If you file GSTR 1 (outward Supply return ) after Due date ( Refer Due Dates of GSTR 1) , then you will be levied penalty to be called late fees under CGST Act 2017.

Who is required to File GSTR 1

| Form of return | Person required to file return | Periodicity |

GSTR-1 (Outward Supply) | Details of invoices, debit notes and credit notes issued for supplies by taxable person (including casual taxable person) other than under composition scheme | Monthly,if turnover exceeding Rs 1.50 crores per annum. Persons with turnover upto Rs 1.50 crores are required to file quarterly return

Refer Due Dates of GSTR 1 |

Commentary on GSTR 1 Penalty for Late Filing

- Form GSTR-1 filing after the due date prescribed will attract Late Fees Under Section 47 of CGST Act 2017

- It should be noted that fee is applicable even if you are filing Nil returns. Filing return (GSTR 3b/ GSTR 1) is compulsory under GST law. Once you have registered under GST, you have to file returns.

- Govt has been given the power under section 128 of CGST act to waive of Late fees for delayed filing GST Returns .

- Relevant Notifications and Sections on GSTR 1 Late Fees and Penalty :

- Section 37 of CGST Act 2017 : Furnishing details of outward supplies.

- Section 47 of CGST Act 2017; Levy of late fee.

- Notification No 75/2018 Central Tax Dated 31st December, 2018 : Waiver of GSTR 1 Late Fees for the period July, 2017 to September, 2018 in specified cases.

- Notification No. 4/2018–Central Tax dated 23.01.2018 :Reduction of late fee in case of delayed filing of FORM GSTR-1

- Notification No. 43/2018 – Central Tax dated 10/09/2018 and Notification No. 44/2018 – Central Tax dated 10/09/2018

- GSTR 1 Late fees is paid while submitting GSTR 3B.

- GSTR 3B return cannot be filed without the payment of the Late fee.

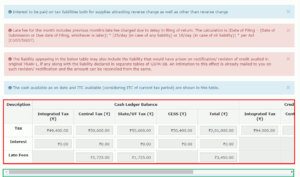

- The GSTR 1 Late fee is paid in cash separately for CGST, SGST and IGST in separate electronic cash ledgers. You can not use Input tax Credit Ledger balance to pay GSTR 1 Late Fees.

- Non-payment of tax due to late filing of GST Returns attracts Interest.

- Amount of Late Fees of GSTR 1 :

- GSTR 1 Late Fees / Penalty for Delayed filing by Notification No. 4/2018–Central Tax dated 23.01.2018

- on failure to furnish the details of outward supplies for any month/quarter in FORM GSTR-1 by the due date under section 47 of the said Act : Rs 25 per day under CGST Act and Rs 25 per day under SGST act ( total Rs 50 per day ) during which such failure continues . However, the upper ceiling of Rs 10,000 per return ( Rs 5000 under CGST Act and Rs 5000 under SGST Act ) is not changed. Thus, maximum late fee continues to be Rs 10,000 per return.

- when there are no outward supplies in any month/quarter, the amount of late fee payable by such registered person for failure to furnish the said details by the due date under section 47 of the said Act : Rs 10 per day under CGST Act and Rs 10 per day under SGST act (

( total Rs 20 per day ) ) during which such failure continues. However, the upper ceiling of Rs 10,000 per return ( Rs 5000 under CGST Act and Rs 5000 under SGST Act ) is not changed. Thus, maximum late fee continues to be Rs 10,000 per return.

- GSTR 1 Late Fees / Penalty for Delayed filing by Notification No. 4/2018–Central Tax dated 23.01.2018

- Before the above Notification Notification No. 4/2018–Central Tax dated 23.01.2018 , Late filing fees of GSTR 1 was as per

Section 47 of CGST act . Section 47(1) described that any registered person who fails to furnish the details of outward or inward supplies required under Section 37 or 38 or 39 or Section 45 by due date shall pay a late fee of Rs.100 per day during which such failure continues subject to a maximum of Rs.5000.[ Note : This Late fees is under CGST Act, Similar Late fees ( Rs.100 per day during which such failure continues subject to a maximum of Rs.5000- ) is also prescribed under SGST act 2017 ] - Note : GST Portal is not demanding interest on delayed payment of Late Fees.

