How to Draft Notices and Order under GST

I Introduction

As per the Kerala Goods and Services Act, 2017, every registered person shall self assess the taxes under this Act and furnish a return for each tax period under section 39. This means GST continues to promote self-assessment just like the Excise, VAT and Service Tax under current tax regime. For a self assessment system to be effective the apparent freedom granted to tax payers must be backed up with a comprehensive and integrated set of enforcement strategies. This includes scrutiny of returns and connected records which has to be statutorily submitted by the tax payer. External information received from various sources and agencies viz., eway Bill, OR/CR files, Information from various Central and State Govt. Agencies etc also has to be verified with the declared tax liability of the tax payer.

In the case of Inspection of the business premises of the tax payer the Inspecting authority gathers many vital information and evidences in the form of stock, documents, records, accounts etc. which also has to be verified with the returns submitted by the tax payer.

If any discrepancies or irregularities are noticed on the verification as detailed above, it has to be explained by the respective assessee for which such information and intention of the assessing authority has to be passed on to the tax payer. The notice is intended to serve the said purpose.

II The need for drafting good notices and orders

A reasoned order is one of the requirements of natural justice.

Moreover, not passing a reasoned order has an impact on tax administration. Notices in files which may have all the materials, may get stayed by Hon’ble High Courts, only for the reason of bad drafting or not containing sufficient materials. It is true for orders also.

A badly drafted order not containing sufficient materials or discussions, or is not logically coherent can go against the revenue in appellate forums or may be subjected to remand. Remanded orders create extra work on the administration. Moreover, it may be dealt by an officer who may not be party to the original evidence collection or / and proceedings.

Remanded orders and such stays would also affect the revenue recovery mechanism of the departments since; they require extra entries in registers and connected procedures.

In these cases the department would suffer, even though the files would contain sufficient materials for a sustainable order or the law on the issue is in favour of the department. Hence, a sustainable order observing all the principles of natural justice in form and in the procedure involved is the key to successful revenue mobilization.

III Main provisions in GST Act

Main provisons in the Kerala GST Act, 2017 which statutorily requires issuance of Notices are contained in

Chapter XII- Assessment (section 59, 60,61,62,63 and 64),

Chapter XIV- Inspection, Search, Seizure and Arrest (section 67, 68,69,70,71),

Chapter XV- Demands and Recovery (section 73, 74, 75, 76, 77, 78, 79) and

Chapter XIX Offences and Penalties (section 122,123,125)

IV General Contents expected in a Notice

1. The statutory provision and the period for which the proposed action is contemplated.

2. The records or evidence which is relied on by the assessing authority for the proposed action has to be invariably marked and referenced.

3. The self declaration, if any, made by the assessee to the department which is sought to be disproved or disagreed by the assessing authority has to be stated.

4. Detailed analysis of evidences/records based on which the proposed action is sought to be made.

5. Conclusion of the assessing authority based on the analysis as stated above.

6. Arithmetic as well as logical calculation resorted by the assessing authority to arrive into the liability proposed has to be provided with reasonable clarity.

7. If any additions or estimations based on best judgment of the assessing authority is made, the special circumstances and reasons which warrants such additions or estimation has to be spelt out. The Quantum of addition or estimation should have a realistic bearing on the nature of irregularity detected, size of business etc.

8. The tax payer should be afforded with reasonable time, a minimum of 15 days, to show cause against the proposal.

9. The request of the tax payer for perusal/obtaining copies of the documents or records relied by the authority for making such proposal shall be considered and allowed. Copies of documents relied on which can be given, should be given along with the notice itself so as to avoid any delay.

10. The request for cross examination of the witnesses, if any, should be considered judiciously and decided upon.

11. On completion of the above time limit, an opportunity of being heard in the matter shall also be given.

12. Requests for adjournment of time and hearing should be granted based on the merit of such requests.

13. As per the judgment of the WP(C).No. 14332 of 2010(N) Dt. 02/06/2010 in Suzlon infrastructure service ltd vs. The commercial tax officer (W.C), where the assessment provisions require that the tax payer should be given a reasonable opportunity of being heard, the provisions should be obeyed in letter and spirit, by intimating the assesee regarding the date, time and place of hearing. It should not be a vague intimation like “the party is at liberty to have hearing on any date, within the time stipulated for submitting the objections.”

14. Assessment and penalty proposals under different sections of the Kerala GST Act, 2017, if proposed, should be by way of different independent proceedings.

15. The authority should avoid unnecessary imputations which are not cardinal to the matter beforehand. He should be factual in his findings. Such unnecessary imputations would prejudice or vitiate the entire proceedings.

V Points to be Noted before issuance of Orders

1. Must ensure that the Proposal Notice is properly served on the assessee according to the modes of Service prescribed under Section 169 of the Kerala GST Act 2017.

2. Ensure that all the parameters of natural justice, such as opportunity to show cause, opportunity of being heard in person, requests for cross examination, Requests of adjournment etc., are properly acted upon.

