Time of Supply of Goods and Services under GST

Time of Supply of Goods

Provisions of Time of Supply of Goods are covered in Section 12 of CGST Act 2017 read with Section 31 of CGST Act 2017 (Tax Invoice)

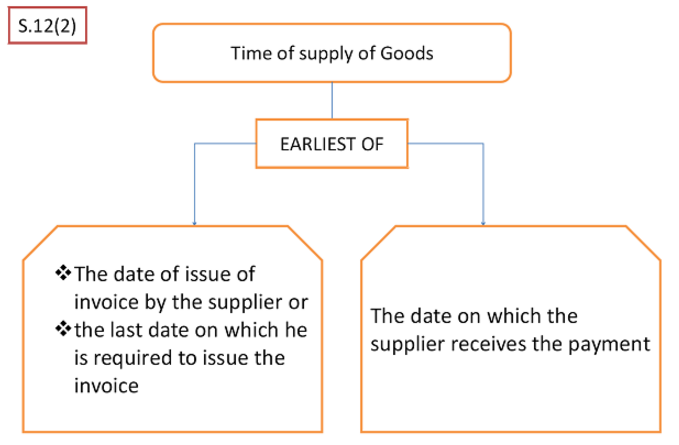

As per Section 12 (2) of CGST Act

The time of supply of goods shall be the earlier of the following dates, namely:—

(a) the date of issue of invoice by the supplier or the last date on which he is required, under sub-section (1) of section 31, to issue the invoice with respect to the supply; or

(b) the date on which the supplier receives the payment with respect to the supply:

Provided that where the supplier of taxable goods receives an amount upto one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess amount shall, at the option of the said supplier, be the date of issue of invoice in respect of such excess amount.

Explanation 1.—For the purposes of clauses (a) and (b), “supply” shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment.

Explanation 2.—For the purposes of clause (b), “the date on which the supplier receives the payment” shall be the date on which the payment is entered in his books of account or the date on which the payment is credited to his bank account, whichever is earlier.

As per Section 31(1) of CGST Act

A registered person supplying taxable goods shall, before or at the time of,—

(a) removal of goods for supply to the recipient, where the supply involves movement of goods; or

(b) delivery of goods or making available thereof to the recipient, in any other case,

issue a tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as may be prescribed:

Provided that the Government may, on the recommendations of the Council, by notification, specify the categories of goods or supplies in respect of which a tax invoice shall be issued, within such time and in such manner as may be prescribed.

1. Supply involves movements of Goods

Example : A Ltd Supplied Car to Mr B . Since supply of Car involves movements of Goods , Time of Supply will be as follows :-

| Sr No | Supply involves movement of goods Section 12(2) r/w Section 31(1)(a) | Invoice Date | Invoice Due Date [ Section 12(2)(a) read with Section 31(1)(a)*] | Payment entry in supplier’s books [ Sec 12(2)(b) read with Explanation 2] | Credit in bank account [ Sec 12(2)(b) read with Explanation 2 ] | Time of supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | Earlier of c , d , e or f |

| 1 | Invoice Raised before Removal | 2-Jul-17 | 20-Jul-17 | 26-Jul-17 | 30-Jul-17 | 2-Jul-17 |

| 2 | Advance Received | 2-Jul-17 | 20-Jul-17 | 1-Jul-17 | 30-Jul-17 | 1-Jul-17 |

* Goods removed on 20.07.2017

| Sr No | Supply involves movement of goods Section 12(2) r/w Section 31(1)(a) | Invoice Date | Invoice Due Date (Removal of Goods) [ Section 12(2)(a) read with Section 31(1)(a)*] | Delivery of Goods ( Since Supply involves Movement of Goods , Delivery Date is not Relevant) | Payment entry in supplier’s books [ Sec 12(2)(b) read with Explanation 2] | Credit in bank account [ Sec 12(2)(b) read with Explanation 2 ] | Time of Supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | (g) | Earlier of c , d , f and g |

| 1 | Delay in Issue of Invoice | 25-Jul-17 | 20-Jul-17 | 26-Jul-17 | 27-Jul-17 | 30-Jul-17 | 20-Jul-17 |

| 2 | Branch Transfer/ Stock Transfer | 10-Jul-17 | 20-Jul-17 | 26-Jul-17 | – | – | 10-Jul-17 |

