How to File Your Federal Taxes

Taxes are due on April 15, 2019 (April 17 in Maine and Massachusetts). The new tax law has changed many forms, credits, and deductions. Check this page carefully before filing your federal income tax return.

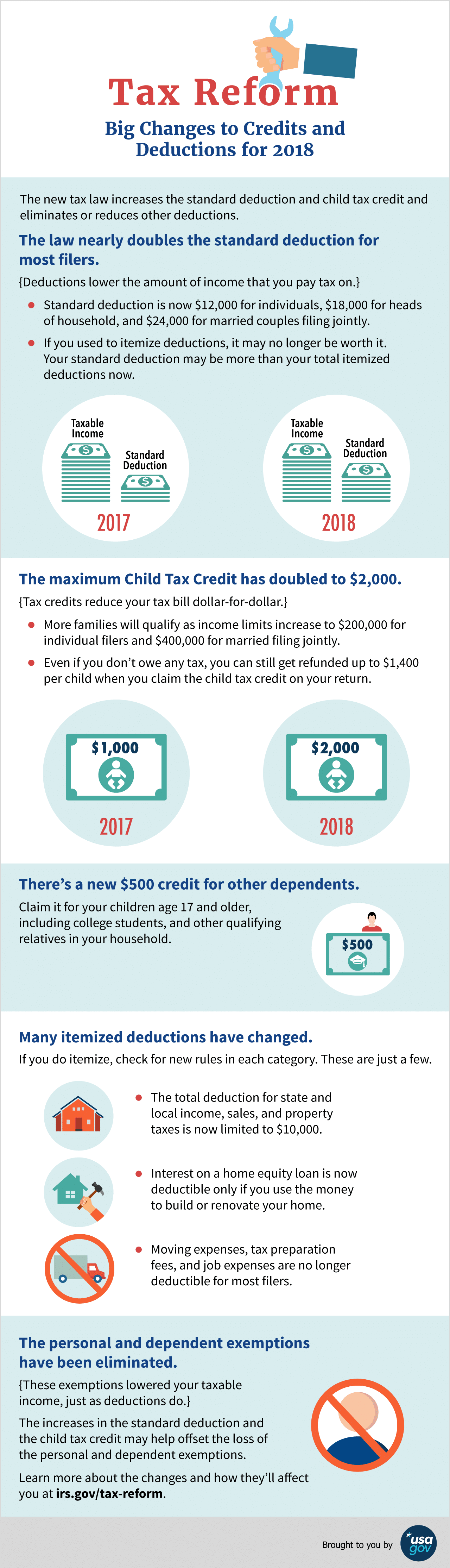

Tax Reform – Big Changes to Credits and Deductions for 2018

Learn the changes that affect you and your family under the tax reform law.

File a Federal Income Tax Return

The federal government uses taxes to pay its bills and provide public goods and services. The Internal Revenue Service (IRS) collects the taxes you owe through withholding from your paycheck, estimated tax payments, and when you file your taxes each year.

Do I Need to File?

You may not have to file a federal income tax return if your income is below a certain amount. However, you must file a tax return to claim a refundable tax credit or a refund on income tax withheld. Find out if you have to file a tax return.

Follow These Steps to File a Tax Return

Note: The new tax law has changed the forms, credits, and deductions you may have used in the past. Learn the basics of the tax law changes.

- Gather your paperwork, including

- A W-2 form from each employer

- Other earning and interest statements (1099 and 1099-INT forms)

- Proof of health insurance coverage

- Receipts for charitable donations, medical, and business expenses

- Choose your filing status – Whether you’re married and the percentage you pay for household expenses determine your filing status.

- See if you qualify for free tax return preparation – The IRS offers free tax help to people with a low income, military service members and their families, people with disabilities, seniors, and taxpayers with limited English.

- Decide how you want to file your taxes – The IRS recommends using tax preparation software for easiest and most accurate returns. You can use free or paid programs to calculate and file your taxes online or get paper forms to mail to the IRS. You can also hire a tax preparer to do your taxes for you.