3. Ensure that the requests for authorization are properly considered as per the terms contained in Section 116 of the Kerala GST Act, 2017

4. Once the assessee has filed his objections in writing/through GSTN, the authority shall apply his attention to the contentions being raised by the tax payer against the proposal and shall have a cross check with the facts already available. If any further ambiguity in the contentions needs further clarification, it can easily be done at the time of personal hearing. This would give a better understanding of the matter at his disposal.

5. Subsequently, oral submissions made by the assessee at the time of Personal hearing, if any, shall be reduced into writing by the authority by way of Hearing Notes. Such Notes can be required to be authenticated by the assessee which will be a token of proper hearing.

6. Circumstances may arise where the evidences or records produced by the tax payer or otherwise points toward enhanced liability than already proposed, a revised notice shall be issued and all the safeguards and procedures taken for the original notices are to be followed.

VI Points to be Noted While Drafting of Orders

♦ General points:-These guidelines are only illustrative in nature, not exhaustive and can further be elaborated looking to the need and requirement of a given case:-

- Check the year for which notice has been issued

- Check the documents and reply filed by the tax payer to see that it represents to the relevant year

- The records of notice issued, acknowledgments, adjournments, records, documents and evidences should be marked and referenced. The references should be chronologically quoted including the proposal notice, revised proposal notice, if any, reply to the proposals, evidences submitted etc.

- The details of the tax payer, the circumstances under which and gist of the reasons for which the notice has been issued can be narrated first. The main issues framed as per the proposal notice can also be provided in detail.

- The date of filing of his written reply/reply through electronic media & the Objections/Contentions raised by him, the date of awarding personal hearing & the details of oral submission put forth by him at the time of hearing, has to specifically mentioned in the Order. The evidences or other documents, if any, adduced by the dealer should also be detailed.

- Further, the contentions raised by the tax payer against the issued raised in the proposal can be logically listed according to the facts of each case. Related issues have to be identified from the reply and evidences and need to be grouped together. It must be ensured that all the contentions raised by the dealer has been taken up and listed.

- Objections regarding lack of jurisdiction, limitation and non-compliance of natural justice have to be taken up and answered as the first issue.

- After listing all issues to be decided upon, the assessing authority should segregate the issues broadly in two categories:-

- One on which there is no dispute between Department & assessee and

- The other on which there is dispute between Department and assessee.

The issues, on which there is no dispute, may be summarized in one or two paragraphs of the findings and there is no need to discuss the same in great details. The remaining issues, where dispute between the Department and assessee exists, should be listed. At this stage, the question of sequencing of issues to be decided is required to be considered carefully.

- Now, the issues listed can be taken up chronologically and answered one by one with consideration to the evidences, records and other documents already in possession. Resultantly a finding either in favour of the contention or in favour of the revenue is to be explicitly arrived and recorded.

- Simultaneously, the inferences that could be deduced from the Chief examination, cross examination etc. has to be given in detail.

- If any proceedings are made as a result of the interference of the appellate authority including High Court, the fact of such directions and its applicability to the instant proceeding has to be provided in detail and acted accordingly.

- The arithmetical as well as logical calculation based on the issued decided in favour of the revenue has to be resorted to fix the liability of the tax payer. Addition or Estimation, if any resorted shall be in tune with the facts of the case and not be too low or too excessive. It should commensurate with the issues decided in favour of revenue.

- The tabulation should be descriptive enough and should be referenced to the above issued already decided. Anyone who goes through the tabulation must be able to understand the ratios or logic applied behind such fixation of liability.

- It should always be kept in mind that nothing should be written in the order, which may not be germane to the facts of the case; it should have a co-relation with the applicable law and facts. The ratio decidendi should be clearly spelt out from the order.

- After preparing the draft, it is necessary to go through the same to find out, if anything, essential to be mentioned, has escaped discussion.

- The ultimate finished judgement/order should have sustained chronology; regard being had to the concept that it has readable, continued interest and one does not feel like parting or leaving it in the midway. To elaborate, it should have flow and perfect sequence of events, which would continue to generate interest in the reader.

- Appropriate care should be taken not to load it with all legal knowledge on the subject as citation of too many judgements creates more confusion rather than clarity. The foremost requirement is that leading judgements should be mentioned and the evolution that has taken place ever since the same were pronounced and thereafter, latest judgement, in which all previous judgements has been considered should be mentioned. While writing the order psychology of the reader has also to be borne in mind.

- Language should not be rhetoric and should not reflect a contrived effort on the part of the author.

- It must be specifically provided in the Order that the final liability fixed along with the interest shall be paid as per the Demand Notice attached. A Demand Notice requiring the tax payer to pay the liability has to be attached along with the Order electronically.

♦ Consideration of Case Laws

- Case laws relied upon by the assessee in his defence should be carefully gone through. Each order of the High Court and Supreme Court, inter alia, has two important portion– (i) obiter dictum– (it is by way of observation and it is not an issue under consideration of the court) and (ii) ratio decidendi- ratio laid down by the court. For the purposes of judicial precedent, ratio decidendiis binding, whereas obiterdicta are persuasive only. While considering the case laws quoted by the party, entire case has to be gone through thoroughly, not the head notes alone.

Each case law relied upon by the notice has to be examined from the consideration of its applicability to the facts and circumstances of the impugned case. On consideration, if the assessing authority finds that it is not applicable to the impugned case, then the authority should mention in its order as to why the case law relied upon by the assesee in its defence is not applicable to the impugned case. If the adjudicating authority finds that the case law is relevant and is in favour of the asseessee, but there is another case which is contrary to the case law quoted and relied upon by the assessee, then it must be mentioned in the order.

(ii) Maintaining Judicial Discipline/Judicial Precedence

Judgement delivered by Hon’ble Supreme Court is of the highest precedence as it becomes law of the land. If, under any circumstances, the Hon’ble Apex Court reverts its own judgment, then the lordships discuss the earlier judgment and also give reasons for reverting the earlier Judgment and more often, the orders are reverted by larger bench. In that case, the last Judgement becomes the law.

As regard interpretation of any law, sometimes different high courts may take different view. In that case, normally, the issues go to Hon’ble Supreme Court which finally decides the issue. But in other cases, the jurisdictional High Court Judgement is binding upon all in its jurisdiction. If contrary judgements exist on the same issue at the same level (i.e. High Court/Tribunal), then two more aspects comes into play:

• Number of judges/Members in the bench delivering the Judgement; and

(ii) Date of the Judgement.

Sometimes, the case laws of lower appellate authority lower than Supreme Court are stayed by higher forum on department appeal against that order. Then it must be checked as to whether it is so in the case law relied upon by the party. If it is so, then the case law need not be applied on ground of stay.

(iii) Case Law to be considered with Reference to the Law existed at Material time

Since the law as well as its interpretation by Court/Tribunal is dynamic, the case law must be seen in the light of law (i.e. text of legal provision) which existed at the time of the case. Or in other words, the case law must be seen in the light of law with reference to which it was given. At times, the relevant provisions of law which existed at the time of booking of impugned case is not the same with reference to which the case law relied upon by the assessee(in his/her defence)pertains. At times, assessing authority summarily dismisses all the case laws relied upon by the assessee by writing in the order as under:

“ I have gone through the case laws relied upon by the assessee in its defence and find that the facts and circumstances of these case laws are different from the facts and circumstances of the impugned case and therefore the same are not applicable to the instant case.”

The case laws relied upon by the assessee cannot be dismissed summarily as explained above. Such approach by adjudicating authority may be interpreted as non application of mind and order being non-speaking or non-reasoned order. It is important to discuss as to why and how the case laws relied upon by the assessee are not applicable to the impugned case. It is MUST for every adjudicating authority.

Kerala GST Act, 2017 follows HSN/SAC code classification. While deciding tax rate disputes of commodities, judgments produced by the assessee for goods or services which were covered under HSN/SAC codes, should be carefully scrutinized, to find out whether such judgments were delivered on an HSN/SAC issue or on the interpretational rule of common parlance.

(iv) Considering Case Laws in support of Charges made by the Department/ or contrary to the Case Laws Relied Upon by the assessee

At the time of issuance of the notice, the Departmental officers do not mention any case law in support of charges made by the Department in the Notice. The assessee in his defence only mentions those case laws which are in his favour. Therefore, for objectively reaching at a conclusion at the time of adjudication, it is necessary for the assessing authority to find out and consider all relevant case laws on the issue under consideration and pass a reasoned order.

GENERAL CONTENTS OF A MODEL ORDER ARRANGED IN LOGICAL SEQUENCE

1. Full address of the authority including email and telephone number.

2. Statutory provision(s) which gives authority to pass the order

3. Quote the references (in chronological order)

eg 1. Returns/statement of accounts/audit reports /Reconciliation Statement in form 9A.

2. Notice for checking of accounts/audit.

3. Adjournment requests.

4. Adjournments granted.

5. External information received/ details of eway bill.

6. Statement recorded.

7. Extract /narration in accounts.

8. Invoices of Inward and Outward supply.

9. SIR/inspection reports/mahazar

10.OR/CR details

11. Cross examination request/adjournments

12. Pre assessment/penalty notices

13. Replies filed by the tax payer

4. Narrate the name and address, tin, and brief business practice, person to whom the order is intended and the assessment year which the order relates.

5. Narrate the contents of the notice.

6. Narrate tax payer’s reply.

7. Discuss and decide on jurisdiction, limitation, non-observance of natural justice.

8. Briefly discuss and decide on the issues conceded by the assessee.

9. On matters in which there is difference between assessing authority and the assessee, frame issues. Connected issues to be answered along with the main issue.

10. Discuss issue-wise along with evidence and facts. Judgments if any cited should be discussed in depth decide on the issue.

11. Furnish the tax liability calculation

In order to give idea to the reader the following few areas are stated here. The detailed information regarding the assessment and inspections etc may be read in Audit assessment / Intelligence related booklets and in respective GST laws and Rules.

| I. Procedure of Assessment under GST Regime – Section 59, 60,61,62,63 and 64 of Kerala GST Act, 2017 |

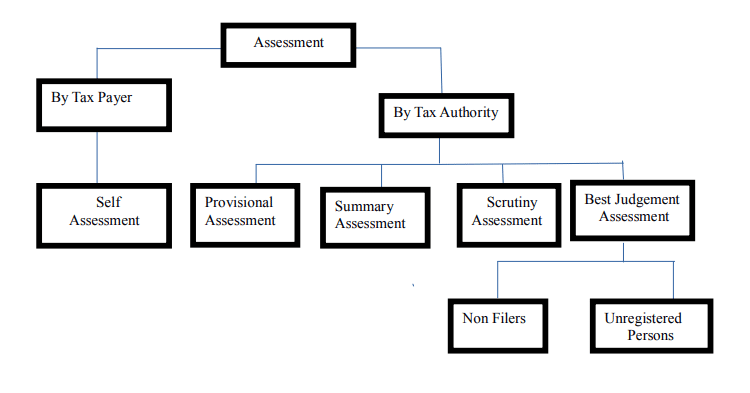

Assessment means determination of tax liability under GST law.

Types of Assessment under GST

• Self-assessment

• Provisional assessment

• Scrutiny assessment

• Best judgment assessment

• Assessment of non-filers of returns

• Assessment of unregistered persons

• Summary assessment

Only self-assessment is done by the taxpayer himself. All the other assessments are by tax authorities

1. Self-Assessment – Section 59 of Kerala GST Act, 2017

Every registered taxable person shall himself assess the taxes payable and furnish a return for each tax period as specified under section 39.

2. Provisional Assessment- Section 60 of Kerala GST Act, 2017 & Rule 98 of

Kerala GST Rule, 2017

A tax payer can request the officer for provisional assessment if he is unable to determine value of goods or services or both or determine rate of tax applicable, electronically in FORM GST ASMT -01.

1. Unable to determine value due to difficulty in –

- Calculating the transaction value

- Understanding whether certain receipts should be included or not

2. Unable to determine rate of tax due to difficulty in –

- Classifying the goods/services

- Identifying whether any notification is applicable or not

Provisions of Provisional Assessment – section 60 (1), 60(2), 60(3), 60(4) and 60(5) of Kerala GST Act, 2017

• Requests for provisional assessments will be given electronically in FORM GST ASMT 01 [Rule 98(1)].

• On receipt of the request, the proper officer issue notice in FORM GST ASMT-02 requiring the registered person to furnish additional information or documents supporting his request.

• The applicant shall file reply to the notice in FORM GST ASMT -03 [Rule 98(2)]

• The proper officer can allow paying tax on provisional basis at a rate or on a value specified by him.

• Order will be passed in FORM GST ASMT -04 within 90 days from date of request. – section 60(1). [Rule 98(3)]

• The taxable person has to issue a bond in FORM GST ASMT -05 with a security to be furnished not exceeding 25% of the amount covered under the bond, promising to pay the difference between provisionally assessed tax and final assessed tax. – section 60(2). [Rule 98(4)]

• Provisional assessments will be followed by final assessments order in FORM GST ASMT -07 within a period of 6 months from the date of order issued under section 60(1). The proper officer can ask for information before final assessment in notice FORM GST ASMT -06 section 60(3). [Rule 98(5)]

• Time Limit for Final Assessments can be extended for 6 months by the Joint/Additional Commissioner. However, the Commissioner can extend it for further 4 years as he seems fit. – Proviso to section 60(3).

• The Tax payer will have to pay interest on any tax payable under provisional assessment which was not paid within the due date. Interest period will be calculated from the day when tax was first due on the goods/services (and not the date of provisional assessment) till the actual payment date, irrespective of payment being before or after final assessment. Rate of interest will be maximum 18%. – section 60(4).

• If the tax as per final assessment is less than provisional assessment then the taxable person will get a refund. He will also get interest on refund. Rate of interest will be maximum 6%. – section 60(5).

• The applicant may file an application in FORM GST ASMT -08 for the release of the security furnished under sub rule (4) after issue of the order under sub rule (5) [Rule 98(6)]

• The proper officer shall release the security furnished under sub rule (4) after ensuring that the applicant has paid the amount specified in sub rule (5) and issue order in FORM GST ASMT- 09 within a period of 7 days from the date of receipt of the application under sub rule (6) [Rule 98(6)

3. Scrutiny of Returns- Section 61 of Kerala GST ACT 2017 & Rule 99 Kerala GST Rule 2017

The proper officer can scrutinize the return to verify its correctness of the return and inform the tax payer for explanations on discrepancies noticed in FORM GST ASMT- 10. section 61(1), [Rule 99(1)]

If the officer finds the explanations furnished by the tax payer in FORM GST ASMT- 11 satisfactory and pay the tax, interest and any other amount, then the taxable person will be informed in FORM GST ASMT- 12 and no further action will be taken. section 61 (2) , [Rule 99(3)]

If the officer finds the explanation is not satisfactory then the proper officer will take action-If the taxable person does not give a satisfactory explanation within 30 days or He does not rectify the discrepancies within a reasonable time ,the officer may conduct Audit of the tax payer u/s 65 , Start Special Audit- procedure u/s 66 , Inspection and Search- the places of business of the tax payer u/s 67 and Start Demand and Recovery provision u/s 73 or 74 – section 61(3)

4. Best Judgement Assessment under GST

In the best judgment assessment, an assessing officer assesses based on his reasoning and using the information available. Under GST, best judgement assessment becomes applicable in 2 situations-

- When a taxable person has not filed a return – section 62(1)

- When a person has not registered for GST even though he is liable to to do so. – section 62(2)

a. Assessment of Non-Filers- Section 62 of Kerala GST Act, 2017- Rule 100(1) of Kerala GST Rule, 2017

If the registered taxable person does not file his return (even with a notice under section 46 in FORM GSTR-3A) he will be sent a notice u/s 62 (1), even after the receipt of the notice, the tax payer does not file return, the proper officer will assess the tax liability to the best of his judgement in FORM GST ASMT- 13 [Rule 100(1)]. He will assess on the basis of the available information. The assessment order will be issued within 5 years from the due date of the annual return.