* Goods removed on 20.07.2017

2.Time of Supply of Goods otherwise than by involving movement of goods

Example Job worker develops a mould for the production of goods for the principal and retains the mould in his place itself for production of goods. The mould developed by the job worker is sold to the principal but the same is retained by the job worker without causing the movement of mould from job worker’s premises to the principal’s premises. In this case the place of supply would be job worker’s premises. and Time of Supply will be as follows :-

| Sr No | Supply otherwise than by involving movement of goods Section 12(2) r/w Section 31(1)(b) | Invoice Date | Receipt of invoice by recipient ( This date not irrelevant) | Delivery of Goods / making available thereof to recipient, [ Section 12(2)(a) read with Section 31(1)(b)*] | Payment entry in supplier’s books [ Sec 12(2)(b) read with Explanation 2] | Credit in bank account [ Sec 12(2)(b) read with Explanation 2] | Time of Supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | (g) | Earlier of c , e , f and g |

| 1 | Delayed Issue of Invoice | 30-Jul-17 | 5-Aug-17 | 26-Jul-17 | 6-Aug-17 | 7-Aug-17 | 26-Jul-17 |

| 2 | Invoice Issued before Delivery | 21-Jul-17 | 5-Aug-17 | 26-Jul-17 | 6-Aug-17 | 7-Aug-17 | 21-Jul-17 |

3. Time of Supply in case of continuous supply of goods

As per Section 31(4) of CGST Act

In case of continuous supply of goods, where successive statements of accounts or successive payments are involved, the invoice shall be issued before or at the time each such statement is issued or, as the case may be, each such payment is received.

| Sr No | Continuous Supply of goods Section 12(2) r/w Section 31(4) | Invoice Date | Removal of Goods on various dates ( These Dates are not Relevant*) | SoA / payments due date [ u/s 31(4) ] | Payment entry in supplier’s books [ Sec 12(2)(b) read with Explanation 2] | Credit in bank account [ Sec 12(2)(b) read with Explanation 2] | Time of Supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | (g) | Earlier of c , e , f and g |

| Successive statements of account/ successive payments are Provided in Contract | 9-Aug-17 | 01 July 17 and 10 July 17 | 5-Aug-17 | 10-Aug-17 | 10-Aug-17 | 5-Aug-17 | |

| 9-Sep-17 | 05 Aug 17 and 1 2 Aug 17 | 5-Sep-17 | 10-Sep-17 | 11-Sep-17 | 5-Sep-17 | ||

| 9-Oct-17 | 08 Sep 17 and 15 sep 17 | 5-Oct-17 | 1-Oct-17 | 2-Oct-17 | 1-Oct-17 |

- These dates are not relevant because it is continuous supply of goods

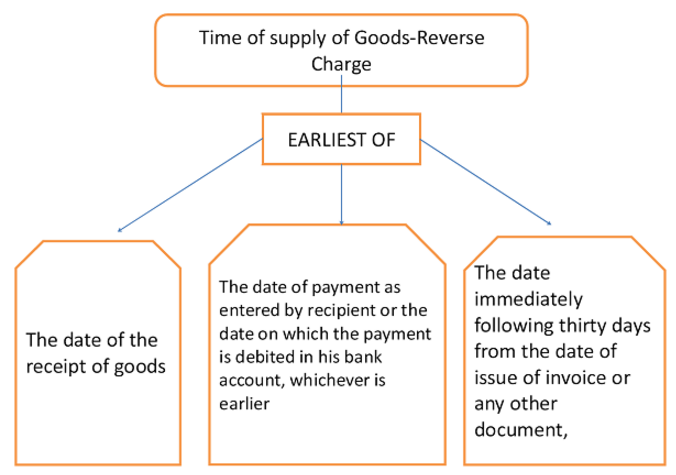

4. Time of Supply of Goods in case of Reverse Charge

As per Section 12 (3) of CGST Act 2017

In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely:—

(a) the date of the receipt of goods; or

(b) the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

(c) the date immediately following thirty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier:

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b) or clause (c), the time of supply shall be the date of entry in the books of account of the recipient of supply.

| Sr No | Reverse Charge Section 12(3) | Date of Issue of invoice by supplier | 30 days from Date of Invoice of Supplier [ Sec 12(3)( c ) ] | Removal of Goods by Supplier ( This Date is not relevant) | Date of Receipt of goods [ Sec 12(3) (a) ] | Payment entry in Recipient books [ Sec 12(3) (b)] | Debited in bank account of Recipient [ Sec 12 (3) (b)] | Time of Supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | (g) | (h) | Earlier of d , f, g and h |

| 1 | Goods Received | 31-Jul-17 | 30-Aug-17 | 5-Aug-17 | 7-Aug-17 | 9-Aug-17 | 11-Aug-17 | 7-Aug-17 |

| 2 | Advance Paid for Goods | 31-Jul-17 | 30-Aug-17 | 5-Aug-17 | 7-Aug-17 | 1-Aug-17 | 11-Aug-17 | 1-Aug-17 |

| 3 | No Payment made for Supply of Goods | 31-Jul-17 | 30-Aug-17 | 5-Aug-17 | 1-Nov-17 | 30-Aug-17 |

