GST Registration

Provisions for GST Registration Process

- Chapter VI of the Model GST Law

- Schedule III of the Model GST Law

- Report of Joint Committee on Business Processes on GST Registration

- Draft GST Registration Rules

- Draft GST Registrations Formats

- FAQ’s on GST Registration

Benefits of taking GST Registration

Timely GST Registration will give you ITC on Stock held preceding the date from which Taxable person becomes liable to pay tax ( Example 1 to 3-Annexure-B)

Save yourself from Legal Action against the person who failed to obtain GST Registration (Example 4-Annexure-B)

- Save from Confiscation of Goods if GST Registraton not obtained by Taxable Person (Example 5-Annexure-B)

- If GST Registraton not obtained by Taxable Person it is treated as ‘ Offence ‘. Thus timely GST registration will save you from this harsh provision u/s section 66 of GST.

- Legally recognized as a supplier of goods or services in India;

- Proper accounting of taxes paid on the input goods or services that can be utilized for payment of GST due on supply of goods or services or both by the business;

- Pass on the Input Tax Credit of the taxes paid on the goods or services supplied to purchasers or recipients; and

Topic Covered in this article on GST Registration

| S.No | Topics Covered |

| 1 | Persons liable for GST Registration |

| 2 | Documents required for GST Registration |

| 3 | Time Limit for GST Registration |

| 4 | Procedure for Application of GST Registration |

| 5 | Grant of GST Registration certificate |

| 6 | Structure of GST Registration Number |

| 7 | Multiple GST Registrations in case of Multiple Business Verticals |

| 8 | Migration of persons registered under Earlier Law |

| 9 | GST Registration under Special Categories |

| 10 | Examples |

1. Persons liable for GST Registration

- Turnover for GST Registration of New taxable person :– Every supplier shall be liable to be registered under GST in the State from where he makes a taxable supply of goods and/or services if his aggregate turnover in a financial year exceeds Rs 9 lakhs. However, if supplier is engaged in business from North Eastern States (Arunachal Pradesh, Assam, Meghalaya, Manipur, Mizoram, Nagaland and Tripura and Sikkim.) then this threshold will be Rs. 4 lakhs. It is also important to understand that the threshold for registration and threshold for payment of tax are different. While the threshold for payment of tax is Rs. 10 lacs and Rs. 5 lacs as indicated above ( However as per GST Council decision threshold for payment of tax is Rs. 20 lacs and Rs. 10 lacs for NR States) , the threshold for registration is Rs. 9 lacs and Rs. 4 lacs respectively.

- GST Registration of Existing registered person:- Every person who, on the day immediately preceding the appointed day, is registered or holds a license under an earlier law, shall be liable to be registered under this Act with effect from the appointed day. Such person is not required to get fresh registration under this act. He can follow the procedure as may be prescribed in this behalf.

- GST Registration in case of succession /Transfers :- Where a business carried on by a taxable person registered under this Act is transferred, whether on account of succession or otherwise, to another person as a going concern, the transferee, or the successor, as the case may be, shall be liable to be registered with effect from the date of such transfer or succession.

- GST Registration in case of Amalgamation :- In a case of transfer pursuant to sanction of a scheme or an arrangement for amalgamation or, as the case may be, de-merger of two or more companies by an order of a High Court, the transferee shall be liable to be registered, where required, with effect from the date on which the Registrar of Companies issues a certificate of incorporation giving effect to such order of the High Court.

- Mandatory GST Registration irrespective of Turnover:– Following categories of suppliers shall mandatory required to get registered under this Act irrespective of the threshold limit:

1. Persons making any inter-State taxable supply.

2. Casual taxable persons. (Section 2(21) – a casual taxable person means a

person who occasionally undertakes transactions involving supply of goods and/or

services in the course or furtherance of business whether as principal, agent or in any

other capacity, in a taxable territory where he has no fixed place of business.)

3. Persons who are required to pay tax under reverse charge.

4. Non-resident taxable persons.(Section 2(69) – a non-resident taxable person

means a taxable person who occasionally undertakes transactions involving supply of

goods and/or services whether as principal or agent or in any other capacity but who

has no fixed place of business in India.)

