Registration Process under Model GST Law of India

Liability for GST Registration as per Chapter VI of Model GST Law:

(I) Section 19 – GST Registration

♠ Person is liable to register under this Act as per Schedule III ( Read : Taxable Persons under GST (India) : Complete Guide . Registration has to be done in every such state where he is so liable within 30 days from the date on which he becomes liable. Read Flow Chart of GST Registration and Return by New Taxable Person

♠ For the persons registered under earlier laws (except Input Service Distributor): Fresh registration under GST in not required and will get automatic registration based on PAN as per the procedure prescribed in Rule 14 of GST Registration Rules.Read GST Registration Process for Existing Registered Dealer- Flow Chart

♠ Mandatory GST registration for certain persons : Read Compulsory Registration under GST – 11 types

♠ A person having multiple businesses in the same State may obtain separate registration for each business in accordance with Rule 4 of GST Registration Rules.

♠ Voluntary registration is also available under the GST Regime.

♠ Every person should have PAN as given under Income Tax, to be eligible for registration under GST. For NRI who does not have PAN would be eligible for registration with some other equivalent document as may be prescribed.

♠ Once the registration is accepted, Certificate of registration & Unique Identity Number (GSTIN) shall be granted.

II. Section 19A of Chapter VI of Model GST Law – Special provisions relating to Casual Taxable Person & Non-resident taxable person

♠ Validity period of certificate of registration issued will be only for 90 days and the same can be extended upto 180 days on request to appropriate officer.

♠ If a person is registered under earlier law (except Input Service Distributor), fresh registration under GST in not required and procedure for transformation for such cases would be prescribed in course of time.

♠ At the time of submission of application, Causal Taxable Person or Non-resident Person would be required to advance deposit the estimated tax liability. Such amount deposited shall be deposited in the electronic ledger of such person.

III.Section 21 of Chapter VI of GST Act – Cancellation of GST registration

I. The Officer on his own or on the basis of an application filed by the registered person or by his legal heirs in case of death may cancel the registration on account of following circumstances:

a) Disposal or discontinuance of business or amalgamation or demerger.

b) Change in constitution of the business

c) Person is no longer liable to registered other than voluntarily registered person.

II. The Officer may cancel registration with effect from any anterior date i.e., date earlier than existing date on account of following circumstances:

a) Contravention of the provisions of Act or Rules.

b) Person under composition scheme has not filed returns for 3 consecutive tax periods.

c) Any person other than under composition scheme has not filed returns for a continuous period of 6 months.

III. Where any person has obtained registration by means of fraud, willful misstatement or suppression of facts, the Officer may cancel the registration with retrospective effect.

♠ The cancellation of registration under this section shall not affect the liability of the taxable person to pay tax and other dues for any period before to the date of cancellation as determined.

♠ Stock of Inputs or Work in Progress held by registered taxable person as on the date of cancellation, he will be liable to pay input tax credit availed or output tax payable on that, whichever is higher.

♠ For the capital goods held, the taxable person shall pay the amount of input tax credit availed as reduced by some percentage points as may be prescribed or tax payable on the transaction value of capital goods, whichever is higher.

GST Registration Rules:

GST Registration Rules covered mainly under following Heads

| Sr No | Head | Relevant Rule |

| I. | GST Registration of Person existing under earlier laws. | Rule 14, |

| II. | New Applicant GST registration. | Rule-1, Rule 2, Rule 3,Rule 4, Rule 5, Rule 6, Rule 8,Rule 10, Rule 16 |

| III. | Amendment of GST registration | Rule 9 |

| IV. | Cancellation of GST registration. | Rule 11, Rule 12 |

| V. | Revocation of cancellation of GST registration. | Rule 13 |

| VI. | Display of GST registration Certificate | Rule 7 |

| VII | Physical Verification of Business premises before GST Registration | Rule 17 |

