How is NRI Taxed under Indian Income Tax Act?

( By CA Satbir Singh (Author) can be contacted for ITR filing of NRI at Taxheal@gmail.com )

Every person, being an individual or a Hindu undivided family or an association of persons or a body of individuals, whether incorporated or not, or an artificial juridical person, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year, without giving effect to the provisions of clause (38) of Section 10 or] Section 10A or section 10B or section 10BA [or Section 54 or section 54B or section 54D or section 54EC or section 54F or section 54G or Section 54GA or Section 54GB] or Chapter VI-A exceeded the maximum amount which is not chargeable to income-tax, shall, on or before the due date, file ITR in India

Video Explantion of ITR filing for NRI

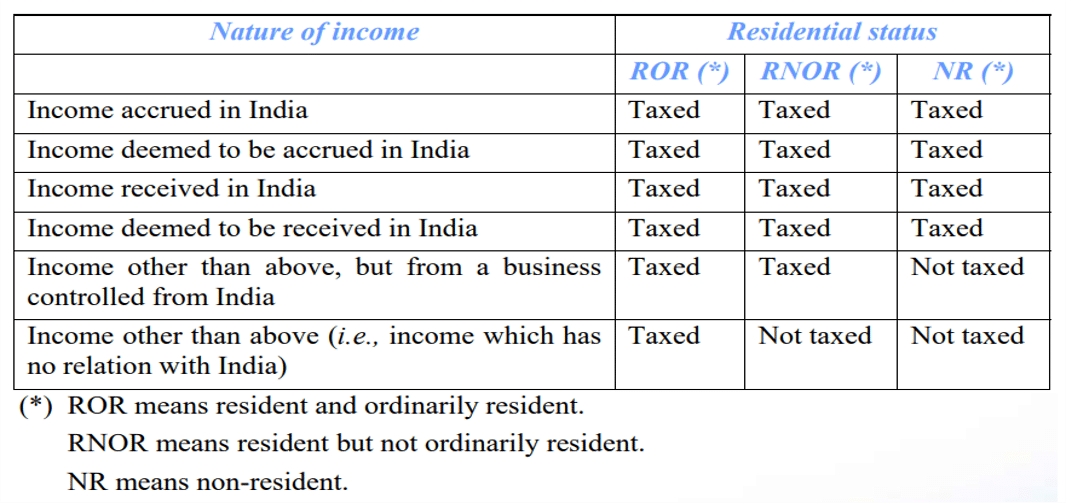

Whether NRI will be mandatory required to file ITR in india will depends upon his scope of Income . Here is the scope of income for which ITR is required to be filed

NRI is required to mandatory file his ITR in india if his taxable income exceeds Rs 2.5 Lakh.

Short Stay : Ought Not Result in Indian Residency

| Type of Individual | Total Income from Indian sources | Stay in India | |

| India Citizen or person of Indian origin. | Less than INR 15 lakhs during PY 2020-21. | 182 days or more during PY 2020-21. | |

| India Citizen or person of Indian origin. | INR 15 lakhs or more during PY 2020-21. | a. 182 days or more during PY 2020-21; OR | |

| b. 120 days or more during PY 2020-21 & 365 days or more in preceding 4 FYs. | |||

| Individual who is NOT an Indian Citizen or a person of Indian origin. | Not applicable. | a. 182 days or more during PY 2020-21; OR | |

| b. 60 days or more during PY 2020-21 AND 365 days or more in preceding 4 FYs. |

From FY 2020-21, if an NRI has income more than INR 15 Lakhs from Indian sources, comes for visit to India, and spends 120 or more days, he will be treated as Resident & has to file ITR as a resident does.

There are Double Taxation Avoidance Agreements (DTAA) in place by which the same income won’t be taxed doubly. For claiming such DTAA benefits you need to file Income Tax Return.

