Steps for Acceptance of TDS Credit by Deductee under GST

w.e.f 01.10.2018 any eligible payment received from the Specified persons where contract price exceeding RS 2.50 Lakhs , [1% CGST & 1% SGST/UTGST ( In case of Intra State Supply of Goods / Services)] or [2% IGST ( In case of Inter State Supply of Goods / Services) ] then TDS will be deducted under GST.

After deduction all the above persons (i.e. Deductor) are required to file GSTR-7 before 10th of Succeeding month ,therefore, the GST TDS Deducted during October 2018 need to be paid & return to be filled before 10th of November 2018.

As far as Deductee is concerned, the deductee need to Accept/ Reject the TDS/TCS Credit on the GSTIN portal by filling TDS / TCS online.

The deductee can accept/ reject the TDS details auto-populated to TDS and TCS Credit received table of his/her return. Taking action by deductee is mandatory for crediting the amount of TDS to cash ledger.

Thus TDS amount will be credited to deductee’s Electronic Cash Ledger only after his/ her accepting of TDS and TCS credit received (which is auto populated on filing of returns by the deductor in GSTR 7 ).

Therefore, for availing the GST TDS Deducted by the above eligible deductors , all the deductee need to follow file the TDS/TCS Credit Received which is detailed below.

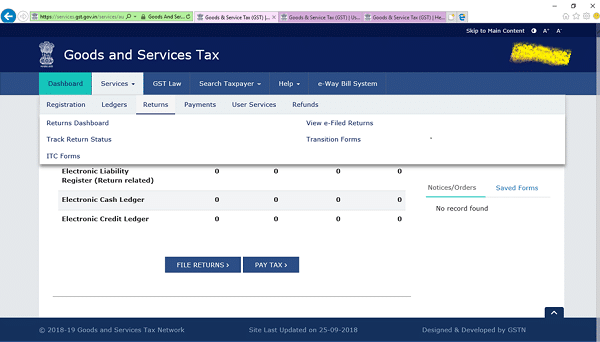

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

Go the the Return dashboard

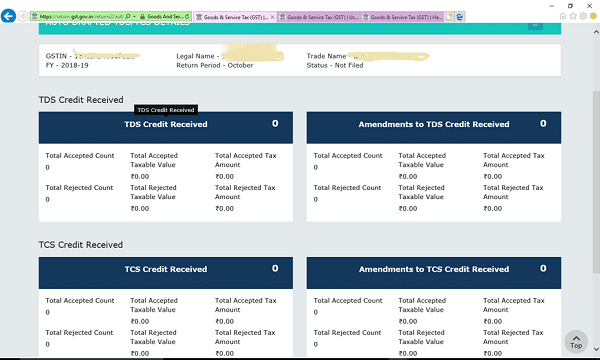

Click on the TDS and TCS Credit Received

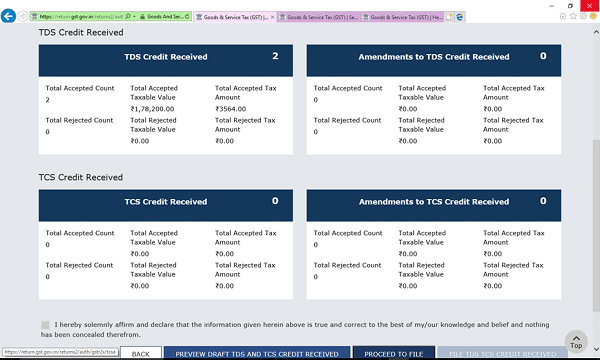

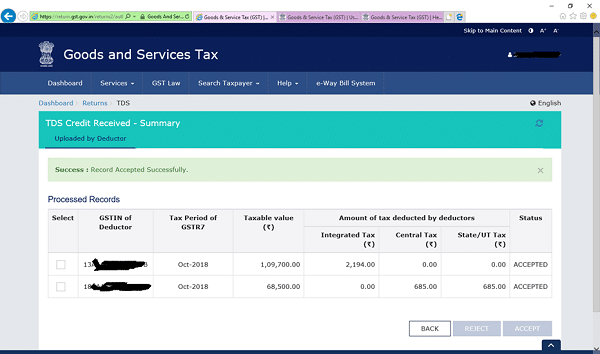

Please select the TDS which you want to accept , after selection then press Accept : as detailed below

