GUIDANCE NOTE FOR DEPT. OFFICERS

Annexure A : GUIDANCE NOTE FOR DEPT. OFFICERS

Procedure of migration of existing Central Excise and Service tax assessees to GST

The roll out of Goods and Services Tax (GST) is scheduled from 01.04.2017. The taxes of Central Excise and Service Tax would be subsumed in the GST. So a current Central Excise/ Service Tax taxpayer would need to migrate to GST, provided the taxpayer has not initiated such action as a VAT/Luxury Tax/Entry Tax/Entertainment Tax assesse under STATE COMMERCIAL TAX Dept

(2) Legal provisions for migration to GST:

Section 166 of the Draft Model GST Law- Migration of existing taxpayers to GST:

(1) On the appointed day, every person registered under any of the earlier laws and having a valid PAN shall be issued a certificate of registration on a provisional basis in such form and manner as may be prescribed

Rule 14 of the Draft GST Registration Rules: Migration of persons registered under Earlier Law

(1) Every person registered under an earlier law and having a Permanent Account Number issued under the Income Tax Act, 1961 (Act 43 of 1961) shall be granted registration on a provisional basis and a certificate of registration in FORM GST REG- 21, incorporating the Goods and Services Tax Identification Number (GSTIN) therein, shall be made available on the Common Portal.

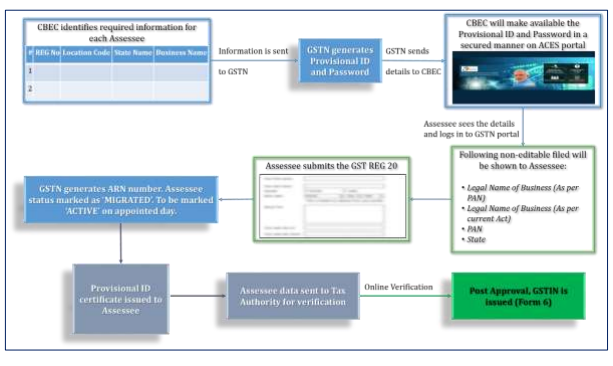

(3) A schematic representation of the migration process is given below:

(4) In order to migrate to GST, DG Systems has shared registration details for Central Excise and Service Tax assessees with GSTN for issue of provisional ID and password. The ID and password would be available to assessees individually by logging into ACES portal (www.aces.gov.in). This is to ensure the confidentiality of the log in details. The assessee may periodically log in to see their status.

(5) After the issue of the provisional ID and password, assessees will haveto log into GSTN portal (www.gst.gov.in) to fill up the required details and upload the supporting documents. After providing the requisite details, a ARN (Application Reference Number) would be communicated to the assessee by GSTN. Once an assessee has the ARN, she would migrate to GST on the scheduled GST roll out date with issue of Provisional Certificate.

(6) The details filled up by assessee (including VAT assessees) would be made available to jurisdictional officers via ACES (or through new CBEC-GST portal under development) for next steps as per the legal position.

(7) In case the Central Excise or Service Tax registration does not have a valid income tax PAN number, the assessee needs to obtain the PAN number and update the registration details on to ACES portal before assessee can be migrated to GST.

Further since in GST regime, one unique registration for a single PAN + State would be issued, the existing assessees would be given one provisional ID per State where place of business is registered in current CE and ST registrations. The remaining registrations in a State could be added as additional place of business in the details filled at the GSTN portal.

(8) In case the assessee is also registered with State Commercial Tax Dept (STATE VAT/ Luxury Tax/ Entry Tax/ Entertainment Tax) and has already initiated this process of migration, then no further action is required to be taken in terms of this Guidance Note by such assesse as a Central Excise/Service Tax assessee.

(9) Dept officers are required to suitably guide the jurisdictional assessees to migrate to GST in time. Local seminars and workshops may be arranged for taxpayers to facilitate the process.

(10). More details regarding migration are available on www.cbec.gov.in or www.aces.gov.in In case of any difficulty or query, assessees may contact the following helpdesk numbers:

CBEC : 1800-1200-232.

GSTN: 0124 – 4688999

Assessees can also email at cbecmitra.helpdesk@icegate.gov.in.

Annexure B :- Communication to the Central Excise/Service Tax Taxpayers on migration to GST

Dear Central Excise/Service Tax Taxpayers,

Greetings from Central Board of Excise and Customs (CBEC). We thank you for your duty/tax payments which have contributed to Nation building.

As you are aware, roll out of Goods and Services Tax (GST) is scheduled from 01.04.2017. The taxes of Central Excise and Service Tax would be subsumed in the GST. So as a Central Excise/Service tax taxpayer you need to take certain action to migrate to the GST regime.

In case you are also registered with State Commercial Tax dept (VAT/Luxury Tax/Entry Tax/Entertainment Tax), you may have already initiated this process of migration and no further action suggested below would be applicable to you.

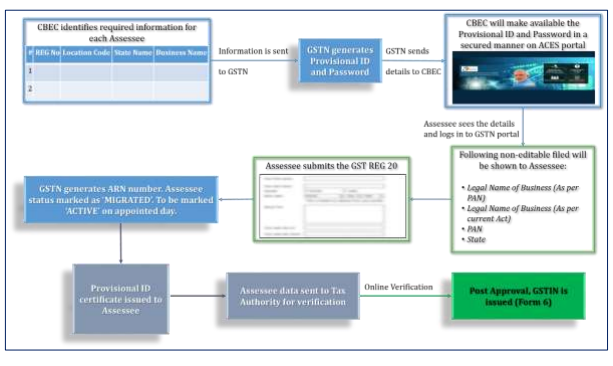

A schematic representation of the migration process is given below:

In order to migrate to GST, you need to have a provisional ID and password. These details you can obtain by logging into ACES portal (www.aces.gov.in). These details are being obtained from GSTN and you may periodically log in to see your status.

You are required to use the provisional ID and password to log into GSTN portal (www.aces.gov.in) to fill up the required details and upload the supporting documents. After you provide the requisite details, an ARN (Application Reference Number) would be communicated to you by GSTN. Once you have the ARN, you would migrate to GST on the scheduled GST roll out date with issue of Provisional Certificate.

Please note: In case your Central Excise or Service Tax registration does not have a valid Income Tax PAN number, you need to obtain the PAN number and update your registration details on to ACES portal before you can be migrated to GST.

You may visit www.cbec.gov.in or www.aces.gov.in to know more about the process of migration to GST.

[ Related Post Guide for GST Enrolment for existing Central Excise & Service Tax Assessees ]

In case of any difficulty or query, please contact your jurisdictional Central Excise/Service Tax officers or call the following helpdesk numbers:

CBEC : 1800-1200-232.

GSTN: 0124 – 4688999

You can also send us mail at cbecmitra.helpdesk@icegate.gov.in.

We in CBEC would like to assure you of the appropriate guidance and assistance in your smooth migration to GST and awaiting prompt action from your side.