Summary of Late Fees of GSTR 1

| Sl no | GST returns | Return Period | Applicability

of Late fee | Refer Notification |

| 1 | GSTR-1 | July 2017 onwards | Reduced Late fees

| Notification No. 4/2018–Central Tax dated 23.01.2018 |

| GSTR-1 if filed between 22nd Dec 2018 to 31st Mar 2019 | July 2017 -September 2018 | Late Fee Waived off completely [ However, interest for late payment of taxes will apply].] | 75/2018 Central Tax Dated 31st December, 2018 |

How to Calculate GSTR 1 Late Fees

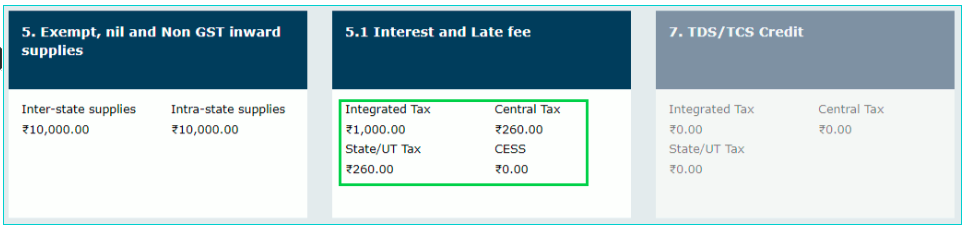

Late fees for the month includes late fees charged due to delay in filing of GSTR 1 and previous month’s Late fees charged due to delay in filing of GSTR 3B . The calculation is

[ Date of filing -(date of submission or Due date of Filing whichever is later)]* 25 per day (in case of any Liabilty) or Rs 10 Per day (In case of Nil Liability )]* per Act ( CGST Act /SGST Act )

Example-1 ( Assuming there is Liability to Pay Tax)

GST 1 Due Date 13/04/2019

GSTR1 Actual Filing Date 15/04/2019

No of Days Delay = 2

| Particulars | Numbers |

|---|---|

| Delay in Days | 2 |

| CGST Late Fee | 50 ( Rs 25*2) |

| SGST Late Fee | 50 (Rs 25*2) |

| Total Late Fee | 100 |

Example 2:

If There is Outward Supply in GSTR 1

| Return | Due Date | Date of Filing | No of days delay | Late Fees per Day (a) | Maximum Late Fees (b) | Late fees Payable [Lower of (a) or (b) ] | |||

| CGST | SGST | CGST | SGST | CGST | SGST | ||||

| july to September 2018 | 31st October 2018 | 20th May 2019 | 201 | 5025 | 5025 | 5000 | 5000 | 5000 | 5000 |

| Oct to december 2018 | 31st January 2019 | 15th April 2019 | 74 | 1850 | 1850 | 5000 | 5000 | 1850 | 1850 |

If There is NO Outward Supply in GSTR 1

| Return | Due Date | Date of Filing | No of days delay | Late Fees per Day (a) | Maximum Late Fees (b) | Late fees Payable [Lower of (a) or (b) ] | |||

| CGST | SGST | CGST | SGST | CGST | SGST | ||||

| july to September 2018 | 31st October 2018 | 20th May 2019 | 201 | 2010 | 2010 | 5000 | 5000 | 2010 | 2010 |

| Oct to december 2018 | 31st January 2019 | 15th April 2019 | 74 | 740 | 740 | 5000 | 5000 | 740 | 740 |

How to deposit GSTR 1 Late fees with Government

Note : Amount of Late fee applicable will automatically be calculated by the GST portal while submitting the GST returns of GSTR 3B.