| VIII | Manner of Authentication of Documents to be submitted | Rule 15 |

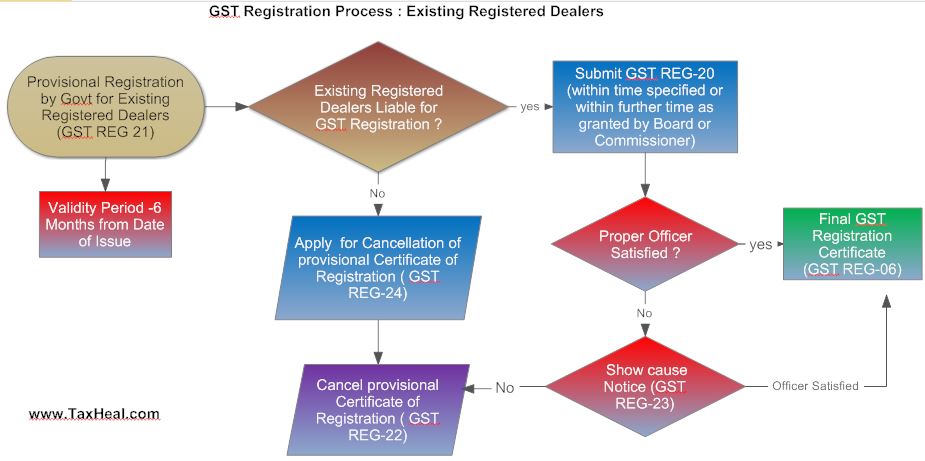

I.GST Registration of Person existing under earlier laws (Central Excise, Service Tax, Respective VAT

Rule 14 – Procedure for migration of persons registered under earlier law:

- Every person registered under earlier law having a PAN will get registration on provisional basis and certificate of registration in Form GST REG-21 and

- After obtaining provisional registration, e-application for regularization of registration in Form GST REG-20 has to be submitted within the period of 6 months (As given u/s 142 of Model GST Law.

- If the information & particulars submitted in the above application are found correct, the Officer shall issue the certificate of registration in Form GST REG–06

- If the information & particulars submitted in the above application are found incorrect, the Officer shall issue a show-cause notice in Form GST REG-23 and give a reasonable opportunity of being heard to the concerned person and then finally cancel the provisional registration by issuing an order in Form GST REG–22

- Persons who are registered under earlier law but not liable to be registered under GST Act, then he may file e-application in Form GST REG-24 for cancellation of automatically granted provisional registration. The Officer after conducting enquiry as required shall cancel the said registration.

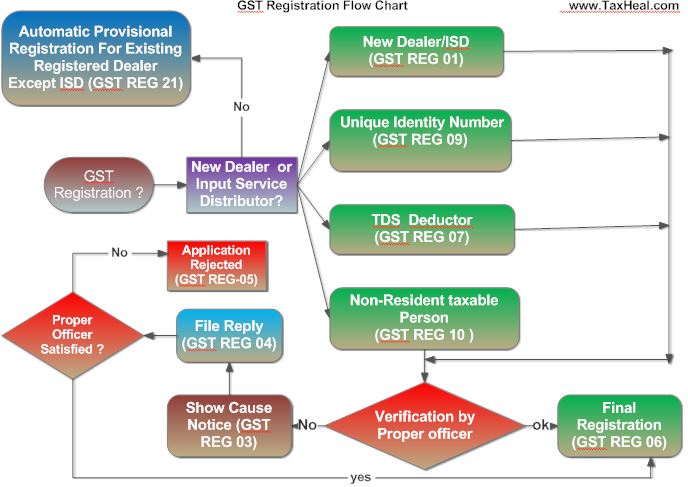

II – GST registration of new applicant

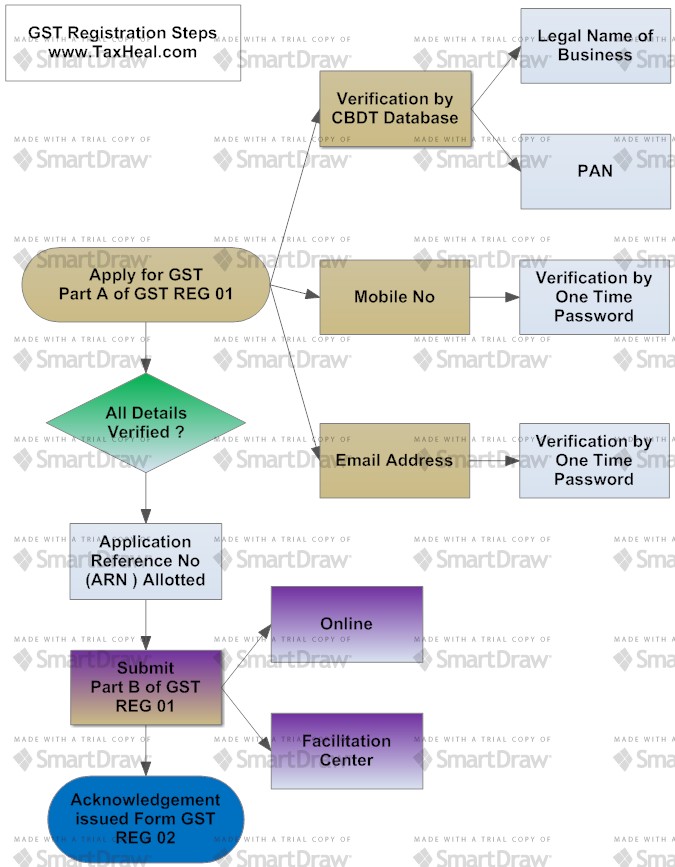

Rule 1 – Application for registration for new applicants:

