GST Rate Change

One party billed to his customer with GST 28% and meanwhile tax rate was reduce @ 18%. After ten days, now buyer is demanding credit note for 10% of GST. What is the solution.

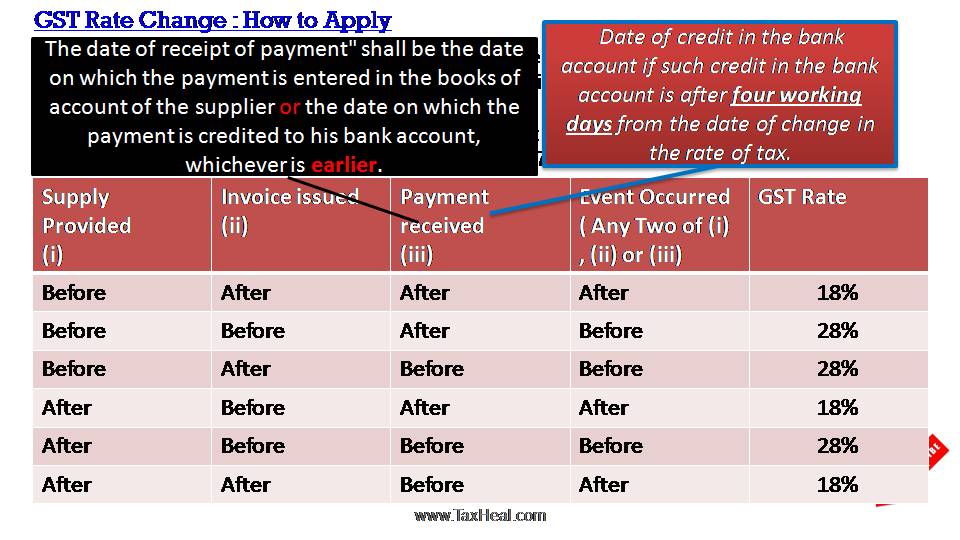

Q- How do we determine the rate of tax in case, if there is change in the GST tax rates?

Ans. Three important events need to be considered –

1.Date of raising invoice,

2.Receipt of payment and

3.Completion of supply.

If any of the two events occur before the change in rate of tax, then the old rate will apply else the new rate will apply.

[ Section 14 of CGST Act (Change in rate of tax in respect of supply of goods or services ) ]

Illustration – Rate of GST on Supply made on or after November 15, 2017 reduced from say 28% to 18% then the tax to be applied on supplies will be as under :

Before – Event occurred before November 15, 2017 : 28%

After – Event occurred on or after November 15, 2017 : 18%

Related Topic on GST

| Topic | Click Link |

| GST Acts | Central GST Act and States GST Acts |

| GST Rules | GST Rules |

| GST Forms | GST Forms |

| GST Rates | GST Rates |

| GST Notifications | GST Act Notifications |

| GST Circulars | GST Circulars |

| GST Judgments | GST Judgments |

| GST Press Release | GST Press Release |

| GST Books | Best Books on GST in India |

| GST Commentary | Topic wise Commentary on GST Act of India |

| GST You Tube Channel | TaxHeal You Tube Channel |

| GST Online Course | Join GST online Course |

| GST History | GST History and Background Material |