After acceptance the TDS Amount will be reflected under TDS Received , Then Press PROCEED TO FILE ,

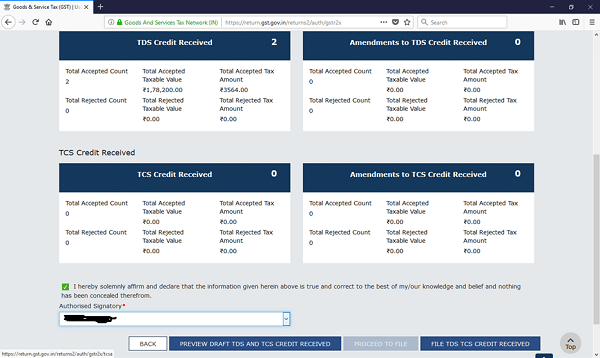

After PROCEED TO FILE, proceeds for filling of TDS/TCS Received

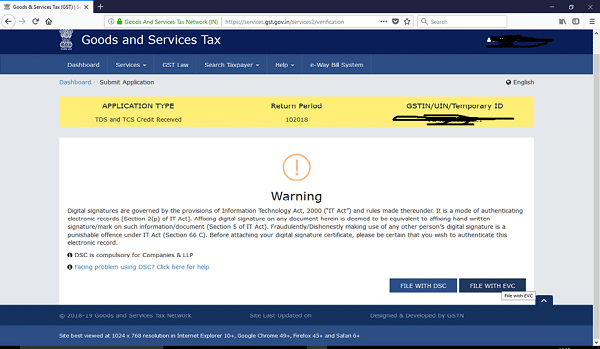

File with DSC / EVC

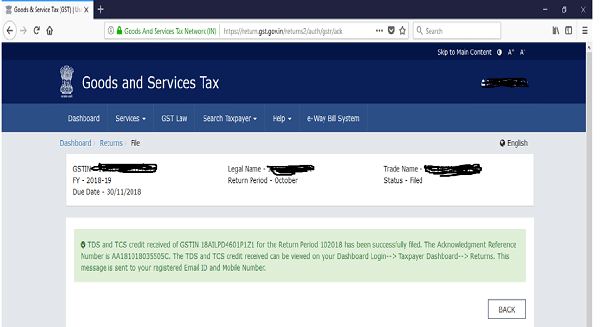

Acknowledgment will be received

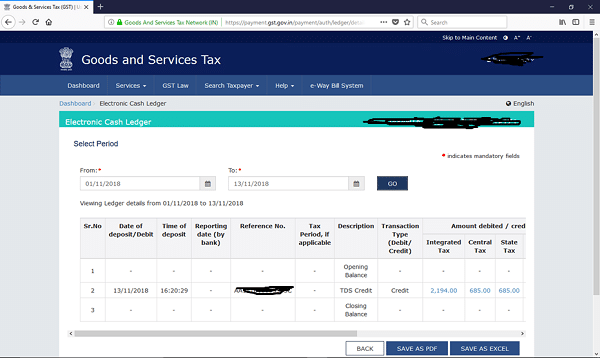

The Amount Will appeared in CASH Ledger ,Which can be utilized for payment of balance amount for the reporting period.

Related Post

GST TDS Accounting Entries in Supplier Books

When TDS is to be deducted Under GST : Situations

How to Accept GST TDS deducted by Deductee

when GST TDS will not be deducted : List of situations

What will happen if GST TDS return not filed on Time

Learning Material for TDS Deductors under GST (Part 1 – Registration & Payment)

Learning Material for TDS Deductors under GST (Part 2 – Returns Filing)

How to register as TDS Deductors in GST

GST TDS SOP released by CBIC : Download

[Video] who is required to deduct GST TDS : GST News 495

CBEC Circular No 65/39/2018-DOR : Guidelines for TDS by DDO under GST

Attention all DDO’S : TDS under GST w.e.f 01.10.2018 : Circular