Every person liable to register u/s 19 except 1) Non-resident taxable person, 2) Person who is required to deduct tax u/s 37, 3) E- Commerce Operator is required to follow the below prescribed procedure:

- E-Application form for registration – Form GST REG-01

- Online validation of PAN, Mobile Number and E-Mail ID through Part A of Form GST REG-01

- After successful validation, online application in Part B of Form GST REG-01 has to be submitted along with the specified documents.

- On receipt of application, acknowledgment shall be issued electronically in Form GST REG-02.

- For Casual Taxable person, acknowledgment in Form GST REG-02 shall be issued only once the advance deposit of tax is made as per Section 19A.

Rule 4 -Separate Registrations for multiple business verticals within a State

(1) Any person having multiple business verticals within a State, requiring a separate registration for any of its business verticals under sub-section (2) of section 19 shall be granted separate registration in respect of each of the verticals subject to the following conditions:

(a) Such person has more than one business vertical as defined under subsection (18) of section 2 of the Act;

(b) No business vertical of a taxable person shall be granted registration to pay tax under section 8 if any one of the other business verticals of the same person is paying tax under section 7.

Explanation: Where any business vertical of a registered taxable person that has been granted a separate registration becomes ineligible to pay tax under section 8, all other business verticals of the said person shall become ineligible to pay tax under section 8.

(c) All separately registered business verticals of such person shall pay tax under this Act on supply of goods and/or services made to another registered business vertical of such person and issue a tax invoice for such supply.

(2) A registered taxable person eligible to obtain separate registration for business verticals may file separate application in FORM GST REG-01 in respect of each such vertical.

Rule 6 : Assignment of unique identity number to certain special entities

(1) Every person required to obtain a unique identity number under sub-section (6) of section 19 may submit an application, electronically in FORM GST REG-09, duly verified in the manner specified in rule 1, at the Common Portal either directly or through a Facilitation Centre, notified by the Board or Commissioner.

(2) The proper officer may, upon submission of an application in FORM GST REG-9 or after filling up the said form, assign a Unique Identity Number to the said person an issue a certificate in FORM GST REG-06, within three common working days from the date of submission of application.

Rule 10 : Suo Moto Registration

Where, during the course of any survey, inspection, search, enquiry or any other proceeding under the Act, the proper officer finds that a person liable to registration under the Act has failed to apply for such registration, such officer may register the said person on a temporary basis and issue an order in FORM GST REG 13.The registration issued shall be effective from the date of order of registration.Every person to whom a temporary registration has been granted under shall, within thirty days from the date of the grant of such registration file an application for registration in the form and manner provided in rule 1 unless the said person has filed an appeal against the grant of temporary registration, in which case the application for registration shall be applied for thirty days after the date of the issuance of order upholding the liability to register by the Appellate Authority.

Rule 2 – Verification of the application:

- Application submitted would be examined by the Officer and approved if found correct within 3 working days. In case of no action by the officer, the application submitted would be deemed to have been approved

- In case of deficiency in the application submitted, Officer would intimate the applicant in Form GST REG-03 within 3 working days and applicant shall submit clarification in respect of information provided and documents submitted in Form GST REG 04 within 7 working days of intimation.

- When the officer is satisfied with the clarification, he would approve the registration within 7 working days else would reject the application and intimate the applicant electronically in Form GST REG-05. In case of no action by the officer, the application submitted along with the clarification would be deemed to have been approved.

Rule 3 – Registration Certificate:

- Certificate of registration has granted u/s 19 shall be issued under Form GST REG-06.

- Effective date of Registration:

| Scenario | Effective date of registration |

| In case of application is submitted within 30 days | Date from which the person becomes liable. |

| In case of application is submitted after 30 days | Date of grant of GST registration certificate. |

Rule 5 – Application of Registration for the person required to deduct tax u/s 37 and E Commerce Operator:

Person who is required to deduct tax u/s 37 and E- Commerce Operator is required to follow the below prescribed procedure:

- E-Application form for registration – Form GST REG-07.

