GST Return

The basic features of the returns mechanism in GST include electronic filing of returns, uploading of invoice level

information and auto-population of information relating to Input Tax Credit (ITC) from returns of supplier to that

of recipient, invoice-level information matching and auto reversal of Input Tax Credit in case of mismatch. The returns mechanism is designed to assist the taxpayer to file returns and avail ITC.

Under GST, a regular taxpayer needs to furnish monthly returns and one annual return. There are separate returns for a taxpayer registered under the composition scheme, nonresident taxpayer, taxpayer registered as an Input Service Distributor, a person liable to deduct or collect the tax (TDS/ TCS) and a person granted Unique Identification Number. It is important to note that a taxpayer is NOT required to file all types of returns. In fact, taxpayers are required to file returns depending on the activities they undertake.

All the returns are to be filed online. Returns can be filed using any of the following methods:

1. GSTN portal (www.gst.gov.in )

2. Offline utilities provided by GSTN

3. GST Suvidha Providers (GSPs) – If you are already using the services of ERP providers such as Tally, SAP, Oracle etc., there is a high likelihood that these ERP providers would provide inbuilt solutions in the existing ERP systems

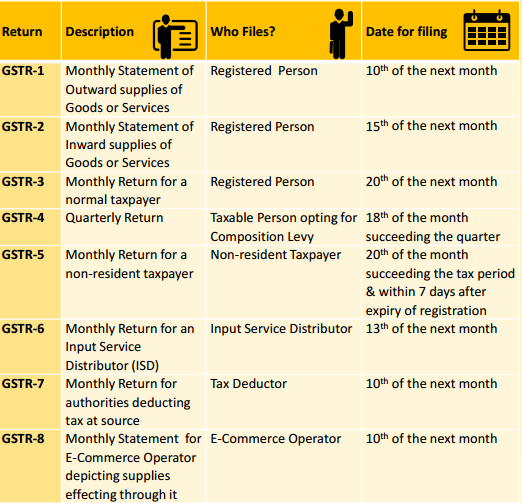

Following table lists the various types of returns under GST Law:

GST Return Formats

GST Return formats as approved by GST Council as per Final GST Return Rules approved by GST Council on 03.06.2017

| Sr. No. | Form No. | Title of the Form |

| 1 | 2 | 3 |

| 1. | GSTR 1 | Details of outwards supplies of goods or services |

| 2. | GSTR-1A | Details of auto drafted supplies of goods or services |

| 3. | GSTR 2 | Details of inward supplies of goods or services |

| 4. | GSTR-2A | Details of supplies auto drafted from GSTR- 1 or GSTR-5 to recipient |

| 5. | GSTR-3 | Monthly return |

| 6. | GSTR-3A | Notice to return defaulter u/s 46 |

| 7. | GSTR -4 | Quarterly return for registered persons opting composition levy |

| 8. | GSTR-4A | Auto drafted details for registered persons opting composition levy |

| 9. | GSTR -5 | Return for Non Resident Taxable Persons |

| 10. | GSTR-5A | Details of supplies of online information and database access or retrieval services by a person located outside India made to non-taxable persons in India |

| 11. | GSTR -6 | Return for input service distributors |

| 12. | GSTR-6A | Details of supplies auto drafted from GSTR-1 or GSTR-5 to ISD. |

| 13. | GSTR -7 | Return for Tax Deduction at Source |

| 14. | GSTR -7A | Tax Deduction at Source Certificate |

| 15. | GSTR-8 | Statement for Tax Collection at Source |

| 16. | GSTR 9 | Annual return |

| 17 | GSTR 9A | Simplified annual return for compounding taxable persons |

| 18 | GSTR 9B | Audit Report certified by a…………. |

| 19 | GSTR 10 | Final Return under ___ of Goods and Services Act, 2016 |

| 20 | GSTR-1 1 | Inward supplies statement for persons having Unique Identification Number (UIN) |

Filing Process

A normal taxpayer has to file the following returns:

1. GSTR-1 (Statement of Outward Supplies):

a. This return signifies the tax liability of the supplier for the supplies effected during the previous month.

b. It needs to be filed by the 10th of every month in relation to supplies effected during the previous

month. For example, a statement of all the outward supplies made during the month of July 2017 needs to be filed by 10th August, 2017.