5. Persons who are required to deduct tax under section 37. Department or establishment of a Central or State Government; or

Local authority; or

Governmental agency; or

Such other person or category of persons, as may be notified by the Central or State Government on recommendation of the Council6. Persons who supply goods and/or services on behalf of other registered taxable persons whether as an agent or otherwise.

7. Input service distributor (Section 2(56)- An Input service distributor means an

office of the supplier of goods and / or services receiving or issuing tax invoices including debit / credit notes for the purposes of distributing SGST / CGST / IGST to the supplier of goods and / or services having the same PAN.)

8. Persons who supply goods and/or services, other than branded services, through electronic commerce operator.

9. Every electronic commerce operator.(In terms of Section 43B(e) of the Act, an electronic

commerce operator means any person who directly or indirectly owns or operates or

manages an e-platform that is engaged in enabling the supply of goods and / or

services or information. It would however, not include person supplying goods and / or

services on their own behalf.)10. An aggregator who supplies services under his brand name or his trade name.(In terms of

Section 43B(a) of the Act, an aggregator is defined to mean a person, who owns and

manages an electronic platform, and by means of the application and a communication

device, enables a potential customer to connect with the persons providing service of a

particular kind under the brand name or trade name of the said aggregator.)11.Job worker, in respect of goods supplied by the job worker after completion of job work

(refer Section 43A)12. Such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council. [UN bodies for allotment of Unique Identification Number]

Note 1: Taxable threshold for GST Registration

The taxable threshold shall include all supplies made by the taxable person, whether on his own account or made on behalf of all his principals.

Note 2: Supply of goods to Job worker

The supply of goods, after completion of job-work, by a registered job worker shall be treated as the supply of goods by the “principal” referred to in section 43A, and the value of such goods shall not be included in the aggregate turnover of the registered job worker.

Note 3 : Separate Registration for each state

Every person who is liable to take a Registration will have to get registered separately for each of the States where he has a business operation.

Note 4:Agriculturist

An agriculturist shall not be considered as a taxable person and shall not be liable to take registration. (As per section 9 (1)).

Note 5 : Registration under SGST means registration under CGST also and vice versa.

2. Documents required for New GST Registration

List of documents to be uploaded as evidence for filling Application for New Registration under GST (GST REG 01 )

- Photographs (wherever specified in the Application Form)

(a) Proprietary Concern – Proprietor

(b) Partnership Firm / LLP – Managing/Authorized/Designated Partners (personal details of all

partners is to be submitted but photos of only ten partners including that of Managing Partner

is to be submitted)

(c) HUF – Karta

(d) Company – Managing Director or the Authorised Person

(e) Trust – Managing Trustee

(f) Association of Person or Body of Individual –Members of Managing Committee (personal

details of all members is to be submitted but photos of only ten members including that of

Chairman is to be submitted)

(g) Local Authority – CEO or his equivalent

(h) Statutory Body – CEO or his equivalent

(i) Others – Person in Charge - Constitution of Taxpayer:

- Partnership Deed in case of Partnership Firm,

- Registration Certificate/Proof of Constitution in case of Society, Trust, Club, Government Department,Association of Person or Body of Individual, Local Authority, Statutory Body and Others etc.

- Proof of Principal/Additional Place of Business:

(a) For Own premises –

Any document in support of the ownership of the premises like Latest Property Tax Receipt or

Municipal Khata copy or copy of Electricity Bill.

(b) For Rented or Leased premises –

A copy of the valid Rent / Lease Agreement with any document in support of the ownership of

the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of

Electricity Bill.

(c) For premises not covered in (a) & (b) above –

A copy of the Consent Letter with any document in support of the ownership of the premises

of the Consenter like Municipal Khata copy or Electricity Bill copy. For shared properties also,

the same documents may be uploaded. - Bank Account Related Proof:

Scanned copy of the first page of Bank passbook / one page of Bank Statement

Opening page of the Bank Passbook held in the name of the Proprietor / Business Concern –

containing the Account No., Name of the Account Holder, MICR and IFSC and Branch details. - Authorization Form:-

For each Authorised Signatory mentioned in the application form, Authorization or copy of

Resolution of the Managing Committee or Board of Directors to be filed in the following

format:

Declaration for Authorised Signatory (Separate for each signatory)

I/We —

(Details of Proprietor/all Partners/Karta/Managing Directors and whole time

Director/Members of Managing Committee of Associations/Board of Trustees etc)

1. << Name of the Proprietor/all Partners/Karta/Managing Directors and whole time

Director/Members of Managing Committee of Associations/Board of Trustees etc>>

2.

3.

hereby solemnly affirm and declare that <<name of the authorized signatory>> to act as an

authorized signatory for the business << GSTIN – Name of the Business>> for which

application for registration is being filed/ is registered under the Goods and Service Tax Act,

20__.

All his actions in relation to this business will be binding on me/ us.

Signatures of the persons who are Proprietor/all Partners/Karta/Managing Directors and

whole time Director/Members of Managing Committee of Associations/Board of Trustees etc.

S. No. Full Name Designation/Status Signature

Acceptance as an authorized signatory

I <<(Name of the authorized signatory>> hereby solemnly accord my acceptance to act as

authorized signatory for the above referred business and all my acts shall be binding on the

business

Signature of Authorised Signatory

Place (Name)

Date Designation/Status

Read Also :GST Registration (India)- Instruction for filling Application for New Registration

3. Time Limit for GST Registration

4.1 Every Manufacturer or a Service provider or a dealer registered under Central Excise Act or under Service tax law or State Vat law will get automatic PAN based registration number without fresh application.

4.2 In case of new dealer, he has to apply online for the registration within a specified period as stated below:

| S. No | Category | Time Limit |

| 1 | A dealer crossing threshold limit as specified under GST Law (Rs 9 Lakhs or Rs 4 Lakhs).(This limit may get changed under the final GST law) | Within 30 days from crossing of such limit. |

| 2 | Other than 1 above (Example: In case of Reverse Charge etc) | Within 30 days from the date on which he become liable for registration |

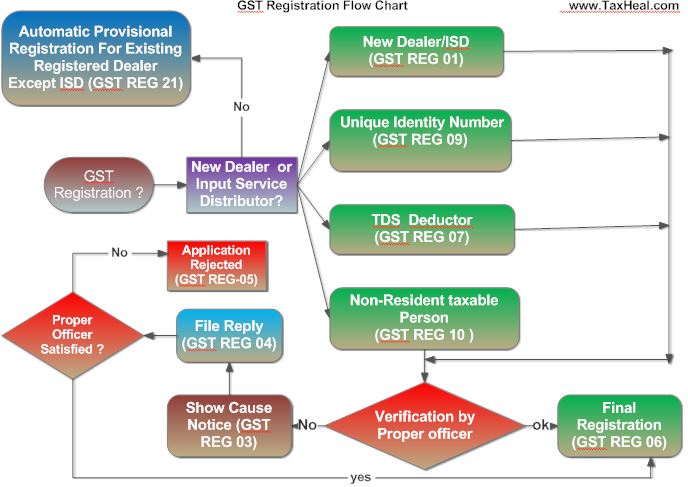

4. Procedure for Application of Registration

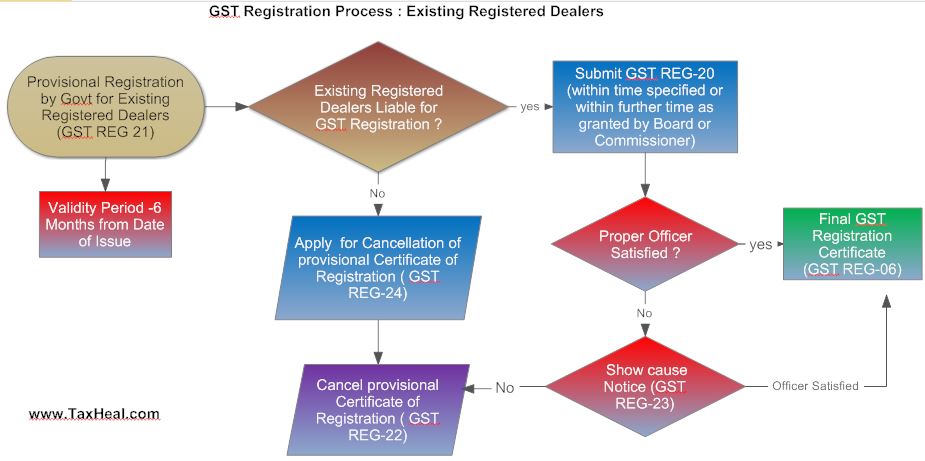

GST Registration Steps for Existing Delaer (Automatic Provisional Registration)

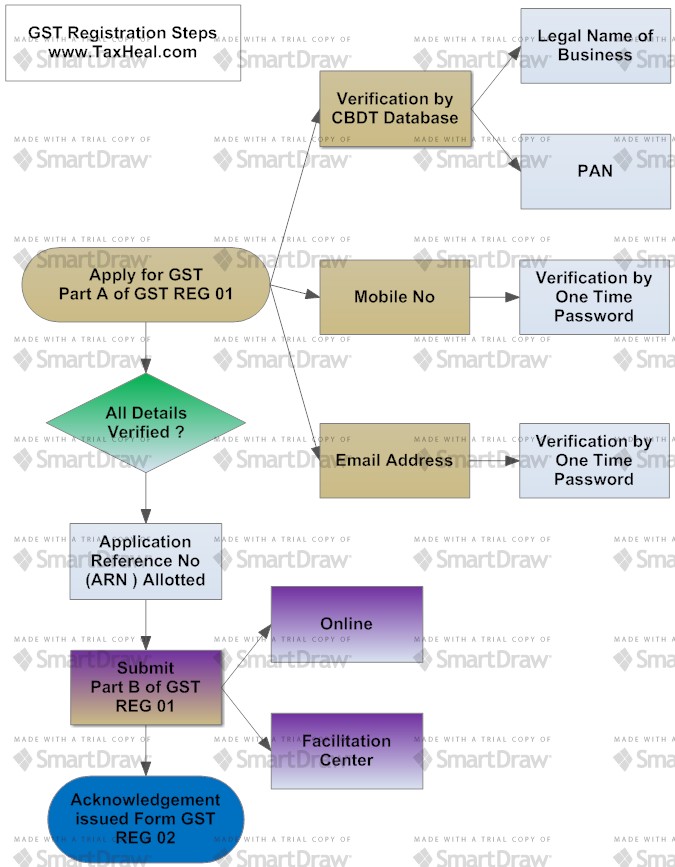

GST Registration Steps for New Dealer

- There are 26 forms for registration from GST REG-01 to GST REG-26 (Refer Annexure-A). Before applying for registration, the taxable person needs to declare his PAN, mobile number and e-mail address in PART A of FORM GST REG-01 on common portal and then submit application in PART B of FORM GST REG-01 duly signed along with Documents specified. There are different forms for the registration of casual taxable person, Non-resident taxable person etc. There are forms for cancellation and amendment as well.

- Application for registration to be made electronically on the Common Portal or the GST Network (“GSTN”) within the due dates as per the Model GST Act (“GST Law”)

- Validation of PAN, E-Mail ID and Contact Number is mandatory before submission of application for GST Registration

- Documents prescribed for GST registration has to be uploaded before submission of application.

- GST Registration will be granted within 3 common working days if no discrepancy found. If any discrepancy is found, the same will be communicated through the GSTN within the above time limit.

- Any discrepancy communicated by Central GST officer would also be forwarded to the concerned State GST Officer for his action and vice versa. Reply to discrepancies has to be furnished within 7 common working days.

- The GST Registration is deemed to have been granted if the officer fails to take action within the prescribed time limits.

- GST Registration Certificate will be available on the GSTN for the principle place of business and for every additional place of business.

- Separate GST registration for each business vertical is allowed subject to conditions.

- Display of GSt Registration Certification and GSTIN is mandatory.

- No fee is prescribed for obtaining GST registration. However, the advance deposit of tax is applicable to prescribed persons before obtaining GST registration.

- Amendments has to be communicated filing prescribed form on GSTN within fifteen days of occurrence. Certain amendments are approved immediately upon submission of application.

- There are separate provisions and forms for Suo Moto GST Registration, Cancellation of GST Registration and its Revocation.

- Verification of premises may be taken up by the proper officer after granting GST registration.

Transition Provision for GST Registration

- All existing dealers will be automatically granted registration under the GST law on a provisional basis.

- The provisional GST registration will be given final status upon submission of prescribed information and documents within six months. No time limit prescribed for the officer to grant final GSt registration.