If the taxable person files a valid return within 30 days from the above assessment order, then the best judgement assessment order will be withdrawn. Valid return includes return along with payment of all due taxes ie, late fees, penalty, interest will still be payable in best judgement orders.

b. Assessment of Unregistered Persons- Section 63 of Kerala GST Act, 2017- Rule 100(2) of Kerala GST Rule, 2017

When a taxable person fails to obtain registration even though he is liable to do so. The officer will assess the tax liability for relevant tax periods to the best of his judgement. The taxable person will be sent a show cause notice in FORM GST ASMT- 14 and an opportunity of being heard and allowing a time of 15 days to furnish his reply,if any, before passing the order in FORM GST ASMT- 15 . The officer can issue assessment order within 5 years from the due date of the annual return for the year when the tax was not paid.

If it is found that he did not register when he was liable to, then demand and recovery for unpaid tax will commence and the penalty for not registering will also apply. This shows that even unregistered persons will be assessed to keep a check on their eligibility of not registering.

5. Summary Assessment – Section 64 of Kerala GST ACT 2017- Rule 100(3)of Kerala GST Rule 2017

This assessment is done when the assessing officer has sufficient grounds to believe that any delay in assessing a tax liability can harm the interest of the revenue. To protect the interest of the revenue, he can pass the summary assessment under section 64(1) Rule 100(3) on the basis of evidence of tax liability. The prior permission of Additional/Joint commissioner is required. Summary Assessment is a fast-track assessment based on the return filed by the assessee and order is issued in FORM GST ASMT- 16. It is completed on a priority basis without the presence of the taxpayer because the delay in such assessments may lead to loss of revenue. Summary assessment is usually done in cases of defaulting or absconding taxpayers.

The taxpayer can apply in FORM GST ASMT- 17 for withdrawal of the summary assessment order within 30 days from the date of receipt of order or he proves to the Additional/Joint Commissioner that the order was wrongly passed, and then the order will be cancelled under section 64(2), Rule 100(4). The Additional/Joint Commissioner can on his own, cancel the order if he is of the opinion that it was wrongly passed or reject the application in FORM GST ASMT- 18. After this, demand and recovery provisions u/s 73 & 74 will be applicable under section 64(2) Rule 100(5).

Often summary assessments are carried out in situations where it is not possible to identify the taxable person concerned in a case of supply of goods. In such cases, the person in charge of the goods will be deemed to be the taxable person. He will be assessed and held liable to pay tax and amount due under summary assessment. This provision is not applicable for services.

The format of FORMS GST ASMT- 01 to GST ASMT- 18 may be referred at the time of drafting notices and orders.

II.Procedure for interception of conveyances for inspection of goods in movement, and detention, release and confiscation of such goods and conveyances- Rules 138, Section 68

Sub-section (1) of section 68 of the SGST Act, 2017 stipulates that the person in charge of a conveyance carrying any consignment of goods of value exceeding Rs.50,000/- shall carry with him the documents and devices prescribed in this behalf. Sub-section (2) section 68 states that the details of documents required to be carried by the person in charge of the conveyance shall be validated in such manner as may be prescribed. Sub-section (3) section 68 provides that where any conveyance referred to in sub-section (1) of the section 68 is intercepted by the proper officer at any place, he may require the person in charge of the conveyance to produce the documents for verification, and the said person shall be liable to produce the documents and also allow the inspection of goods.

As per Rules 138 to 138D of the SGST Rules, 2017 the provisions relating to e-way bills., in case of transportation of goods by road, an e-way bill is required to be generated before the commencement of movement of the consignment. Rule 138 A of the SGST Rule, 2017 prescribes that the person in charge of a conveyance shall carry the invoice or bill of supply or delivery challan, as the case may be; and in case of transportation of goods by road, he shall also carry a copy of the e-way bill in physical form or the e-way bill number in electronic form or mapped to a Radio Frequency Identification Device embedded on to the conveyance in such manner as may be notified by the Commissioner. Section 129 of the SGST Act, 2017 provides for detention, seizure and release of goods and conveyances in transit while section 130 of the SGST Act, 2017 provides for the confiscation of goods or conveyances and imposition of penalty.