- Calculate your taxes, credits, and deductions – Tax law changes may impact your credits and deductions and the taxes you owe.

- Add up your sources of income, including salary, interest and investment earnings, and pension or retirement accounts.

- Check if you are eligible for education, family, and dependent credits for a qualifying child or relative.

- You may also qualify for deductions for things like mortgage interest or charitable donations. Credits and deductions can lower the amount of your taxable income. But keep in mind, while the IRS has increased the standard deduction for tax year 2018, it eliminated some other types of deductions.

- If you owe money, learn how to make a tax payment, including applying for a payment plan.

- File your taxes by April 15, 2019 (April 17 in Maine and Massachusetts).

Find out how to check the status of your tax refund.

Contacting the IRS

For the fastest information, the IRS recommends finding answers to your questions online. You can also call the IRS. This option works best for less complex questions. Keep in mind that wait times to speak with a representative may be long.

Do I Need to Pay Quarterly Estimated Taxes?

If you’re self-employed, not enough tax is taken out of your salary or pension, or you have other earnings such as alimony, interest, or dividends, you may need to pay quarterly estimated taxes. Learn how to calculate your estimated taxes, when they’re due, and the penalty for underpaying.

IRS Mailing Addresses

The Internal Revenue Service (IRS) provides mailing addresses for tax returns, non-return forms, applications, and payments. The correct mailing address to use depends on the purpose of contact and the region of the country you are in:

- Paper Tax Returns (with or without a payment)

- Non-Return Forms (applications and payments)

You can also check a form’s corresponding instructions for a mailing address.

Get Tax Forms and Publications

Federal Tax Forms

Federal tax forms have changed as a result of the new tax law. Get the new forms, instructions, and publications for free directly from the Internal Revenue Service (IRS).

- Download them from IRS.gov

- Order by phone at 1-800-TAX-FORM (1-800-829-3676)

The IRS can provide many forms and publications in accessible formats, including Section 508 accessible PDFs and Braille or text. They also have forms for prior tax years.

You can find the new tax forms in your community for free at

State Tax Forms

Download your state’s tax forms and instructions for free.

Tax Filing Deadlines

The Internal Revenue Service (IRS) began accepting and processing federal tax returns for tax year 2018 on January 28, 2019. The deadline to file federal taxes for most taxpayers is April 15, 2019, unless you file for an extension. If you live in Maine or Massachusetts, you have until April 17, 2019, to complete your return.

Federal and state taxes usually have the same filing deadlines. Find out the tax filing due dates in your state. If you do not file and pay your taxes on time, you will be charged interest and a late payment penalty. For taxpayers due a refund, there is no penalty for filing a late return.

Tax Filing and Payment Help

- Learn how to file a federal income tax return.

- File online or find the address for mailing your paper return. To find out how to mail your tax return, get tips and information from the U.S. Postal Service (USPS).

- Explore free online tools from the IRS and special programs for qualifying taxpayers.

- Learn about your payment options if you owe money. If the IRS owes you money, you can choose to receive your tax refund by direct deposit, U.S. Series I Savings Bonds, or paper check.

Extension to File Your Tax Return

If you are unable to file your federal income tax return by the due date, you may be able to get an extension from the Internal Revenue Service (IRS). This does not grant you more time to pay your taxes.

You may be able to get an automatic six-month extension to file your return. To do so, you must file IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return (PDF, Download Adobe Reader) by the due date for filing your calendar year return (usually April 15) or fiscal year return. For a Spanish version of this form, download IRS Form 4868sp (PDF, Download Adobe Reader).

Special rules may apply if you are:

- Living outside the United States

- Out of the country when your six-month extension expires

- Living in a combat zone or a qualified hazardous area

Get tax filing information, including guidelines on extensions of time to file.

Get Your W-2 Before Tax Time

The Wage and Tax Statement, known as a W-2 form, is an important document to have at tax time. This form shows the income you earned for the year and the taxes withheld from those earnings. If you have had several jobs over the year, you may have several W-2 forms to file your tax return. Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work.

