GST Status : Pending for Clarification

This article deals with GST Status : Pending for Clarification and provides answer to how to respond to the notice issued by the Tax Official.

FAQ on GST Status Pending for Clarification

I have received notice for seeking clarifications for the registration application submitted on the GST Portal. Why?

The Status of my application is “ Pending for Clarification ”. What does it indicate?

If the Tax Official is not satisfied with the information provided by you in the Registration Application or the documents attached, the Tax Official can seek for clarifications from the taxpayer.

In such cases, the status of the application is changed to “Pending for Clarification”.

Once you have received the intimation for notice seeking clarifications, you must login to the GST Portal using your TRN and provide the clarifications electronically or upload the document(s) sought with 7 working days from the date of receipt of such intimation.

User Manual for Application for Filing Clarification on GST Portal

I have received notice for seeking clarifications for the registration application submitted on the GST Portal. How do I respond to the notice issued by the Tax Official?

To respond to the notice seeking clarifications on the GST Portal, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

In case of New Registration:

a. Click the REGISTER NOW link.

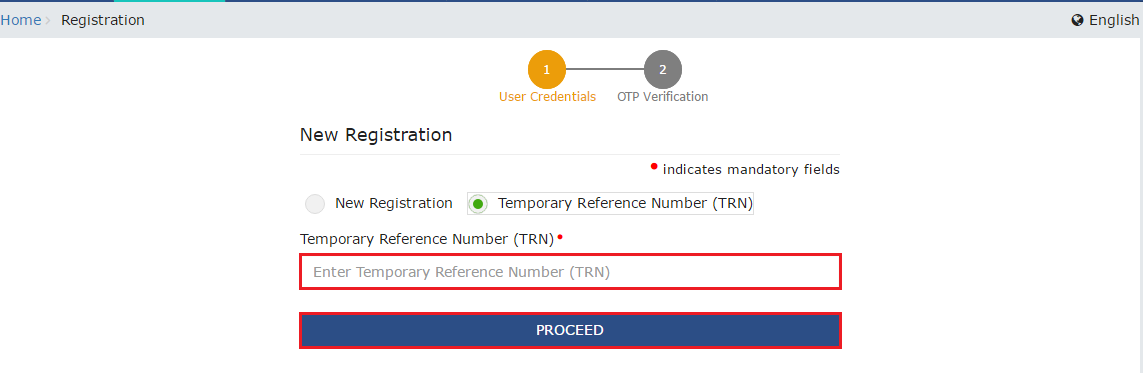

b. Select the Temporary Reference Number (TRN) option.

c. In the Temporary Reference Number (TRN) field, enter the TRN received.

d. Click the PROCEED button.

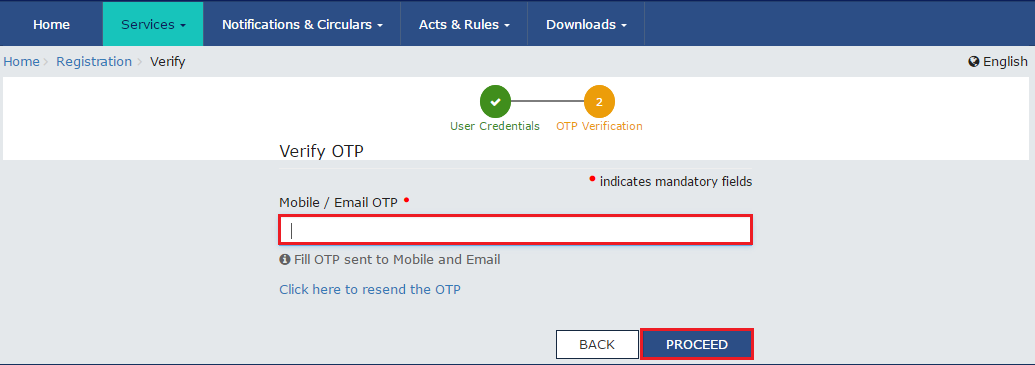

e. In the Mobile / Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

Note:

- OTP sent to mobile number and email address are same.

- In case OTP is invalid, try again by clicking the Click here to resend the OTP link. You will receive the OTP on your registered mobile number or email ID again. Enter the newly received OTP again.

f. Click the PROCEED button.