As per section 168 (1) of the SGST Act, 2017 the jurisdictional Commissioner or an officer authorised by him for this purpose shall, by an order, designate the proper officer/officers to conduct interception and inspection of conveyances and goods in the jurisdictional area specified in such order. The officer, empowered to intercept and inspect a conveyance, may intercept any conveyance for verification of documents and/or inspection of goods. At the time of inspection, the person in charge of the conveyance shall produce the documents related to the goods and the conveyance. The officer shall verify such documents and where, prima facie, no discrepancies are found, the conveyance shall be allowed to move further. An e-way bill number may be available with the person in charge of the conveyance or in the form of a printout; sms or it may be written on an invoice.

Where the person in charge of the conveyance fails to produce any prescribed document or where the proper officer intends to undertake an inspection, he shall record a statement of the person in charge of the conveyance in FORM GST MOV-01. In addition, the proper officer shall issue an order for physical verification/inspection of the conveyance, goods and documents in FORM GST

MOV-02, requiring the person in charge of the conveyance to station the conveyance at the place mentioned in such order and allow the inspection of the goods. The proper officer shall, within twenty four hours of the aforementioned issuance of FORM GST MOV-02, prepare a report in Part A of FORM GST EWB-03 and upload the same on the common portal.

Within a period of three working days from the date of issue of the order in FORM GST MOV-02, the proper officer shall conclude the inspection proceedings, either by himself or through any other proper officer authorised in this behalf. Where circumstances warrant such time to be extended, he shall obtain a written permission in FORM GST MOV-03 from the Commissioner or an officer authorized by him, for extension of time beyond three working days and a copy of the order of extension shall be served on the person in charge of the conveyance.

On completion of the physical verification/inspection of the conveyance and the goods in movement, the proper officer shall prepare a report of such physical verification in and serve a copy of the said report to the person in charge of the goods and conveyance. The proper officer shall also record, on the common portal, the final report of the inspection in Part B of FORM GST EWB-03 within three days of such physical verification/inspection. Where no discrepancies are found after the inspection of the goods and conveyance, the proper officer shall issue forthwith a release order in FORM GST MOV-05 and allow the conveyance to move further. Where the proper officer is of the opinion that the goods and conveyance need to be detained under section 129 of the SGST Act, 2017 he shall issue an order of detention in FORM GST MOV-06 and a notice in FORM GST MOV-07 in accordance with the provisions of sub-section (3) of section 129 of the SGST Act, 2017, specifying the tax and penalty payable. The said notice shall be served on the person in charge of the conveyance.

Where the owner of the goods or any person authorized by him comes forward to make the payment of tax and penalty as applicable under clause (a) of sub-section (1) of section 129 of the SGST Act, 2017, or where the owner of the goods does not come forward to make the payment of tax and penalty as applicable under clause (b) of sub-section (1) of the said section, the proper officer shall, after the amount of tax and penalty has been paid in accordance with the provisions of the SGST Act, 2017 and the SGST Rules, 2017 release the goods and conveyance by an order in FORM GSTMOV-05. Further, the order in FORM GST MOV-09 shall be uploaded on the common portal and the demand accruing from the proceedings shall be added in the electronic liability register and the payment made shall be credited to such electronic liability register by debiting the electronic cash ledger or the electronic credit ledger of the concerned person in accordance with the provisions of section 49 of the SGST Act, 2017.

Where the owner of the goods, or the person authorized by him, or any person other than the owner of the goods comes forward to get the goods and the conveyance released by furnishing a security under clause (c) of sub-section (1) of section 129 of the SGST Act, 2017 the goods and the conveyance shall be released, by an order in FORM GST MOV-05, after obtaining a bond in FORM GST MOV-08 along with a security in the form of bank guarantee equal to the amount payable under clause(a) or clause (b) of sub-section (1) of section 129 of the SGST Act, 2017. The finalisation of the proceedings under section 129 of the SGST Act, 2017, shall be taken up on priority by the officer concerned and the security provided may be adjusted against the demand arising from such proceedings.

Where any objections are filed against the proposed amount of tax and penalty payable, the proper officer shall consider such objections and thereafter, pass a speaking order in FORM GST MOV-09, quantifying the tax and penalty payable. On payment of such tax and penalty, the goods and conveyance shall be released forthwith by an order in FORM GST MOV-05. The order in FORM GST MOV-09 shall be uploaded on the common portal and the demand accruing from the order shall be added in the electronic liability register and, upon payment of the demand, such register shall be credited by either debiting the electronic cash ledger or the Page 3 of 32electronic credit ledger of the concerned person in accordance with the provisions of section 49 of the SGST Act, 2017.

In case the proposed tax and penalty are not paid within seven days from the date of the issue of the order of detention in FORM GST MOV-06, action under section 130 of the SGST Act, 2017 shall be initiated by serving a notice in FORM GST MOV-10, proposing confiscation of the goods and conveyance and imposition of penalty. Where the proper officer is of the opinion that such movement of goods is being effected to evade payment of tax, he may directly invoke section 130 of the SGST Act, 2017 by issuing a notice proposing to confiscate the goods and conveyance in FORM GST MOV-10. In the said notice, the quantum of tax and penalty leviable under section 130 of the SGST Act, 2017 read with section 122 of the SGST Act, 2017, and the fine in lieu of confiscation leviable under sub-section (2) of section 130 of the SGST Act, 2017 shall be specified. Where the conveyance is used for the carriage of goods or passengers for hire, the owner of the conveyance shall also be issued a notice under the third proviso to sub-section (2) of section 130 of the SGST Act, 2017, proposing to impose a fine equal to the tax payable on the goods being transported in lieu of confiscation of the conveyance.