Mandatory ITR Filing for NRI if

A. Taxable Income Exceeds Rs 2.5 Lakh

NRI might have dividend Income, Saving Bank interest Income , FDR income etc , if all these income exceeds Rs 2.5 Lakh , he is mandatorily required to file ITR

B. Deposit in Current Account exceeds Rs 1 Crore

NRI is required to mandatory file ITR if he deposited an amount or aggregate of the amounts exceeding 1 crore in one or more current accounts maintained with a bank or co-operative bank during the Financial Year

C. Expenses on Foreign Travel Exceeds Rs 2 Lakh

NRI is required to mandatory file ITR incurred an expenditure of an amount or aggregate of amounts exceeding INR 2 lakh for self or for any other person for travel to a foreign country during the FY

“Travel to any foreign country” does not include travel to the neighbouring countries or to such places of pilgrimage as the Board may specify in this behalf by notification in the Official Gazette.

D. Incurred Expenses on Electricity Bill above Rs 1 Lakh

If Non resident Indian Has incurred expenditure of an amount or aggregate of amounts exceeding INR 1 lakh on the consumption of electricity during the financial year.

Other reasons for ITR Filing by NRI

Non Resident Indian may also be required to file Income Tax Return in India because of the following reasons :-

1. Taxation of Interest Income of NRO and NRE Bank Account

NRE Bank account : NRE account is an account which a person can open after becoming a non-resident under FEMA.

NRE account can be maintained in either Indian currency or in any permitted foreign currency.

There are restrictions about the money which can be credited in an NRE account. Generally, money remitted, through banking channel, from outside India can only be credited in an NRE account.

Money in NRE account is fully repatriable outside India.

An NRE account is virtually a bank account maintained outside India though actually maintained with Indian banks.

NRO Bank Account : Once an Indian resident becomes a non-resident under the provisions of FEMA, he has to intimate his bank about change of his residential status. The banks then re-designates all the existing bank accounts as NRO accounts.

Generally, there are no restrictions in respect of the money which can be deposited in your NRO account. You can also open a new NRO account after becoming a Non Resident under FEMA.

Up to 1 USD million can be remitted every financial year from your NRO account, after paying applicable taxes in India.

Taxation of NRE and NRO Account :-

- Interest earned on an NRE account is fully exempt under Section 10.

- Interest credited on NRO account is fully taxable in India and the banks are required to deduct tax at source on the interest credited on all NRO bank account including a saving bank account.

2. NRI can CLaim Refund of Tax Deducted after filing ITR

TDS may have been deducted from FDR made with indian Bank by NRI therefore refund can be claimed only when ITR if filed .

3. Sale of Property by NRI

IF Non Resident Indian has sold property (like Land or Building ) in India then he is required to pay Income tax on Capital Gains earned by him.

4 Loan requirement

NRI may be planning to avail a Home Loan jointly with a Resident in the future, filing ITR will help hime in documentation and easy availabity of loan

You can also refer Income Tax website for detailed provisions on NRI filing

5 Set off Losses

If NRI have made long-term capital losses from sale of any investments or assets, & he may want to set them off in future, it is possible only if ITR is filed before due date in India.

Note : NRIs are not required to mention Aadhaar in ITR or link PAN with Aadhaar .The CBDT through notification 37/2017, has exempted NRIs from quoting Aadhaar in PAN applications and Income Tax Returns while ITR Filing for NRI. So, if you are NRI as per IT Act, then you shall not be required to quote Aadhaar and also not required to link PAN and Aadhaar also.

(By CA Satbir Singh (Author) can be contacted for ITR filing of NRI at Taxheal@gmail.com )

Related Post

How to get NRI Lower TDS Certificate on Property Sale ISection 195 of Income Tax

How to File ITR of NRI AY 2021-22 I Income Tax Return Non Resident Indian I CA Satbir Singh

How to Apply Lower TDS Certificate for NRI on TDS CPC I Form 13 I Income Tax I CA Satbir Singh

How to File TDS Return of NRI Payments in Form 27Q I Income Tax TDS Software