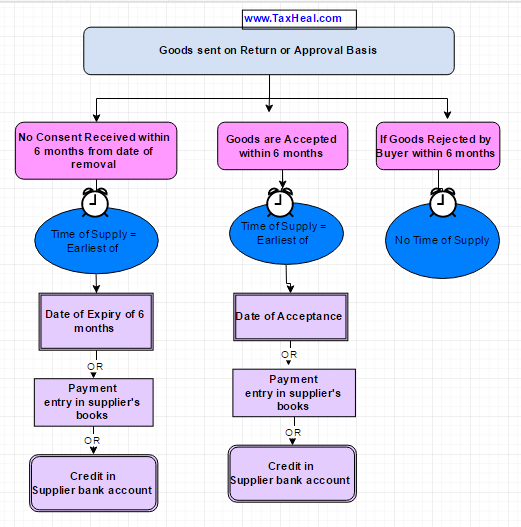

5. Time of Supply in case of Goods sent on Approval Basis

we have to read provisions of Time of Suuply of Goods as are covered in Section 12 (2) of CGST Act 2017 (refer above) and as as per Section 31(7) of CGST Act (Given below) :-

Notwithstanding anything contained in sub-section (1), where the goods being sent or taken on approval for sale or return are removed before the supply takes place, the invoice shall be issued before or at the time of supply or six months from the date of removal, whichever is earlier.

| Sr No | Goods sent on Approval Basis Section 12(2) read with Section 31(7) | Date of Issue of invoice by supplier | Removal of Goods for Approval by Supplier | 6 months from Date of Removal[ Section 31(7) | Goods Approved/ Accepted by Recipient [ section 31(7) | Payment entry in supplier’s books [ Sec 12(2)(b) read with Explanation 2] | Credit in bank account [ Sec 12(2)(b) read with Explanation 2] | Time of Supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | (g) | (h) | Earlier of e, f, g and h |

| 1 | Acceptance Communicated Within 6 months of removal | 25-Nov-17 | 1-Nov-17 | 1-Apr-18 | 15-Nov-17 | 16-Nov-17 | 17-Nov-17 | 15-Nov-17 |

| 2 | Acceptance not Communicated Within 6 months of removal | 16-May-18 | 1-Nov-17 | 1-Apr-18 | 15-May-18 | 17-May-18 | 18-May-17 | 1-Apr-18 |

| 3 | Payment made to Supplier before informing Acceptance | 25-Nov-17 | 1-Nov-17 | 1-Apr-18 | 15-Nov-17 | 12-Nov-17 | 13-Nov-17 | 12-Nov-17 |

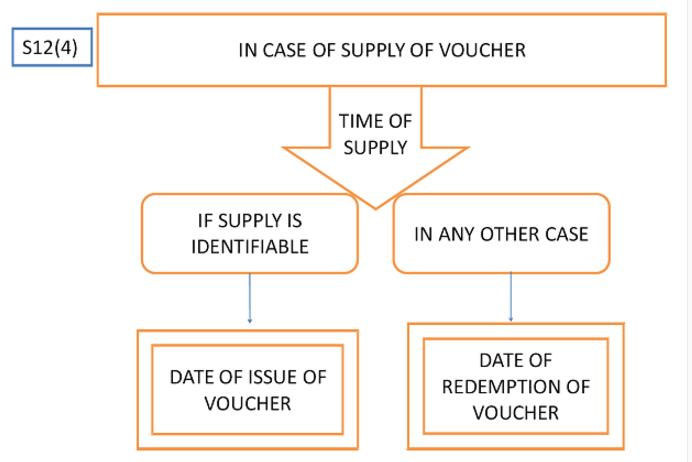

6. Time of Supply of Goods in case of Issue of vouchers

As per Section 12 (4) of CGST Act 2017 ( Time of supply of Goods ) –

In case of supply of vouchers by a supplier, the time of supply shall be—

(a) the date of issue of voucher, if the supply is identifiable at that point; or

(b) the date of redemption of voucher, in all other cases.

| Sr No | Issue of vouchers Section 12(4)] | First delivery of goods | Issue of voucher | Redempti on of voucher | Last date for acceptan ce of voucher | Time of supply |

| 1 | Voucher issued to a recipient of machinery along at the time of delivery, for availing repair services [or specific goods] worth Rs. 4,000 – valid for 1 year | 1-Nov-17 | 1-Nov-17 | 14-Dec-17 | 30-Oct-18 | 1-Nov-17 |

| 2 | Voucher issued to a recipient after supply of Goods for any other goods across India, – valid for 1 year | 1-Nov-17 | 1-Nov-17 | 14-Dec-17 | 30-Oct-18 | 14-Dec-17 |

| 3 | Gift voucher for Rs. 1,500 for goods- valid for 6 months | 1-Nov-17 | 25-Dec-17 | 31-Mar-18 | 1-Nov-17 |