No order for confiscation of goods or conveyance, or for imposition of penalty, shall be issued without giving the person an opportunity of being heard. An order of confiscation of goods shall be passed in FORM GST MOV-11, after taking into consideration the objections filed by the person in charge of the goods (owner or his representative), and the same shall be served on the person concerned. Once the order of confiscation is passed, the title of such goods shall stand transferred to the State Government. In the said order, a suitable time not exceeding three months shall be offered to make the payment of tax, penalty and fine imposed in lieu of confiscation and get the goods released. The order in FORM GST MOV-11 shall be uploaded on the common portal and the demand accruing from the order shall be added in the electronic liability register and, upon payment of the demand, such register shall be credited by either debiting the electronic cash ledger or the electronic credit ledger of the concerned person in accordance with the provisions of section 49 of the SGST Act. Once an order of confiscation of goods is passed in FORM GST MOV-11, the order in FORM GST MOV-09 passed earlier with respect to the said goods shall be withdrawn.

An order of confiscation of conveyance shall be passed in FORM GST MOV-11, after taking into consideration the objections filed by the person in charge of the conveyance and the same shall be served on the person concerned. Once the order of confiscation is passed, the title of such conveyance shall stand transferred to the State Government. In the order passed above, a suitable time not exceeding three months shall be offered to make the payment of penalty and fines imposed in lieu of confiscation and get the conveyance released. The order in FORM GST MOV-11 shall be uploaded on the common portal and the demand accruing from the order shall be added in the electronic liability register and, upon payment of the demand, such register shall be credited by either debiting the electronic cash ledger or the electronic credit ledger of the concerned person in accordance with the provisions of section 49 of the SGST Act, 2017.

In case neither the owner of the goods nor any person other than the owner of the goods comes forward to make the payment of tax, penalty and fine imposed and get the goods or conveyance released within the time specified in FORM GST MOV-11, the proper officer shall auction the goods and/or conveyance by a public auction and remit the sale proceeds to the account of the State Government.

Suitable modifications in the time allowed for the service of notice or order for auction or disposal shall be done in case of perishable and/or hazardous goods. Demand of any tax, penalty, fine or other charges shall be added in the electronic liability ledger of the person concerned. Where no electronic liability ledger is available in case of an unregistered person, a temporary ID shall be created by the proper officer on the common portal and the liability shall be created therein. He shall also credit the payments made towards such demands of tax, penalty or fine and other charges by debiting the electronic cash ledger of the concerned person. A summary of every order in FORM GST MOV-09 and FORM GST MOV-11 shall be uploaded electronically in FORM GST-DRC-07 on the common portal.

The format of FORMS GST MOV-01 to GST MOV-11 may be referred at the time of drafting notices and orders.

III. Procedure for inspection search and seizure of business place- Rules 139, Section 67

Where the SGST officer, not below the rank of Joint Commissioner, has reasons to believe that

1. a taxable person has suppressed any transaction relating to supply of goods and/or services or the stock of goods in hand, or has claimed input tax credit in excess of his entitlement under the Act or has indulged in contravention of any of the provisions of this Act or rules made there under to evade tax under this Act or

2. any person engaged in the business of transporting goods or an owner or operator of a warehouse or a godown or any other place is keeping goods which have escaped payment of tax or has kept his accounts or goods in such a manner as is likely to cause evasion of tax payable under this Act, he may authorize in writing in FORM GST INS-01, any other officer subordinate to him of SGST to inspect any places of business of the taxable person or the persons engaged in the business of transporting goods or the owner or the operator of warehouse or godown or any other place as the case may be, seizure of goods, documents, books or things liable to confiscation.

Whether the proper officer has reasons to believe that any goods liable to confiscation or any documents or books or things, which in his opinion shall be useful for or relevant to any proceedings under this Act, are secreted in any place, he may authorize in writing any other SGST officer to search and seize or may himself search and seize such goods, documents, books or things by making an order of seizure in FORM GST INS-02.

Where it is not practicable to seize any such goods, the proper officer may serve on the owner or the custodian of the goods an order or prohibition in FORM GST INS-03 that he shall not remove, part with, or otherwise deal with the goods except with the previous permission of such officer:

The goods so seized under sub-section (2) section 67 shall be released, on a provisional basis, upon execution of a bond for the value of goods in FORM GST INS-04 and furnishing of a security in the form of a bank guarantee equivalent to the amount of applicable tax, interest and penalty payable.

Where the goods or things seized are of perishable or hazardous nature, and if the taxable person pays an amount equivalent to the market price of such goods or things or the amount of tax, interest and penalty that is or may become payable by the taxable person, whichever is lower, such goods or as the case may be things shall be released forthwith by an order in FORM GST INS-05 on proof of payment.

The format of FORMS GST INS-01 to GST INS-05 may be referred at the time of drafting notices and orders.

OTHER NOTICES

CR No.

Office of the Intelligence Officer,

Squad No…………..

Kerala Goods and Services Tax Department

Dated.