- After the verification by Officer, registration certificate in Form GST REG-08 shall be issued within 3 working days.

- When the concerned person is no longer liable to be registered, the Officer may cancel the registration and issue Form GST REG-08 for such cancellation.

Rule 8 – Application of Registration for Non-resident taxable person:

Non-resident taxable person is required to follow the below prescribed procedure:

- Submit an e-application for registration in Form GST REG-10 at least 5 days prior to commencement of the business.

- Acknowledgment in Form GST REG-02 shall be issued only once the advance deposit of tax is made as per Section 19A.

- The provisions of Rule 1 and Rule 2 relating to verification and grant of registration shall apply mutatis mutandis to an application made under this rule

Rule 16 – Extension in period of operation by casual taxable person and non-resident taxable person:

- For extension of period of registration, the casual taxable person or non-resident taxable person has to submit e-application in Form GST REG-25 before the end of validity of earlier registration granted to him.

- Above application shall be acknowledged only after the advance deposit of tax is made as per Section 19A.

III. Amendment to GST registration

Rule 9 – Amendment to GST registration

- For amendment of the details submitted in the original application, the registered taxable person has to submit an e-application within 15 days in Form GST REG-11 along with the documents related to change.

| Details to be changed | Forms |

| Change in Constitution of business resulting in change of PAN Number | Fresh application in Form GST REG-01 and follow procedure thereafter |

| Registered Mobile Number and E-Mail ID | Submit Form GST REG-11 and certificate would get amended only after validation of mobile number or E-mail ID as the case may be. |

| Name of business, Principal place of business, Details of partners, directors, karta, CEO, Board of Trustees as the case may be | Submit Form GST REG-11 and amendment will take effect after verification by Officer and Issue of order by him in Form GST REG-12 |

- In case the Officer feels that the amendment is not warranted or application submitted is incorrect, then he issue a show-cause notice in Form GST REG-03 within 15 working days and applicant shall submit clarification in respect of information provided and documents submitted in Form GST REG 04 within 7 working days of intimation.

- In case of no action by the officer, the application submitted along with or without the clarification would be deemed to have been approved.

IV.Cancellation of GST Registration

Rule 11 – Application for cancellation of registration by self:

- The registered taxable person has to submit e-application in Form GST REG-14 including the details of closing stock and liability thereon along with the other required documents for cancellation of registration.

- Voluntarily registered persons cannot apply for cancellation before expiry of one year from grant of registration to them.

- Every taxable person other than person paying tax under composition scheme has to file a final return.

Rule 12 – Cancellation of registration by Officer:

- When the Officer believes that the registration of the person is liable to be cancelled u/s 21 of GST Act, then issue a notice in Form GST REG-15 with show cause period of 7 days.

- When the Officer is satisfied about the application submitted by the person for cancellation of registration u/r 11, then he may issue an order in Form GST REG-16 within 30 days of application and direct the person to pay arrears of tax, interest or penalty as determined u/s 21.

V Revocation of cancellation of GST registration

Rule 13 – Revocation of cancellation of registration:

- The taxable person whose registration is cancelled may submit an e-application for revocation of cancellation of registration in Form GST REG-17 within 30 days of cancellation order.

- Application for revocation would not be entertained if the registration is cancelled on account of failure of furnishing of return unless the same are filed along with payment of due taxes, interest and penalty as applicable.

- On satisfaction, the Officer may issue an order for revocation of cancellation of registration in Form GST REG-18 within 30 days.

VI. Display of GST registration certificate

Rule 7 – Display of registration certificate and GSTIN:

- Certificate of registration has to be displayed in a prominent location at his principal place of business and also at every additional place of business.

- GSTIN has to be displayed in the name board exhibited at the entry of his principal place of business and also at every additional place of business.

VII. Physical Verification of Business premises

Rule 17 – Physical verification of business premises in certain cases:

In case the Officer requires the physical verification of business premises before granting registration, he may do so and submit the verification report in Form GST REG-26 in the online portal on the same of day of verification.

VIII. Manner of Authentication of Documents to be submitted

(1) All applications, including reply, if any, to the notices, returns, appeals or any other document required to be submitted under these rules shall be filed electronically at the Common Portal with digital signature certificate or through e-signature as specified under Information Technology Act, 2000 (21 of 2000) or through any other mode of signature notified by the Board/Commissioner in this behalf.