Time of Supply of Services

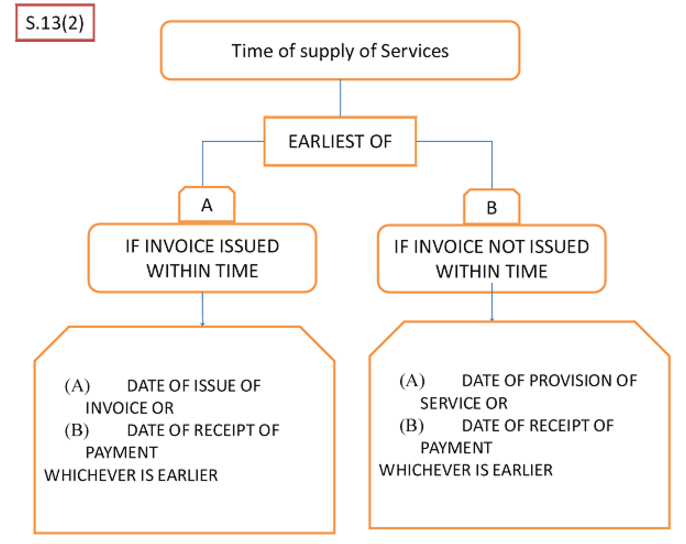

As per Section 13 (2) of CGST Act 2017 :-

The time of supply of services shall be the earliest of the following dates, namely:—

(a) the date of issue of invoice by the supplier, if the invoice is issued within the period prescribed under sub-section (2) of section 31 or the date of receipt of payment, whichever is earlier; or

(b) the date of provision of service, if the invoice is not issued within the period prescribed under sub-section (2) of section 31 or the date of receipt of payment, whichever is earlier; or

(c) the date on which the recipient shows the receipt of services in his books of account, in a case where the provisions of clause (a) or clause (b) do not apply:

Provided that where the supplier of taxable service receives an amount upto one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess amount shall, at the option of the said supplier, be the date of issue of invoice relating to such excess amount.

Explanation.—For the purposes of clauses (a) and (b)—

(i) the supply shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment;

(ii) “the date of receipt of payment” shall be the date on which the payment is entered in the books of account of the supplier or the date on which the payment is credited to his bank account, whichever is

earlier.

As per Section 31(2) of CGST Act

A registered person supplying taxable services shall, before or after the provision of service but within a prescribed period, issue a tax invoice, showing the description, value, tax charged thereon and such other particulars as may be prescribed:

Provided that the Government may, on the recommendations of the Council, by notification and subject to such conditions as may be mentioned therein, specify the categories of services in respect of which—

(a) any other document issued in relation to the supply shall be deemed to be a tax invoice; or

(b) tax invoice may not be issued.

Prescribed period as per Rule 2 of Final GST Invoice Rule is :-

The invoice in case of taxable supply of services, shall be issued within a period of thirty days from the date of supply of service:

Provided that where the supplier of services is an insurer or a banking company or a financial institution, including a non-banking financial company, the period within which the invoice or any document in lieu thereof is to be issued shall be forty five days from the date of supply of service:

Provided further that an insurer or a banking company or a financial institution, including a non banking financial company, or a telecom operator, or any other class of supplier of services as may be notified by the Government on the recommendations of the Council, making taxable supplies of services between distinct persons as specified in section 25, may issue the invoice before or at the time such supplier records the same in his books of account or before the expiry of the quarter during which the supply was made.

1. Time of Supply of Services in case of Forward Charge

| Sr No | supplying taxable services Section 13(2) r/w Section 31(2) and Invoice Rule 2 | Invoice Date | Date of Completion of Supply of Service | Invoice Due Date [ Section 13(2) read with Section 31(2) and Invoice Rule 2*] | Payment entry in supplier’s books [ Sec 13(2)(a) read with Explanation (ii)] | Credit in bank account [ Sec 13(2)(a) read with Explanation (ii) ] | Time of supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | (g) | Earlier of c , e , f or g |

| 1 | Invoice raised before completion of service | 10-Jul-17 | 1-Jul-17 | 30-Jul-17 | 1-Aug-17 | 5-Aug-17 | 10-Jul-17 |

| 2 | Advance Received | 21-Jul-17 | 1-Jul-17 | 30-Jul-17 | 19-Jul-17 | 25-Jul-17 | 19-Jul-17 |

| 3 | Delayed issue of invoice | 1-Aug-17 | 1-Jul-17 | 30-Jul-17 | 5-Aug-17 | 6-Aug-17 | 30-Jul-17 |

* Invoice to be issued within 30 days from date of Completion of Supply of Service in case of Other than Banking or Financial Institution ( Rule 2 of Invoice Rules)

2. Time of Supply in case of Continuous supply of services

As per Section 31(5) of CGST Act in case of continuous supply of services,—

(a) where the due date of payment is ascertainable from the contract, the invoice shall be issued on or before the due date of payment;

(b) where the due date of payment is not ascertainable from the contract, the invoice shall be issued before or at the time when the supplier of service receives the payment;

(c) where the payment is linked to the completion of an event, the invoice shall be issued on or before the date of completion of that event.