- Any person holding provisional GST registration may file a declaration on GSTN that he is not required to obtain GST registration under the GST Law and the provisional registration would be cancelled.

5. Grant of GST Registration certificate

- GST Registration will be granted within 3 common working days in GST REG 06 if no discrepancy found. If any discrepancy is found, the same will be communicated through the GSTN within the above time limit.

- Any discrepancy communicated by Central GST officer would also be forwarded to the concerned State GST Officer for his action and vice versa. Reply to discrepancies has to be furnished within 7 common working days.

- The GST Registration is deemed to have been granted if the officer fails to take action within the prescribed time limits.

- The registration shall be effective from the date on which the person becomes liable to registration where the application for registration has been submitted within thirty days from such date. Where an application for registration has been submitted by the applicant after thirty days from the date of his becoming liable to registration, the effective date of registration shall be the date of grant of registration.

- GST Registration Certificate will be available on the GSTN for the principle place of business and for every additional place of business.

- Separate GST registration for each business vertical is allowed subject to conditions.

- Display of GST Registration Certification and GSTIN is mandatory.

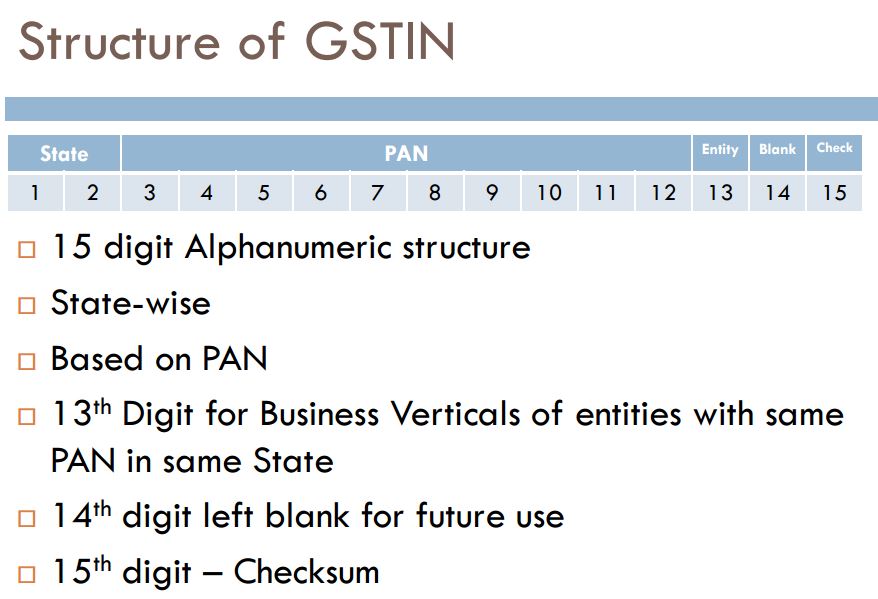

6. Structure of GST Registration Number (GSTIN)

Each tax payer will be allotted a State wise PAN based 15- digit Goods and Services Taxpayer Identification Number (GSTIN). First 2 digits will be State Code. Next 10 digits will be Income Tax PAN. 13th digit will be entity code. 14thdigit will be blank for future use. 15th digit will be check digit which is a form of redundancy check used for detection of errors

7. Multiple GST Registrations in case of Multiple Business Verticals

7.1 A person having multiple business verticals in a state may obtain separate registration for each business vertical by filing separate application for each vertical in FORM GST REG-01.

7.2 “Business vertical” shall have the meaning assigned to a ‘business segment’ in Accounting Standard 17 issued by ICAI- Section 2(18) of GST Model Law 2016.

7.3 As per Accounting Standard-17

“A business segment is a distinguishable component of an enterprise that is engaged in providing an individual product or service or a group of related products or services and that is subject to risks and returns that are different from those of other business segments. Factors that should be considered in determining whether products or services are related include:

(a) the nature of the products or services;

(b) the nature of the production processes;

(c) the type or class of customers for the products or services;

(d) the methods used to distribute the products or provide the services; and

(e) if applicable, the nature of the regulatory environment, for example, banking, insurance, or public utilities.”

7.4 For example ABC Ltd. is an Indian conglomerate headquartered in Kolkata, West Bengal. Its diversified business includes five segments: fast moving consumer goods, hotels, paperboards & packaging. It may go for separate registration for each business vertical or may continue with single registration of all the verticals in a state. It needs to take registration of principle place of business in every state from where the supplies are being made.

8.Migration of persons registered under Earlier Law

8..1 Existing Migrants are those who are either registered with States or with the Centre or with both.

8.2 At present, taxpayers are separately registered with State and/ or with Central tax administrations or with both based on their business activity. In the GST regime, a taxpayer will have to obtain State wise registration. Procedure for Migration is explained in Rule 14 of Draft Registration Rules would work out as follows:

GST Registration Steps for Existing Delaer (Automatic Provisional Registration)

| Steps | Procedure | FORM |

| 1 | Existing taxable persons will be given provisional registration certificate | GST REG-21 |

| 2 | Provisional registration holder shall submit application duly signed and along with the documents required in the application form electronically within period of 6 months | GST REG-20 |

| 3 | If the application and documents found in order, Registration Certificate would be granted | GST REG-06 |

| 4 | If there is found any discrepancy in the application then proper officer can cancel the provisional registration and issue an order | GST REG-22 |

| 5 | No provisional certificate would be cancelled without serving a notice to show cause | GST REG-23 |

| 6 | Person registered under earlier law, if not liable to register under this law due to any reason shall file an application | GST REG-24 |

9. GST Registration under Special Categories

| Categories | Procedure |

| Casual Taxable Persons- Person who occasionally undertakes transactions involving supply of goods and/or services in the course or furtherance of business whether as principal, agent or in any other capacity, in a taxable territory where he has no fixed place of business.(Section 2(21) of Model GST Act) | Procedure for application is same as explained above for new applicant with a slight difference that a casual taxable person shall be given a temporary identification number by the Common Portal for making advance deposit of tax under acknowledgement in FORM GST REG—02 shall be issued electronically thereafter. |

| Non Resident taxable Persons- means a taxable person who occasionally undertakes transactions involving supply of goods and/or services whether as principal or agent or in any other capacity but who has no fixed place of business in India (Section 2(69) of Model GST Act) | Non Resident taxable person shall submit an application in FORM GST REG-10 atleast 5 days prior to the commencement of business. |

| Compounding Dealers- Dealers below the Compounding ceiling (50 lakhs) will be provided with an option of availing the Compounding scheme i.e. they can pay the tax at Compounding rate (to be decided) without entering the credit chain. | Although the Compounding scheme is only a temporary phase before the taxable person starts functioning as a normal taxable person. When the taxable person opts for Compounding scheme he should indicate so in the registration form and GST Common Portal would internally flag him as a Compounding dealer. Later on when he goes out of the Compounding scheme due to his turnover crossing the Compounding ceiling (change will be triggered by the tax return values) or he opts out of the scheme (through an amendment application), the said flag will be removed and he would continue operating with the same registration number, without undertaking any fresh registration. |

Note: The Registration Certificate issued to casual taxable person or a non resident taxable person shall be valid for a period of 90 days from the effective date of registration. For extension of the same, an application in FORM GST REG-25 shall be furnished electronically.

Annexure -A (GST Registration Forms)

26 Forms for Registration prescribed for GST Registration

26 Forms for Registration have been prescribed (Form GST REG-01 to Form GST REG-26), namely-GST REG 01, GST REG 02, GST REG 03, GST REG 04, GST REG 05, GST REG 06, GST REG 07, GST REG 08, GST REG 09, GST REG 10, GST REG 11, GST REG 12, GST REG 13, GST REG 14, GST REG 15, GST REG 16, GST REG 17, GST REG 18, GST REG 19, GST REG 20, GST REG 21, GST REG 22, GST REG 23, GST REG 24, GST REG 25,

| Sr. No | Form Number | Content |

| 1 | GST REG 01 | Application for Registration under Section 19(1) of Goods and Services Tax Act, 20– |

| 2 | GST REG 02 | Acknowledgement |

| 3 | GST REG 03 | Notice for Seeking Additional Information/ Clarification/ Documents relating to Application for<<Registration/Amendment/Cancellation>> |