In case of Existing Registration:

1. Login to the GST Portal with valid credentials.

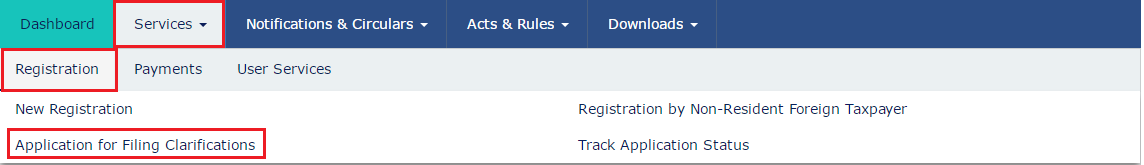

2. Click Services > Registration> Application for Filing Clarifications command.

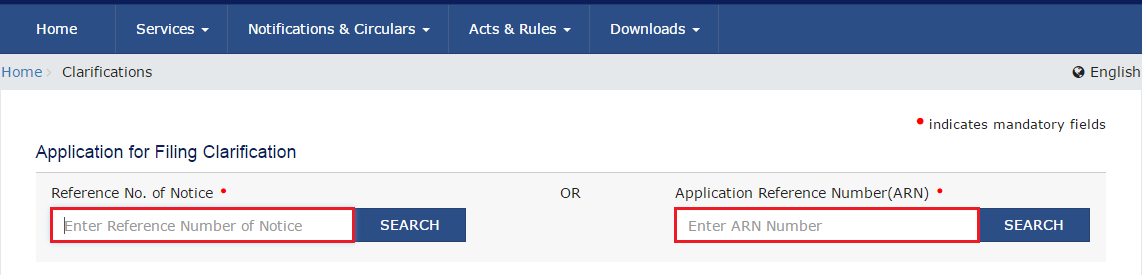

3. In the Reference No. of Notice field, enter the reference number specified on the notice which you have received for filing the clarifications. Or In the Application Reference Number (ARN)field, enter the application reference number received corresponding to the application submitted. Click the SEARCH button.

4. In the Modification in the Registration Application filed field, select Yes or No.

In case of Yes:

a. Original application is available in editable mode for all those fields for which Notice has been issued. Edit the details and upload the additional documents wherever required.

In case of No:

a. In the Additional Information field, enter the additional information.

Note:

- You need to enter response to all the queries in the textbox provided corresponding to each query.

- You can save the form at any point of time within the timeline of maximum 7 working days from generation of the Notice for seeking clarifications by the Tax Official.

5. Submit the application using SUBMIT WITH DSC or SUBMIT WITH E-SIGN as applicable/ eligible.

In case of SUBMIT WITH DSC:

a. Click the SUBMIT WITH DSC button.

b. Click the PROCEED button.

c. Select the certificate and click the SIGN button.

d. Enter the PIN (dongle password) for the attached DSC.

In case of SUBMIT WITH E-SIGN:

a. Click the SUBMIT WITH E-SIGN button.

b. In the Declaration box, click the AGREE button.

Note: OTP will be sent to your e-mail address and mobile phone number registered with Aadhaar.

c. In the Declaration box, click the AGREE button.

d. Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail address and mobile phone number registered with Aadhaar. Click the CONTINUE button.

6. Success message is displayed.

Note: Intimation of submission of the form by the Taxpayer is sent via SMS to the applicant on the registered mobile number. Email is sent to the applicant as well the authorized signatory.

Related Post

Track GST Application Status online ; Steps

Video -How to Track GST Refund Status : GST News [Part 190] : TaxHeal.com

How to Track GST Refund Status

How to Track GST Payment Status

how to solve pending for clarification in gst , gst pending for clarification , gst pending for clarification means , pending for clarification , gst registration status pending for clarification

pending for clarification gst , gst registration clarification , pending for clarification gst registration

pending for clarification in gst , pending clarification ,pending for clarification in gst registration

clarification filed – pending for order gst , gst registration pending for clarification ,application for filing clarification in gst ,pending for clarification in gst portal , pending for clarification for gst registration , gst status , gst practitioner registration pending for processing