| Sr No | Supplying taxable services Section 13(2) r/w Section 31(5) and Invoice Rule 2 | Invoice Date | Due date of Payment as per Contract [ Section 31(5) ] | Receipt of Payment | Time of supply |

| (a) | (b) | (c ) | (d) | (e) | Earlier of c , d and e |

| 1 | Where Contract provides for payments monthly on the 10th of succeeding month | 2-Nov-17 | 10-Nov-17 | 15-Nov-17 | 2-Nov-17 |

| 16-Dec-17 | 10-Dec-17 | 15-Dec-17 | 10-Dec-17 | ||

| 11-Jan-18 | 10-Jan-18 | 6-Jan-18 | 6-Jan-18 |

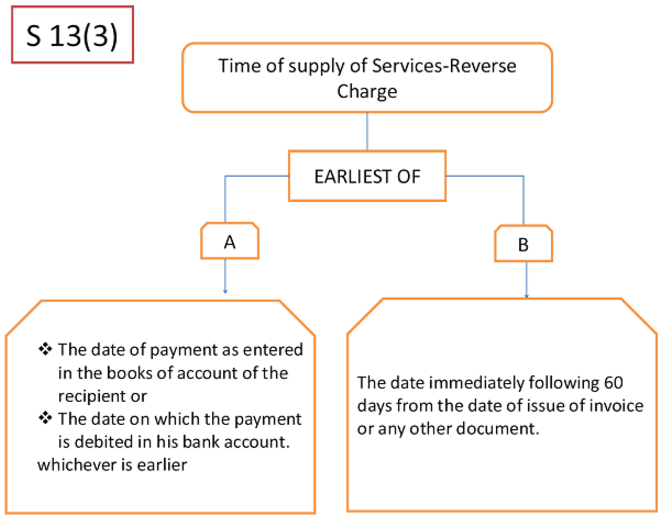

3. Time of supply of services in case of Reverse Charge

Under the reverse charge mechanism, the recipient or buyer of services has to pay tax to the credit of the government unlike forward charge, where the supplier has to pay the tax. For example, on availing a transportation service, the recipient of the service has to pay service tax to the government.

As per Section 13 (3) of CGST Act 2017 :-

In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earlier of the following dates, namely:—

(a) the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

(b) the date immediately following sixty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier:

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b), the time of supply shall be the date of entry in the books of account of the recipient of supply:

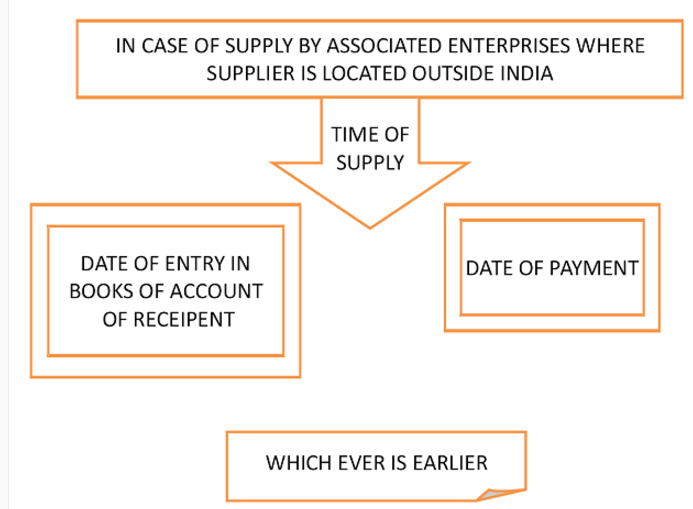

Provided further that in case of supply by associated enterprises, where the supplier of service is located outside India, the time of supply shall be the date of entry in the books of account of the recipient of supply or the date of payment, whichever is earlier.

| Sr No | Revese Charge [ Section 13(3) ] | Date of Issue of invoice by supplier | Date of Completion of Service | 60 days from Date of Completion of Service [ Section 13(3)(b) ] | Payment entry in Recipient books [ Sec 13(3) (a)] | Debited in bank account of Recipient [ Sec 13 (3) (a)] | Entry of receipt of services in recipient’ s books | Time of supply |

| (a) | (b) | (c ) | (d) | (e) | (f) | (g) | (h) | Earlier of e, f , g and h |

| 1 | Services received under Reverse Charge | 31-Oct-17 | 31-Oct-17 | 31-Dec-17 | 20-Nov-17 | 21-Nov-17 | 20-Nov-17 | |

| 2 | Advance Paid | 31-Oct-17 | 31-Oct-17 | 31-Dec-17 | 5-Nov-17 | 6-Nov-17 | 5-Nov-17 | |

| 3 | Delay in Payment of Service Received under Reverse Charge | 31-Oct-17 | 31-Oct-17 | 31-Dec-17 | 11-Jan-18 | 12-Jan-18 | 31-Dec-17 | |

| 4 | Service received from associated enterprise (Supplier of Service located outside India) | 31-Oct-17 | 30-Nov-17 | Not Applicable | 5-Apr-18 | 6-Apr-18 | 31-Mar-18 * | 31-Mar-18 |

| 5 | Service by unregistered person, no payment made | Not Available | Not Available | Not Available | Payment Not Made | Payment Not Made | 06-Dec-17# | 6-Dec-17 |

*Second Provisio to Section 13(3)