| 4 | GST REG 04 | Application for filing clarification/additional information/ document for <<Registration/Amendment/Cancellation/ Revocation of Cancellation>> |

| 5 | GST REG 05 | Order of Rejection of Application for <<Registration /Amendment / Cancellation/ Revocation of Cancellation>> |

| 6 | GST REG 06 | Registration Certificate issued under Section 19(8A) of the Goods and Services Tax Act, 20– |

| 7 | GST REG 07 | Application for Registration as Tax Deductor or Tax Collector at Source under Section 19(1) of the Goods and Service Tax Act, 20– |

| 8 | GST REG 08 | Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source under Section 21 of the Goods and Service Tax Act, 20–. |

| 9 | GST REG 09 | Application for Allotment of Unique ID to UN Bodies/Embassies /any other person under Section 19(6) of the Goods and Service Tax Act, 20–. |

| 10 | GST REG 10 | Application for Registration for Non Resident Taxable Person. |

| 11 | GST REG 11 | Application for Amendment in Particulars subsequent to Registration |

| 12 | GST REG 12 | Order of Amendment of existing Registration |

| 13 | GST REG 13 | Order of Allotment of Temporary Registration/ Suo Moto Registration |

| 14 | GST REG 14 | Application for Cancellation of Registration under Goods and Services Tax Act, 20–. |

| 15 | GST REG 15 | Show Cause Notice for Cancellation of Registration |

| 16 | GST REG 16 | Order for Cancellation of Registration |

| 17 | GST REG 17 | Application for Revocation of Cancelled Registration under Goods and Services Act, 20–. |

| 18 | GST REG 18 | Order for Approval of Application for Revocation of Cancelled Registration |

| 19 | GST REG 19 | Notice for Seeking Clarification/Documents relating to Application for << Revocation of Cancellation>> |

| 20 | GST REG 20 | Application for Enrolment of Existing Taxpayer |

| 21 | GST REG 21 | Provisional Registration Certificate to existing taxpayer |

| 22 | GST REG 22 | Order of cancellation of provisional certificate |

| 23 | GST REG 23 | Intimation of discrepancies in Application for Enrolment of existing taxpayer |

| 24 | GST REG 24 | Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Services Tax Act 20– |

| 25 | GST REG 25 | Application for extension of registration period by Casual / Non-Resident taxable person. |

| 26 | GST REG 26 | Form for Field Visit Report |

Examples on GST Registration ( Annexure -B)

Q1 . What is the ITC entitlement of a person who has applied for registration under the Act within thirty days from the date on which he becomes liable to registration and has been granted such registration? (Section 16(2))

Ans. He shall be entitled to take credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date from which he becomes liable to pay tax under the provisions of this Act. It may be noted that the credit on pre-registration stock would not be admissible if the registration has not been obtained within a period of 30 days from the date on which he becomes liable to registration.

Q2 . A person becomes liable to pay tax on 1st August, 2017 and has obtained registration on 15th August, 2017. Such person is eligible for input tax credit on inputs held in stock as on …….

Ans. 31st July, 2017.

Q3 . Mr. A applies for voluntary registration on 5th June, 2017 and obtained registration on 22nd June, 2017. Mr. A is eligible for input tax credit on inputs in stock as on …………..

Mr. A is eligible for input tax credit on inputs held in stock and inputs contained in semi-finished or finished goods held in stock as on 21st June, 2017.

Q4 . What is the legal recourse available in respect of a person who is liable to pay tax but has failed to obtain registration?

Ans. Section 47 of Model GST Law provides that in such a case, the proper officer can assess the tax liability and pass an order to his best judgment for the relevant tax periods. However, such an order must be passed within a period of five years from the due date of filing of the annual return for the financial year to which non-payment of tax relates.

Q 5. When does goods become liable to confiscation under the provisions of Model GST Law?

Ans. As per section 70 of Model GST Law, goods become liable to confiscation when any person does the following:

(i) supplies any goods in contravention of any of the provisions of this Act or rules made thereunder leading to evasion of tax;

(ii) does not account for any goods on which he is liable to pay tax under this Act; 190 191

(iii) supplies any goods liable to tax under this Act without having applied for the registration;

(iv) contravenes any of the provisions of the CGST/ SGST Act or rules made thereunder with intent to evade payment of tax.