Notice Under Section 122(1)(xv) of the Kerala GST Act, 2017

Sub: Kerala GST ACT 2017 – (Name of the tax payer) – inspection conducted – due to defect detected on scrutiny of returns- offence detected for the period …………- penalty proposed- notice issued – reg.

Ref: Shop Inspection Report vide No. …………… dated ………..

M/s. (Name of the tax payer) is a registered tax payer dealer on the rolls of (Name of State Tax Office) bearing GSTIN-……………………. Intelligence Squad No…………, State Taxes Department, (District) conducted an inspection at the business premises of the said tax payer on (date) and prepared the SIR referred above. [ The inward and outward supply details for the period obtained from the tax payers accounts /registers/ computer system shows that the tax payer has a for the period from …………….. to ………….. The tax due for the said period comes to Rs……………………… . But the tax payer has disclosed taxable turnover of Rs only. Suppression detected ]

It is an offence punishable under section 122(1)(xv) of the Kerala GST Act, 2017. Hence it is proposed to impose a penalty of Rs………… being double the amount of tax sought to be evaded or Rs. 10000/- whichever is higher for the (period ) under section 122(1)(xv) Kerala GST Act, 2017.

Objections, if any, to the above proposal shall be filed within 15 days receipt of this notice, failing which the proposal shall be confirmed without further notice.

The tax payer is also afforded an opportunity of being heard in the matter in person or through an authorized representative at my office at the ……………………. at ………. A.M. on ……………………………

(Note : Subsequent verification of books of accounts with respect to the Shop Inspection Report vide No………………… dated ……… …. will not be affected by this proceedings and will be proceeded separately under the Kerala GST Act ‘2017 & Rules made there under.)

Intelligence Officer

Squad No.,…

Note: During inspection officer may find different offences under sec 122(1) and the above notice can be issued by changing the matter mention in the square bracket according to the context.

FORM GSTR – 3A

[See rule 68]

Reference No:

Date:

To

GSTIN

Name

Address

Notice to return defaulter u/s 46 for not filing return

Tax Period

Type of Return –

Being a registered taxpayer, you are required to furnish return for the supplies made or received and to discharge resultant tax liability for the afore said tax period by due date. It has been noticed that you have not filed the said return till date.

You are, therefore, requested to furnish the said return within 15 days failing which the tax liability will be assessed u/s 62 of the Act, based on the relevant material available with this office. Please note that in addition to tax so assessed, you will also be liable to pay interest and penalty as per provisions of the Act.

Please note that no further communication will be issued for assessing the liability.

The notice shall be deemed to have been withdrawn in case the return referred above, is filed by you before issue of the assessment order.

STO,…………………………

Reference No:

Date:

To

GSTIN

Name

Address

Notice- GSTR 3 B Defaulter having GSTR 2 A

(Section 39(1) and 46 of the CGST Act , 2017/ SGST Act ,2017 read with Rule 61 (5) of the CGST/SGST Rules 2017 and Section 62 ot the CGST Act 2017/SGST Act ,2017)

Being a regular registered person under GST , as per Section 39(1) and 46 of the CGST Act ,2017/ SGST Act ,2017 read with Rule 61 (5) of the CGST/SGST Rules, 2017, you shall for every calendar month or part thereof, furnish, FORM GSTR 3B the monthly return, electronically, of supplies of goods or services or both, input tax credit availed, tax payable, tax paid and such other particulars as may be prescribed, on or before the 20th day of every succeeding month or on or before the notified extended date as the case maybe. But you have failed to file the return for the month of ………….. till date.

On further vefification of GSTR 2A available against you for the period …………., it is found that you had been continuing business and there is an inward supply of Rs……………. from the registered dealers under GST fot the said period.

You are therefore , required to furnish the said return within 15 days failing which the tax liability will be assessed u/s 62 of the CGST Act 2017/SGST Act, 2017 to the best of judgement of the undersigned, based on the relevant material available or gathered. You may also note that in addition to the tax so assessed, you are liable to pay interest upto a rate of…….%.

You may also note that for each return period, you are liable to be impose with a penalty equivalent to the tax due u/s 74 of the CGST Act 2017/SGST Act, 2017 or an amount of Rs.50,000/-(Rs. 25,000/- each) u/s 125 of the CGST Act 2017/SGST Act, 2017.

Please note that no further communication will be issued for intimating further proceedings.

This notice shall be deemed to have withdrawn in case the return referred above is filed by you as per law, within the time specified.

State Tax officer,

…………………………..

To

……………………………………

……………………………………

Acknowledgement

This booklet will give guidance to all officers regarding the drafting of notices and orders. It is expected that the officers will take efforts to add on points as per the particular case.

I appreciate the works done by Shri Mansur M I for drafting the notes to use during VAT regime and Smt Aghi Achamma Alex STO for customizing the draft to use in GST regime. I also appreciate the contribution of other officers for giving suggestions and guidance to prepare this document.

Dr Rajan Khobragade

Prl Secretary & Commissioner

State GST Department.

Source- http://keralataxes.gov.in

Download in PDF Click here

Pingback: TaxHeal - GST and Income Tax Complete Guide Portal