#First Provisio to Section 13(3)

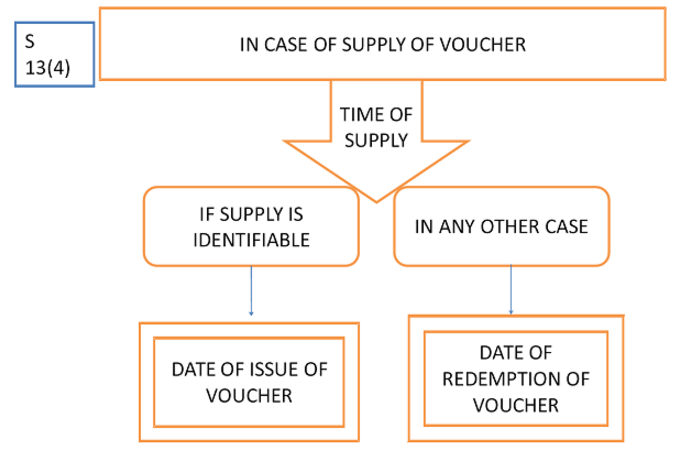

4. Time of Supply of Services in case of Issue of vouchers

As per Section 13 (4) of CGST Act 2017 ( Time of supply of services ) :-

In case of supply of vouchers by a supplier, the time of supply shall be—

(a) the date of issue of voucher, if the supply is identifiable at that point; or

(b) the date of redemption of voucher, in all other cases.

| Sr No | Issue of vouchers Section 13(4) | First service of goods | Issue of voucher | Redempti on of voucher | Last date for acceptan ce of voucher | Time of supply |

| 1 | Voucher issued to a recipient after supply of a service [or specific goods], for the same service – valid for 1 year | 1-Nov-17 | 1-Nov-17 | 14-Dec-17 | 30-Oct-18 | 1-Nov-17 |

| 2 | Voucher issued to a recipient after supply of a service, for any other services or goods across India, – valid for 1 year | 1-Nov-17 | 1-Nov-17 | 14-Dec-17 | 30-Oct-18 | 14-Dec-17 |

| 3 | Gift voucher for Rs. 2,500 for services [or goods]- valid for 6 months | 1-Nov-17 | 25-Dec-17 | 31-Mar-18 | 1-Nov-17 |

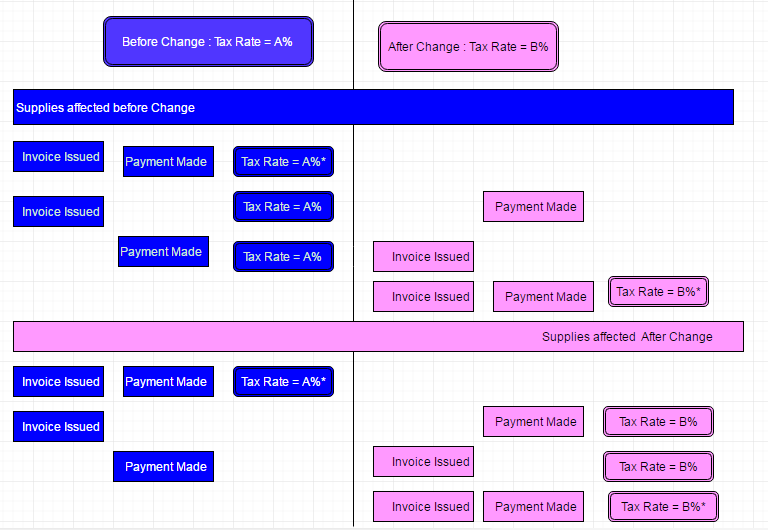

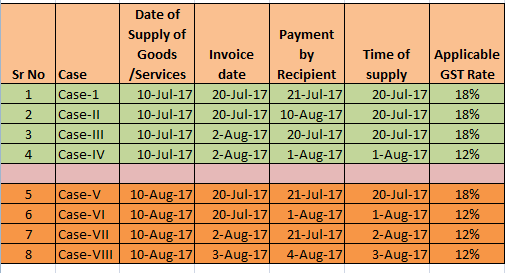

Change in Rate of Tax of Supply of Goods or Services

- Where Invoices are issued and Payments are received before date of change in rate of tax , or invoices are issued / and payments are received after date of change in rate of tax , Time of Supply will be earlier of two dates

As per Section 14 of CGST Act 2017 :-

Notwithstanding anything contained in section 12 or section 13, the time of supply, where there is a change in the rate of tax in respect of goods or services or both, shall be determined in the following manner, namely:—

(a) in case the goods or services or both have been supplied before the change in rate of tax,—

(i) where the invoice for the same has been issued and the payment is also received after the change in rate of tax, the time of supply shall be the date of receipt of payment or the date of issue of invoice, whichever is earlier; or

(ii) where the invoice has been issued prior to the change in rate of tax but payment is received after the change in rate of tax, the time of supply shall be the date of issue of invoice; or