Q. ABC Ltd., located in Delhi supplies goods in Delhi as well as in neighbouring states Haryana, Rajasthan and Uttar Pradesh. The company has noted its turnover never exceeds 20 lakhs. Examine whether ABC Ltd is required to register under GST. If yes, in which states registration are required.

Yes, ABC Ltd is required to register under GST law. Though the turnover is below threshold but since the company is making inter-state sales, it is required to apply for registration under GST.

As per Schedule III of the Model GST law every supplier shall be liable to be registered under this act in State from where he makes a taxable supply of goods/services.

As per the Schedule III, ABC Ltd is required to register in all the states from where it is affecting taxable supplies of goods or services. In case the supplies are affected only from Delhi, then registration shall be in Delhi only.

Q. PQR Ltd., located in the state of Maharashtra is engaged in selling designer shirts. The process of designing is completed at the job worker premises, located within Maharashtra. Goods are sold from the location of PQR Ltd. How will the process of registration work in this matter?

If the supply of goods is made from the premises of PQR Ltd., then the job worker would be required to take registration only if its turnover exceeds the maximum threshold limit. However, the value of goods supplied to PQR Ltd after completion of job work, would not be taken into account while computing turnover of the job worker.

Q. State whether PQR Ltd is required to take registration. The value of supplies made during the FY 2017-18 is as follows:

| Particulars | Value of supplies (excluding GST) |

| Supply of goods | 5 lakhs |

| Supply of goods from registered job worker premises | 2 lakhs |

| Supply of exempted goods | 12 lakhs |

| Supply of goods under reverse charge | 20 lakhs |

| Supply of non taxable goods | 0.5 lakhs |

Since the aggregate turnover of PQR Ltd does not exceed 20 Lakhs without taking into account the value of supplies on which tax is levied on reverse charge basis, the company is not liable for registration under GST.

Note: Aggregate turnover does not include the value of supplies on which tax is levied on reverse charge basis and the value of inward supplies.

Q. Company A Ltd. is operating in 10 states under the same PAN number. It is having at least 3 branches in each state. How does the provisions of registration apply on the company?

If a company is operating in different states with the same PAN number, it is liable to get registered separately for each of the states where it has a business operation and from where supplies are being made.

In the given case, Company A Ltd. is liable for registration in all those states from where it is making supply of goods/services.

For the branches within each state, single registration number can be used for each state. Also, the company may also obtain separate registration for each business vertical in terms of sub-section (2) of section 19.

Q A logistics company operates in different parts of country. It has warehouses in the state of Haryana, Maharashtra, West Bengal and Punjab. Also, the company is headquartered in Delhi from where no supplies are made. Supplies made by various warehouses are given below:

| Supplies From | Supplies to | Turnover |

| Warehouse in Haryana | Other Warehouses only | 8 lakhs |

| Warehouse in Maharashtra | Customers With in Maharashtra only | 5 lakhs |

| Warehouse in West Bengal | Customers with in West Bengal only | 22 lakhs |

| Warehouse in Punjab | Customers outside the state of Punjab | 2 lakhs |

Which all states does the company need to register?

Comments. Since the Company is headquartered in Delhi with no supplies made therefrom, there is no need to take registration. However, if the company avails taxable services, it can explore the possibility of obtaining registration as Input Service Distributor (ISD). For ISD registration threshold limit is not required.

Assuming all the warehouses are operating under the same PAN. All are considered as place of business as per the definition given under section 2(75) of Model GST law. The gross turnover of all warehouses is exceeding 20 lakhs therefore separate registration is required in each state from where the supplies are made.

Q A Chartered Accountancy firm has branches in Delhi, Mumbai and Bangalore. The HO is in Delhi from where majority of the services are supplied. However, services are also provided from Mumbai and Bangalore. Currently, the firm has taken centralised registration in Delhi and all the billing happens from Delhi. How will the position change under GST?

Comments. The concept of centralised registration has been done away with under the Model GST law. Consequently, each office of the CA firm that is supplying services, i.e., Delhi, Mumbai and Bangalore would need to get registered under GST. This also means that each office will need to issue invoices for supplies made in the respective states and maintain all the necessary records and documentation.

Free Education Guide on Goods & Service Tax (GST)