2. GSTR-2 (Statement of Inward Supplies):

a. This return signifies accrual of ITC (Input Tax Credit) from the inputs received during the previous month.

b. It is auto-populated from the GSTR-1s filed by the corresponding suppliers of the Taxpayer except for a few fields like imports, and purchases from unregistered suppliers.

c. It needs to be filed by the 15th of every month in relation to supplies received during the previous month. For example, a statement of all the inward supplies received during the month of July 2017 needs to be filed by 15th August, 2017.

3. GSTR-3:

This is a consolidated return. It needs to be filed by the 20th of every month. It consolidates the following details

a. Outward Supplies (Auto-Populated from GSTR-1)

b. Inward Supplies (Auto-Populated from GSTR-2)

c. ITC availed

d. Tax Payable

e. Tax Paid (Using both Cash and ITC)

NOTE: Payment should be made on or before 20th of every month.

Annual Return

This return needs to be filed by 31st December of the next Financial Year. In this return, the taxpayer needs to furnish details of expenditure and details of income for the entire Financial Year. The population of these returns is explained by the following graphic:

NOTE:

1. Taxpayer’s GSTR-2 is auto-populated from the Suppliers’ GSTR-1s

2. Taxpayer’s GSTR-3 is significantly auto-populated from tax payer’s GSTR-1 and GSTR-2

Return Filing Milestones

Revision of Returns:

The mechanism of filing revised returns for any correction of errors/ omissions has been done away with.The rectification of errors/ omissions is allowed in the subsequent returns. However, no rectification is allowed after furnishing the return for the month of September following the end of the financial year to which,

such details pertain, or furnishing of the relevant annual return, whichever is earlier.

Penal Provisions Relating to Returns:

Any registered person who fails to furnish form GSTR-1, GSTR-2, GSTR-3 or Final Return within the due dates, shall be liable to pay a late fee of Rs. 100 per day, subject to a maximum of Rs. 5,000. ITC Matching and Auto-Reversal:

1. It is a mechanism to prevent revenue leakage.

2. The process of ITC Matching begins after the due date for filing of the return (20th of every month). This is carried out by GSTN.

3. The details of every inward supply furnished by the taxable person (i.e. the “recipient” of goods and/or services) in form GSTR-2 shall be matched with the corresponding details of outward supply furnished by the corresponding taxable person (i.e. the “supplier” of goods and/or services) in his valid return. A return may be considered to be a valid return only when the appropriate GST has been paid in full by the taxable person, as shown in such return for

a given tax period.

4. In case the details match, then the ITC claimed by the recipient in his valid returns shall be considered as finally accepted and such acceptance shall be communicated to the recipient. Failure to file valid return by the supplier may lead to denial of ITC in the hands of the recipient.

5. In case the ITC claimed by the recipient is in excess of the tax declared by the supplier or where the details of outward supply are not declared by the supplier in his valid returns, the discrepancy shall be communicated to both the supplier and the recipient. Similarly, in case, there is duplication of claim of ITC, the same shall be communicated to the recipient.

6. The recipient will be asked to rectify the discrepancy of excess claim of ITC and in case the supplier has not rectified the discrepancy communicated in his valid returns for the month in which, the discrepancy is communicated, then such excess ITC as claimed by the recipient shall be added to the output tax liability

of the recipient in the succeeding month.

7. Similarly, duplication of ITC claimed by the recipient shall be added to the output tax liability of the recipient in the month in which, such duplication is communicated.

8. The recipient shall be liable to pay interest on the excess or duplicate ITC added back to the output tax liability of the recipient from the date of availing of ITC till the corresponding additions are made in their returns.

9. Re-claim of ITC refers to taking back the ITC reversed in the Electronic Credit Ledger of the recipient by way of reducing the output tax liability. Such re-claim can be made by the recipient only in case the supplier declares the details of the Invoice and/or Debit Notes in his valid return within the prescribed timeframe. In such case, the interest paid by the recipient shall be refunded to him by way of crediting the amount to his Electronic Cash Ledger.

Amazing service Satbir…quality content!!