(iii) where the payment has been received before the change in rate of tax, but the invoice for the same is issued after the change in rate of tax, the time of supply shall be the date of receipt of payment;

(b) in case the goods or services or both have been supplied after the change in rate of tax,—

(i) where the payment is received after the change in rate of tax but the invoice has been issued prior to the change in rate of tax, the time of supply shall be the date of receipt of payment; or

(ii) where the invoice has been issued and payment is received before the change in rate of tax, the time of supply shall be the date of receipt of payment or date of issue of invoice, whichever is earlier; or

(iii) where the invoice has been issued after the change in rate of tax but the payment is received before the change in rate of tax, the time of supply shall be the date of issue of invoice:

Provided that the date of receipt of payment shall be the date of credit in the bank account if such credit in the bank account is after four working days from the date of change in the rate of tax.

Explanation.—For the purposes of this section, “the date of receipt of payment” shall be the date on which the payment is entered in the books of account of the supplier or the date on which the payment is credited to his bank account, whichever is earlier.

Suppose : Rate of Tax before 01.08.2017 was 18% and has been reduced to 12% w.e.f 01.08.2017

Video Lecture on Time of Supply

Read Also : – Place of Supply in GST – India , Place of Supply Rules GST India

FAQ on Time of Supply

Q1. What is time of supply?

Ans. The time of supply fixes the point when the liability to charge GST arises. It also indicates when a supply is deemed to have been made. The CGST/SGST Act provides separate time of supply for goods and services.

Q2. When does the liability to pay GST arise in respect of supply of goods and Services?

Ans. Section 12 of the CGST/SGST Act provides for time of supply of goods. The time of supply of goods shall be the earlier of the following namely,

(a) the date of issue of invoice by the supplier or the last date on which he is required, under sub-section (1) of section 31, to issue the invoice with respect to the supply; or

(b) the date on which the supplier receives the payment with respect to the supply:

Provided that where the supplier of taxable goods receives an amount upto one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess amount shall, at the option of the said supplier, be the date of issue of invoice in respect of such excess amount.

Explanation 1.—For the purposes of clauses (a) and (b), “supply” shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment.

Explanation 2.—For the purposes of clause (b), “the date on which the supplier receives the payment” shall be the date on which the payment is entered in his books of account or the date on which the payment is credited to his bank account, whichever is earlier.

Q3. When does the liability to pay GST arise in respect of supply of Services?

Section 13 of the CGST/SGST Act provides for time of supply of Services. The time of supply of Services shall be the earliest of the following namely,

(a) the date of issue of invoice by the supplier, if the invoice is issued within the period prescribed under sub-section (2) of section 31 or the date of receipt of payment, whichever is earlier; or

(b) the date of provision of service, if the invoice is not issued within the period prescribed under sub-section (2) of section 31 or the date of receipt of payment, whichever is earlier; or

(c) the date on which the recipient shows the receipt of services in his books of account, in a case where the provisions of clause (a) or clause (b) do not apply:

Provided that where the supplier of taxable service receives an amount upto one thousand rupees in excess of the amount indicated in the tax invoice, the time of supply to the extent of such excess amount shall, at the option of the said supplier, be the date of issue of invoice relating to such excess amount.

Explanation.—For the purposes of clauses (a) and (b)—

(i) the supply shall be deemed to have been made to the extent it is covered by the invoice or, as the case may be, the payment;

(ii) “the date of receipt of payment” shall be the date on which the payment is entered in the books of account of the supplier or the date on which the payment is credited to his bank account, whichever is

earlier.

Q 4. What is time of supply in case of supply of vouchers in respect of goods and services?

Ans. The time of supply of voucher in respect of goods and services shall be;

a) the date of issue of voucher, if the supply is identifiable at that point; or

b) the date of redemption of voucher in all other

Q 5. Where it is not possible to determine the time of supply in terms of sub-section 2, 3, 4 of Section 12 or that of Section 13 of CGST/SGST Act, how will time of supply be determined?

Ans. There is a residual entry in Section 12(5) as well as Section 13 (5) which says that if periodical return has to be filed, then the due date of filing of such periodical return shall be the time of supply. In other cases, it will be the date on which the CGST/SGST/IGST is actually paid.

Q6. What does “date of receipt of payment” mean?

Ans. It is the earliest of the date on which the payment is entered in the books of accounts of the supplier or the date on which the payment is credited to his bank account.

Q7. Suppose, part advance payment is made or invoice issued is for part payment, whether the time of supply will cover the full supply?

Ans. No. The supply shall be deemed to have been made to the extent it is covered by the invoice or the part payment. [ Explanation to Section 12(2) / Section 13(2) of CGST Act ]

Q 8. What is the time of supply of goods in case of tax payable under reverse charge?

Ans. The time of supply will be the earliest of the following dates:

a) date of receipt of goods; or

b) date on which payment is made; or

c) the date immediately following 30 days from the date of issue of invoice by the supplier.

Q 9. What is the time of supply of service in case of tax payable under reverse charge?

