGL, goods shall be liable to confiscation if any person:

• supplies any goods in contravention of any provision of this Act and such contravention results in evasion of tax payable under the Act, or

• does not account for any goods in the manner required under the Act, or

• supplies goods that are liable to tax under the Act without applying for registration, or

• contravenes any provision of the Act/Rules with the intention of evading payment of tax.

Q 12. What happens to the goods upon confiscation of goods by the proper officer?

Ans. Upon confiscation, the title in the confiscated goods shall vest in the Government and every Police officer to whom the proper officer makes a request in this behalf, shall assist in taking possession of the goods.

Q 13. After confiscation, is it required to give option to the person to redeem the goods?

Ans. Yes. In terms of section 70(6), the Owner or the person in-charge of the goods liable to confiscation is to be given the option for fine (not exceeding market price of confiscated goods) in lieu of confiscation. This fine shall be in addition to the tax and other charges payable in respect of such goods.

Q 14. Can any conveyance carrying goods without cover of prescribed documents be subject to confiscation?

Ans. Yes. Section 71 provides that any conveyance carrying goods without the cover of any documents or declaration prescribed under the Act shall be liable to confiscation. However, if the owner of the conveyance proves that the goods were being transported without cover of the required documents/declarations without his knowledge or connivance or without the knowledge or connivance of his agent then the conveyance shall not be liable to confiscation as aforesaid. If the conveyance is being used for carrying goods or passengers for hire then the owner of such a conveyance may be provided an option to pay a fine equivalent to the tax payable on the goods, in lieu of confiscation. Section 72 provides that the confiscation or penalty under section 70 or 71 shall be without prejudice to any other punishment/action provided in the Act for the offence of carrying goods without cover of the required documents/declaration.

Q 15. What is Prosecution?

Ans. Prosecution is the institution or commencement of legal proceeding; the process of exhibiting formal charges against the offender. Section 198 of the Criminal Procedure Code defines “prosecution” as the institution and carrying on of the legal proceedings against a person.

Q 16. Which are the offences which warrant prosecution under the MGL?

Ans. Section 73 of the MGL codifies the major offences under the Act which warrant institution of criminal proceedings and prosecution. 12 such major offences have been listed as follows:

1) Making a supply without issuing an invoice or upon issuance of a false/incorrect invoice;

2) Issuing an invoice without making supply;

3) Not paying tax collected for a period exceeding 3 months;

4) Not depositing any tax that has been collected in contravention of the Act for a period exceeding 3 months;

5) Availing or utilizing credit of input tax without actual receipt of goods and/or services;

6) Obtaining any fraudulent refund;

7) Furnishing false information or falsification of financial records or furnishing of fake accounts/ documents with intent to evade payment of tax;

8) Obstructing or preventing any official in the discharge of his duty;

9) Dealing with goods liable to confiscation i.e. receipt, supply, storage or transportation of goods liable to confiscation;

10) Receiving/dealing with supply of services in contravention of the Act;

11) Failing to supply any information required of him under the Act/Rules or supplying false information;

12) Attempting to commit or abetting the commission of any of the above 11 offences.

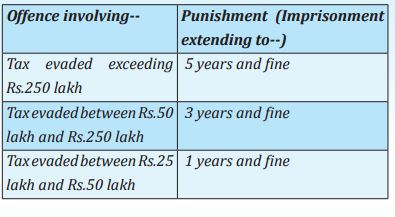

Q 17. What is the punishment prescribed on conviction of any offence under the MGL?

Ans. The scheme of punishment provided in section 73(1) is as follows:

Section 73(2) provides that a second or any subsequent conviction for an offence in this section shall be punishable with imprisonment for a term that may extend to 5 years and a fine. However, no imprisonment for any of the offences shall be for a period less than six months

Q 18. What are cognizable and non-cognizable offences under MGL?

Ans. In terms of Section 73(3) and 73(4) of MGL

• all offences where the evasion of tax is less than Rs.250 lakh shall be non-cognizable and bailable,

• all offences where the evasion of tax exceeds Rs.250 lakh shall be cognizable and nonbailable.

Q 19. Is prior sanction of competent authority mandatory for initiating prosecution?

Ans. Yes. No person shall be prosecuted for any offence without the prior sanction of the designated authority

Q 20. Is ‘mensrea’ or culpable mental state necessary for prosecution under MGL?

Ans. Yes. However, Section 75 presumes the existence of a state of mind (i.e. “culpable mental state” or mensrea) required to commit an offence if it cannot be committed without such a state of mind.

Q 21. What is a culpable state of mind?

Ans. While committing an act, a “culpable mental state” is a state of mind wherein-

• the act is intentional;

• the act and its implications are understood and controllable;

• the person committing the act was not coerced and even overcomes hurdles to the act committed;

• the person believes or has reasons to believe that the act is contrary to law.

Q 22. Can a company be proceeded against or prosecuted for any offence under the MGL?

Ans. Yes. Section 77 of the MGL provides that every person who was in-charge of or responsible to a company for the conduct of its business shall, along-with the company itself, be liable to be proceeded against and punished for an offence committed by the company while such person was in-charge of the affairs of the company. If any offence committed by the company—

• has been committed with the consent/ connivance of, or

• is attributable to negligence of—

any officer of the company then such officer shall be deemed to be guilty of the said offence and liable to be proceeded against and punished accordingly.

Q 23. What is meant by compounding of offences?

Ans. Section 320 of the Code of Criminal Procedure defines “compounding” as to forbear from prosecution for consideration or any private motive.

Q 24. Can offences under MGL be compounded?

Ans. Yes. As per section 78 of the MGL, any offence, other than the following, may upon payment of the prescribed (compounding) amount be compounded and such compounding is permissible either before or after the institution of prosecution:

• Offences numbered 1 to 7 of the 12 major offences (outlined in Q. 16 above), if the person charged with the offence had compounded earlier in respect of any of the said offences;

• Aiding/abetting offences numbered 1 to 7 of the 12 major offences, if the person charged with the offence had compounded earlier in respect of any of the said offences;

• Any offence (other than the above offences)under any SGST Act/IGST Act in respect of a supply with value exceeding Rs.1 crore, if the person charged with the offence had compounded earlier in respect of any of the said offences;

• Any offence which is also an offence under NDPSA or FEMA or any other Act other than CGST/SGST;

• Any other class of offences or persons that may be prescribed in this behalf.

Compounding is to be permitted only after payment of tax, interest and penalty and compounding shall not affect any proceeding already instituted under any other law.

Q 25. Are there any monetary limits prescribed for compounding of offence?

Ans. Yes. The lower limit for compounding amount is to be the greater of the following amounts:-

• 50% of tax involved, or

• Rs.10,000.

The upper limit for compounding amount is to be greater of the following amounts:-

• 150% of tax involved or

• Rs.30,000.

Q 26. What is the consequence of compounding of an offence under MGL?

Ans. Sub-section (3) of section 77 provides that on payment of compounding amount no further proceeding to be initiated under this Act and criminal proceeding already initiated shall stand abated.

Download Complete FAQ on GST released by CBC

Download Model GST Law Released by Govt

[wysija_form id=”1″]