The Internal Revenue Service (IRS) offers advice on what to do if you were an employee and haven’t received your W-2 by January 31 or if the information is incorrect. Employers that have questions about filing W-2 forms for employees can check these resources on where, when, and how to filefrom the IRS.

For more information, contact the IRS. Wait times to speak with a representative may be long.

1099 Income Statements

Businesses and government agencies use Form 1099 to report various types of income other than wages, salaries, and tips to the Internal Revenue Service (IRS).

Common types of Form 1099 include

- 1099-MISC for contracting and freelance work, gambling and prize winnings, and more

- 1099-INT for bank account interest

- 1099-DIV for investment distributions and dividends

- 1099-R for retirement account distributions from 401(k) accounts, IRAs, Thrift Savings Plans, annuities, and pensions

- 1099-S for real estate sales income

Every business or agency must

- Complete a Form 1099 for each transaction

- Retain a copy for its records

- Send a copy to you and to the IRS. You should have received your copy by early February (or mid-February for Form 1099-B).

You must include this income on your federal tax return.

Incorrect or Missing Form 1099

If you do not agree with the information contained in your Form 1099, contact the business or federal agency that issued it.

If you did not receive your Form 1099, contact the business or federal agency that should have issued it.

Contact the IRS

If you requested Form 1099 from a business or agency and did not receive it, contact the IRS. Wait times to speak with a representative may be long.

Check Your Tax Withholding

Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Keep in mind, the new tax law has changed tax rates, credits, and deductions, and could affect your withholding. If you don’t withhold enough tax, you could face a penalty.

Use the IRS Withholding Calculator to estimate your 2019 income tax and compare it with your current withholding. You’ll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 (PDF, Download Adobe Reader) for your employer or make an estimated tax payment to the IRS before the end of the year.

Filing Tax Returns When Living Abroad

Who Files

- U.S. citizens or resident aliens (Green Card holders) living abroad must pay U.S. income tax on their worldwide income.

- The rules for filing tax returns, paying estimated taxes, or estate taxes are generally the same whether you are in the U.S. or abroad. Get information for taxpayers living abroad.

How to File

- As a resident alien or U.S. citizen living abroad, you can use the same forms (1040, 1040A or 1040EZ) as people living in the U.S. to file your taxes.

- The amounts you report on your U.S. tax return must be in U.S. dollars. Learn more about filing requirements.

When to File

- As a taxpayer living outside the U.S., you are allowed a two-month extension. Get more information about your filing date.

Where to File

- If you’re living outside the U.S., you can mail your return or use e-file.

- Learn where to mail your return if you are expecting a refund or if you owe money to the IRS.

Where to Get Tax Preparation Help While Living Abroad

Taxpayer service is no longer available at foreign posts of duty. Instead, use the International Taxpayer Service Call Center.

Find More Resources for Taxpayers Living Abroad

- Use the list of frequently asked questions (FAQs) about international individual tax matters or search by international tax topic.

- Find a list of tax FAQs especially for resident aliens.

- Use the international taxpayers interactive tools for general tax questions.

- If you owe money to the IRS but do not have a U.S. bank account to send a check, you may be able to use a debit or credit card.

Nonresidents Filing Tax Returns in the U.S.

Who Files

You will need to file a U.S. tax return depending on your:

Review this list of five situations to learn more about who must file.

How to File

- You will need an individual taxpayer identification number (ITIN) or Social Security number (SSN). The IRS will issue an ITIN if a foreign national is not eligible for an SSN for tax reporting purposes. Learn more about getting an ITIN for federal tax reporting.

- You can use form 1040NR to file a tax return.

- Review the specific filing requirements if you are a foreign exchange student or visiting scholar.

- If you are on a J-1 visa working as an au pair, you may need to file estimated taxes using form 1040ES-NR.

- If you can’t file your return by the due date, use form 4868.

Find More Resources

- Review the tax treaty information between the U.S. and your country. In some cases, your taxable amount may be lower.

- If you are a foreign student, use this reference guide to learn more about the special rules that apply to your U.S. income including your liability for Social Security and Medicare taxes.

- Learn more from the most recent version of the U.S. Tax Guide for Aliens.

Related IRS News