Ans. The time of supply will be the earlier of the following dates:

a) the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier ; or

b) the date immediately following sixty days from the date of issue of invoice by the Supplier

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b), the time of supply shall be the date of entry in the books of account of the recipient of supply:

Provided further that in case of supply by associated enterprises, where the supplier of service is located outside India, the time of supply shall be the date of entry in the books of account of the recipient of supply or the date of payment, whichever is earlier.

Q10.What is the time of supply applicable with regard to addition in the value by way of interest, late fee or penalty or any delayed payment of consideration?

Ans. The time of supply with regard to an addition in value on account of interest , late fee or penalty or delayed consideration shall be the date on which the supplier receipts such additional consideration.

Q11. Is there any change in time of supply, where supply is completed prior to or after change in rate of tax?

Ans. Yes. In such cases provisions of Section 14 will apply.

Q 12. What is the time of supply, where supply is completed prior to change in rate of tax?

Ans. In such cases time of supply will be

(i) where the invoice for the same has been issued and the payment is also received after the change in rate of tax, the time of supply shall be the date of receipt of payment or the date of issue of invoice, whichever is earlier; or

(ii) where the invoice has been issued prior to change in rate of tax but the payment is received after the change in rate of tax, the time of supply shall be the date of issue of invoice; or

(iii) where the payment is received before the change in rate of tax, but the invoice for the same has been issued after the change in rate of tax, the time of supply shall be the date of receipt of payment;

Q 13. What is the time of supply, where supply is completed after to change in rate of tax?

Ans. In such cases time of supply will be

(i) where the payment is received after the change in rate of tax but the invoice has been issued prior to the change in rate of tax, the time of supply shall be the date of receipt of payment; or

(ii) where the invoice has been issued and the payment is received before the change in rate of tax, the time of supply shall be the date of receipt of payment or date of issue of invoice, whichever is earlier; or

(iii) where the invoice has been issued after the change in rate of tax but the payment is received before the change in rate of tax, the time of supply shall be the date of issue of invoice

Q 14. Let’s say there was increase in tax rate from 18% to 20% w.e.f.1.8.2017. What is the tax rate applicable when services provided and invoice issued before change in rate in July 2017, but payment received after change in rate in Aug 2017?

Ans. The old rate of 18% shall be applicable as services are provided prior to 1.8.2017.

Q 15. Let’s say there was increase in tax rate from 18% to 20% w.e.f. 1.8.2017. What is the tax rate

applicable when goods are supplied and invoice issued after change in rate in Aug 2017, but full advance payment was already received in April 2017?

Ans. The new rate of 20% shall be applicable as goods are supplied and invoice issued after 1.8.2017

Q 16. What is the time period within which invoice has to be issued for supply of Goods?

Ans. As per Section 31 of CGST/SGST Act

A registered person supplying taxable goods shall, before or at the time of,—

(a) removal of goods for supply to the recipient, where the supply involves movement of goods; or

(b) delivery of goods or making available thereof to the recipient, in any other case,

issue a tax invoice showing the description, quantity and value of goods, the tax charged thereon and such other particulars as may be prescribed:

Provided that the Government may, on the recommendations of the Council, by notification, specify the categories of goods or supplies in respect of which a tax invoice shall be issued, within such time and in such manner as may be prescribed.

Q 17. What is the time period within which invoice has to be issued for supply of Services?

Ans. As per Section 31 of CGST/SGST Act

A registered person supplying taxable services shall, before or after the provision of service but within a prescribed period, issue a tax invoice, showing the description, value, tax charged thereon and such other particulars as may be prescribed:

Provided that the Government may, on the recommendations of the Council, by notification and subject to such conditions as may be mentioned therein, specify the categories of services in respect of which—

(a) any other document issued in relation to the supply shall be deemed to be a tax invoice; or

(b) tax invoice may not be issued.

Q 18. What is the time period within which invoice has to be issued in a case involving continuous supply of goods?

Ans. In case of continuous supply of goods, where successive statements of accounts or successive payments are involved, the invoice shall be issued before or at the time each such statement is issued or, as the case may be, each such payment is received.

Q 19. What is the time period within which invoice has to be issued in a case involving continuous supply of services?

Ans.In case of continuous supply of services,—

(a) where the due date of payment is ascertainable from the contract, the invoice shall be issued on or before the due date of payment;

(b) where the due date of payment is not ascertainable from the contract, the invoice shall be issued before or at the time when the supplier of service receives the payment;

(c) where the payment is linked to the completion of an event, the invoice shall be issued on or before the date of completion of that event.

Q 20. What is the time period within which invoice has to be issued where the goods being sent or taken on approval for sale?

where the goods being sent or taken on approval for sale or return are removed before the supply takes place, the invoice shall be issued before or at the time of supply or six months from the date of removal, whichever is earlier.

GST FAQ- Time of Supply -31.03.2017 by CBEC

Read GST FAQ- Time of Supply issued on 31.03.2017 by CBEC