The GSTR 1 Late fee is paid in cash separately for CGST, SGST and IGST in separate electronic cash ledgers. You can not use Input tax Credit Ledger balance to pay GSTR 1 Late Fees.

How to pay Late filing fee on GST portal?

Paying GST late filing fee is easy.

The process to pay late filing fee is similar to payment of tax.

- Click Service

- Click on Challans

- Click on Create Challan

A normal form will open, you are already familiar with this form as it is the same form used to pay your CGST and SGST tax.

In this form fill the amount of fee under FEE column of respective tax head.

Note: Do not fill complete fee amount in a single column, fill in different tax heads such as SGST and CGST.

GST return cannot be filed without the payment of the Late fee.

Late fee for the month includes previous month’s late fee charged due to delay in filing of the return. Also, non-payment or late payment of GST attracts Interest.

Whether GSTN Can Impose any restriction if Late Fees not Paid

GSTN is often programmed in a way not envisaged in law. E.g. law never states that GST return cannot be filed unless tax is paid or late fee is filed. However, the system just does not accept return without payment of taxes and late fees.

In A & M Design & Print Production v. Union of India [2018]

W.P. (C) NO. 7977 OF 2017 C.M. APPL. NO. 32898 OF 2017 (Delhi HC), it was held that as per section 146 of CGST Act, mandate of Common Goods and Services Tax Electronic Portal is to facilitate registration, payment of tax, furnishing of its returns, etc.,

Thus, it could not be programmed so as to deny utilization of CGST and SGST credit in a manner not envisaged either under section 49(5) or rules made under section 49(4) of CGST Act.

In this case The Petitioner states that its attempt to make payment of the integrated tax partially from the CGST credit and partially from the SGST credit was frustrated when the Electronic Credit Ledger available at the Portal www.gst.gov.in showed a pop-up error message which stated: “Offset the CGST Credit completely before cross utilization [of] SGST Credit against IGST tax liability.”

Petitioner, points out that this pop-up error is appearing only on the system and there is no such rule prescribed in terms of Section 49 (4) of the CGST Act. He also states that it does not appear on the form which is available on the Portal. It appears only after the figures are entered. A reference is made to Rule 86 (2) of the CGST Rules which states that `the electronic credit ledger shall be debited to the extent of discharge of any liability in accordance with the provisions of Section 49.’ It is also pointed out that under Section 146 of the CGST Act, the mandate of the Common Goods and Services Tax Electronic Portal is to facilitate the registration, payment of tax, furnishing of its returns, etc. It is also submitted that the system cannot be programmed so as to deny the utilization of CGST and SGST credit in a manner not envisaged either under Section 49 (5) of the Act or the Rules made under Section 49 (4) of the Act.

Whether Govt has power to waive GSTR 1 Late Fees

The Government may, by notification, waive in part or full, any penalty referred to in section 122 or section 123 or section 125 or any late fee referred to in section 47 for such class of taxpayers and under such mitigating circumstances as may be specified therein on the recommendations of the GST Council – section 128 of CGST Act.

Issues in GSTR 1 Late filing fees

Tax payers have following concerns which government should address:

- Late filing fee is more than amount of tax payable.

- Late filing fee is charged even for Nil returns.

- Late filing fee should be waived for the period or days on which GST portal face problems.

Related Post

GSTR 3B Late fees Changes from 1st April 2019 [Video]

Advisory : Filing of Quarterly GST Returns FORM GSTR1

How to declare Supply to merchant exporters @ 0.1% in GST returns

Uploading GST invoices using CSV templates : Video ,

GSTR 1 Late Fees, GSTR 1 Penalty, GST late fees notification ,GST late fee calculator,gst late fees waiver,gst late fee waiver notification, late fees for GSTR 1,GST late fee calculator online, GSTR 1 Delayed filing

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal