EPF Balance Check

Employee Provident Fund (EPF) balance can be checked by following methods

1. Check EPF Balance on EPFO Portal

To check EPF balance, make sure that the employer has activated your Universal Account Number (UAN).

Universal Account Number or UAN is unique for all the employees enrolled under the EPF scheme. A UAN number is allotted by the Employee Provident Fund Organization (EPFO). All employees should have only one UAN during their working life irrespective of the companies they change.

Once your UAN number is activated, just follow these steps:

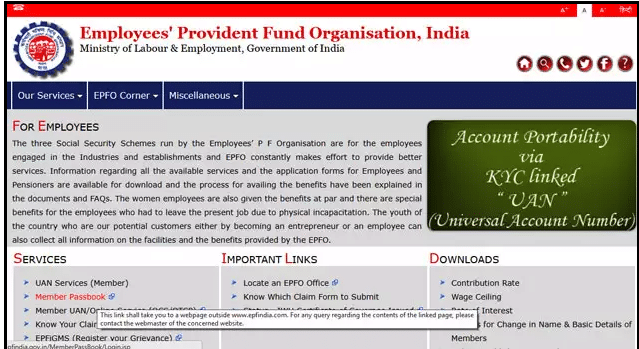

Step 1: Log on to the EPFO portal Click here. Go to the tab ‘Our Services’ and choose the option that says “for employees” from the drop-down menu.

Sep 2: Now, click on the option ‘Member passbook’ under the option “Services.”

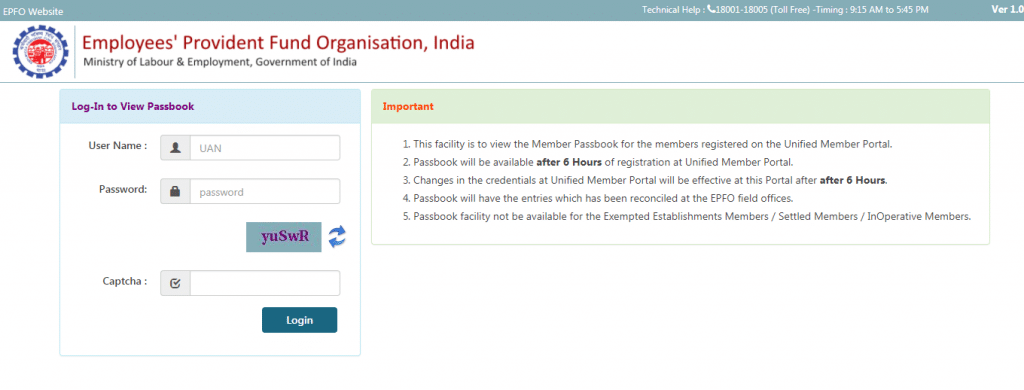

Step 3: A login page will appear. Enter your UAN number and password here after it has been activated.

2. Check EPF Balance on Mobile by SMS

It is essential to integrate your UAN number with your KYC details, i.e. Aadhar or PAN or bank account details. Only then can you be eligible to access your EPF balance via SMS.

Once the UAN number is integrated with your KYC details, follow these steps:

Step 1: Send an SMS to mobile number 7738299899.

Step 2: You need to send the message as EPFOHO UAN ENG.

You’ll need to set your preferred language of communication. You can do that by using the first three characters of your preferred language. If you wish to receive updates in English, use the first three characters of the word English like EPFOHO UAN ENG – where ENG stands for English.

If you want to receive the message updates in Marathi, then type in EPFOHO UAN MAR – where MAR stands for Marathi.

This facility is available in English, Hindi, Punjabi, Gujarati, Marathi, Kannada, Telugu, Tamil, Malayalam, and Bengali.

3. Check EPF Balance on Mobile By missed call

You can inquire about your EPF balance by giving a missed call to the authorised phone from your registered mobile number. This service is only available upon the integration of your UAN with your KYC details. If you are unable to do this, you can take the help of your employer.

Once the UAN is integrated with your KYC details, follow the steps mentioned below:

Step 1: Give a missed call to 011-22901406 from your registered mobile number.

Step 2: After placing a missed call, you will receive an SMS providing you with your PF details.

4. Check EPF Balance on EPFO app

To check your EPF balance, make sure that the employer has activated your UAN number.

You can also check your EPF balance by downloading the “m-sewa app of EPFO” from the Google Play Store.

Step 1: Once the app is downloaded, click on ‘Member’ and then go to ‘Balance/Passbook’.

Step 2: Afterwards, enter your UAN and registered mobile number. The system will verify your mobile number against your UAN. If all the details check out, you can view your updated EPF balance details. In case of a mismatch, it will display an error.

Recently, the Electronics and IT Ministry has launched an app called “Umang.” Umang helps merges different government services like Aadhaar, gas booking, crop insurance, NPS, and EPF. You can also use this app to check your EPF details. Upon installation, you can find the EPFO option from the app’s homepage under the head “Employee Centric Services” option and access your EPF account details. The app can be downloaded from Google Play Store.

Income Tax on amount received from Provident Fund

No Income Tax Exemption for PF interest on accumulated balance after retirement : ITAT

Provident Fund withdrawal taxability if 5 years service not completed

Withdrawal from provident fund for Housing ; Presentation by EPFO 19.05.2017

Govt allowed to withdraw entire amount from provident fund : Press Release 21.04.2016

Contribution to wife’s PPF account , Can I Get Income Tax Deduction ?

15 year Public Provident Fund Account (PPF) Benefits and Features

How to open PPF account online

[Video] How to open SBI PPF Account online : एसबीआई पीपीएफ खाता ऑनलाइन कैसे खोलें :

SBI Bank PPF Account Opening Form : Download/Print