(2) Each document including return filed online shall be signed by

(a) in the case of an individual, by the individual himself or by some person duly authorised by him in this behalf and where the individual is mentally incapacitated from attending to his affairs, by his guardian or by any other person competent to act on his behalf;

(b) in the case of a Hindu Undivided Family, by a Karta and where the Karta is absent

from India or is mentally incapacitated from attending to his affairs, by any other adult

member of such family or by the authorised signatory of such Karta;

(c) in the case of a company, by the chief executive officer or authorised signatory thereof;

(d) in the case of a Government or any Governmental agency or local authority, by an

officer authorised in this behalf;

(e) in the case of a firm, by any partner thereof, not being a minor or authorised signatory;

(f) in the case of any other association, by any member of the association or persons or authorised signatory;

(g) in the case of a trust, by the trustee or any trustee or authorised signatory; and

(h) in the case of any other person, by some person competent to act on his behalf.

(2) All orders and notices under this chapter / Part shall be issued electronically by the proper officer or any other officer authorised to issue any notice or order, through digital signature certificate specified under the Information Technology Act, 2000 (21 of 2000).

Table of List of Forms under GST Registration Rules:

26 Forms for Registration prescribed-26 Forms for Registration have been prescribed (Form GST REG-01 to Form GST REG-26), namely-GST REG 01, GST REG 02, GST REG 03, GST REG 04, GST REG 05, GST REG 06, GST REG 07, GST REG 08, GST REG 09, GST REG 10, GST REG 11, GST REG 12, GST REG 13, GST REG 14, GST REG 15, GST REG 16, GST REG 17, GST REG 18, GST REG 19, GST REG 20, GST REG 21, GST REG 22, GST REG 23, GST REG 24, GST REG 25,

| Sr. No | Form Number | Content |

| 1 | GST REG 01 | Application for Registration under Section 19(1) of Goods and Services Tax Act, 20– |

| 2 | GST REG 02 | Acknowledgement |

| 3 | GST REG 03 | Notice for Seeking Additional Information/ Clarification/ Documents relating to Application for<<Registration/Amendment/Cancellation>> |

| 4 | GST REG 04 | Application for filing clarification/additional information/ document for <<Registration/Amendment/Cancellation/ Revocation of Cancellation>> |

| 5 | GST REG 05 | Order of Rejection of Application for <<Registration /Amendment / Cancellation/ Revocation of Cancellation>> |

| 6 | GST REG 06 | Registration Certificate issued under Section 19(8A) of the Goods and Services Tax Act, 20– |

| 7 | GST REG 07 | Application for Registration as Tax Deductor or Tax Collector at Source under Section 19(1) of the Goods and Service Tax Act, 20– |

| 8 | GST REG 08 | Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source under Section 21 of the Goods and Service Tax Act, 20–. |

| 9 | GST REG 09 | Application for Allotment of Unique ID to UN Bodies/Embassies /any other person under Section 19(6) of the Goods and Service Tax Act, 20–. |

| 10 | GST REG 10 | Application for Registration for Non Resident Taxable Person. |

| 11 | GST REG 11 | Application for Amendment in Particulars subsequent to Registration |

| 12 | GST REG 12 | Order of Amendment of existing Registration |

| 13 | GST REG 13 | Order of Allotment of Temporary Registration/ Suo Moto Registration |

| 14 | GST REG 14 | Application for Cancellation of Registration under Goods and Services Tax Act, 20–. |

| 15 | GST REG 15 | Show Cause Notice for Cancellation of Registration |

| 16 | GST REG 16 | Order for Cancellation of Registration |

| 17 | GST REG 17 | Application for Revocation of Cancelled Registration under Goods and Services Act, 20–. |

| 18 | GST REG 18 | Order for Approval of Application for Revocation of Cancelled Registration |

| 19 | GST REG 19 | Notice for Seeking Clarification/Documents relating to Application for << Revocation of Cancellation>> |

| 20 | GST REG 20 | Application for Enrolment of Existing Taxpayer |

| 21 | GST REG 21 | Provisional Registration Certificate to existing taxpayer |

| 22 | GST REG 22 | Order of cancellation of provisional certificate |

| 23 | GST REG 23 | Intimation of discrepancies in Application for Enrolment of existing taxpayer |

| 24 | GST REG 24 | Application for Cancellation of Registration for the Migrated Taxpayers not liable for registration under Goods and Services Tax Act 20– |

| 25 | GST REG 25 | Application for extension of registration period by Casual / Non-Resident taxable person. |

| 26 | GST REG 26 | Form for Field Visit Report |

Free Education Guide on Goods & Service Tax (GST)